Separation Notice for Independent Contractor

Description

Definition and meaning

The Separation Notice for Independent Contractor is a formal document that notifies a contractor that their services are no longer required. This notice is crucial for clarifying the end of the working relationship and ensuring that both parties are aware of their rights and responsibilities following the termination. It serves to document the reasons for separation, which can include lack of work, mutual agreement, or non-performance of duties.

Who should use this form

This form is intended for businesses and organizations that engage independent contractors for various projects. It should be used whenever a business needs to formally notify a contractor about the termination of their services. This includes situations where a contractor may have temporarily or permanently stopped working for the company. Additionally, this form can also be used by the contractors themselves if they wish to formally communicate their separation from a client.

Key components of the form

The Separation Notice for Independent Contractor typically includes several crucial elements:

- Contractor's Name: The full name of the independent contractor being notified.

- Social Security Number: Identification number for verification purposes.

- Service Dates: Dates indicating the period the contractor was working for the business.

- Reason for Separation: A clear explanation of the circumstances leading to the separation, such as completion of a project, financial constraints, or performance issues.

- Compensation Details: Information regarding any final payments, including wages or severance pay.

- Supervisor Contact Information: Details for the supervisor or manager overseeing the contractor's work.

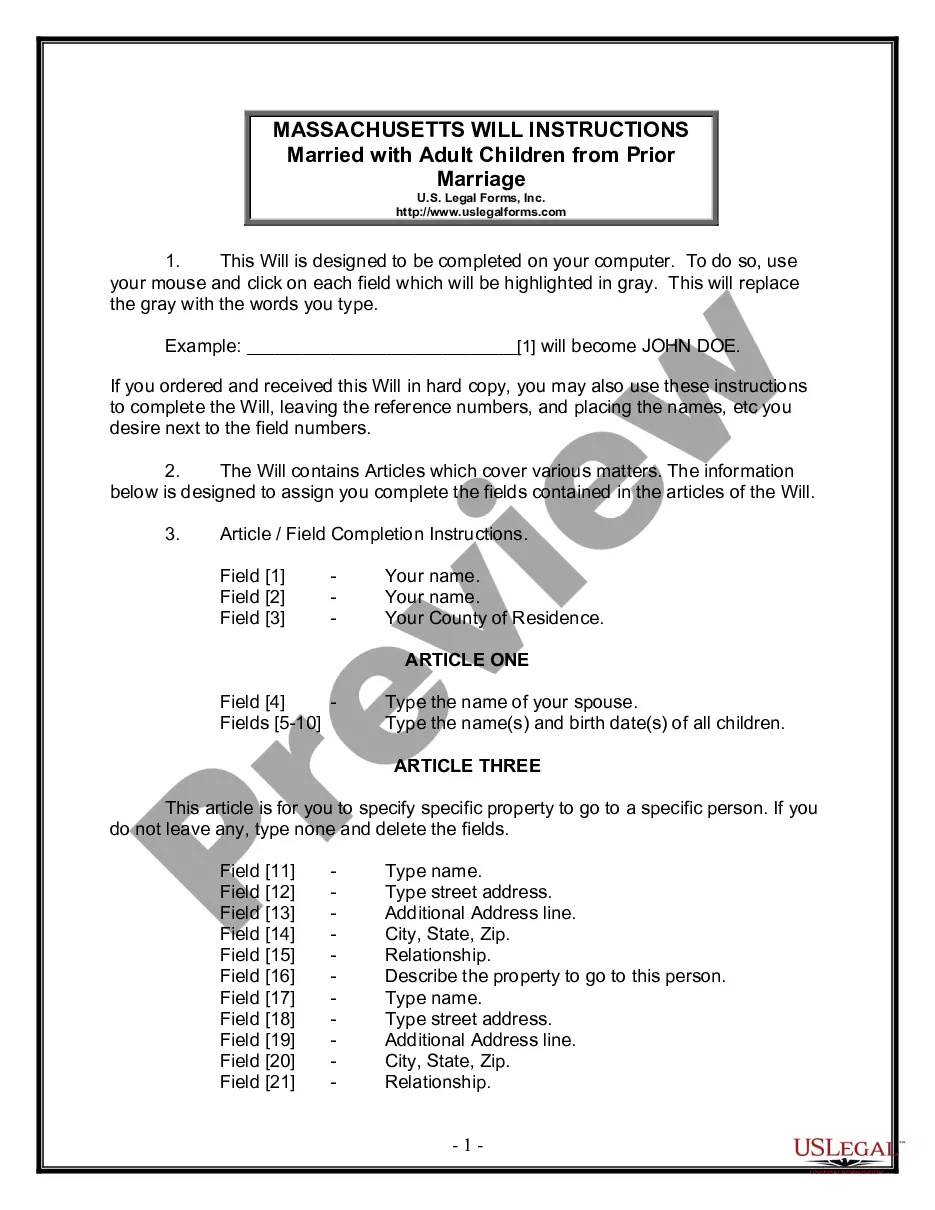

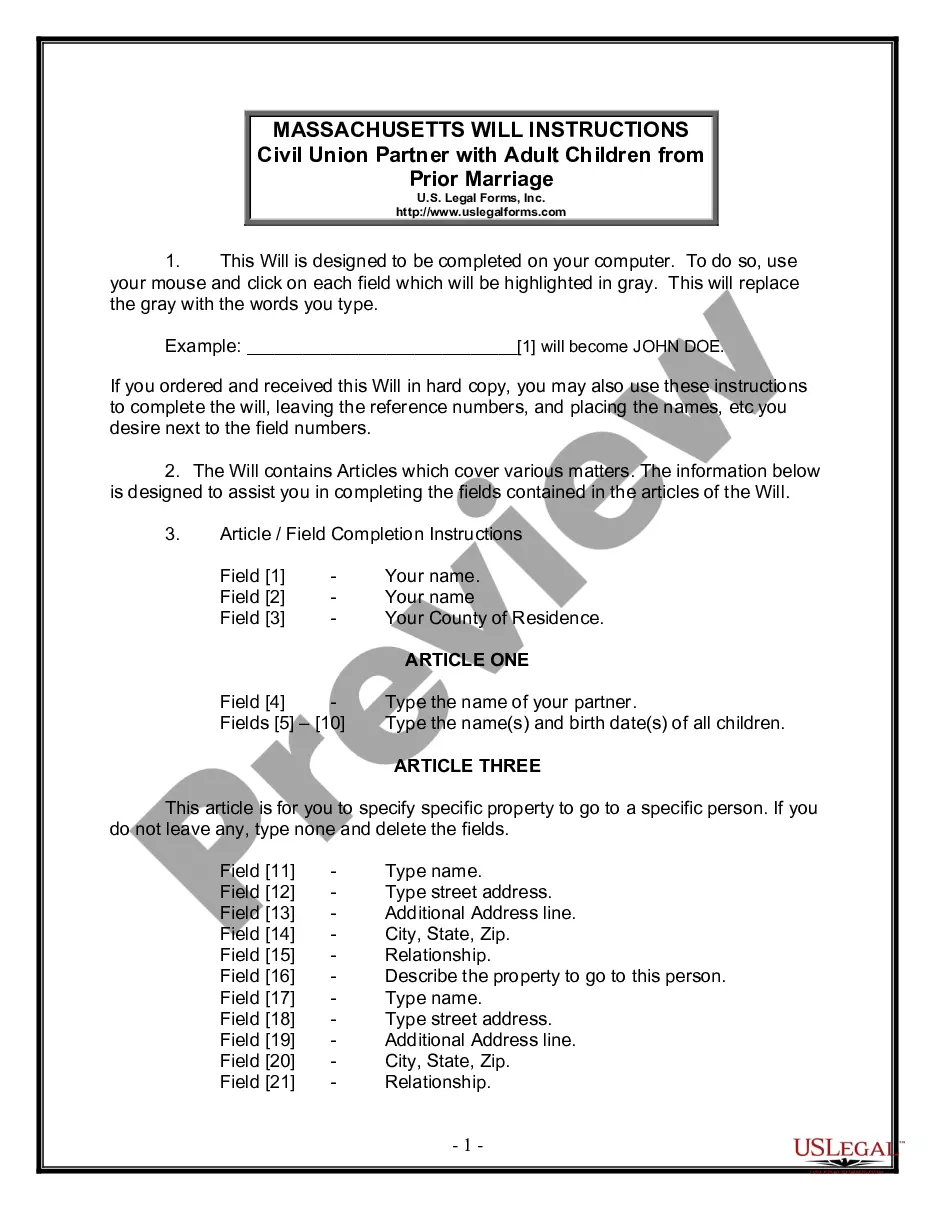

How to complete a form

To effectively complete the Separation Notice for Independent Contractor, follow these steps:

- Begin by filling in the contractor's full name and social security number.

