Hawaii Wage Withholding Authorization

Description

How to fill out Wage Withholding Authorization?

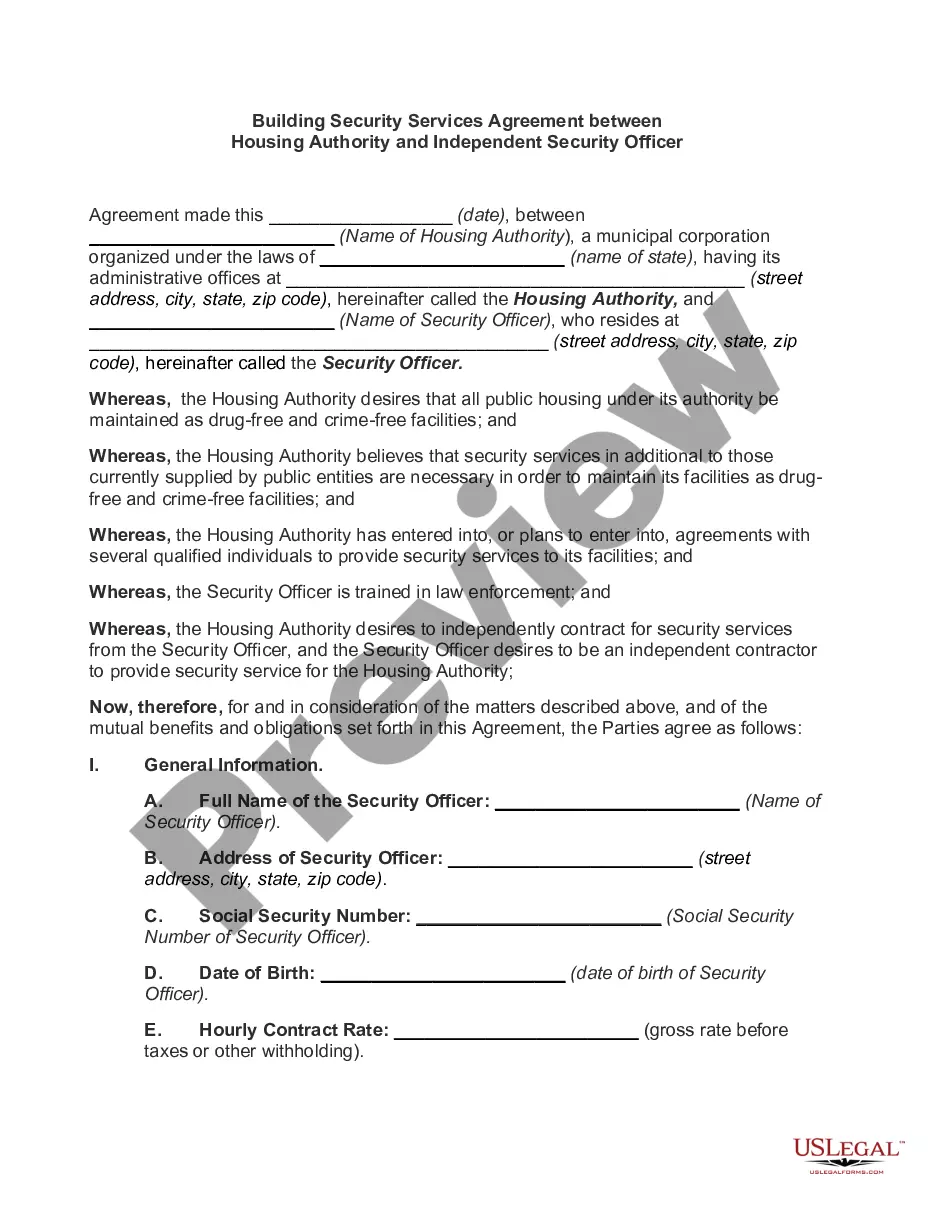

You can spend hours online looking for the legal document template that meets your federal and state requirements.

US Legal Forms provides thousands of legal forms that can be reviewed by experts.

You can easily download or create the Hawaii Wage Withholding Authorization from the platform.

