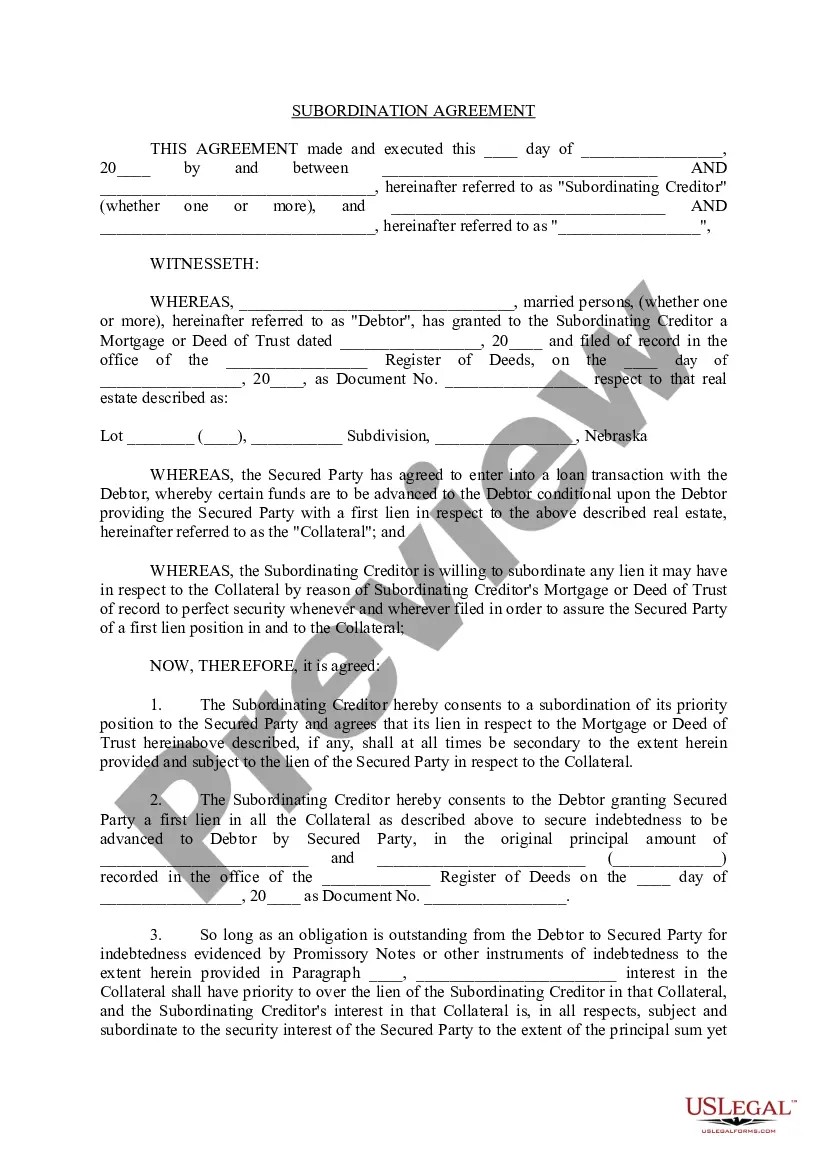

Nebraska Subordination Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Nebraska Subordination Agreement?

Avoid pricey lawyers and find the Nebraska Subordination Agreement you want at a reasonable price on the US Legal Forms site. Use our simple groups function to find and download legal and tax forms. Read their descriptions and preview them prior to downloading. Moreover, US Legal Forms enables users with step-by-step instructions on how to download and fill out each form.

US Legal Forms customers merely must log in and download the particular document they need to their My Forms tab. Those, who haven’t got a subscription yet need to follow the guidelines listed below:

- Make sure the Nebraska Subordination Agreement is eligible for use in your state.

- If available, look through the description and use the Preview option well before downloading the templates.

- If you are confident the document is right for you, click on Buy Now.

- If the template is incorrect, use the search engine to get the right one.

- Next, create your account and select a subscription plan.

- Pay by card or PayPal.

- Select obtain the form in PDF or DOCX.

- Simply click Download and find your template in the My Forms tab. Feel free to save the template to the device or print it out.

