New Jersey Door Contractor Agreement - Self-Employed

Description

How to fill out Door Contractor Agreement - Self-Employed?

It is feasible to spend hours online attempting to discover the sanctioned document format that complies with the federal and state requirements you need.

US Legal Forms offers a vast array of legal templates that are assessed by professionals.

You can easily obtain or print the New Jersey Door Contractor Agreement - Self-Employed from our services.

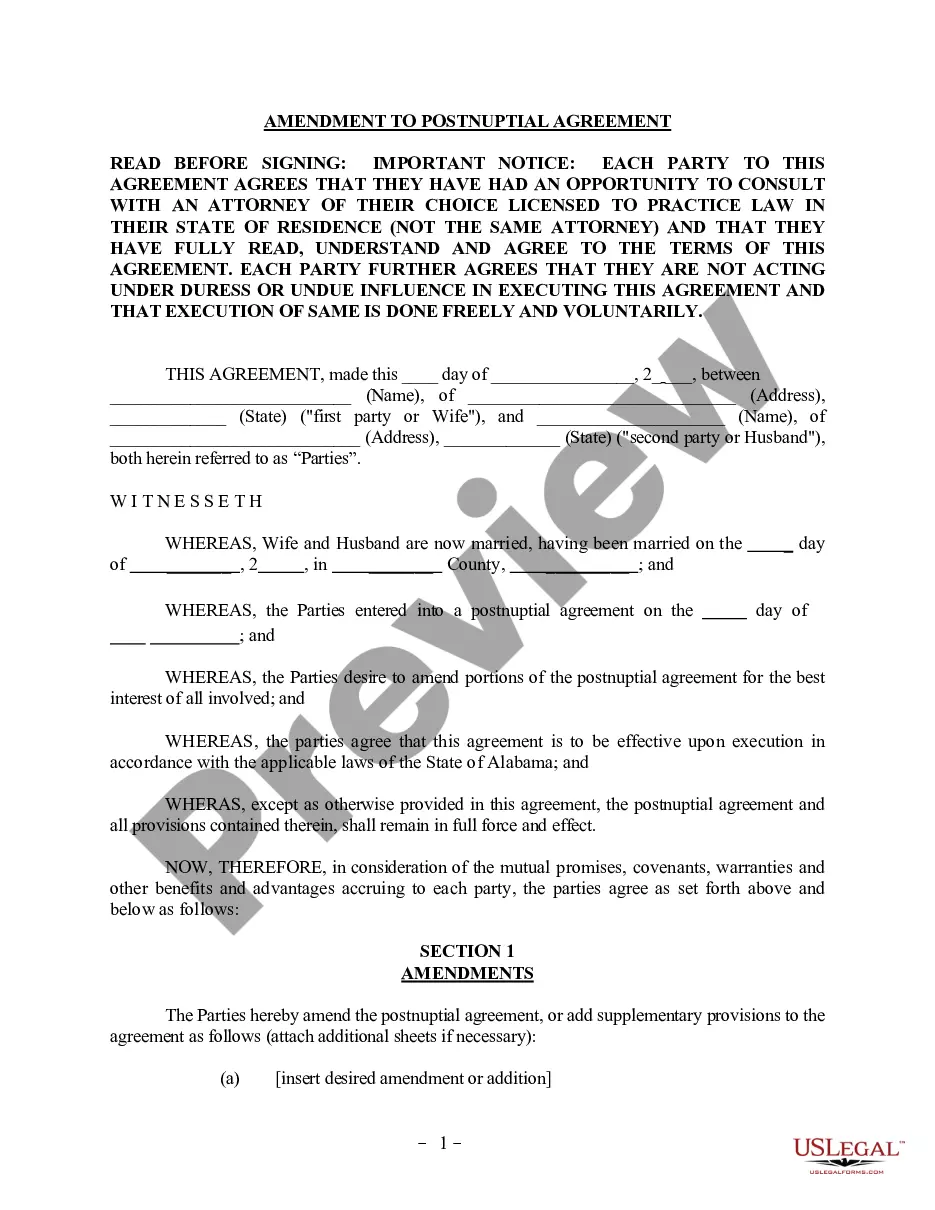

If available, utilize the Preview option to examine the document format as well.