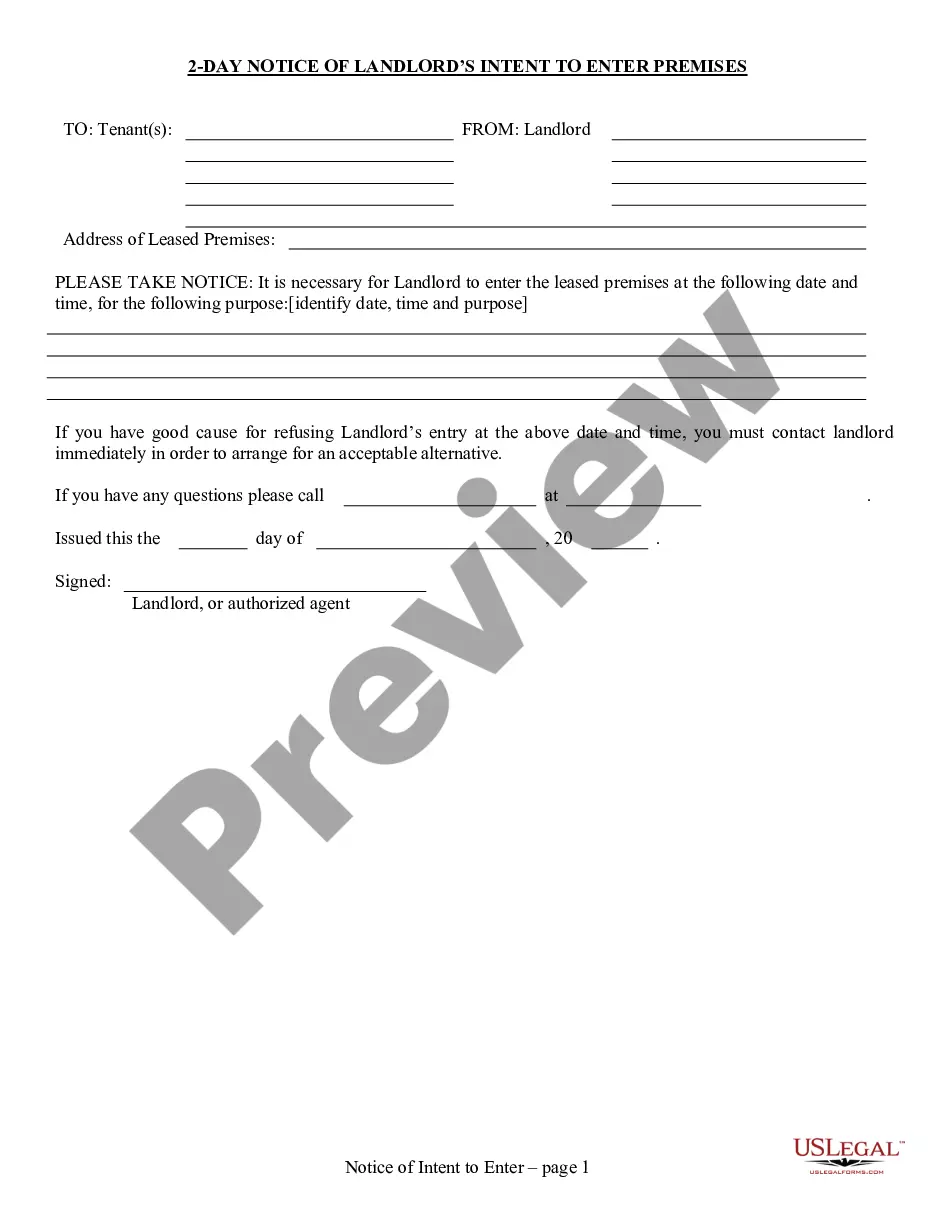

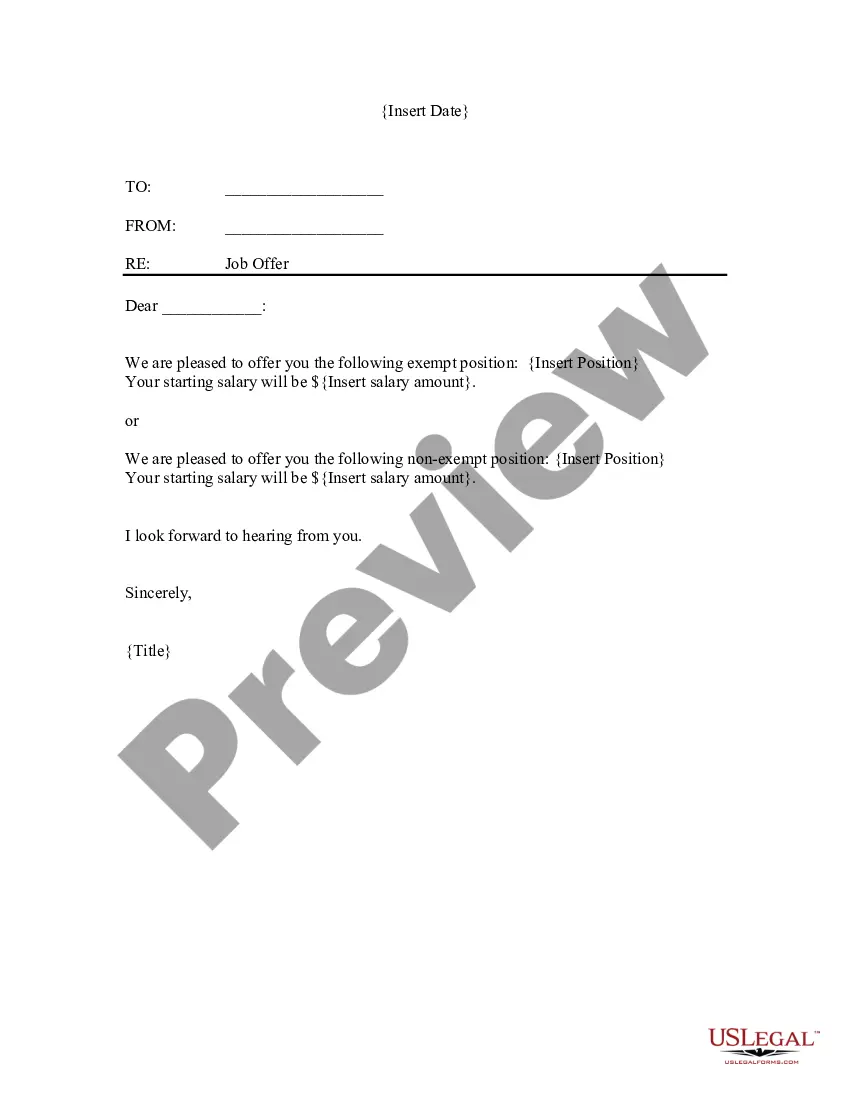

If available, utilize the Review option to browse through the document template as well. If you need to find another version of your form, use the Search field to discover the template that serves your requirements.

- If you already have a US Legal Forms account, you may Log In and select the Download option.

- After that, you can complete, edit, print, or sign the Hawaii Wage Withholding Authorization.

- Every legal document template you obtain is yours to keep indefinitely.

- To obtain another copy of a purchased form, go to the My documents tab and click on the respective option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/city you choose.

- Review the document description to confirm you have chosen the right form.

Form popularity

FAQ

Form N-288A is the Hawaii Wage Withholding Authorization form, used to direct employers on how much state tax to withhold from employee wages. It is important for both employers and employees to complete and file this form to ensure proper withholding. Adopting this form can help maintain compliance with Hawaii's tax requirements.

To register for Hawaii state tax, you can start by completing the appropriate registration forms available from the Hawaii Department of Taxation. You will need to provide information about your business and its structure. Utilizing the Hawaii Wage Withholding Authorization can ensure that you fulfill your state tax registration correctly.

How to Fill Out an HW-4 Form?Employee information - completed by the employee. Write down your full name, social security number, and address.Employer information - completed by the employer. Indicate the employer's name, address, and Hawaii tax identification number.

HARPTA is an acronym for Hawaii Real Property Tax Act. This is a Hawaii State law that requires a withholding of 7.25% of the sales price. (UPDATED! increased from 5% as of 2018) 7.25% of the sales price, not 7.25% of the gains realized.

