North Dakota Petty Cash Form

Description

How to fill out Petty Cash Form?

Are you currently in a situation where you require documents for potential business or personal purposes almost every day.

There are numerous legal document templates accessible online, but locating versions you can trust is not straightforward.

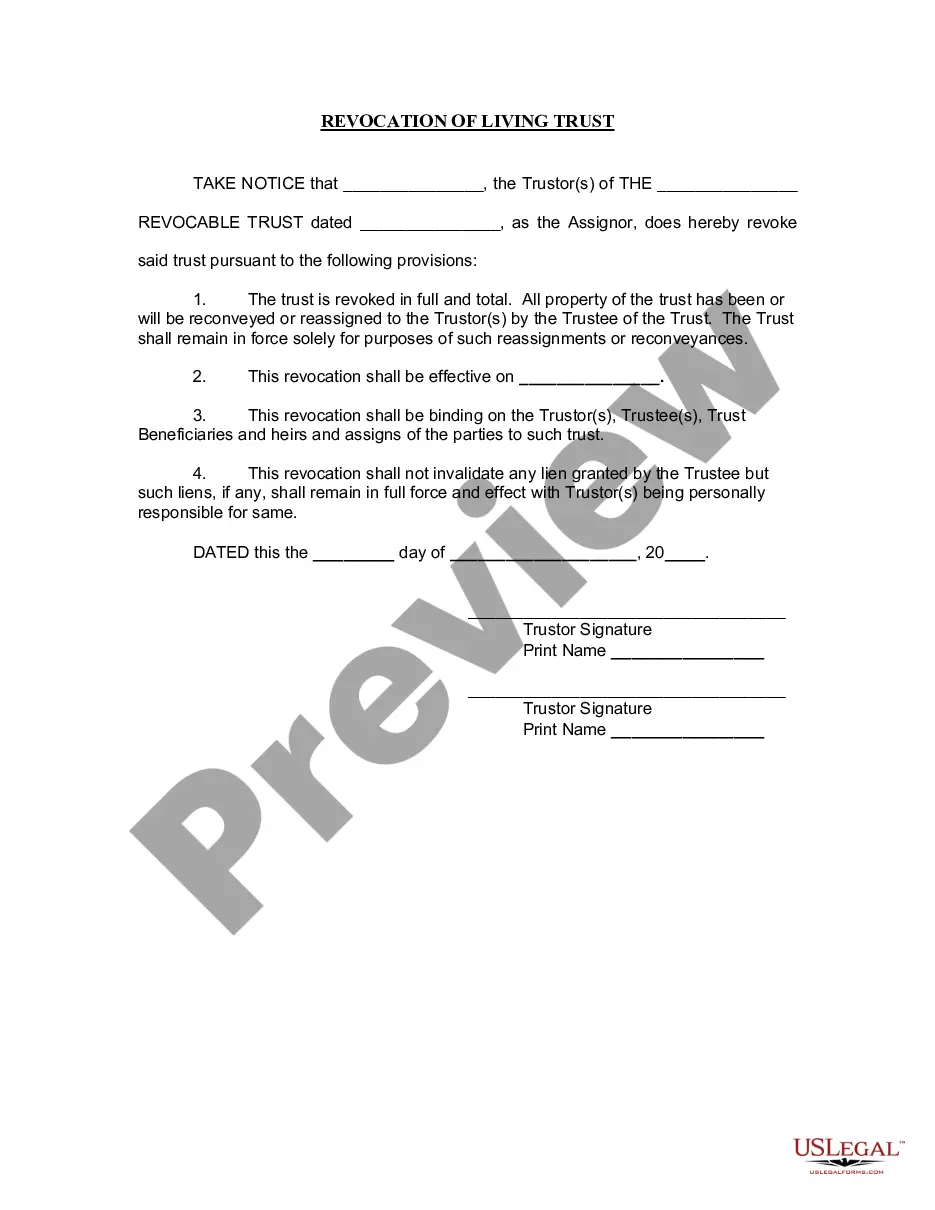

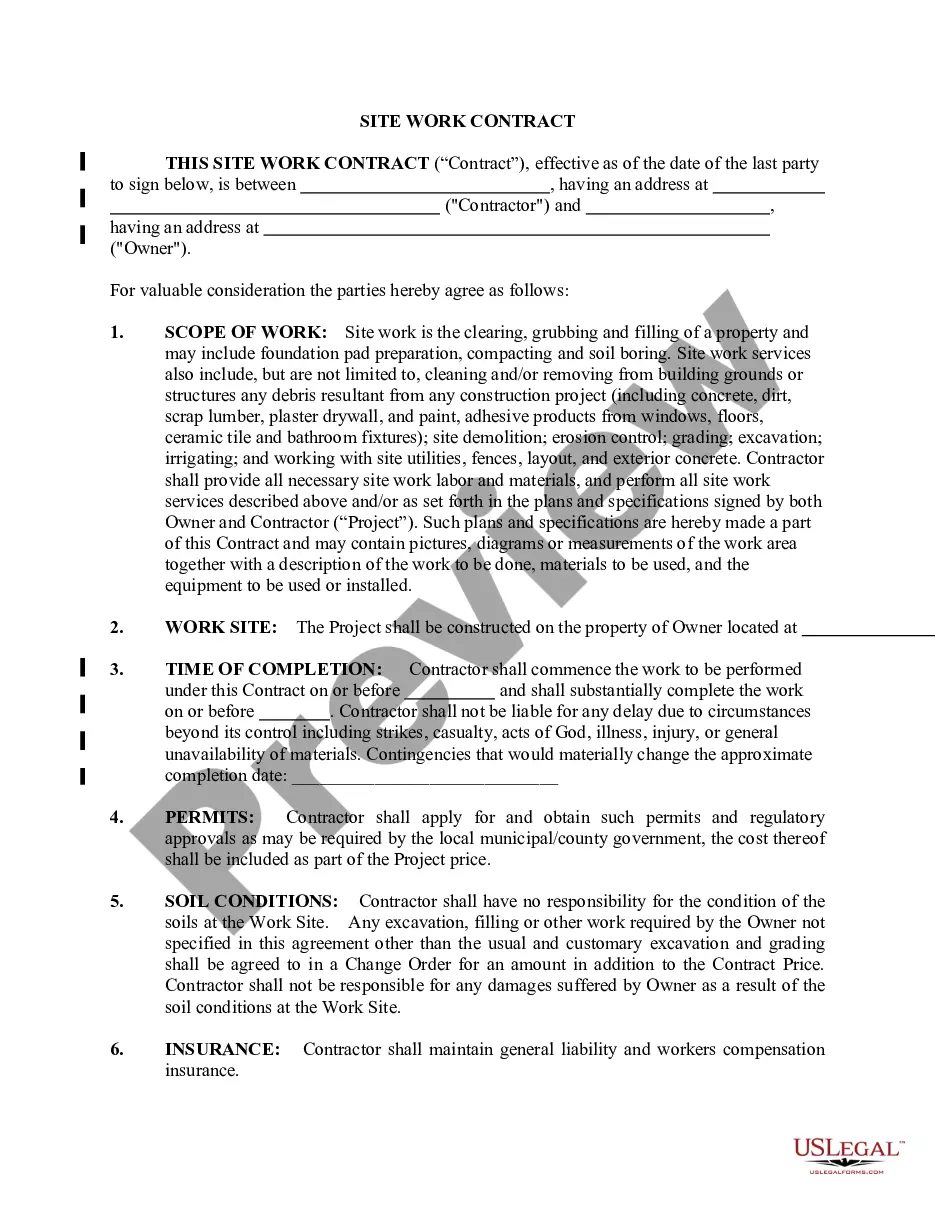

US Legal Forms offers thousands of form templates, such as the North Dakota Petty Cash Form, that are designed to comply with state and federal requirements.

Once you locate the correct form, simply click Buy now.

Select the pricing plan you desire, complete the required details to create your account, and process the payment using your PayPal or Visa or Mastercard. Choose a convenient document format and download your copy. You can find all the document templates you have purchased in the My documents section. You can obtain another copy of the North Dakota Petty Cash Form anytime, if needed. Just select the necessary form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be utilized for a variety of purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the North Dakota Petty Cash Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

- Use the Review button to assess the form.

- Check the description to make sure you have selected the correct form.

- If the form is not what you are looking for, use the Search box to locate the form that meets your needs and requirements.

Form popularity

FAQ

Filing North Dakota state taxes requires you to gather your financial documents, including W-2 forms, 1099s, and any other income statements. You should complete the necessary forms, which can be found on the North Dakota Office of State Tax Commissioner’s website. Additionally, consider utilizing the North Dakota Petty Cash Form for tracking small expenses throughout the year. Using tools like USLegalForms can streamline your process by providing compliant templates and guidance.

To set up petty cash, start with identifying the amount you will need for regular expenses. Utilize a North Dakota Petty Cash Form to outline the fund's intended use and approval process. Designate a custodian to oversee the fund, ensuring they keep receipts and track spending. Regularly assess the petty cash fund to ensure it meets your operational needs, replenishing it as necessary to maintain efficiency.

To set up a petty cash account, begin by defining the cash limit based on your requirements. Use a North Dakota Petty Cash Form to document the initial fund amount and its purpose. Next, appoint someone responsible for managing and disbursing funds. It is essential to implement a tracking system for expenses. Regularly review and reconcile the account to maintain accurate records and avoid discrepancies.