- If you possess a US Legal Forms account, you can Log In and then select the Download option.

- Subsequently, you can complete, alter, print, or sign the New Jersey Door Contractor Agreement - Self-Employed.

- Each legal document format you purchase is yours indefinitely.

- To obtain another copy of any purchased form, navigate to the My documents tab and select the relevant option.

- If this is your first time using the US Legal Forms site, follow the simple instructions below.

- First, ensure you have chosen the appropriate document format for the region/city of your preference.

- Review the form outline to confirm that you have selected the correct form.

Form popularity

FAQ

The 3-day contract rule in New Jersey provides consumers with the right to cancel certain contracts within three days of signing. This rule is significant for independent contractors, including those executing a New Jersey Door Contractor Agreement - Self-Employed. It protects you from hasty decisions, ensuring you have time to reconsider. For detailed guidance on this and other related topics, check out resources from uslegalforms.

While New Jersey does not legally require LLCs to have an operating agreement, it is highly recommended. An operating agreement outlines the management structure and operational guidelines for your LLC. This document can be particularly beneficial when forming a New Jersey Door Contractor Agreement - Self-Employed, as it establishes clear expectations among members. Using uslegalforms can help you draft an effective operating agreement that meets your business needs.

To create an independent contractor agreement, start by defining the scope of work clearly. Include essential details such as deadlines, payment terms, and responsibilities in the agreement. A New Jersey Door Contractor Agreement - Self-Employed can simplify this process, ensuring that all parties understand their rights and obligations. Consider using platforms like uslegalforms to access customizable templates tailored to your needs.

Yes, a contractor can be considered self-employed, especially under the New Jersey Door Contractor Agreement - Self-Employed. This agreement outlines the terms and conditions that define the responsibilities and rights of a contractor working independently. By signing this agreement, contractors acknowledge their status as self-employed individuals, allowing them to manage their business and financial affairs. Understanding this distinction is important for both tax obligations and business operations.

Filling out an independent contractor form requires careful attention to detail. Begin by entering your personal information and the contractor's details. Include specific information that relates to the New Jersey Door Contractor Agreement - Self-Employed, such as the scope of work and contact information. Additionally, ensure that you sign and date the form to confirm mutual acceptance of the terms, as this represents a commitment to uphold the agreement.

To write an independent contractor agreement, start with a clear title at the top of the document. Include a section where you detail the services being provided, such as those outlined in the New Jersey Door Contractor Agreement - Self-Employed. Specify payment terms, work timelines, and any confidentiality agreements. A well-thought-out contract acts as a legal document, providing security and clarity for both parties.

Filling out an independent contractor agreement involves several key steps. First, you need to include details such as your name, the contractor’s details, and the specific services provided under the New Jersey Door Contractor Agreement - Self-Employed. Next, state the payment terms, completion timeline, and any relevant clauses on termination or dispute resolution. By taking the time to complete each section correctly, you build a strong foundation for your work relationship.

Yes, a self-employed person can definitely have a contract. In fact, having a solid agreement, like the New Jersey Door Contractor Agreement - Self-Employed, helps clarify expectations and protect both parties. This contract outlines the terms of the relationship, ensuring that your rights are upheld. Therefore, using a well-crafted agreement can enhance your professional standing and prevent misunderstandings.

To be considered self-employed, a person must run their own business and provide services to clients or customers independently. Typically, this includes managing your own profits, losses, and taxes. When formalizing your work relationships in a New Jersey Door Contractor Agreement - Self-Employed, it's important to recognize the key traits that define self-employment, such as control over your business activities.

Yes, receiving a 1099 form usually indicates that you are classified as self-employed. This form is used to report income earned from freelance or contract work. If you are entering into a New Jersey Door Contractor Agreement - Self-Employed, understanding your 1099 status can help you navigate your financial and tax responsibilities more effectively.