Cook Services Contract - Self-Employed

Understanding this form

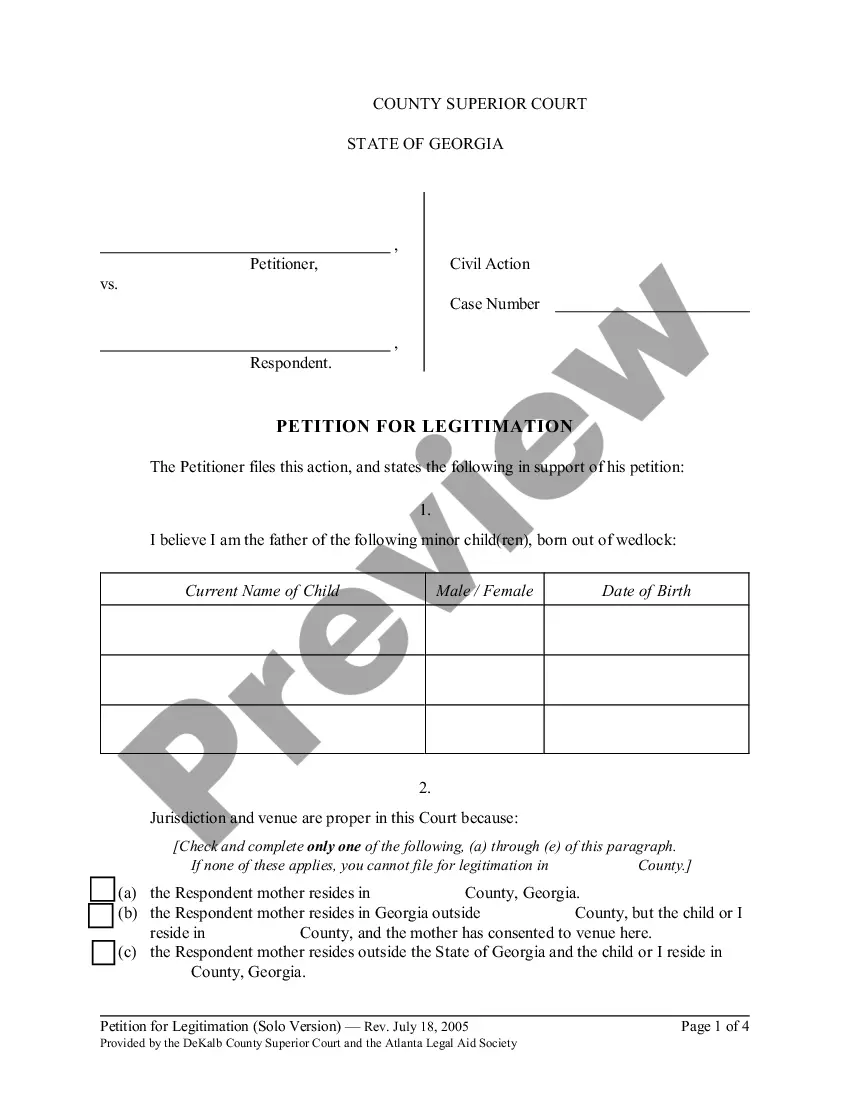

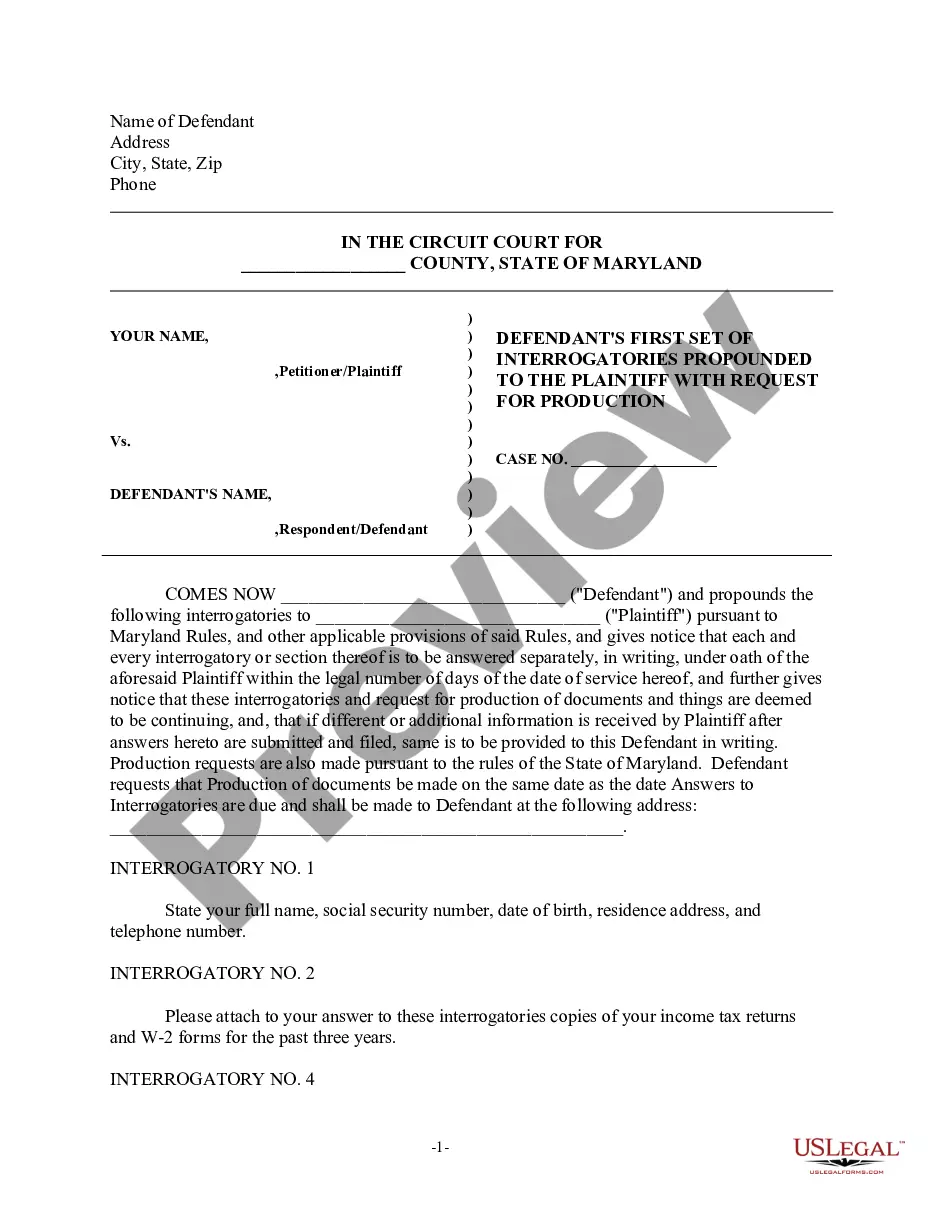

The Cook Services Contract - Self-Employed is a legal document that formalizes the relationship between an employer and a cook who is hired as an independent contractor. This agreement specifies the cooking services to be performed, while clarifying that the cook is not an employee of the employer. This distinction is essential as it affects liability, tax obligations, and rights under the law.

Key parts of this document

- Section defining the work to be performed, including duration and scope of services.

- Independent contractor status, explaining the lack of employer-employee relationship.

- Representations and warranties of the cook to ensure qualifications and compliance.

- Miscellaneous provisions covering defaults, waivers, and enforceability of the contract terms.

When to use this form

This form is ideal when an employer needs to hire a cook as an independent contractor for specific cooking tasks. Scenarios include catering events, preparing meals for private families, or when a business requires chef services without a permanent employment commitment.

Who needs this form

- Employers looking to hire cooks or chefs on a flexible basis.

- Cooks seeking to clarify their independent contractor status and rights.

- Small businesses, event planners, or anyone needing temporary cooking services.

