New Jersey Disclaimer of Right to Inherit or Inheritance

Description

Key Concepts & Definitions

Disclaimer of Right to Inherit or Inheritance: This legal concept refers to the voluntary renunciation or refusal of a potential heir to receive assets from a deceased person's estate. Such a disclaimer can affect probate proceedings and the distribution of the estate among other heirs or beneficiaries.

Step-by-Step Guide on Disclaiming Inheritance

- Assessment of Intent: Confirm your intentions firmly as disclaiming an inheritance is an irrevocable action.

- Understand Your Legal Rights: Consult with an attorney to comprehend your rights and implications of your disclaimer.

- Timely Action: The disclaimer must be made within a specific timeframe, usually within nine months of the decedent's death or upon reaching the legal age of majority.

- Prepare the Disclaimer Document: Write a formal statement declaring your intention to disclaim and specify the part of the inheritance being disclaimed.

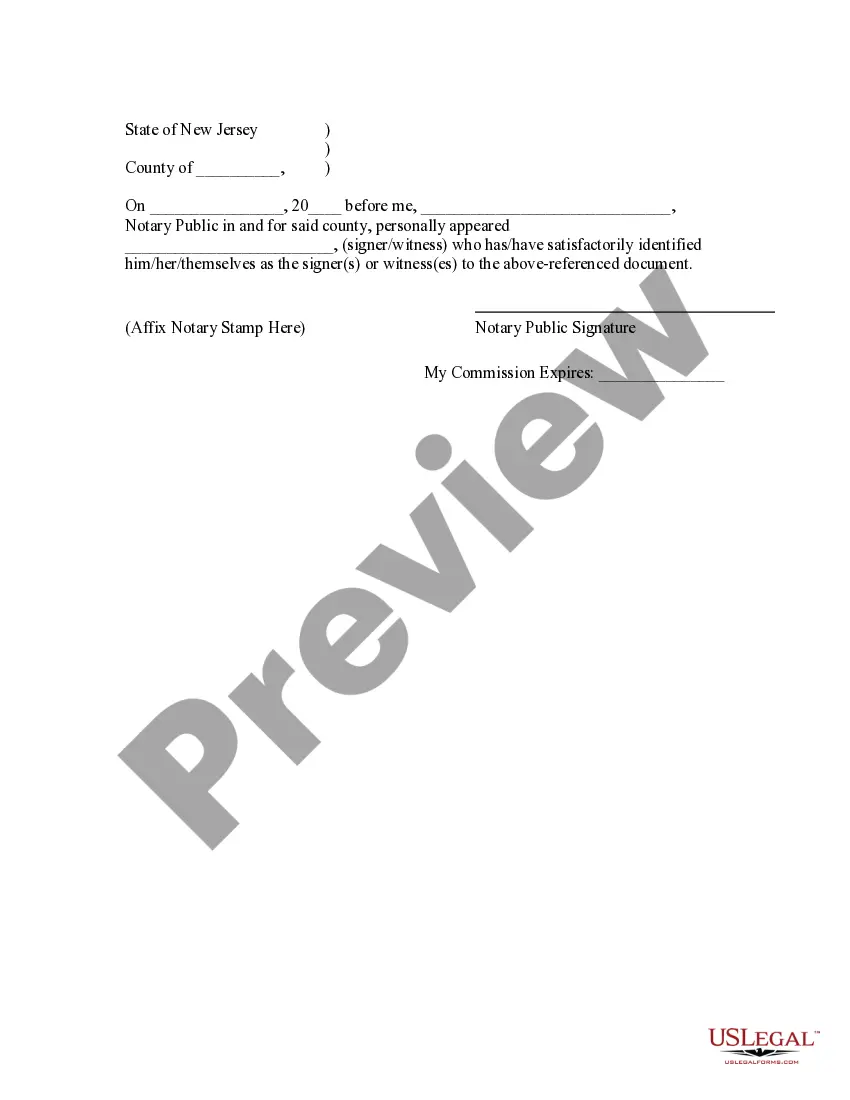

- Execute with Formality: Sign the document in the presence of a notary public.

