New Hampshire Notice of Violation of Fair Debt Act - Notice to Stop Contact

Description

How to fill out Notice Of Violation Of Fair Debt Act - Notice To Stop Contact?

It is feasible to spend time online attempting to locate the legal document format that aligns with the federal and state requirements you require.

US Legal Forms offers a multitude of legal templates that have been reviewed by professionals.

You can easily download or print the New Hampshire Notice of Violation of Fair Debt Act - Notice to Stop Contact from my service.

If available, utilize the Review button to look through the document template concurrently.

- If you already have a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can fill out, modify, print, or sign the New Hampshire Notice of Violation of Fair Debt Act - Notice to Stop Contact.

- Each legal document template you purchase is yours permanently.

- To acquire another copy of a purchased form, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for the county/city of your preference.

- Examine the form description to make certain you have chosen the proper document.

Form popularity

FAQ

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.

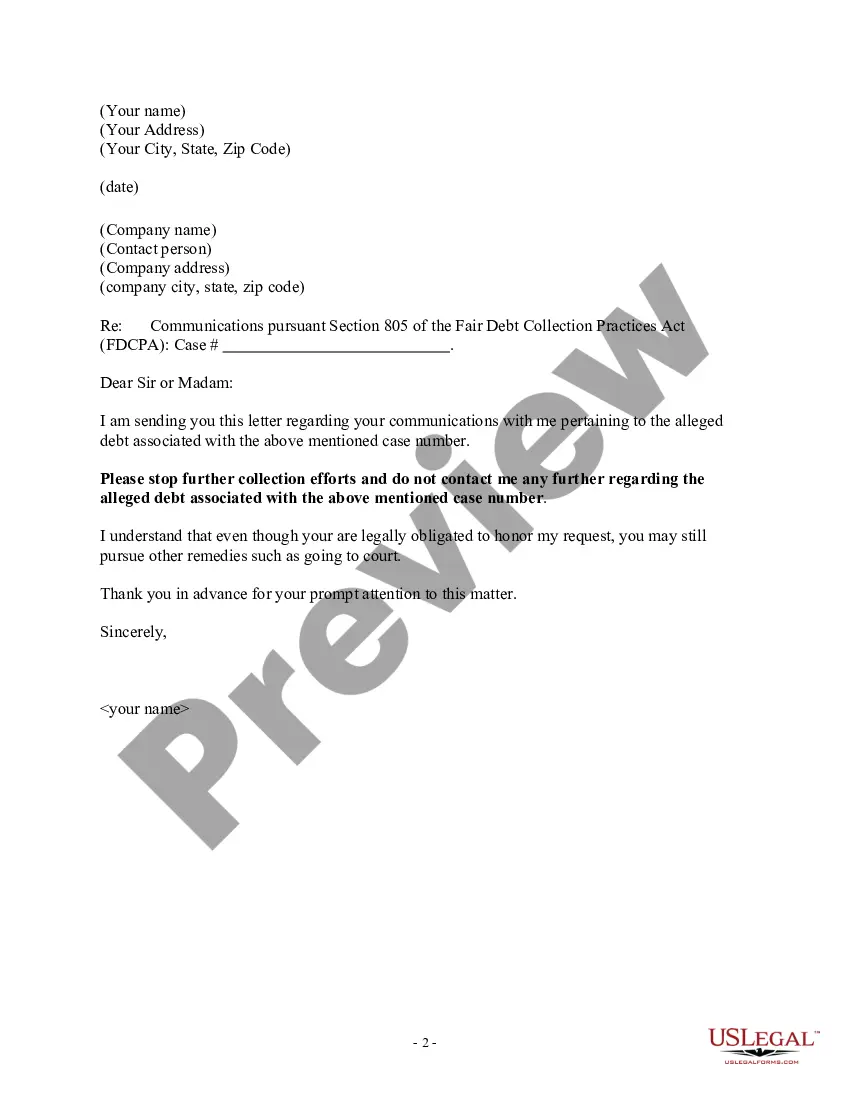

Cease and desist letters are legally binding notices to debt collectors telling them to stop contacting you. You don't need a lawyer for this -- just get your debt collector's name, address, and your account information and write a letter telling them to stop all contact, and by law, they have to do so.