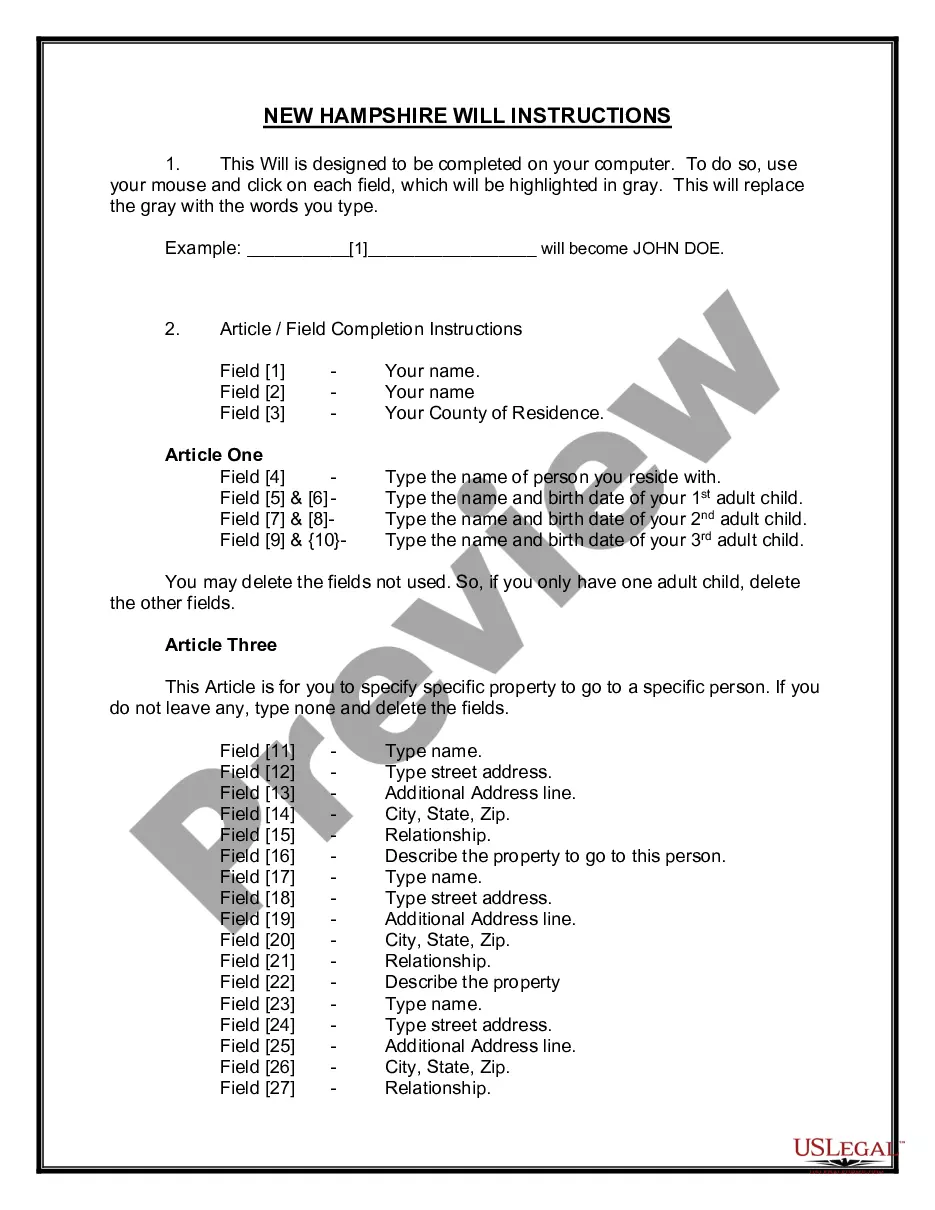

Steps to complete this form

- Identify the parties involved: the employer and the cook.

- Specify the cooking services to be performed, including any particular requirements or preferences.

- Enter the duration of the services to be provided under the contract.

- Include any representations or warranties from the cook about their qualifications.

- Have both parties sign the contract to make it legally binding.

Does this form need to be notarized?

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to define the scope of services clearly, which can lead to misunderstandings.

- Not specifying the duration of services, resulting in potential disputes later.

- Overlooking the independent contractor clause, which may affect legal liability.

Advantages of online completion

- Convenience of downloading and completing the form at any time.

- Editability to tailor the contract to specific needs before finalizing.

- Reliability of having a contract drafted to meet legal standards.

Legal use & context

- This contract clarifies the relationship between the employer and independent contractor to prevent misclassification issues.

- Having a written agreement helps to ensure enforceability in case of disputes.

- Limited liability for the employer is maintained when contracts are properly established.

Looking for another form?

Form popularity

FAQ

Yes, if you have 1099 income you are considered to be self-employed, and you will need to pay self-employment taxes (Social Security and Medicare taxes) on this income.

A sole proprietorship can use independent contractors for the term of the contract without any further obligation. If the sole proprietor no longer needs the independent contractor, the sole proprietor is under no obligation to extend the contract.

Most chefs go the traditional route of working their way up in the same business over a period of years, but in recent years many chefs are exploring freelance and private work. Here we explore everything you need to know about how a career as a freelance chef for hire can work for you.

A chef is integral to the business of preparing food and would not be considered an independent contractor. A specialist chef, who prepares food for a one-time event for the restaurant, could be considered an independent contractor.

An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

People who work for themselves or who own their own company are sometimes alternately referred to as self-employed or independent contractors, though there is a difference between the two. In general, all independent contractors are self-employed, but not all self-employed people are independent contractors.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else. An independent contractor is someone who provides a service on a contractual basis.

The law codifies and expands on an April 2018 California Supreme Court decision that set a strict new test for employers. Independent contractors must be free to perform their work as they wish, must be in a different line of work from the company contracting with them and must operate their own business.

A self employed person will not usually have a contract of employment; they will usually be hired for a certain amount of time. The contract that exists between the self employed person and the person or company supplying the work will have a number of rules or conditions set down within it.