North Dakota Personal Guaranty - Guarantee of Lease to Corporation

Description

How to fill out Personal Guaranty - Guarantee Of Lease To Corporation?

If you need to complete, retrieve, or generate sanctioned document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the site’s user-friendly and effective search feature to acquire the documents you require.

Various templates for business and personal purposes are categorized by type and jurisdiction, or keywords.

Step 4. Once you have located the form you need, click on the Get now button. Select your preferred pricing plan and enter your details to register for an account.

Step 5. Process the transaction. You may utilize your credit card or PayPal account to complete the payment.

- Utilize US Legal Forms to obtain the North Dakota Personal Guaranty - Guarantee of Lease to Corporation in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and hit the Download button to access the North Dakota Personal Guaranty - Guarantee of Lease to Corporation.

- You can also find forms you have previously downloaded in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, please review the following instructions.

- Step 1. Confirm you have selected the form for your specific city/region.

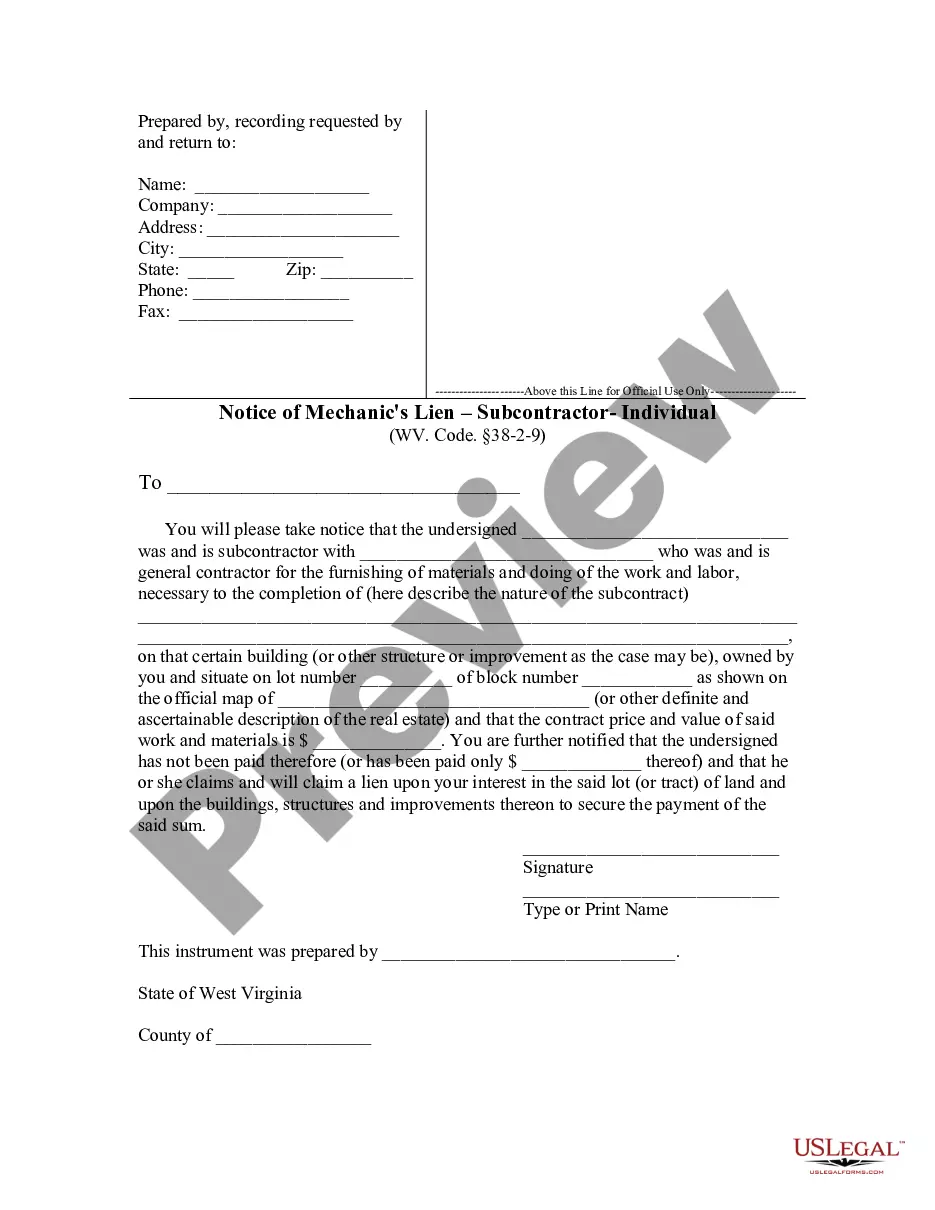

- Step 2. Use the Preview option to review the form’s content. Be sure to check the description.

- Step 3. If you are dissatisfied with the template, use the Search box at the top of the screen to locate other variations of the legal document type.

Form popularity

FAQ

A guarantee can apply to various obligations, often by a corporation or an entity, while a personal guaranty specifically ties an individual's personal assets and creditworthiness to the obligation. When you explore a North Dakota Personal Guaranty - Guarantee of Lease to Corporation, you commit personally to ensure that the lease is honored, creating accountability for the individual guarantor.

A personal guarantee is an agreement that allows a lender to go after your personal assets if your company, relative, or friend defaults on a loan. For instance, if your business goes under, the creditor can sue you to collect any outstanding balance.

Corporate credit cards. Instead, by using a credit that are issued to an individual are another example of a personal guarantee. The individual or employee is responsible for the debt that the organization takes on and the overall spending on the credit card. Here, the cardholder takes the role of a guarantor.

A personal guarantee can be enforced the same way as any debt. If the business owner does not pay, the creditor can bring a lawsuit to receive a judgment and levy the owner's personal assets to cover the debt. The exact terms of a personal guarantee specify a creditor's options under the guarantee.

A Guarantor form acts as a legal piece of insurance to typically protect the landlord against rental loss, damages and any ensuing legal fees that is incurred by a tenant. The Guarantor form is a legal contract enforcing the agreement.

A personal guarantee is a provision a lender puts in a business loan agreement that requires owners to be personally responsible for their company's debt in case of default.

N. a person or entity that agrees to be responsible for another's debt or performance under a contract, if the other fails to pay or perform. ( See: guarantee)

However, you should only be a guarantor for someone you trust and are willing and able to cover the repayments for. To be a guarantor you'll need to be over 21 years old, with a good credit history and financial stability. If you're a homeowner, this will add credibility to the application.

Providing a personal guarantee means that if the business becomes unable to repay the debt, the individual assumes personal responsibility for the balance. Personal guarantees provide an extra level of protection to credit issuers who want to make sure they will be repaid.

A corporate guarantee is a contract between a corporate entity or individual and a debtor. In this contract, the guarantor agrees to take responsibility for the debtor's obligations, such as repaying a debt.