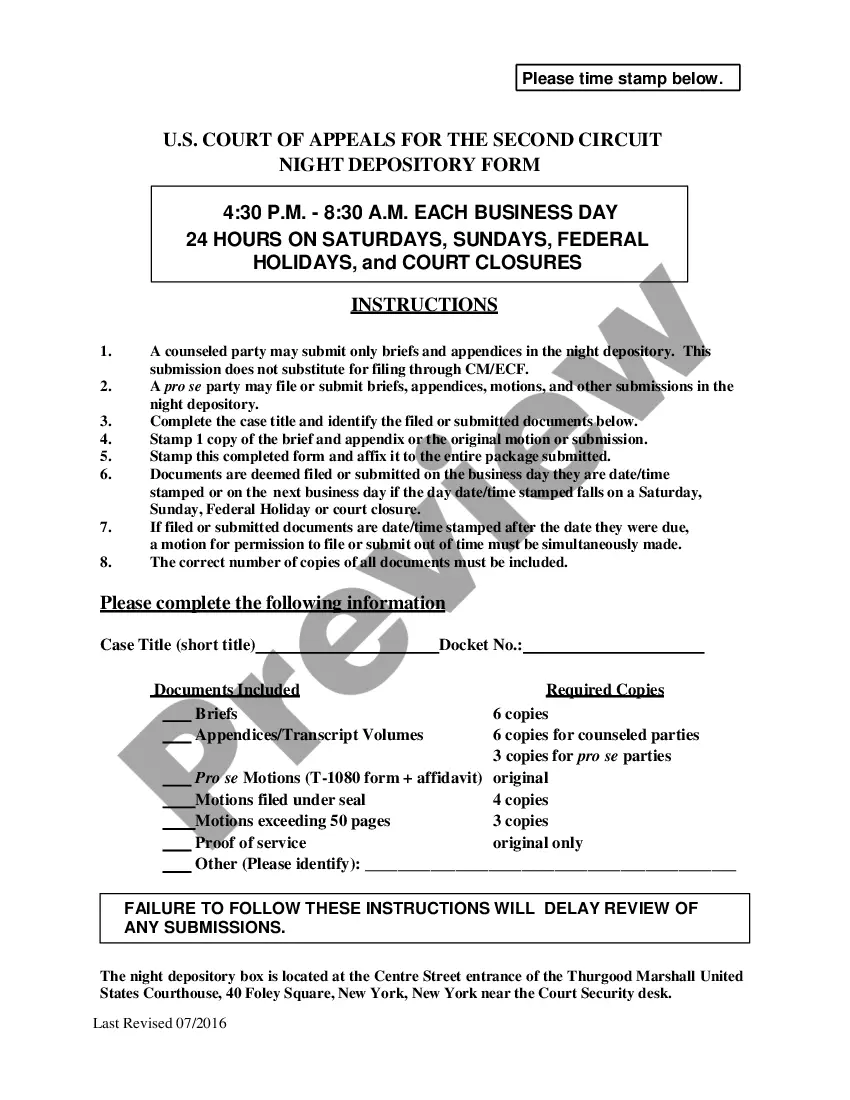

If you believe that an employee has claimed excess allowances for the employee's situation (generally more than 10) or misstated the employee's marital status, you must send a copy of the Form HW-4 for that employee to the Hawaii Department of Taxation, P. O. Box 3827, Honolulu, Hawaii 96812-3827.

How do I get a withholding (WH) account number? Use Form BB-1 to request a withholding (WH) account number. You may also add a withholding account on Hawaii Tax Online if you already have a login.

The following states require state tax withholding whenever federal taxes are withheld. We will apply the state's default with- holding rate to the taxable portion of your distribution if you reside in: Iowa, Kansas, Maine, Massachusetts, Nebraska, Oklahoma, or Virginia. You may not elect out of state withholding.

Hawaii Tax ID's that were issued prior to the modernization project begin with the letter "W" and are followed by 10 digits. (Example: W99999999-01.) Hawaii SalesTax ID's that are issued after the modernization project begin with the letters "GE" and are followed by 12 digits. (Example: GE-999-999-9999-01.)

The Hawaii Tax ID starts with a two-letter account type identifier followed by 12 digits. The "GE" account type stands for General Excise/Use and County Surcharge Tax. Individuals can register online to receive their ID by filing Form BB-1 through Hawaii Business Express .

Overview. Employers need to withhold Hawaii income taxes on employee wages. Employers then pay the withheld taxes to the State of Hawaii, Department of Taxation (DOTAX). Employees reconcile their withholding taxes paid as part of their Individual Income tax return.