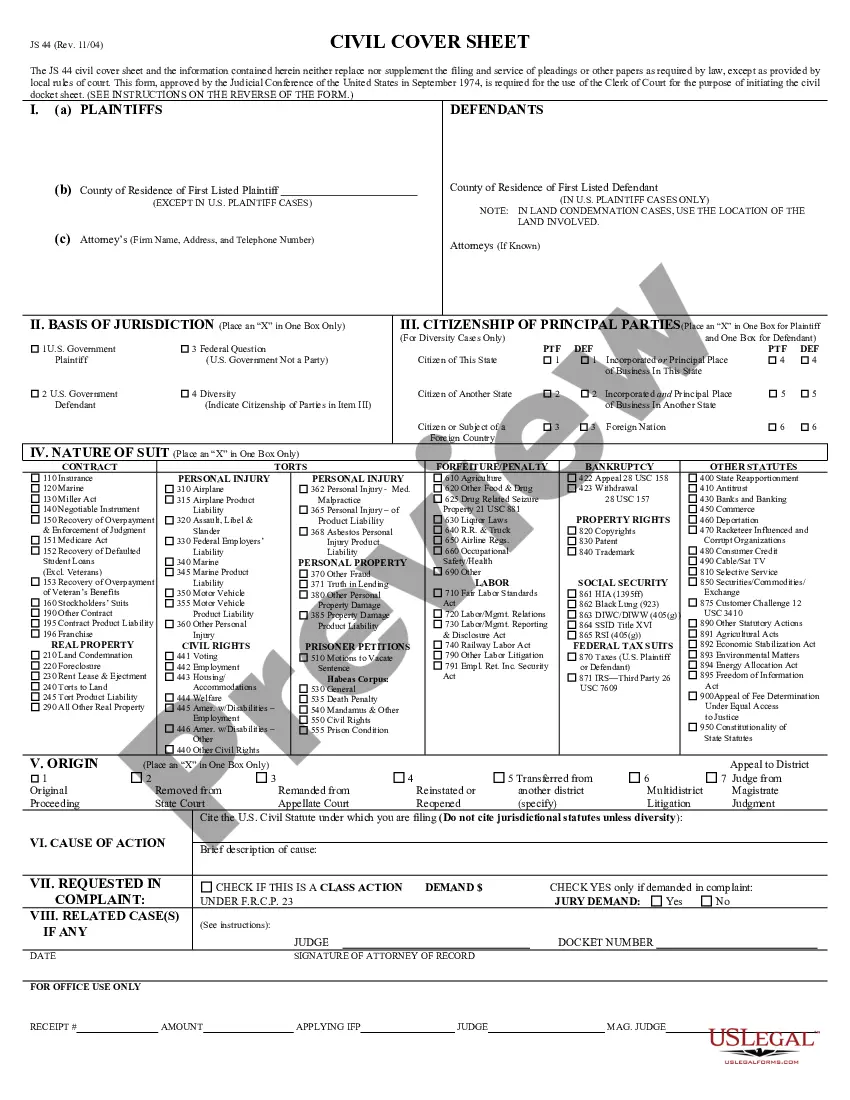

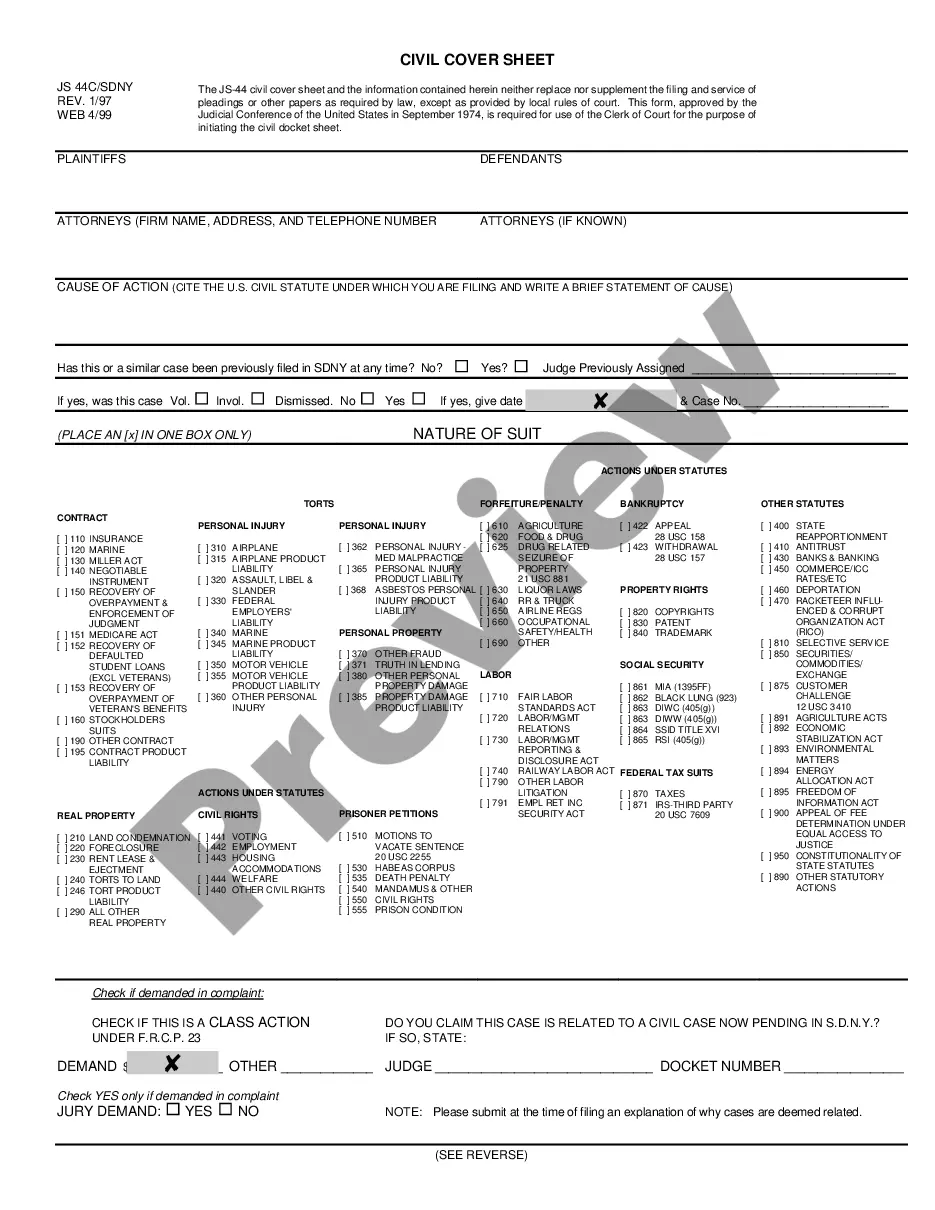

- File the Disclaimer: Submit the document to the relevant probate court and notify the executor of the will or the administrator of the estate.

Risk Analysis of Disclaiming Inheritance

- Financial Implications: Consider potential financial loss, especially if the inheritance includes substantial assets or monetary benefits.

- Irrevocability: Once made, a disclaimer is final and irreversible, preventing any claim to the disclaimed inheritance in the future.

- Tax Considerations: Disclaiming inheritance could impact your tax situation, potentially favorably by avoiding inheritance tax, though each case varies depending on state law and the specifics of the estate.

- Impact on Other Heirs: Your disclaimer affects how the estate is distributed among other heirs, possibly creating familial tension or disputes.

Common Mistakes & How to Avoid Them

- Delay in Disclaiming: Failing to disclaim within the legal timeframe can result in automatic inheritance acceptance.

- Incomplete Documentation: Ensure your disclaimer includes all necessary legal descriptions and is clearly written to prevent any ambiguity.

- Ignoring Tax Consequences: Overlooking the tax implications can lead to unforeseen financial burdens. Always consult with a tax advisor.

- Neglecting State Laws: State laws vary regarding inheritance disclaimers. It's crucial to understand and adhere to local laws.

Key Takeaways

- Legal Consultation is Essential: Involve legal professionals to navigate the complexities of inheritance laws.

- Understand the Full Scope: Be fully aware of what you are disclaiming and its impact on your financial and personal situation.

- Consider the Long-Term Impact: Think beyond the immediate implications to understand how disclaiming may affect your future and that of other heirs.

How to fill out New Jersey Disclaimer Of Right To Inherit Or Inheritance?

US Legal Forms is actually a unique platform where you can find any legal or tax document for submitting, including Disclaimer of Right to Inherit or Inheritance - New Jersey. If you’re tired of wasting time looking for ideal examples and spending money on file preparation/lawyer fees, then US Legal Forms is exactly what you’re looking for.

To experience all of the service’s advantages, you don't have to download any software but just choose a subscription plan and create your account. If you already have one, just log in and look for a suitable sample, download it, and fill it out. Downloaded documents are all stored in the My Forms folder.

If you don't have a subscription but need Disclaimer of Right to Inherit or Inheritance - New Jersey, take a look at the instructions below:

