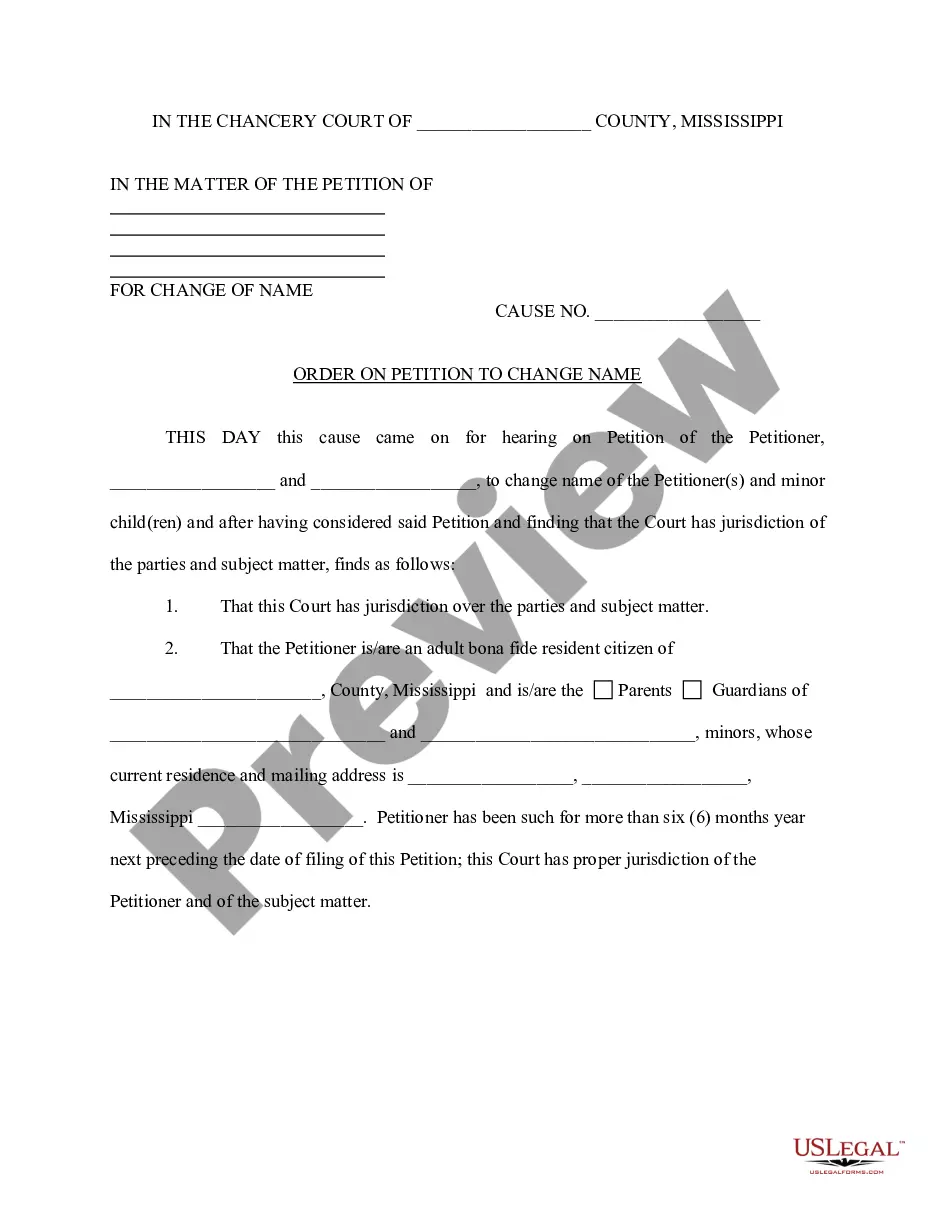

This office lease form states that a guaranty in which a corporate guarantor has the authority of the signatory to bind a corporation. This guaranty gives the guarantor full power, authority and legal right to execute and deliver this guaranty and that this guaranty constitutes the valid and binding obligation of the guarantor.

North Dakota Authority of Signatory to Bind the Guarantor

Description

How to fill out Authority Of Signatory To Bind The Guarantor?

US Legal Forms - one of the biggest libraries of legitimate types in the United States - delivers an array of legitimate record web templates you are able to acquire or print. Utilizing the internet site, you can get a huge number of types for business and person purposes, sorted by types, states, or search phrases.You will discover the latest types of types such as the North Dakota Authority of Signatory to Bind the Guarantor in seconds.

If you already possess a monthly subscription, log in and acquire North Dakota Authority of Signatory to Bind the Guarantor from your US Legal Forms collection. The Obtain key will appear on every single kind you view. You gain access to all previously delivered electronically types in the My Forms tab of your respective bank account.

If you would like use US Legal Forms the first time, listed below are simple recommendations to obtain started:

- Make sure you have picked the correct kind for your personal area/county. Click the Review key to analyze the form`s content. Look at the kind information to actually have selected the right kind.

- In the event the kind doesn`t fit your demands, make use of the Search area near the top of the display screen to obtain the one who does.

- Should you be pleased with the shape, confirm your choice by clicking the Get now key. Then, select the rates strategy you prefer and provide your accreditations to sign up to have an bank account.

- Method the deal. Use your credit card or PayPal bank account to complete the deal.

- Find the structure and acquire the shape on your gadget.

- Make changes. Complete, revise and print and indication the delivered electronically North Dakota Authority of Signatory to Bind the Guarantor.

Each and every format you included with your account does not have an expiry date and is your own eternally. So, if you want to acquire or print another duplicate, just proceed to the My Forms area and then click in the kind you will need.

Gain access to the North Dakota Authority of Signatory to Bind the Guarantor with US Legal Forms, the most considerable collection of legitimate record web templates. Use a huge number of specialist and state-certain web templates that satisfy your company or person requirements and demands.

Form popularity

FAQ

A guarantor contracts to pay if, by the use of due diligence, the debt cannot be paid by the principal debtor. The surety undertakes directly for the payment. The surety is responsible at once if the principal debtor defaults. In other words, a guaranty is an undertaking that the debtor shall pay.

To release the Family Guarantee Once you've paid off the second smaller loan, you can apply to remove the guarantee. This means your guarantor will only be liable for as long as it takes you to pay off the smaller loan. You can even make extra repayments to help release the guarantor's property sooner.

A surety's undertaking is an original one, by which he becomes primarily liable with the principle debtor, while a guarantor is not a party to the principal obligation and bears only a secondary liability.?2 Stated somewhat differently, the distinction between a suretyship and guaranty is that ?a surety is in the first ...

Guarantees are a contractual arrangement where one party (the guarantor) agrees to answer for the liability of another party (the principal) to another party (the guaranteed party). Guarantors have various rights usually conferred in equity against the principal, the guaranteed party and any co-guarantors.

As the name suggests, a guarantee is a contractual promise to pay the liabilities of another. The guarantor is typically a shareholder, director or group company with assets.

Bonds and guarantees are basically a form of security. In other words, the financial protection that supports a contractual obligation. These forms of protection could be included as contract terms, however, it is more likely that they will be provided by a separate security agreement.

If accessoriness is evident, it is a surety bond. In the absence of accessoriness, a guarantee has been agreed. In contrast to a surety, the guarantor may not raise any objections or defenses based on another debt obligation.

A guarantor is someone who vouches for you financially and can be a friend, family member or even a third-party service. The guarantor signs the rental agreement with you and ensures rent payments are made on time if you fall behind or can no longer make the payments yourself.