Nevada Waiver of Qualified Joint and Survivor Annuity - QJSA

Description

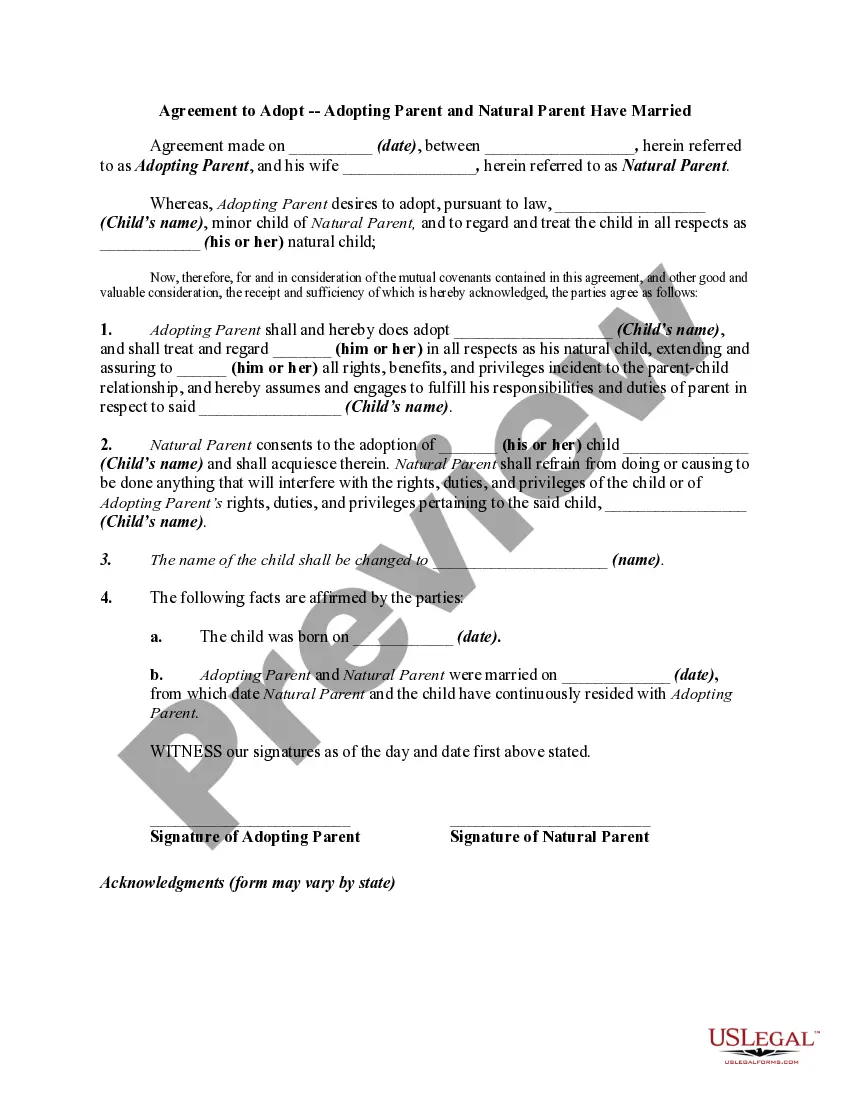

How to fill out Waiver Of Qualified Joint And Survivor Annuity - QJSA?

Are you presently in a circumstance where you require documents for either business or personal purposes on a daily basis.

There are numerous authentic document templates available online, but finding reliable ones can be challenging.

US Legal Forms provides a vast array of template options, including the Nevada Waiver of Qualified Joint and Survivor Annuity - QJSA, which are designed to comply with state and federal regulations.

Choose a convenient paper format and download your copy.

Find all the document templates you have purchased in the My documents section. You can download another copy of the Nevada Waiver of Qualified Joint and Survivor Annuity - QJSA at any time if needed. Just select the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Nevada Waiver of Qualified Joint and Survivor Annuity - QJSA template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Select the form you need and verify that it is for the correct city/state.

- Utilize the Preview button to review the form.

- Ensure that you have chosen the right form by reading the information.

- If the form is not what you are looking for, use the Lookup field to find the form that meets your needs.

- Once you find the correct form, click Purchase now.

- Select the pricing plan you prefer, complete the necessary information to create your account, and make the payment using PayPal or Mastercard.

Form popularity

FAQ

The Nevada Waiver of Qualified Joint and Survivor Annuity - QJSA offers several advantages. One key benefit is that it ensures a surviving spouse receives income even after the primary account holder passes away. This financial security can ease stress for families during difficult times. Additionally, opting for a QJSA can help couples plan better for their retirement years.

This special payment form is often called a qualified joint and survivor annuity or QJSA payment form. This benefit is paid to the participant each year and, on the participant's death, a survivor annuity is paid to the surviving spouse.

A QJSA is when retirement benefits are paid as a life annuity (a series of payments, usually monthly, for life) to the participant and a survivor annuity over the life of the participant's surviving spouse (or a former spouse, child or dependent who must be treated as a surviving spouse under a QDRO) following the

If you do not waive the QPSA, after your death the Plan will pay your spouse the QPSA unless your spouse elects another benefit form. The QPSA will not pay benefits to other beneficiaries after your spouse dies. If you waive the QPSA, the Plan will pay your account to your designated beneficiary.

A QJSA is when retirement benefits are paid as a life annuity (a series of payments, usually monthly, for life) to the participant and a survivor annuity over the life of the participant's surviving spouse (or a former spouse, child or dependent who must be treated as a surviving spouse under a QDRO) following the

Qualified Joint and Survivor Annuity (QJSA) includes a level monthly payment for your lifetime and a survivor benefit for your spouse after your death equal to the percentage designated of that monthly payment.

This benefit provides payments to the participant's spouse for his or her lifetime equal to a percentage (as specified in the Pension Plan) not less than one-half of the annuity that would have been payable during their joint lives. The participant may waive the Qualified Preretirement Survivor Annuity.

QJSA rules apply to money-purchase pension plans, defined benefit plans, and target benefits. They can also apply to profit-sharing and 401(k) and 403(b) plans, but only if so elected under the plan.

A qualified pre-retirement survivor annuity (QPSA) provides monetary distribution to a surviving spouse of a deceased employee. The employee must be under a qualified plan in order for compensation to occur. The Employee Retirement Income Security Act (ERISA) dictates how payments are to be calculated.

When the participant dies, the spouse will receive lifetime payments in the same or reduced amount. The participant may waive the Qualified Joint and Survivor Annuity with spousal consent and elect to receive another form of payment.