- Specify the time period during which the contractor was employed.

- Provide the reason for separation, being as specific as possible.

- If applicable, state any expected date for the contractor’s recall or further engagement.

- Detail any compensation that will be paid, including final wages or separation pay.

- Include the name and contact information of the supervising manager for reference.

Common mistakes to avoid when using this form

When filling out the Separation Notice for Independent Contractor, it's essential to avoid common pitfalls:

- Incomplete Information: Ensure all fields are filled out completely to avoid confusion.

- Vague Reasons for Separation: Be clear and specific about why the contractor's services are ending.

- Not Keeping a Copy: Always retain a copy of the completed notice for your records.

- Delay in Notification: Provide the notice in a timely manner to ensure compliance and clarity.

Legal use and context

The Separation Notice for Independent Contractor is recognized as a vital document in employment law. It serves as a formal record of the determination of a working relationship, protecting both parties by providing clarity surrounding the terms of separation. This document can be crucial in preventing disputes regarding the end of service and can serve as evidence if legal issues arise later. It's important to understand the legal implications of this notice within the context of contractor agreements and local employment laws.

Benefits of using this form online

Utilizing an online template for the Separation Notice for Independent Contractor offers several advantages:

- Accessibility: Users can access the form whenever needed, ensuring that they can complete it without delay.

- Efficiency: Filling out an online form can be faster and easier due to interactive fields and guidance.

- Accuracy: Many online templates come with prompts to help avoid errors and ensure all required information is provided.

- Storage: Online forms can often be saved digitally, making it easy to track completed documents.

How to fill out Separation Notice For Independent Contractor?

Use US Legal Forms to obtain a printable Separation Notice for Independent Contractor. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most complete Forms catalogue on the web and offers affordable and accurate templates for consumers and legal professionals, and SMBs. The templates are categorized into state-based categories and some of them might be previewed before being downloaded.

To download templates, users must have a subscription and to log in to their account. Hit Download next to any form you want and find it in My Forms.

For individuals who do not have a subscription, follow the following guidelines to quickly find and download Separation Notice for Independent Contractor:

- Check to ensure that you get the proper form with regards to the state it is needed in.

- Review the form by reading the description and by using the Preview feature.

- Press Buy Now if it’s the document you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it multiple times.

- Use the Search field if you want to find another document template.

US Legal Forms offers thousands of legal and tax samples and packages for business and personal needs, including Separation Notice for Independent Contractor. More than three million users have already used our service successfully. Select your subscription plan and have high-quality documents within a few clicks.

Form popularity

FAQ

Usually, independent contractors cannot be fired at-will like employees can because they have contracts that outline termination.

California is an employment-at-will state, meaning that the employer can choose to fire you at any time without providing a reason. It also means that you can stop working for the employer at any time.

In most cases, a contract can be terminated by one party if the other party fails to execute their end of the agreement. If one party is unwilling or unable to keep to the terms of the contract, you can legally end the contract.

If your independent contractor agreement contains a provision that allows the parties to terminate the relationship at any time, revise the agreement to include a notice provision with at least some kind of a notice period required for termination of the contract.

By definition, independent contractors are able to dictate their schedules. This means that employers cannot tell an independent contractor when to work unless they want to give the worker the benefits of a true employee.

If neither the employment contract or any company policy requires the employee to give notice, no notice is legally required under California law. This is because California is an at-will employment state.Similarly, at-will employees can also leave their employer at any time, even without a two weeks' notice.

While employees are always eligible for unemployment benefits if they are laid off, an independent contractor will only be eligible if they pay separately into the state unemployment fund. However, if your status as an independent contractor is questionable, filing for unemployment may be worth a try.

When you are resigning as an independent contractor it is not necessary to give a specific amount of notice, however, notice is always appreciated. Do mention your availability for additional work prior to your resignation, if any, in your resignation letter.