New Hampshire Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard

Description

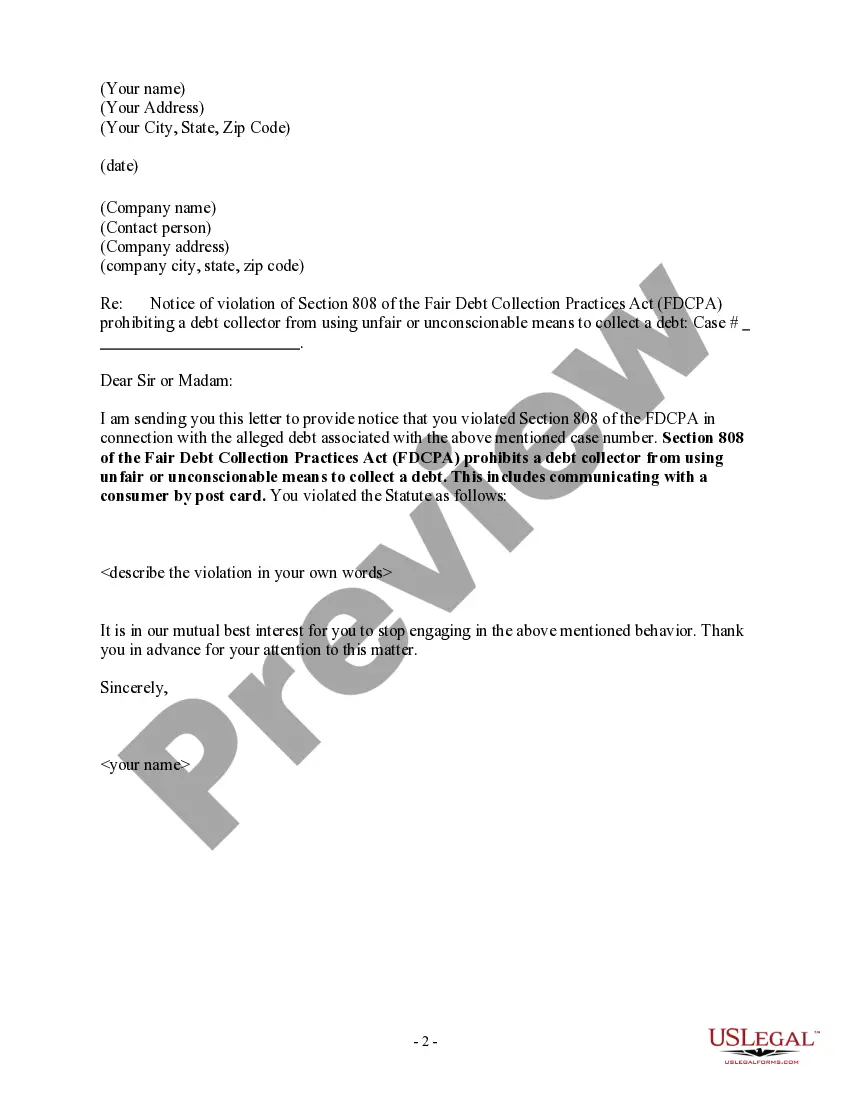

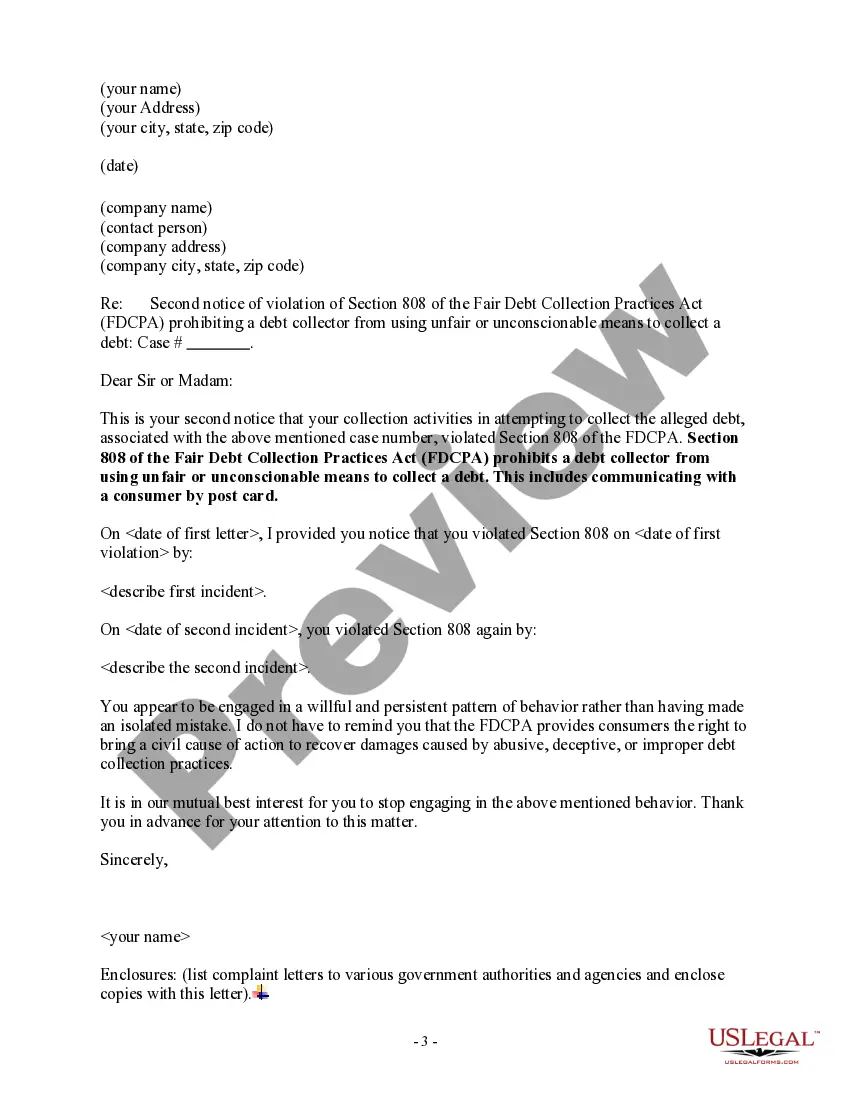

How to fill out Notice Of Violation Of Fair Debt Act - Unlawful Contact By Postcard?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal form templates that you can either download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms such as the New Hampshire Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard within moments.

Review the form description to confirm that you have chosen the right form.

If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you currently have a subscription, Log In and download the New Hampshire Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard from your US Legal Forms library.

- The Download button will be visible on every form you view.

- You can access all previously acquired forms in the My documents section of your account.

- If you're using US Legal Forms for the first time, here are simple steps to get you started.

- Ensure you have selected the correct form for your city/state.

- Click on the Preview button to check the content of the form.

Form popularity

FAQ

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

Don't be surprised if debt collectors slide into your DMs. A new rule allows debt collectors to contact you on social media, text or email not just by phone. The rule, which was approved last year by the Consumer Financial Protection Bureau's former president Kathleen L.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

