Nevada General Consent Form for Qualified Joint and Survivor Annuities - QJSA

Description

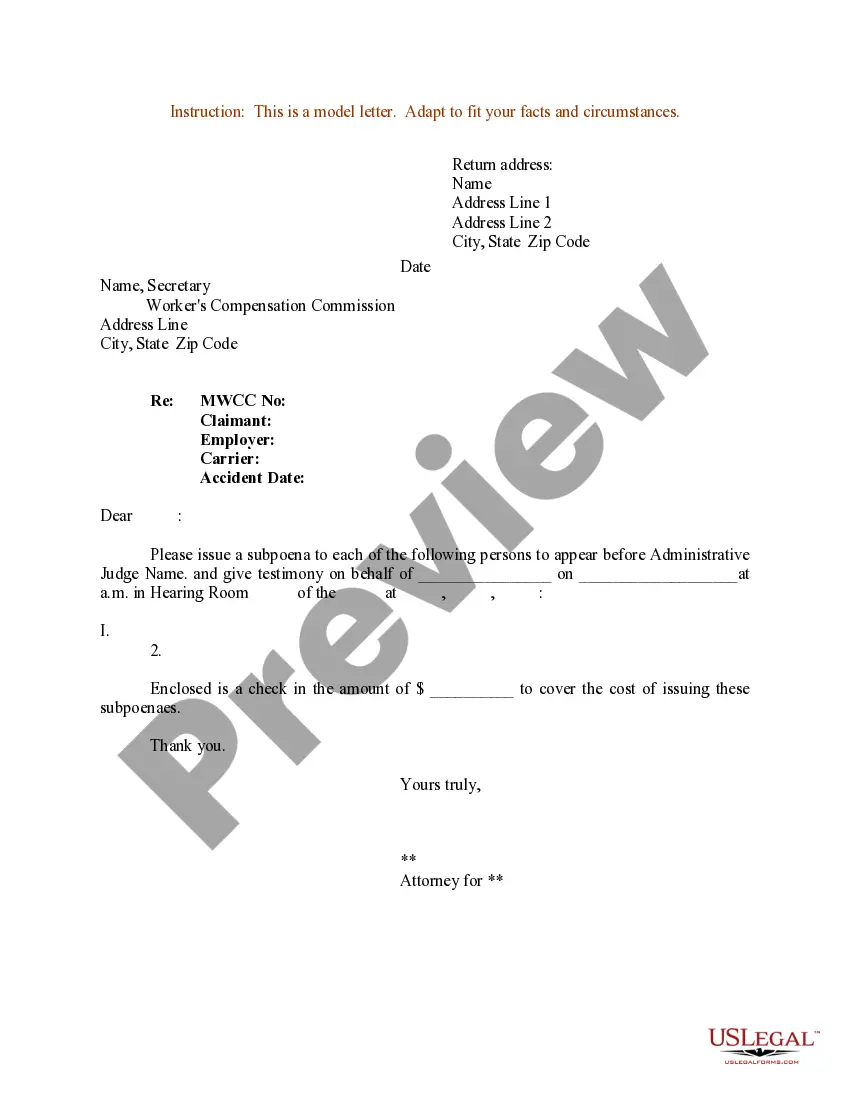

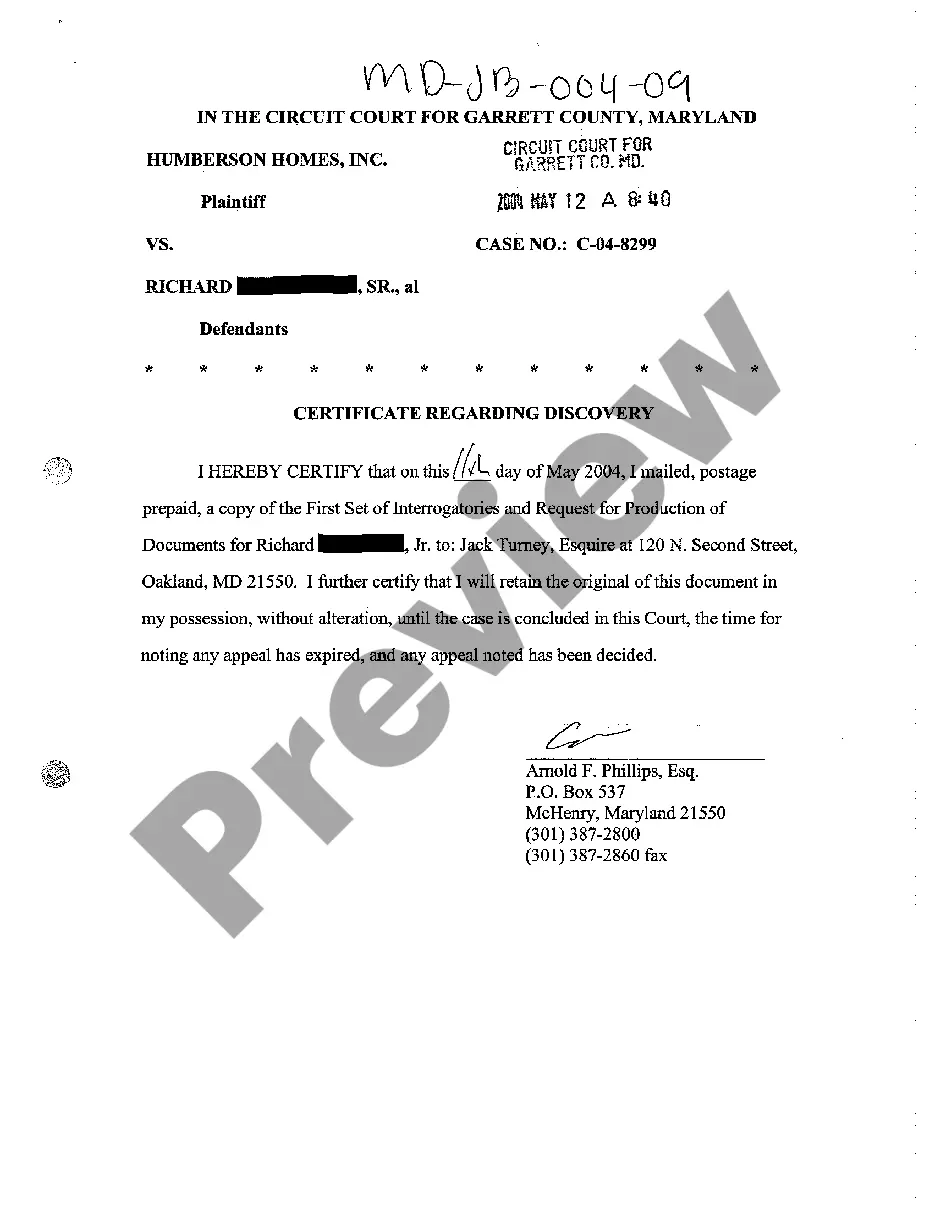

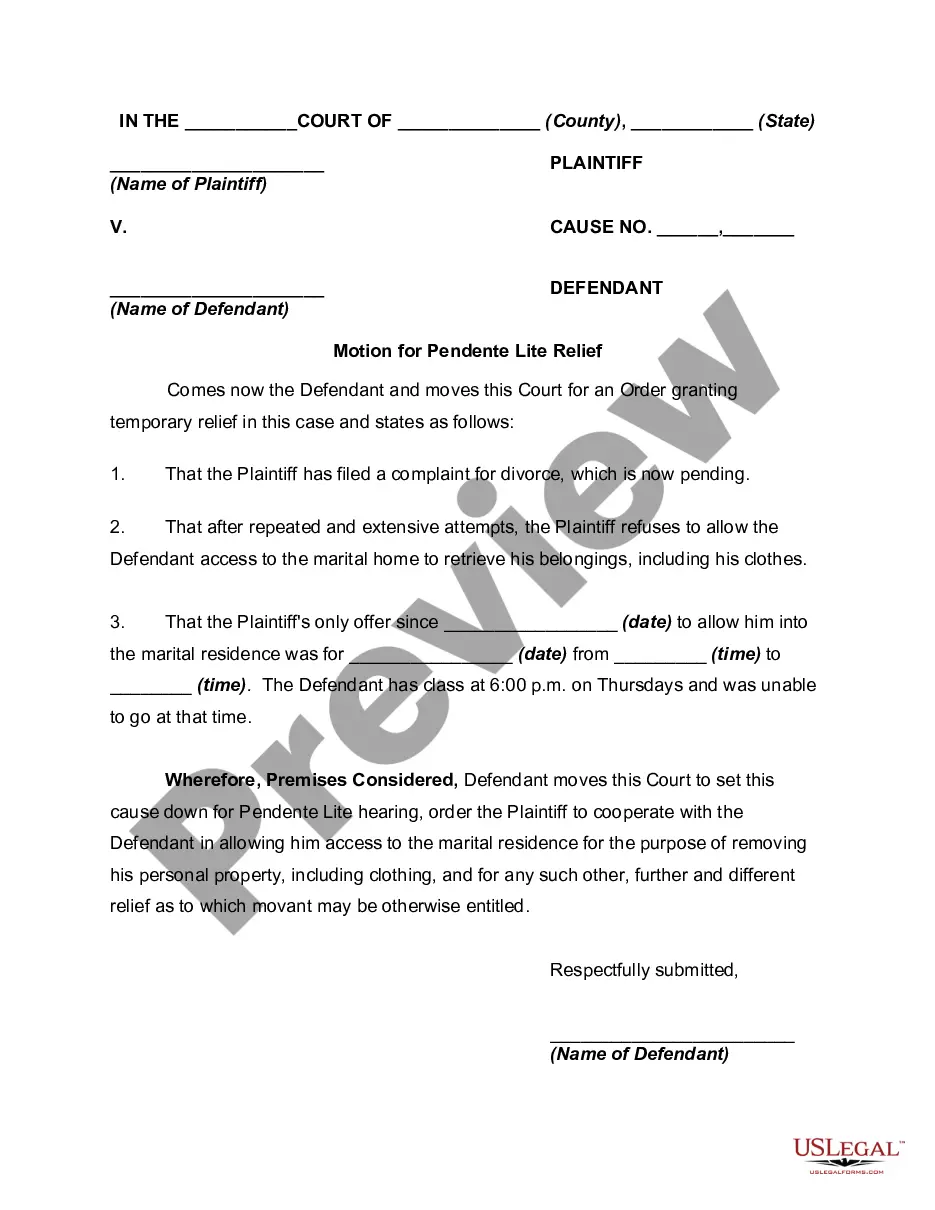

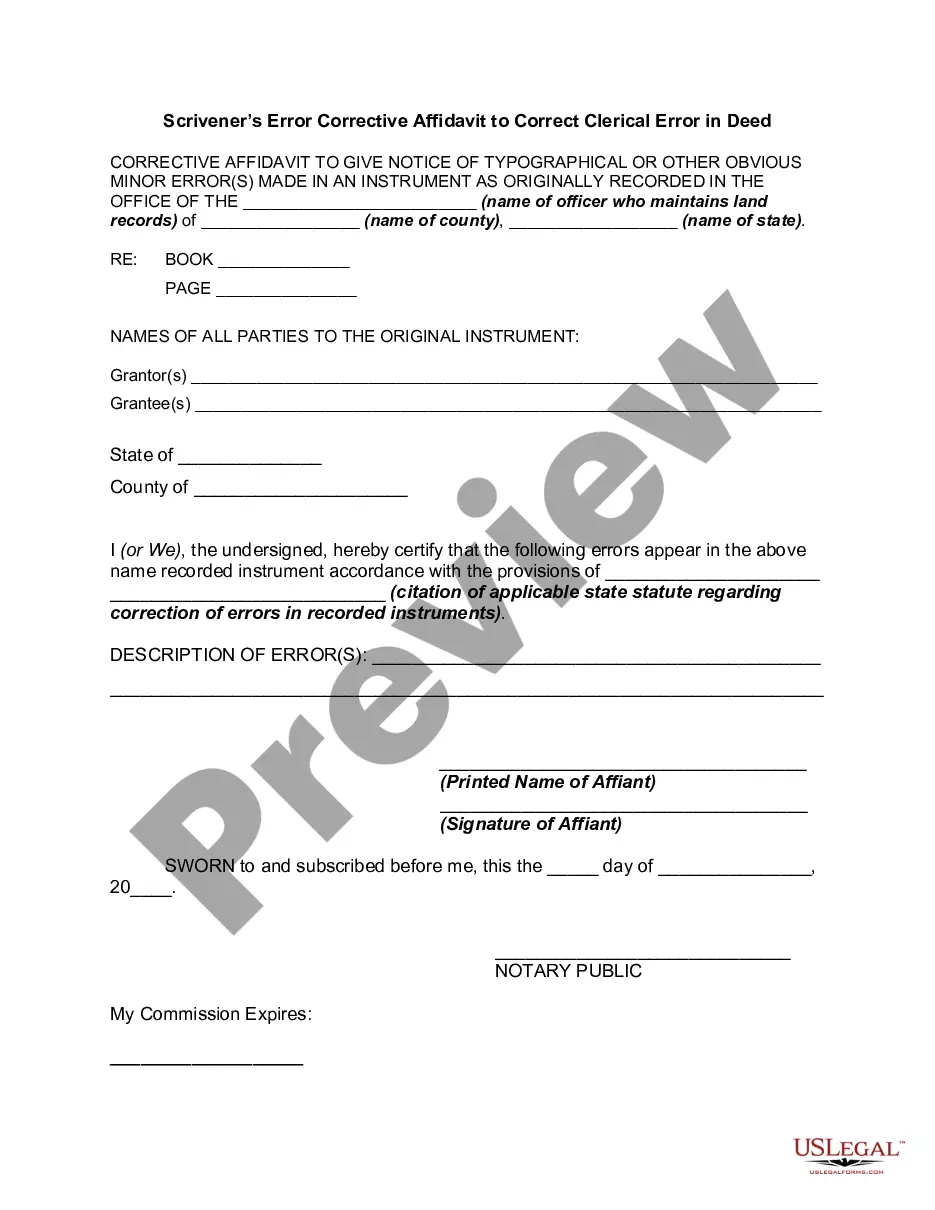

How to fill out General Consent Form For Qualified Joint And Survivor Annuities - QJSA?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a diverse array of legal templates available for purchase or printing.

By using the website, you can discover thousands of documents for business and personal purposes, organized by categories, states, or keywords.

You can locate the latest versions of documents like the Nevada General Consent Form for Qualified Joint and Survivor Annuities - QJSA in moments.

Click the Review button to examine the form’s contents. Read the form description to ensure you've selected the right document.

If the form doesn't meet your requirements, utilize the Search field at the top of the screen to find one that does.

