New Jersey Contractor Agreement

Description

How to fill out Contractor Agreement?

It is feasible to spend hours on the web trying to locate the legal template that fulfills the federal and state standards you require.

US Legal Forms provides a vast array of legal documents that are evaluated by experts.

You can easily obtain or print the New Jersey Contractor Agreement from their service.

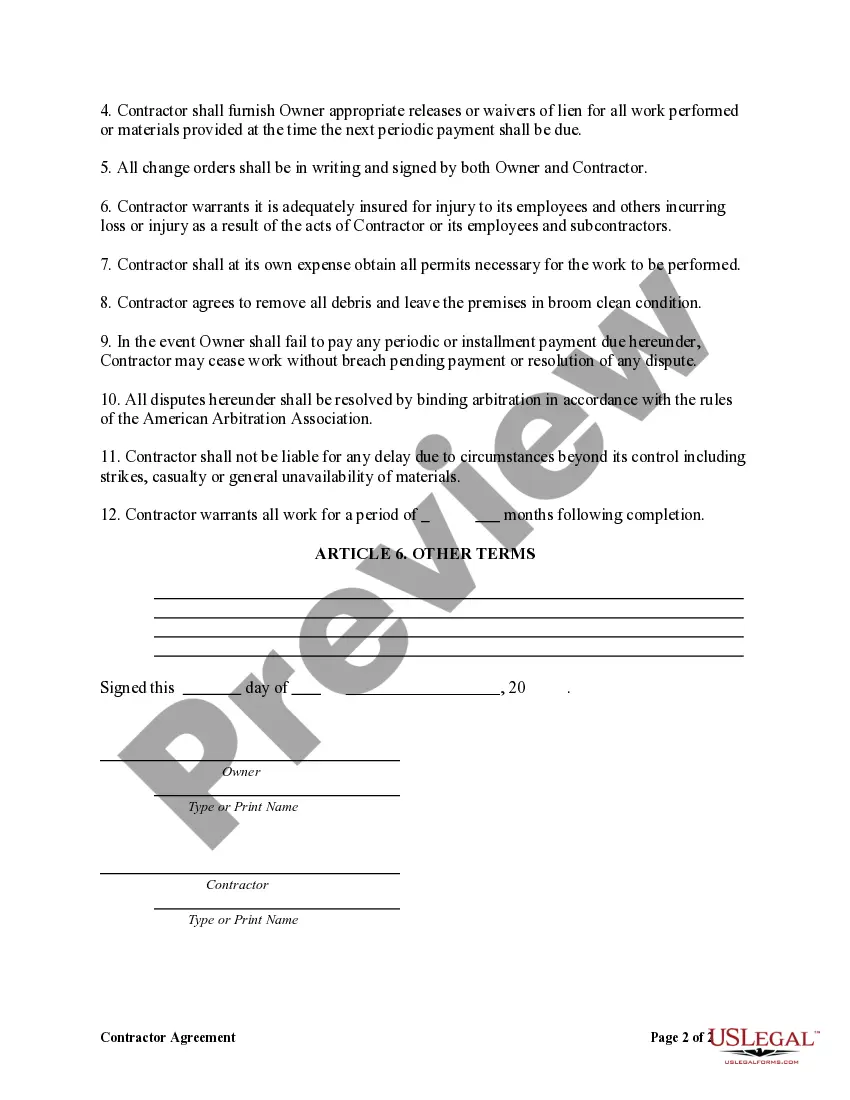

If available, utilize the Preview button to review the template as well. If you wish to find another version of your form, make use of the Search section to locate the format that fulfills your preferences and specifications.

- If you already have an account with US Legal Forms, you can Log In and click on the Download button.

- After that, you may complete, modify, print, or sign the New Jersey Contractor Agreement.

- Every legal template you acquire is yours permanently.

- To obtain another copy of any purchased form, navigate to the My documents section and click on the respective button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct template for the state/region of your choice.

- Review the form description to confirm that you have chosen the correct document.

Form popularity

FAQ

Yes, New Jersey requires certain contractors to obtain a license, especially for specialized trades such as electrical and plumbing work. This requirement helps ensure that contractors meet industry standards and maintain safety. Having a valid contractor's license can also enhance your credibility with clients. If you are unsure about the requirements, you can find resources and assistance through our platform.

To fill out a New Jersey Contractor Agreement, start by gathering the necessary information, such as project details, contractor and client information, and payment terms. Next, ensure that you clearly outline the scope of work and timelines. Using a standardized template can simplify this process, helping you avoid common pitfalls. Our platform offers easy-to-use forms that can guide you in completing your contractor agreement accurately.

A contractor typically needs to complete various documents, including a licensing application, tax forms, and the New Jersey Contractor Agreement. These forms help clarify the responsibilities and expectations between parties. Additionally, contractors should collect any necessary permits depending on the project's nature. Using platforms like uslegalforms can simplify this process, ensuring all paperwork is correctly filled out and compliant with state regulations.

To fill out a contract form, begin by clearly stating the project details, including the names of both parties involved. Next, outline the terms of the agreement, such as the scope of work, payment terms, and timelines for completion. It's crucial to review the New Jersey Contractor Agreement template carefully, ensuring all necessary sections are included. Finally, both parties should sign and date the contract, making it legally binding.

An independent contractor in New Jersey is someone who provides services under a contract but retains control over how those services are executed. Unlike employees, independent contractors are responsible for their own taxes and benefits. The distinction often pertains to factors like the degree of control, independence, and the nature of the relationship established in the New Jersey Contractor Agreement. Understanding this classification is vital for both parties to comply with legal obligations.

Typically, an independent contractor agreement can be drafted by either party involved—usually the client or an attorney specializing in contract law. It's crucial to ensure that the agreement reflects the needs and expectations of both the contractor and the client. Utilizing templates or services available through platforms like USLegalForms can help simplify this process. A well-crafted New Jersey Contractor Agreement can save time and avoid disputes.

The 2-year contractor rule in New Jersey refers to a guideline that affects how employment status is classified. This rule judges whether a contractor has been misclassified as an independent contractor rather than an employee. If a contractor works under the same contract for two years, the state may determine a different employment status, impacting benefits and tax obligations. Knowing this rule can help you effectively structure your New Jersey Contractor Agreement.

If you break an independent contractor agreement in New Jersey, you may face legal consequences that result in financial loss. The agreement typically includes clauses related to breach of contract that can lead to damages or penalties. Depending on the circumstances, the other party may seek compensation for losses incurred due to the breach. To avoid such situations, take the time to carefully review and adhere to your New Jersey Contractor Agreement.

The New Jersey Contractor Agreement is a formal document that outlines the relationship between a contractor and a client. This agreement details the scope of work, payment terms, deadlines, and other vital provisions. By having a clear agreement, both parties understand their responsibilities and rights, reducing the risk of misunderstandings. It's essential to draft a comprehensive New Jersey Contractor Agreement to protect your interests.

Establishing an LLC as an independent contractor can provide you with liability protection and tax benefits. It separates your personal assets from your business, offering peace of mind when entering into a New Jersey Contractor Agreement. This move may also enhance your professional credibility in the eyes of potential clients. Consider discussing your options with a financial advisor to ensure that forming an LLC aligns with your business goals.