New Jersey Drafting Agreement - Self-Employed Independent Contractor

Description

How to fill out Drafting Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast array of legal form templates that you can download or print.

By using the website, you can discover thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the latest versions of forms such as the New Jersey Drafting Agreement - Self-Employed Independent Contractor in moments.

If you already hold a membership, Log In and download the New Jersey Drafting Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Choose the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded New Jersey Drafting Agreement - Self-Employed Independent Contractor. Each template you added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the New Jersey Drafting Agreement - Self-Employed Independent Contractor with US Legal Forms, one of the most comprehensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you would like to use US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for the city/state.

- Click the Review button to examine the form's content.

- Check the form details to confirm you have chosen the right form.

- If the form doesn't meet your needs, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select the payment plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

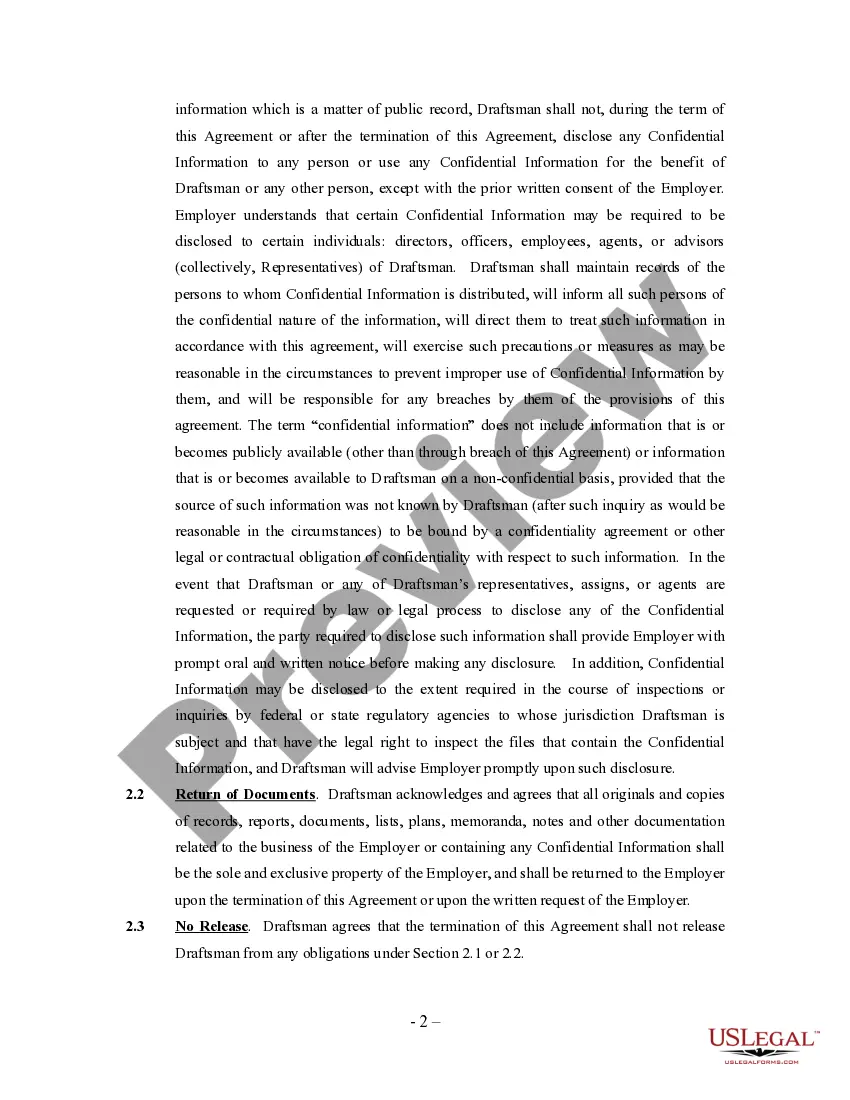

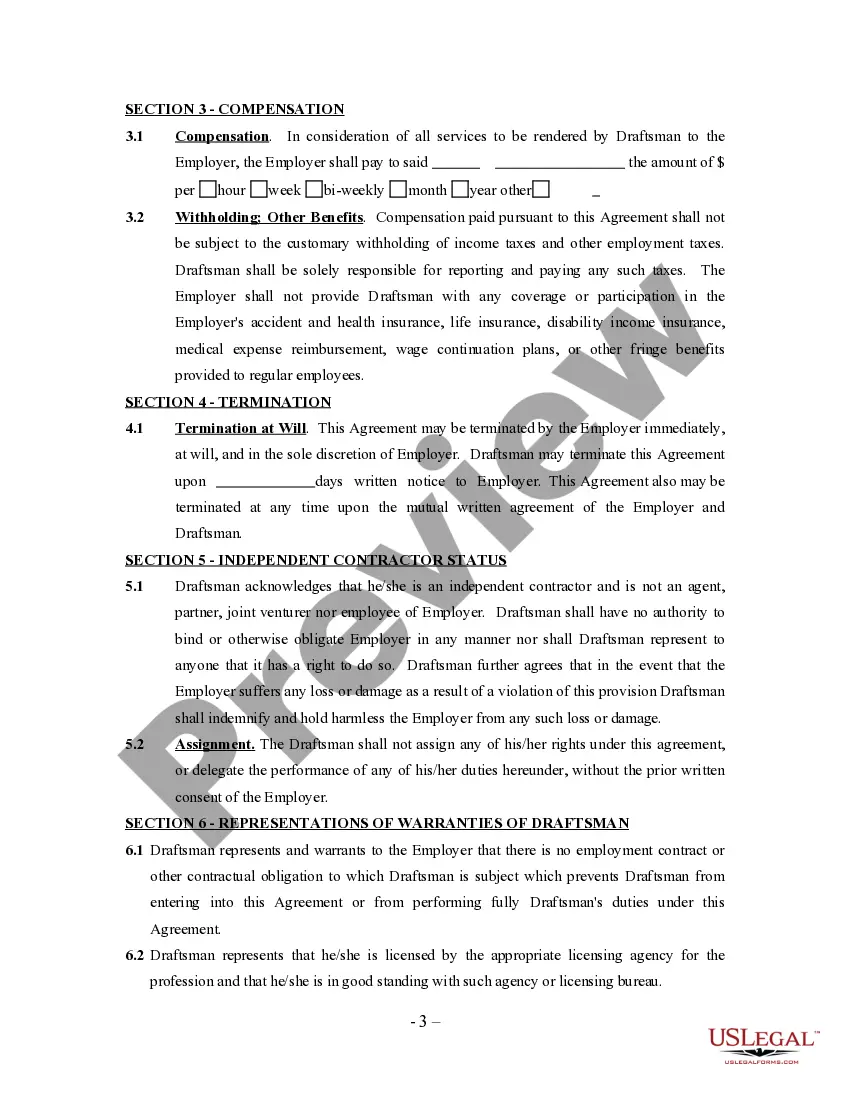

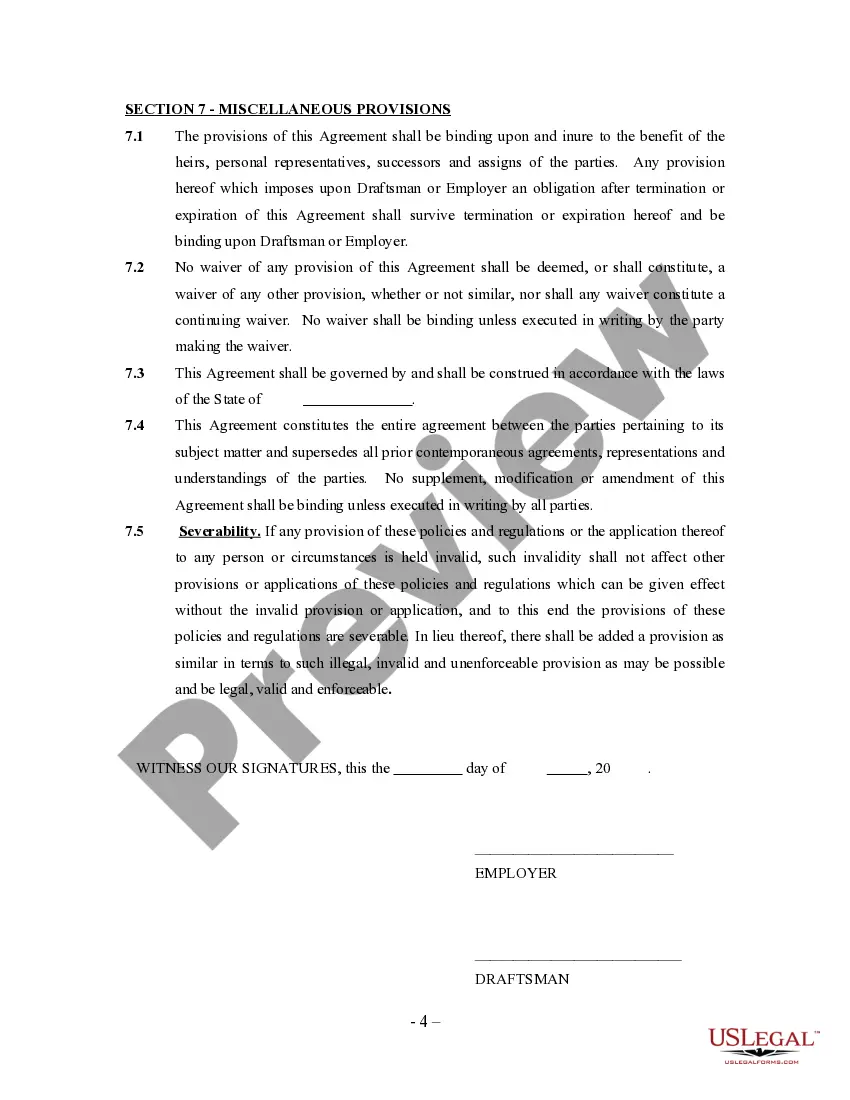

When filling out an independent contractor agreement, ensure you include all necessary details such as the parties involved, terms of engagement, and specific deliverables. It's essential to be clear and concise in your language to avoid misunderstandings. A well-prepared New Jersey Drafting Agreement - Self-Employed Independent Contractor can bolster your professionalism and help safeguard your interests.

Writing an independent contractor agreement starts by clearly defining the scope of work, payment terms, and deadlines. You should include sections on confidentiality, dispute resolution, and termination of the agreement as well. Utilizing resources like US Legal Forms can simplify the process of creating a New Jersey Drafting Agreement - Self-Employed Independent Contractor, ensuring you cover all essential elements necessary for a legally sound document.

