Full, Final and Absolute Release

What is this form?

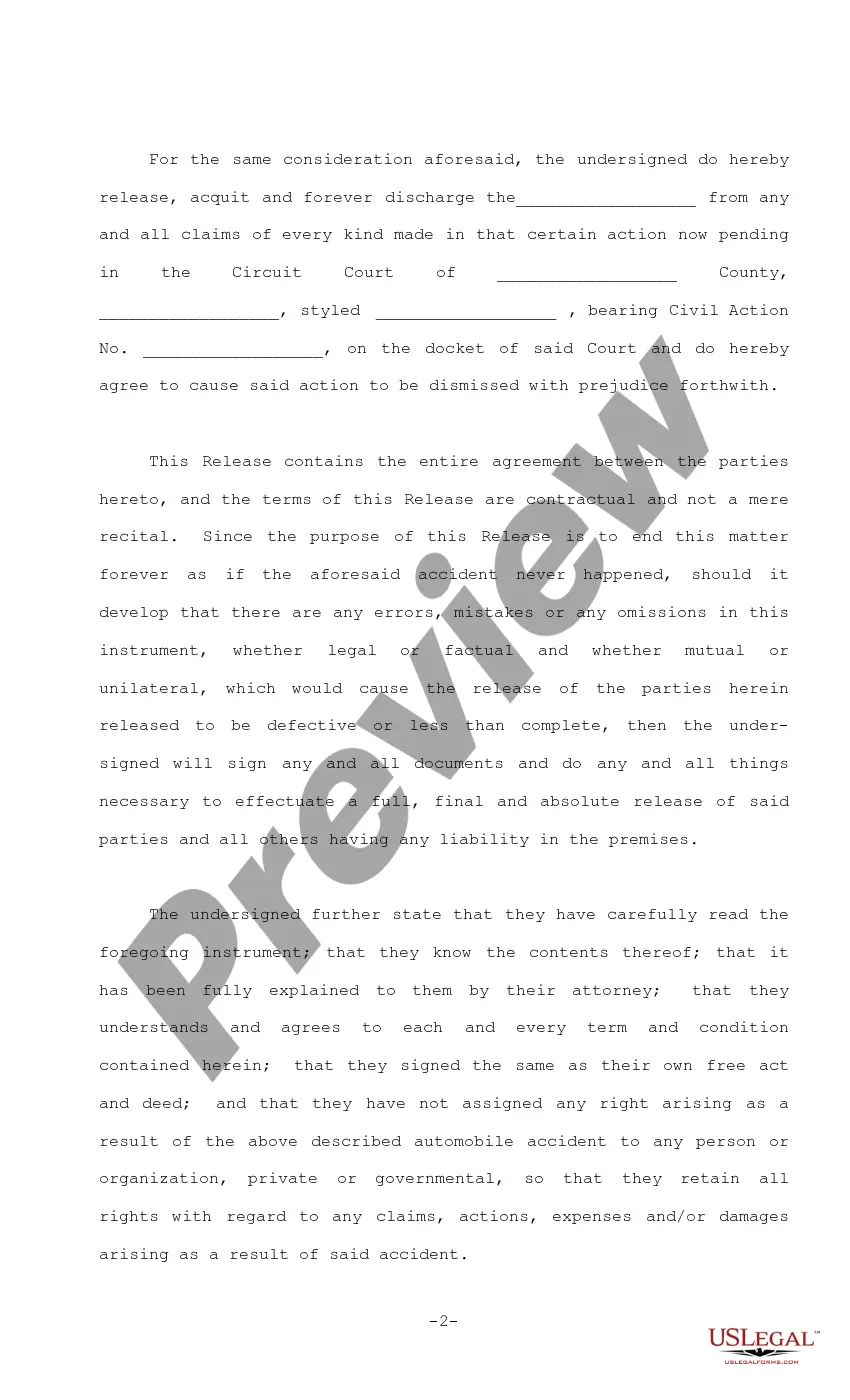

The Full, Final and Absolute Release is a legal document used to relinquish all claims related to a specific incident, such as a fire and the cancellation of an insurance policy. This form explicitly states that while the releasee does not admit liability, it permanently discharges them from any future claims. Unlike other release forms, this one emphasizes a complete and final resolution of any related disputes, preventing any further legal action pertaining to the incident described.

