Delaware Wage Withholding Authorization

Description

How to fill out Wage Withholding Authorization?

US Legal Forms - one of the most notable collections of legal documents in the United States - provides a diverse selection of legal templates that you can download or print.

By using the website, you can access countless forms for both business and personal purposes, categorized by types, states, or keywords. You can obtain the latest versions of forms like the Delaware Wage Withholding Authorization in moments.

If you already have a subscription, Log In and download the Delaware Wage Withholding Authorization from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously downloaded forms from the My documents section of your account.

Complete the transaction using your credit card or PayPal account.

Select the format and download the document onto your device. Edit it by filling it out, modifying it, and printing it, then sign the downloaded Delaware Wage Withholding Authorization. Each template added to your account does not expire and belongs to you forever. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you desire. Access the Delaware Wage Withholding Authorization through US Legal Forms, one of the most extensive libraries of legal document templates. Utilize a vast range of professional and state-specific templates that meet your personal or business requirements.

- Make sure to select the appropriate form for your city/state.

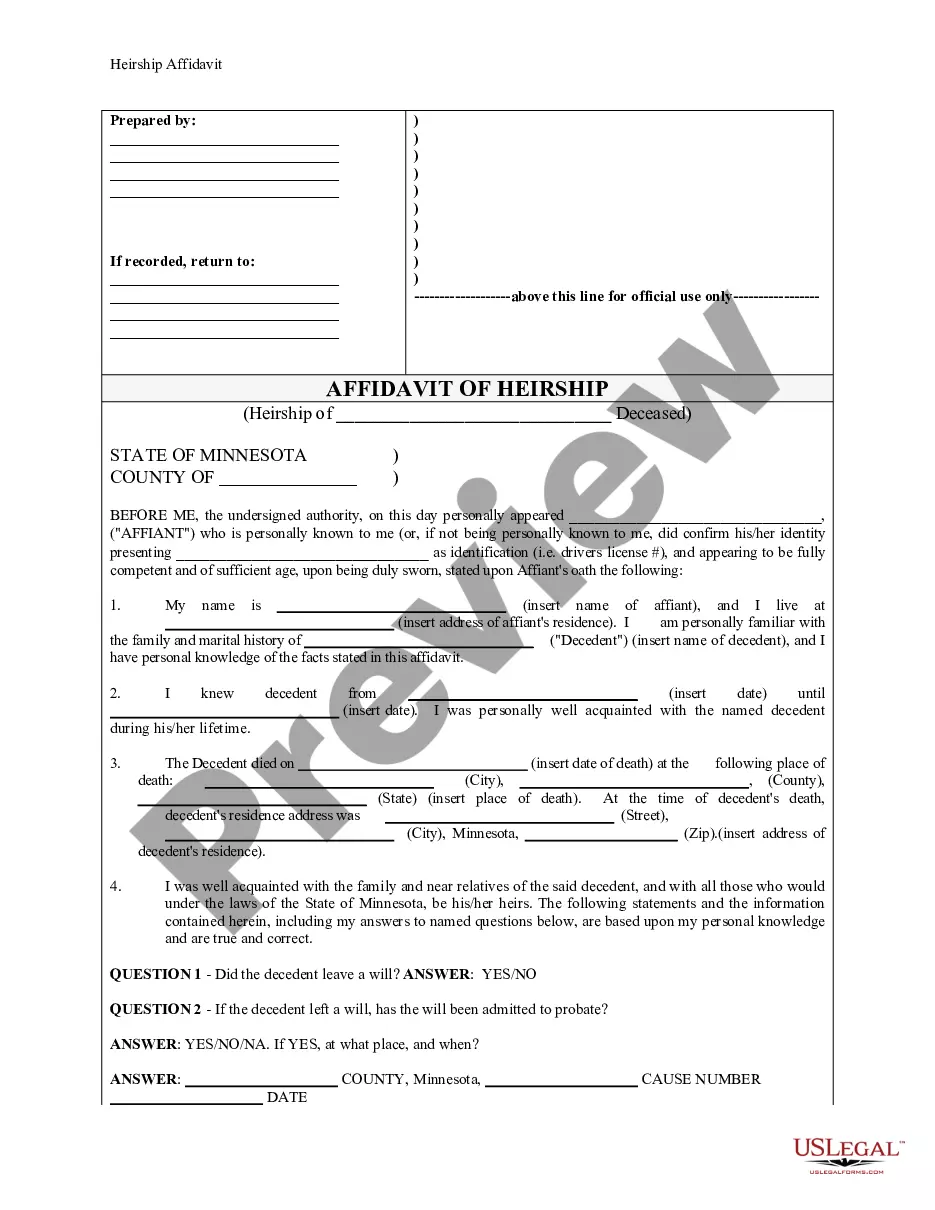

- Click the Review button to check the contents of the form.

- Review the form details to confirm that you've selected the right document.

- If the document does not fit your needs, utilize the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, finalize your selection by clicking the Buy now button.

- Then, select your preferred payment plan and provide your credentials to create an account.

Form popularity

FAQ

Employers generally must withhold federal income tax from employees' wages. To figure out how much tax to withhold, use the employee's Form W-4, the appropriate method and the appropriate withholding table described in Publication 15-T, Federal Income Tax Withholding Methods. You must deposit your withholdings.

The Division of Revenue links for online filing options are available at . Electronic filing is fast, convenient, accurate and easy. When completing a form electronically, please download the form prior to completing it to obtain the best results.

You are a withholding agent if you are a U.S. or foreign person that has control, receipt, custody, disposal, or payment of any item of income of a foreign person that is subject to withholding.

The taxpayer authorizes the ERO to enter or generate the taxpayer's personal identification number (PIN) on his or her e-filed individual income tax return.

Every employer maintaining an office or conducting business in Delaware who makes a payment of wages or other remuneration to a resident or non-resident (of Delaware) must pay Withholding Tax. Withholding Tax requires that a business withhold an estimated amount of tax from its employees.

252 for failure or refusal of any employer/withholding agent to refund excess withholding tax shall, in addition to the penalties, be liable to a penalty equal to the total amount of refunds which was not refunded to the employee resulting from any excess of the amount withheld over the tax actually due on their

Amended Returns - Delaware does not currently support electronic filing for Form DE 200X. Taxpayers must file a paper return, and mail it to the appropriate address.

If you are an out-of-state business that employs a Delaware resident, you may register as a withholding agent only for free on One Stop. This is a courtesy to your employees who live in Delaware.

Delaware requires employers to withhold state income taxes from employee paychecks in addition to employer paid unemployment taxes. Find Delaware's tax rates here. Employers use the federal W-4 form, completed by employees, when calculating employee wage withholdings for Delaware.

Because Delaware still allows taxpayers to take a deduction or a personal credit for exemptions, Delaware has created a new form, a Delaware-specific W-4, for taxpayers to use in connection with calculating their withholding for Delaware purposes.