Self-Employed Lifeguard Services Contract

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Self-Employed Lifeguard Services Contract?

Among lots of paid and free templates that you’re able to get online, you can't be sure about their reliability. For example, who created them or if they’re qualified enough to take care of what you need them to. Always keep relaxed and make use of US Legal Forms! Discover Self-Employed Lifeguard Services Contract templates made by professional lawyers and get away from the high-priced and time-consuming procedure of looking for an lawyer or attorney and after that having to pay them to write a document for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button next to the form you’re trying to find. You'll also be able to access all your previously saved samples in the My Forms menu.

If you’re utilizing our platform for the first time, follow the guidelines listed below to get your Self-Employed Lifeguard Services Contract fast:

- Make sure that the document you discover is valid where you live.

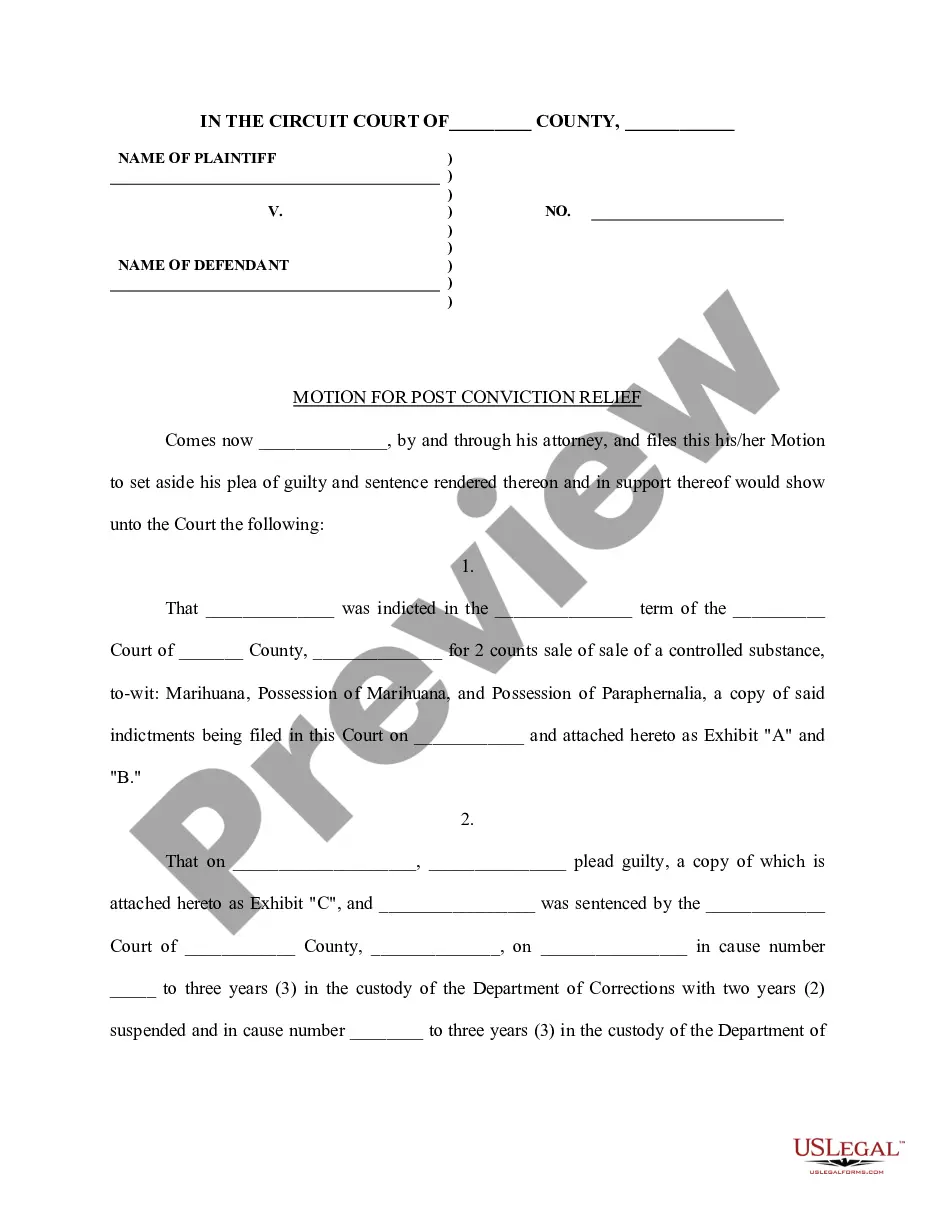

- Review the file by reading the information for using the Preview function.

- Click Buy Now to start the purchasing procedure or find another sample utilizing the Search field located in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

As soon as you’ve signed up and bought your subscription, you may use your Self-Employed Lifeguard Services Contract as often as you need or for as long as it remains active where you live. Change it in your favored online or offline editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

1. Not Having a Written Contract.The taxing, labor and employment, and insurance authorities expect a written contract that states that the worker is an independent contractor and will be paid as such with no tax withholding, no benefits, etc.

A self employed person will not usually have a contract of employment; they will usually be hired for a certain amount of time. The contract that exists between the self employed person and the person or company supplying the work will have a number of rules or conditions set down within it.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else. An independent contractor is someone who provides a service on a contractual basis.

Do not designate someone as a 1099 Employee if: Company provides training on a certain method of job performance. Tools and materials are provided. Employees must follow set schedule. You provide benefits such as vacation, overtime pay, etc.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax.

A self employed person will not usually have a contract of employment; they will usually be hired for a certain amount of time. The contract that exists between the self employed person and the person or company supplying the work will have a number of rules or conditions set down within it.

People who work for themselves or who own their own company are sometimes alternately referred to as self-employed or independent contractors, though there is a difference between the two. In general, all independent contractors are self-employed, but not all self-employed people are independent contractors.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax. If you are an independent contractor, you are self-employed.You are not an independent contractor if you perform services that can be controlled by an employer (what will be done and how it will be done).