North Carolina Self-Employed Independent Welder Services Contract

Description

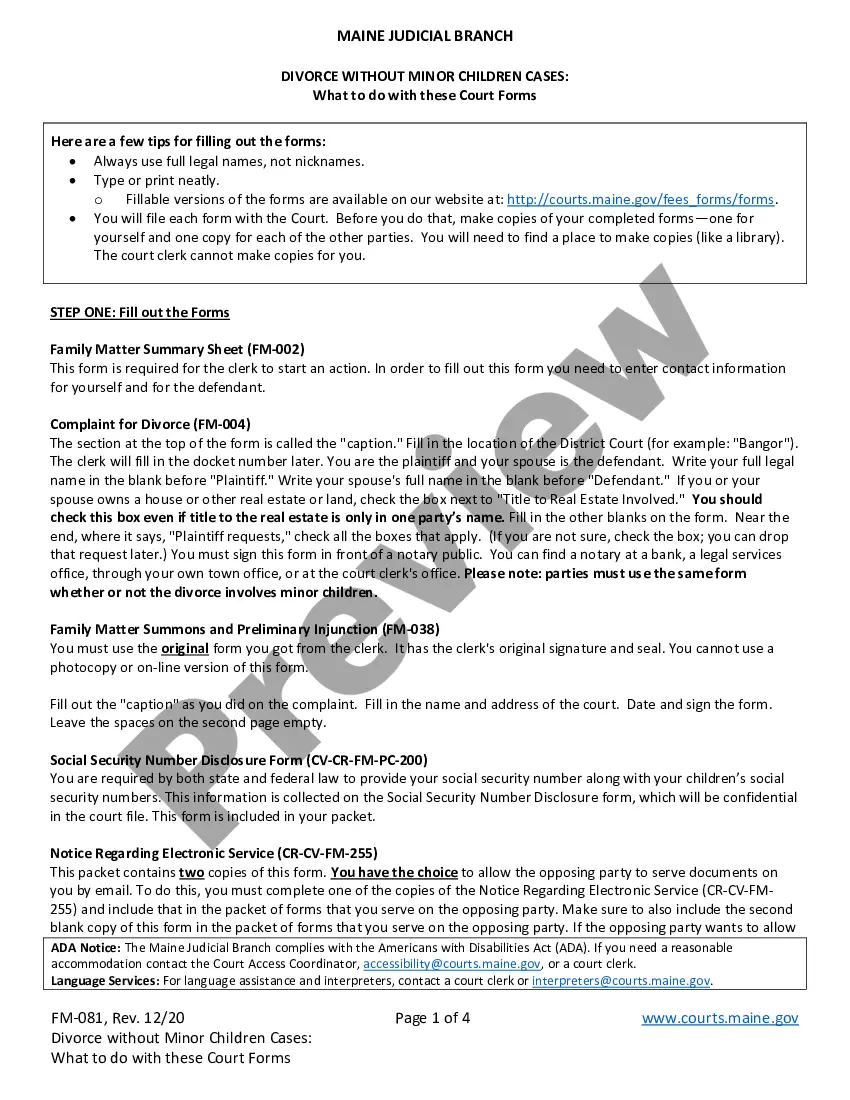

How to fill out Self-Employed Independent Welder Services Contract?

Locating the appropriate legal document template can be rather challenging. Obviously, there is a plethora of layouts available online, but how can you locate the legal form you require.

Utilize the US Legal Forms website. The service offers thousands of templates, including the North Carolina Self-Employed Independent Welder Services Contract, which can be utilized for business and personal purposes.

All the forms are verified by professionals and comply with state and federal regulations.

US Legal Forms is the largest collection of legal forms where you can view a variety of document templates. Utilize the service to download professionally created documents that adhere to state laws.

- If you are already registered, Log In to your account and click on the Download button to obtain the North Carolina Self-Employed Independent Welder Services Contract.

- Use your account to browse the legal forms you have previously purchased.

- Visit the My documents tab of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the right form for your locality/region. You can review the form using the Review option and read the form description to confirm it's the correct one for you.

- If the form does not meet your requirements, utilize the Search field to find the appropriate form.

- Once you are assured that the form is suitable, select the Purchase now option to acquire the form.