- If you already have a monthly subscription, Log In and obtain the Nevada General Consent Form for Qualified Joint and Survivor Annuities - QJSA from the US Legal Forms collection.

- The Download button will show up on every type you view.

- You can access all previously downloaded documents in the My documents section of your account.

- If you want to use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct template for your city/region.

Form popularity

FAQ

The QJSA payment form gives your spouse, the annuitant, a retirement payment for the rest of his or her life. Under the QJSA payment form, after your spouse dies, the contract will pay you, the surviving spouse, at least 50% percent of the retirement benefit that was paid to your spouse, the annuitant.

Form of spousal consent to be used to enforce transfer and voting restrictions contained in a shareholders' agreement, voting agreement, operating agreement, or similar document against the spouse or domestic partner of a shareholder or member in California.

If you are married and your spouse is not named as your sole primary beneficiary, spousal consent is required in the following states of residence, which are community property states: Alaska, Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas and Washington.

Spouse must consent to the waiver of the annuity to receive a cash distribution of RMDs. Otherwise the RMD must be an annuity payment. Usually, the participant and spouse waive the annuity before RBD and the RMD is paid in cash.

Qualified Joint and Survivor Annuity (QJSA) includes a level monthly payment for your lifetime and a survivor benefit for your spouse after your death equal to the percentage designated of that monthly payment.

Some 401(k) plans require spousal consent whenever a participant takes a distribution. Others don't require spousal consent for distributions or loans. Rather, it's required only if a participant wants to designate a primary beneficiary other than his or her spouse.

This special payment form is often called a qualified joint and survivor annuity or QJSA payment form. This benefit is paid to the participant each year and, on the participant's death, a survivor annuity is paid to the surviving spouse.

QJSA rules apply to money-purchase pension plans, defined benefit plans, and target benefits. They can also apply to profit-sharing and 401(k) and 403(b) plans, but only if so elected under the plan.

A qualified pre-retirement survivor annuity (QPSA) provides monetary distribution to a surviving spouse of a deceased employee. The employee must be under a qualified plan in order for compensation to occur. The Employee Retirement Income Security Act (ERISA) dictates how payments are to be calculated.

ANSWER: Spousal consent is required if a married participant designates a nonspouse primary beneficiary and may be necessary if a 401(k) plan offers one or more annuity forms of distribution. Here is a summary of these rules and the way many 401(k) plans avoid spousal consents.