Right after downloading, you may complete the Nebraska Subordination Agreement manually or by using an editing software. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

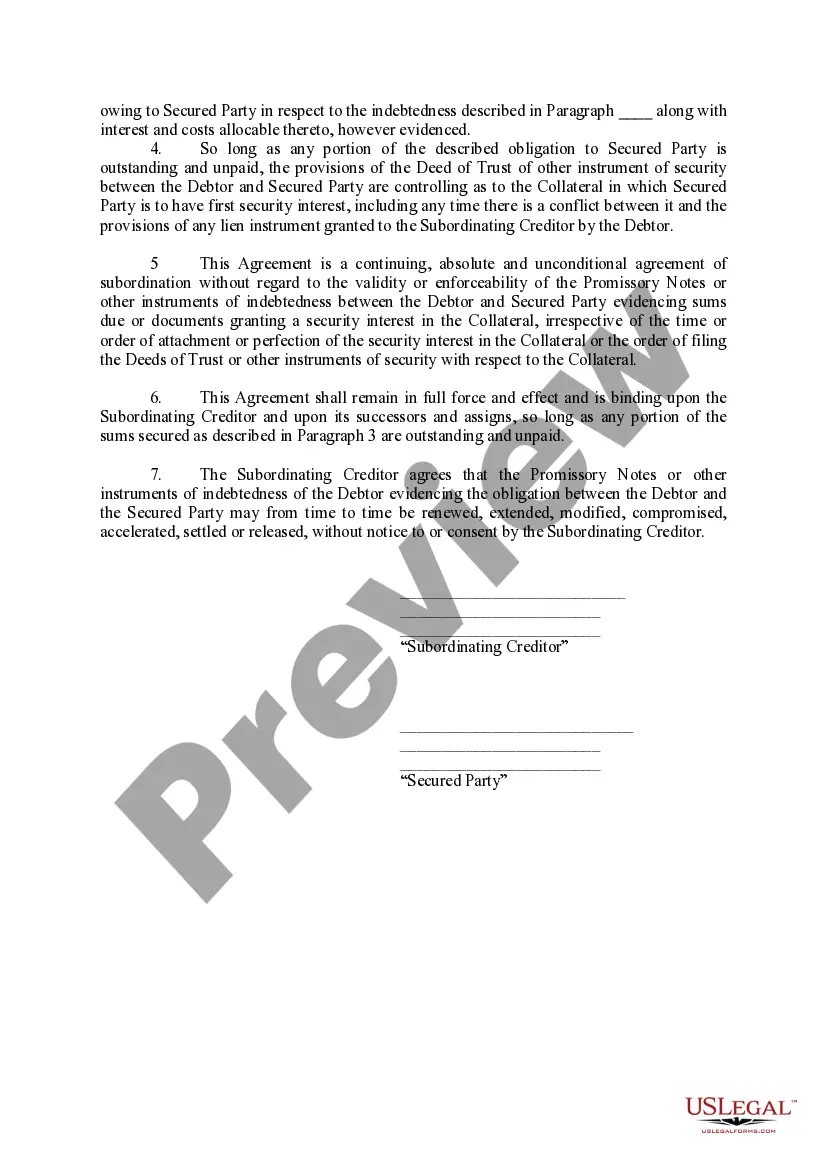

A subordination agreement is a legal document that establishes one debt as ranking behind another in priority for collecting repayment from a debtor. The priority of debts can become extremely important when a debtor defaults on payments or declares bankruptcy.

: placement in a lower class, rank, or position : the act or process of subordinating someone or something or the state of being subordinated As a prescriptive text, moreover, the Bible has been interpreted as justifying the subordination of women to men.

A subordination agreement acknowledges that one party's claim or interest is superior to that of another party in the event that the borrower's assets must be liquidated to repay the debts.

Subordination is the process of ranking home loans (mortgage, HELOC or home equity loan) by order of importance.Through subordination, lenders assign a lien position to these loans. Generally, your mortgage is assigned the first lien position while your HELOC becomes the second lien.

Subordination clauses in mortgages refer to the portion of your agreement with the mortgage company that says their lien takes precedence over any other liens you may have on your property.The primary lien on a house is usually a mortgage. However, it's also possible to have other liens.

Subordination agreements are prepared by your lender. The process occurs internally if you only have one lender. When your mortgage and home equity line or loan have different lenders, both financial institutions work together to draft the necessary paperwork.

When a Borrower wishes to refinance the property, they must request a subordination request to the Lender. The Lender will subordinate their loan only when there is no cash out as part of the refinance.

But as property values are going up and the demand for refinance isn't as much, it seems that the subordination process has gotten a little easier. Typically, it takes two to three weeks to get the resubordination paperwork through, and it is likely to set you back $200 to $300.

Resubordination is the process of keeping the first mortgage in first place, ahead of other mortgages. When you refinance your first mortgage, the lender will insist on resubordinating the home equity loan or line of credit. The equity lender isn't required to resubordinate.