Key parts of this document

- Consideration Amount: Space to enter the amount paid for the release.

- Releasor and Releasee Identification: Information to identify the parties involved.

- Specific Claims Released: Details of the claims being released, including those relating to fire or policy cancellation.

- Statement of No Liability: A clause affirming that the releasee does not admit any liability.

- Legal Acknowledgment: Signature space for both parties to confirm their understanding and agreement.

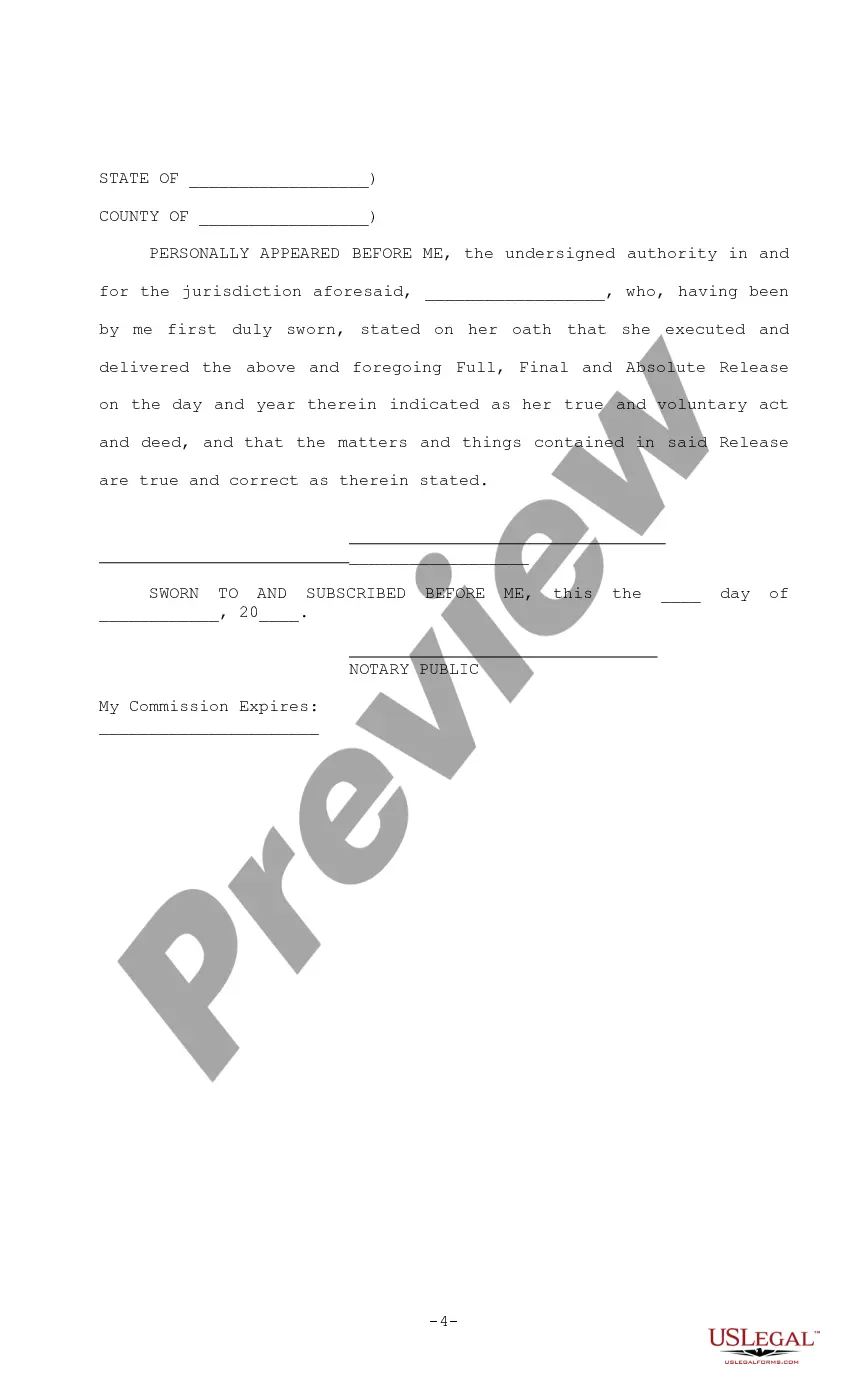

- Notary Section: A designated area for notarization of the document.

Situations where this form applies

This form is typically used after an incident such as a fire, where one party seeks to release another from any legal claims, particularly concerning insurance matters. It is appropriate when the parties have negotiated a settlement or when there are disputes over insurance coverage related to the incident. It serves to provide a clear end to the legal relationship between the parties involved.

Who should use this form

- Individuals who have experienced a fire and are resolving their claims with an insurer.

- Parties involved in legal disputes over insurance coverage termination.

- Anyone needing to secure a complete release from potential claims regarding a specific incident.

Instructions for completing this form

- Identify the parties involved by filling in the names of the releasor and releasee.

- Enter the consideration amount received for the release in the designated space.

- Clearly specify the claims being released, particularly those related to the fire and insurance.

- Ensure both parties sign the document to confirm their mutual agreement and understanding.

- Have the form notarized if required, by providing the notary section with the necessary information.

Does this document require notarization?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to specify all claims being released can lead to confusion later.

- Not properly identifying the releasor or releasee can invalidate the release.

- Omitting the consideration amount may make the form incomplete.

- Neglecting to have the document notarized when required by local laws.

Why use this form online

- Convenient access to legal documents anytime, streamlining the process.