Dear debt collector, I am responding to your contact about collecting a debt. You contacted me by phone/mail, on date and identified the debt as any information they gave you about the debt. I do not have any responsibility for the debt you're trying to collect.

According to the FDCPA, a debt collector can only contact you, your attorney, or a consumer reporting agency. According to the FDCPA, a debt collector can not: Contact you before am or after pm in your time zone or at an inconvenient time. Contact you at your place of employment.

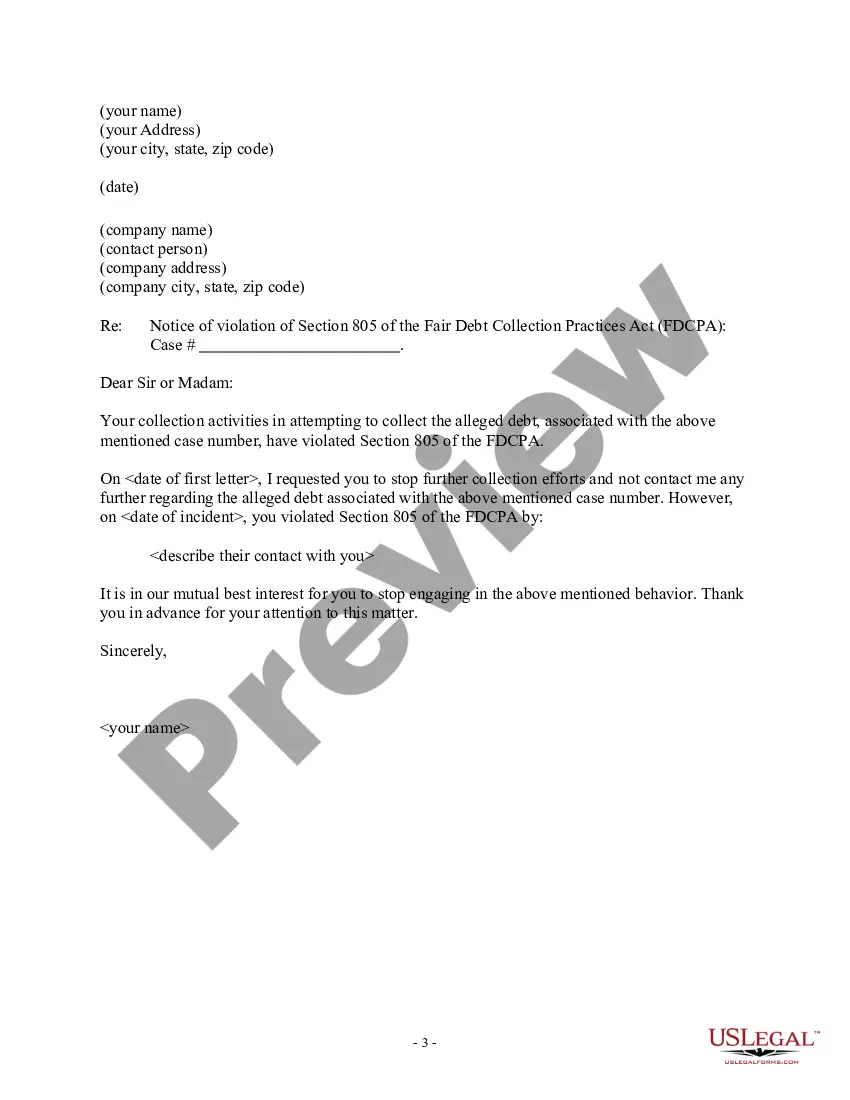

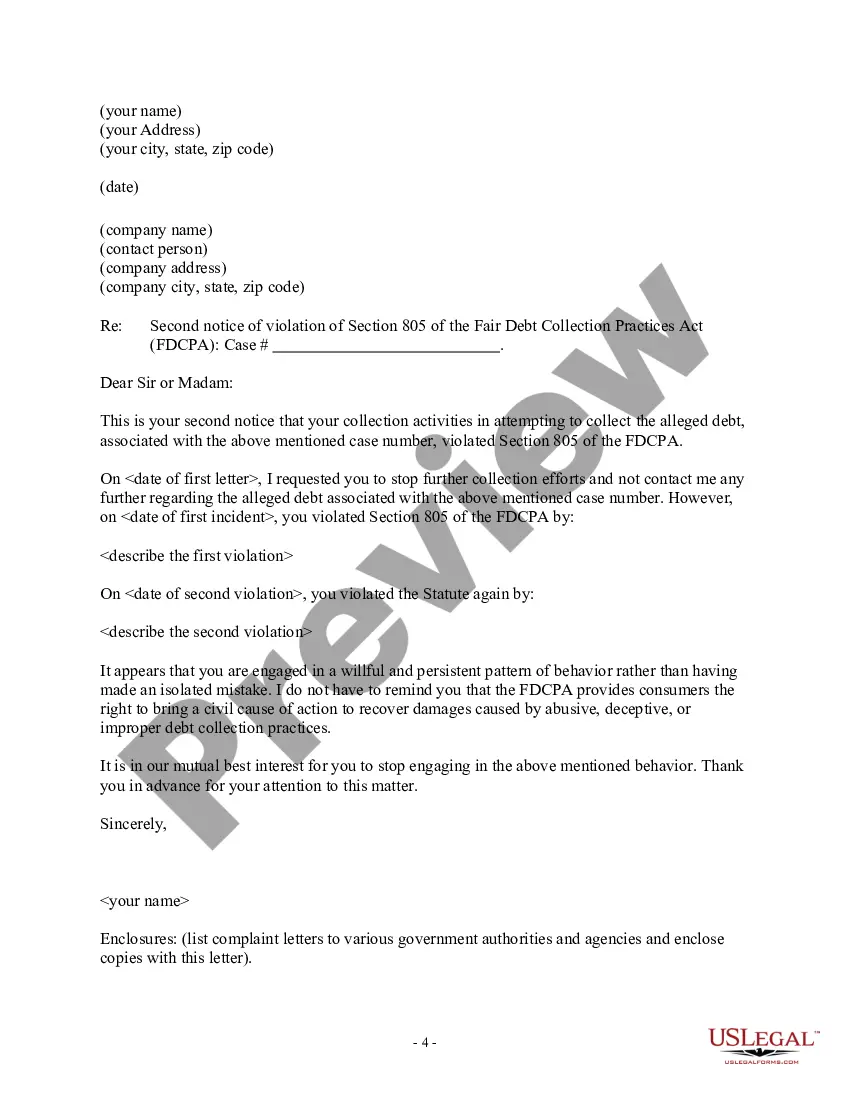

The FDCPA prohibits debt collectors from calling you repeatedly, using profane language, making threats, or otherwise harassing you. If a debt collector is constantly calling you and causing you stress, sending a cease and desist letter can stop the collector from harassing you.

You have the right to tell a debt collector to stop communicating with you. To stop communication, send a letter to the debt collector and keep a copy of the letter. The CFPB's Debt Collection Rule clarifying certain provisions of the Fair Debt Collection Practices Act (FDCPA) became effective on November 30, 2021.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

The Fair Debt Collection Practices Act (FDCPA) is a federal law that provides a mechanism for you to stop debt collectors from contacting you. You can do this by sending a Cease and Desist Letter. Federal law allows you to communicate with debt collectors to tell them that you want them to stop contacting you.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

Even if the debt is yours, you still have the right not to talk to the debt collector and you can tell the debt collector to stop calling you. However, telling a debt collector to stop contacting you does not stop the debt collector or creditor from using other legal ways to collect the debt from you if you owe it.