Georgia Wage Withholding Authorization

Description

How to fill out Wage Withholding Authorization?

If you need to gather, obtain, or print legitimate document templates, utilize US Legal Forms, the most extensive collection of legitimate forms available on the web.

Take advantage of the site's straightforward and efficient search feature to find the documents you require.

Various templates for business and individual purposes are categorized by types and states, or keywords.

Step 4. After you find the form you desire, click on the Purchase now button. Choose the pricing plan you prefer and enter your details to create an account.

Step 5. Complete the transaction. You can utilize your credit card or PayPal account to finalize the purchase. Step 6. Download the format of the legal form and save it on your device. Step 7. Complete, modify, and print or sign the Georgia Wage Withholding Authorization. Each legal document template you purchase is yours to keep permanently. You have access to every form you have obtained in your account. Click on the My documents section to print or download a form again. Participate and obtain, and print the Georgia Wage Withholding Authorization through US Legal Forms. There are numerous specialized and state-specific forms available for your business or personal needs.

- Access US Legal Forms to acquire the Georgia Wage Withholding Authorization in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Get button to procure the Georgia Wage Withholding Authorization.

- You can also view forms you previously obtained from the My documents section of your account.

- For first-time users of US Legal Forms, follow these steps.

- Step 1. Ensure you have selected the form for the correct city/state.