- Double-check that the form you’re checking out is valid in the state you want it in.

- Preview the form its description.

- Simply click Buy Now to get to the register webpage.

- Select a pricing plan and keep on signing up by entering some information.

- Pick a payment method to finish the sign up.

- Save the file by choosing your preferred format (.docx or .pdf)

Now, fill out the document online or print out it. If you are uncertain about your Disclaimer of Right to Inherit or Inheritance - New Jersey form, speak to a legal professional to examine it before you send or file it. Get started hassle-free!

Form popularity

FAQ

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

What are New Jersey Tax Waivers? The New Jersey Inheritance Tax Bureau issues tax waivers after an Inheritance or Estate Tax return has been filed and approved by the Bureau. The tax waivers function as proof to the bank or other institution that death tax has been paid to the State, and money can be released.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor,

In your disclaimer, cover any and all liabilities for the product or service that you provide. You should warn consumers of any dangers or hazards posed by your product. You should list specific risks while at the same time acknowledging that the list is not exhaustive. For example, you could write, NOTICE OF RISK.

Inheritance Tax waivers are required only for real property located in New Jersey.The transfer of any assets, whether real or intangible, which stand in the name of a bona fide trust as of the date of a decedent's death, does not require a tax waiver.

When you relinquish property, you don't get any say in who inherits in your place. If you want to control who gets the inheritance, you must accept it and give it to that person. If you relinquish the property and the deceased didn't name a back-up heir, the court will apply state law to decide who inherits.

You disclaim the assets within nine months of the death of the person you inherited them from. (Note: There's an exception for minor beneficiaries; they have until nine months after they reach the age of majority to disclaim.) You receive no benefits from the proceeds of the assets you're disclaiming.

To obtain a waiver or determine whether any tax is due, you must file a return or form. The type of return or form required generally depends on: The relationship of the beneficiaries to the decedent; and. The size (in dollar value) of the whole estate.

These documents can include the will, death certificate, transfer of ownership forms and letters from the estate executor or probate court.If you received the inheritance in the form of cash, request a copy of the bank statement that reflects the deposit.