- Editable templates ensure you can modify the form to fit your specific situation.

- Reliable templates created and vetted by licensed attorneys, ensuring legal compliance.

Looking for another form?

Form popularity

FAQ

Most cases settle out of court before proceeding to trial. Some say that the measure of a good settlement is when both parties walk away from the settlement unhappy.This means that the defendant paid more than he wanted to pay, and the plaintiff accepted less than he wanted to accept.

If a debtor makes a written or verbal statement saying that they are making payment to you in full and final settlement of the debt, or words to that effect, and that payment is less than the debt owed, care needs to be taken as you could inadvertently lose your legal right to pursue the balance of the debt.

Full and final settlement means that you ask your creditors to let you pay a lump sum instead of the full balance you owe on the debt. In return for having a lump-sum payment, the creditor agrees to write off the rest of the debt.

By contrast, a payment "in full and final settlement" can usually be interpreted as an offer to settle a dispute on terms that, in exchange for the sum tendered, the creditor will give up the rest of its claim.

Depending on your case, it can take from 1 6 weeks to receive your money after your case has been settled. This is due to many factors but below outlines the basic process. If you have been awarded a large sum, it may come in the form of periodic payments. These periodic payments are called a structured settlement.

With that being said, studies have found that most settlement amounts total between $2,000 and $20,000.

What percentage should I offer a full and final settlement? It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

Payment for non-availed leaves (earned or privilege leave), which is calculated as the number of days of non-availed leaves multiplied by basic salary divided by 26 days (paid days in a month).

How Is a Settlement Paid Out? Compensation for a personal injury can be paid out as a single lump sum or as a series of periodic payments in the form of a structured settlement. Structured settlement annuities can be tailored to meet individual needs, but once agreed upon, the terms cannot be changed.