No. Under federal law, a debt collector may contact other people but generally only to find out how to contact you. The CFPB's Debt Collection Rule clarifying certain provisions of the Fair Debt Collection Practices Act (FDCPA) became effective on November 30, 2021.

3 Things You Should NEVER Say To A Debt CollectorAdditional Phone Numbers (other than what they already have)Email Addresses.Mailing Address (unless you intend on coming to a payment agreement)Employer or Past Employers.Family Information (ex.Bank Account Information.Credit Card Number.Social Security Number.

Debt collectors are not permitted to try to publicly shame you into paying money that you may or may not owe. In fact, they're not even allowed to contact you by postcard. They cannot publish the names of people who owe money. They can't even discuss the matter with anyone other than you, your spouse, or your attorney.

Top 7 Debt Collector Scare TacticsExcessive Amount of Calls.Threatening Wage Garnishment.Stating You Have a Deadline.Collecting Old Debts.Pushing You to Pay Your Debt to Improve Your Credit ScoreStating They Do Not Need to Prove Your Debt ExistsSharing Your Debt With Family and Friends.07-May-2021

Debt collection agencies are not bailiffs; They have no extra-legal authority. Debt collectors are either acting on behalf of your creditor or working for a company that has taken on the debt. They don't have any special legal powers and can't do anything different than the original creditor.

You may ask a debt collector to contact you only by mail, or through your attorney, or set other limitations. Make sure you send your request in writing, send it by certified mail with a return receipt, and keep a copy of the letter and receipt.