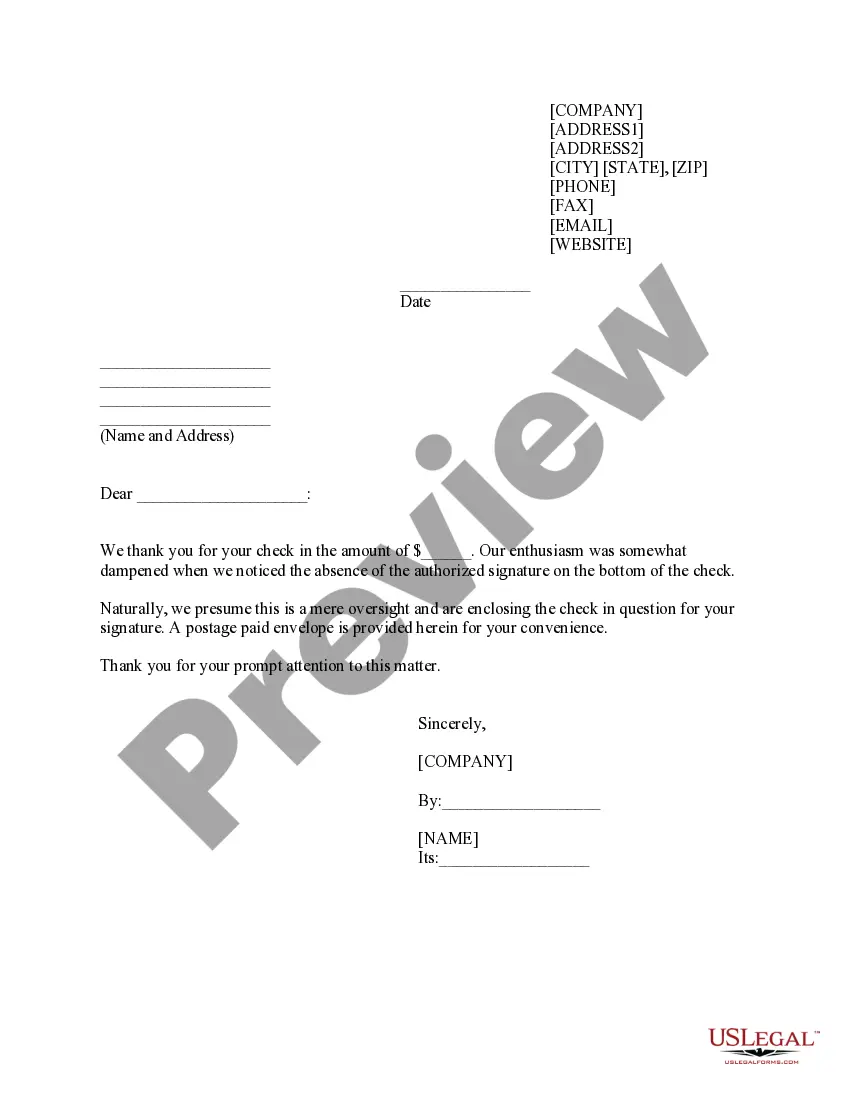

Sample Letter for Return of Check Missing Signature

What is this form?

The Sample Letter for Return of Check Missing Signature is a template designed to formally alert the issuer of a check that it was not signed upon issuance. This letter serves as a professional prompt to rectify the situation, ensuring that the recipient understands the need for correction. It differs from other correspondence by specifically addressing the issue of a missing signature on a financial instrument, which is crucial for processing the payment correctly.

Key components of this form

- Return address: Where the letter is being sent from, including name and address details.

- Date: The date on which the letter is being sent.

- Recipient's address: The name and address of the check issuer.

- Subject line: Clearly states the purpose of the letterâreturn of a check with a missing signature.

- Signature: The senderâs name, confirming the intended action.

When to use this form

This form is used when an individual or business receives a check that lacks the necessary signature from the issuer. It is particularly relevant in situations where an attempt to cash or deposit the check has failed due to the signature being absent. Sending this letter ensures clear communication to resolve the matter promptly.

Intended users of this form

- Individuals who have received a check that is missing a signature.

- Small businesses that issue checks and need to follow up on payment issues.

- Accountants or financial officers managing check payments for their organizations.

Instructions for completing this form

- Identify the parties: Fill in your return address and the recipientâs address details accurately.

- Enter the date: Clearly indicate the date on which the letter is written.

- Specify the subject: Make sure to state that this is regarding the return of a check with a missing signature.

- Sign the letter: Include your name at the bottom as a formal sign of communication.

Is notarization required?

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Not including all necessary address details.

- Failing to proofread for spelling errors, which can undermine professionalism.

- Forgetting to sign the letter before sending it.

Benefits of completing this form online

- Convenience: Easily download and customize the letter from anywhere.

- Editability: Modify the template to fit the specific details of your situation.

- Reliability: Use a professionally drafted template created by licensed attorneys, ensuring legal soundness.

Summary of main points

- The Sample Letter for Return of Check Missing Signature is essential for addressing cheque discrepancies professionally.

- Accurate completion of the letter facilitates effective communication between the sender and recipient.

- Using this template can help reduce errors and ensure proper documentation in financial matters.

Looking for another form?

Form popularity

FAQ

Write the name of the original recepient of the check on the top left side of the page. Skip a couple of lines and write the date that you're sending the letter out on the left hand side of the page.

Step 1: Contact The Recipient. Let the recipient know immediately that you're aware your check bounced. Step 2: Make Good On The Check. Step 3: Pay The Fees You Owe To Your Bank. Step 4: Ask For Receipts.

Sub: Stop Payment We request you to kindly stop the payment of the cheque No. - dated dd/mm/yyyy for Rs. (Rupees Only) issued by us in favor of Mr. (name of client / employee).

Personal checks don't expire. But they do become what is known as stale dated. Simply put, a check becomes stale dated six months after it was written. After six months, banks have the option of refusing to deposit or cash any stale-dated checks.

Include a letter in your postal mail or a note in your email recapping the date of purchase, when you were notified of the bounced check and the extra fees charged to your account. Respectfully request payment by a reasonable date. Do not exhibit anger or threats to your customer.

Dear name, I am writing in to apologize for the inconvenience caused to you because the check check no. was returned due to insufficient funds. I cannot tell you how embarrassed I am feeling because of this.

Void the check and add the amount to your checkbook balance. Debit the general ledger Cash account for the amount, and credit the account that was originally debited. Remove the check from the bank reconciliation's list of outstanding checks.

Dear Name of Bounced-Check Writer: I am writing to inform you that check #Check Number dated Date on Bounced Check, in the amount of $Amount of Bounced Check made payable to Your Name/Payee's Name has been returned to me due to insufficient funds, a closed account, etc..

Dear (Client name), I am writing this letter to inform you that the cheque which you allotted to (Company name) on behalf of (Concern Authority name) published on (Date: DD/MM/YY) got bounced due to some error of writing in it. (Describe in your own words). It was issued on the total amount of (Money Amount) only.