Setting up your petty cash fund involves several key steps. First, determine the amount needed for your petty cash fund based on your business's specific needs. Then, establish a clear purpose for the fund, such as office supplies or employee reimbursements. Next, create a document outlining your policies for using the fund. After that, assign a custodian to manage the fund. You should also track all expenses meticulously. Lastly, when cash runs low, replenish the fund using a North Dakota Petty Cash Form to ensure proper accounting.

Preparing a petty cash report involves gathering all receipts and completing a North Dakota Petty Cash Form that summarizes all expenditures. Review each receipt to ensure accuracy and completeness before calculating the total cash spent. This report will help maintain clear financial transparency and accountability.

To fill out a petty cash form, start with the date and your name. Then, list each expense along with the amount, and ensure all corresponding receipts are attached. Utilizing the North Dakota Petty Cash Form will help you organize this information effectively, making it easier to track spending.

Filling out a petty cash form involves entering the date, amount of cash disbursed, and corresponding expense categories. Additionally, provide details such as the individual responsible for the cash and a brief description of each expense. By using the North Dakota Petty Cash Form, you can streamline this process and enhance accuracy.

To complete petty cash transactions, first, collect all receipts that correspond to cash expenditures. Use a North Dakota Petty Cash Form to itemize these expenses clearly. Finally, ensure that the receipts match the cash amount disbursed to maintain accurate financial records.

To record petty cash properly, begin by establishing a petty cash fund amount. Each time you use the cash, document the expense with a receipt. When cash levels drop below a set amount, replenish the fund using a North Dakota Petty Cash Form to account for withdrawals and maintain accurate records.

Yes, residents of North Dakota typically need to file a tax return if their income exceeds certain thresholds. Filing a tax return helps ensure that all obligations are met and enables you to claim eligible deductions and credits. If you manage a business or handle petty cash, using a North Dakota Petty Cash Form can streamline your record-keeping and improve financial accuracy. For assistance with tax forms and compliance, consider utilizing US Legal Forms, which provides reliable resources.