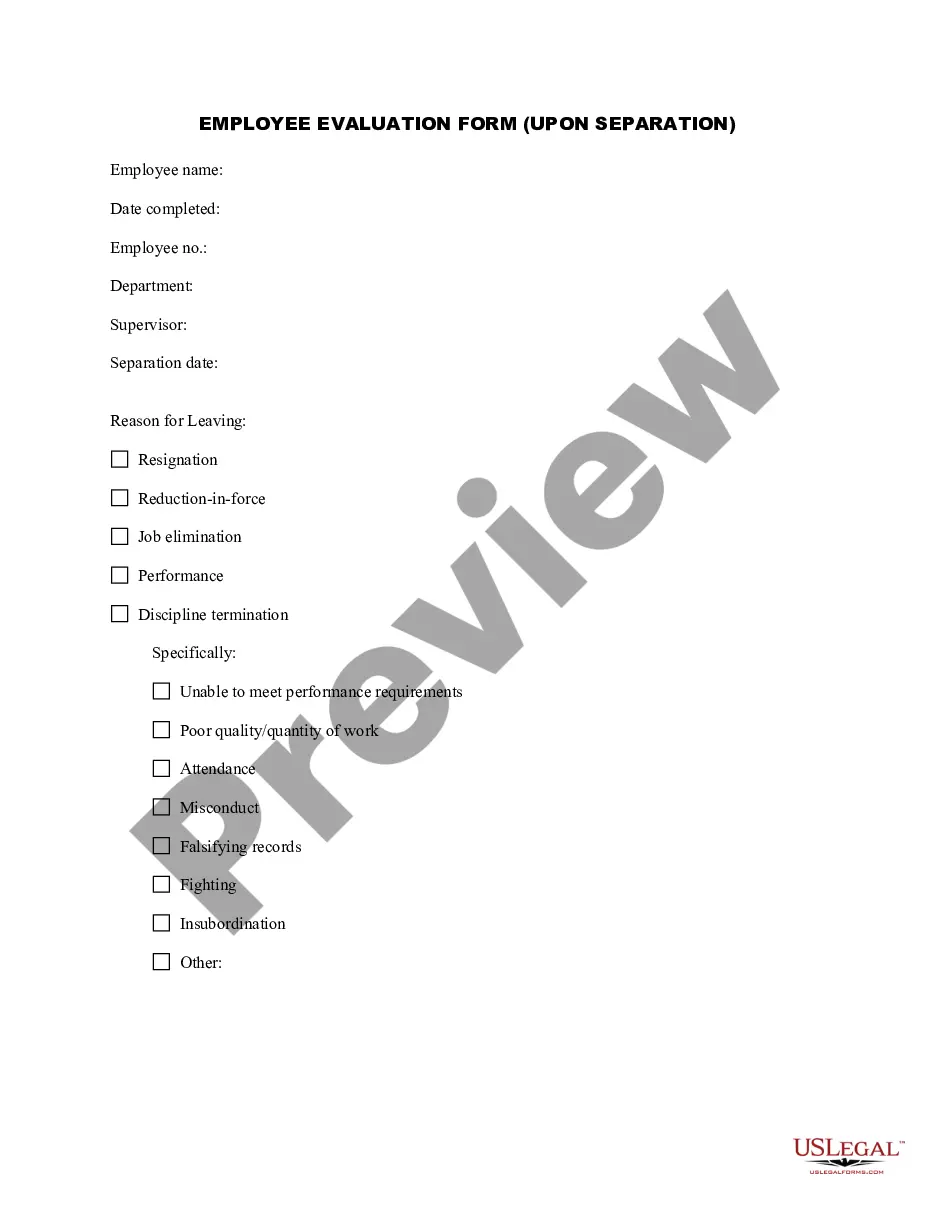

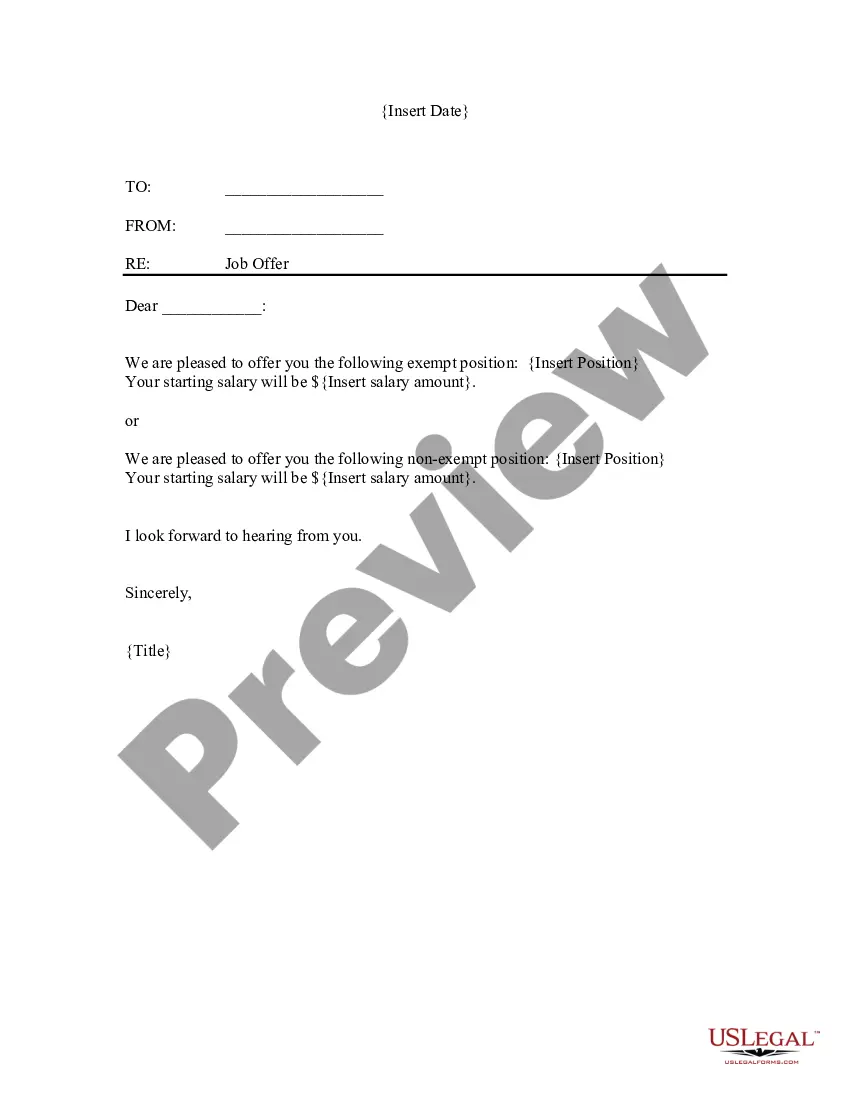

- Step 2. Utilize the Preview option to examine the form's content. Make sure to review all details.

- Step 3. If you are unsatisfied with the type, use the Search area at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

How to fill out a W-4 formStep 1: Personal information. Enter your name, address, Social Security number and tax-filing status.Step 2: Account for multiple jobs.Step 3: Claim dependents, including children.Step 4: Refine your withholdings.Step 5: Sign and date your W-4.

Married, Filing Joint Return - One Spouse Working = Two (2) personal exemptions. Married, Filing Separate Returns or Joint Return - Both Spouses Working = One (1) personal exemption. Single or Head of Household = One (1) personal exemption.

The Georgia Form G-4, Employee's Withholding Allowance Certificate, must be completed so that you know how much state income tax to withhold from your new employee's wages.

Georgia requires employers to withhold state income tax from employees' wages and remit the amounts withheld to the Department of Revenue. Georgia residents working outside the state are exempt from Georgia income tax withholding if their compensation is subject to withholding in that state.

Local TaxesThere are no local income taxes in Georgia.

Withholding tax is the amount held from an employee's wages and paid directly to the state by the employer. This includes tax withheld from: Wages. Nonresident distributions.

How to Complete the W-4 Tax FormDetermine your allowances.Fill out your personal information.Claim an exemption if it applies.Fill out itemized deductions, if you're using them.Figure out how much additional withholding you need.

Form (G4) is to be completed and submitted to your employer in order to have tax withheld from your wages.

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

To get your Georgia Withholding Number, register for an account with the Georgia Department of Revenue. You will receive your nine-character Withholding Number (0000000-XX; first seven characters are digits, the last two are letters) once you complete the registration process.