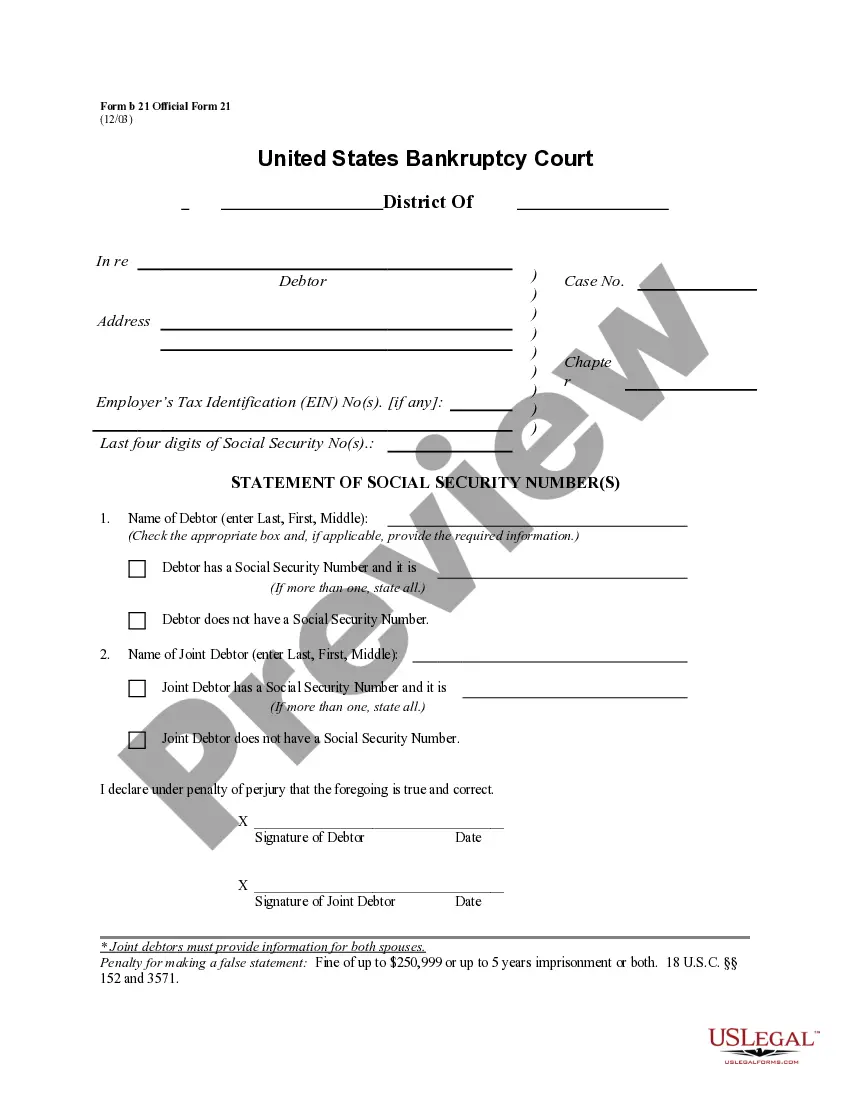

Filling out an independent contractor form involves providing your personal information, business name, and details on the services you offer. It is crucial to be truthful and accurate, as this information will be used for tax purposes. For added protection and professionalism, consider preparing a New Jersey Drafting Agreement - Self-Employed Independent Contractor that outlines your responsibilities and rights.

To fill out a declaration of independent contractor status form, first ensure you have the necessary details about your business and the client relationship. Include your name, business information, and descriptions of the services you provide. When preparing a New Jersey Drafting Agreement - Self-Employed Independent Contractor, this document is a helpful addition to confirm your status and provide clarity to your clients.

As a self-employed independent contractor in New Jersey, you typically need to complete forms such as a W-9 to provide your tax information, along with any additional paperwork required by your clients. Additionally, it's important to draft a New Jersey Drafting Agreement - Self-Employed Independent Contractor to outline the terms of your work. This agreement helps to clarify expectations and can protect both you and your client in the event of any disputes.

The independent contractor agreement is typically written by the hiring party or an attorney familiar with the terms of the contract. However, using a reliable platform like U.S. Legal Forms can simplify this process for you. Their templates for a New Jersey Drafting Agreement - Self-Employed Independent Contractor ensure that you cover all necessary legal aspects clearly and efficiently. This way, you can focus more on your project and less on the paperwork.

Drafting a contractor contract involves outlining the essential details such as project timelines, payment terms, and specific deliverables. Clearly define the roles and responsibilities of each party to avoid ambiguity. You might find it beneficial to use uslegalforms for your New Jersey Drafting Agreement - Self-Employed Independent Contractor to ensure all legal aspects are covered efficiently.

To create an independent contractor agreement, start by clearly defining the scope of work, payment terms, and timelines. Ensure that both parties agree on confidentiality and ownership of work produced. Utilizing platforms like uslegalforms can guide you in drafting a comprehensive New Jersey Drafting Agreement - Self-Employed Independent Contractor that meets legal standards.

New Jersey does not legally require an operating agreement for an LLC, but having one is highly recommended. An operating agreement outlines the management structure and operating procedures of your business. This helps prevent disputes among members and provides clarity, especially when drafting a New Jersey Drafting Agreement - Self-Employed Independent Contractor.

In New Jersey, a contract is legally binding when it includes an offer, acceptance, consideration, and mutual consent. Additionally, both parties must have the legal capacity to enter into an agreement. For those looking into a New Jersey Drafting Agreement - Self-Employed Independent Contractor, understanding these elements is essential to ensure that the contract holds up in court.