- Choose the pricing plan you desire and enter the required information.

- Create your account and complete the purchase with your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

- Complete, modify, print, and sign the acquired North Carolina Self-Employed Independent Welder Services Contract.

Form popularity

FAQ

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Start Soliciting ClientsContact local businesses that could utilize your contracting services. Ask to schedule a meeting with the person in charge of hiring contract workers. Present an informational package that highlights your strengths and services. Follow up with each company if you do not hear back from them.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

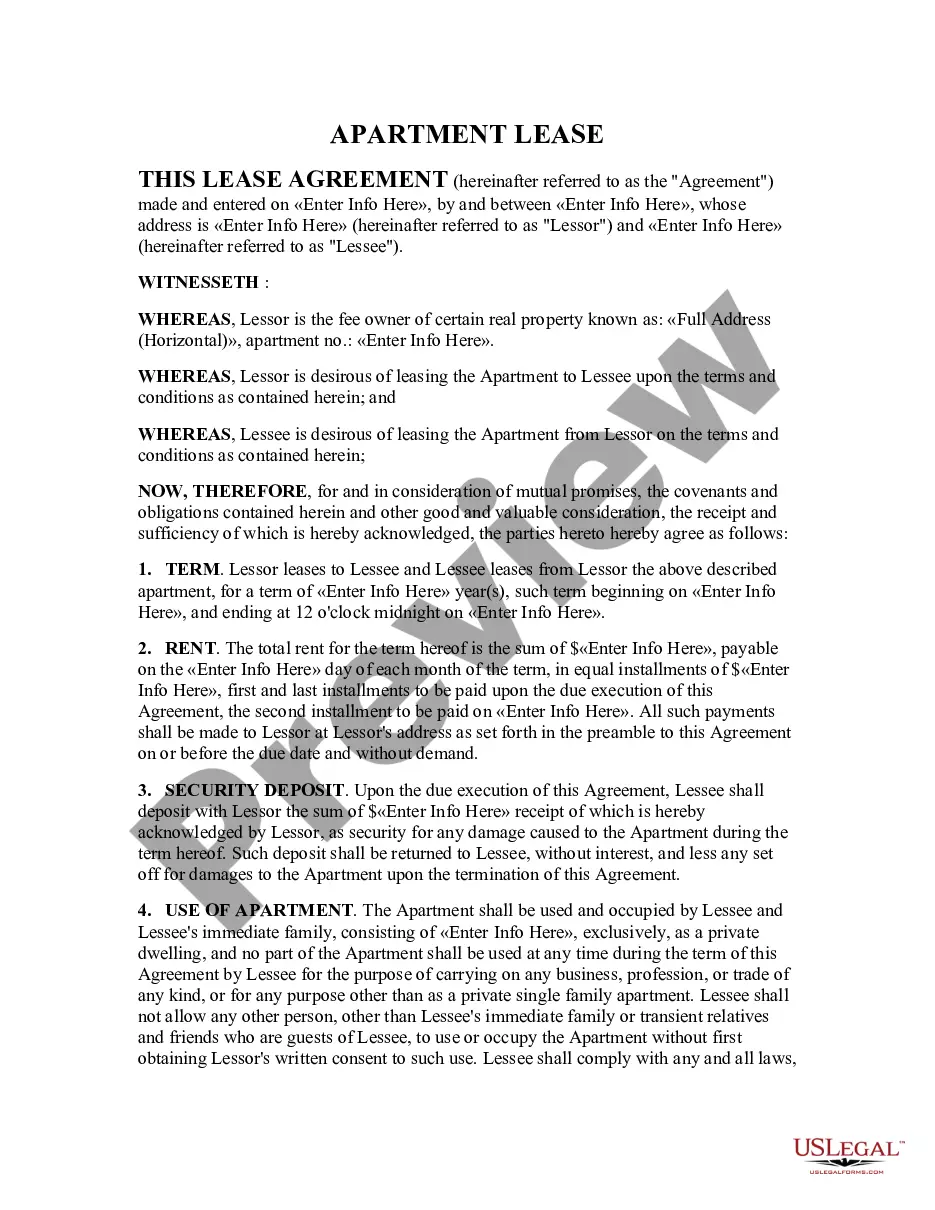

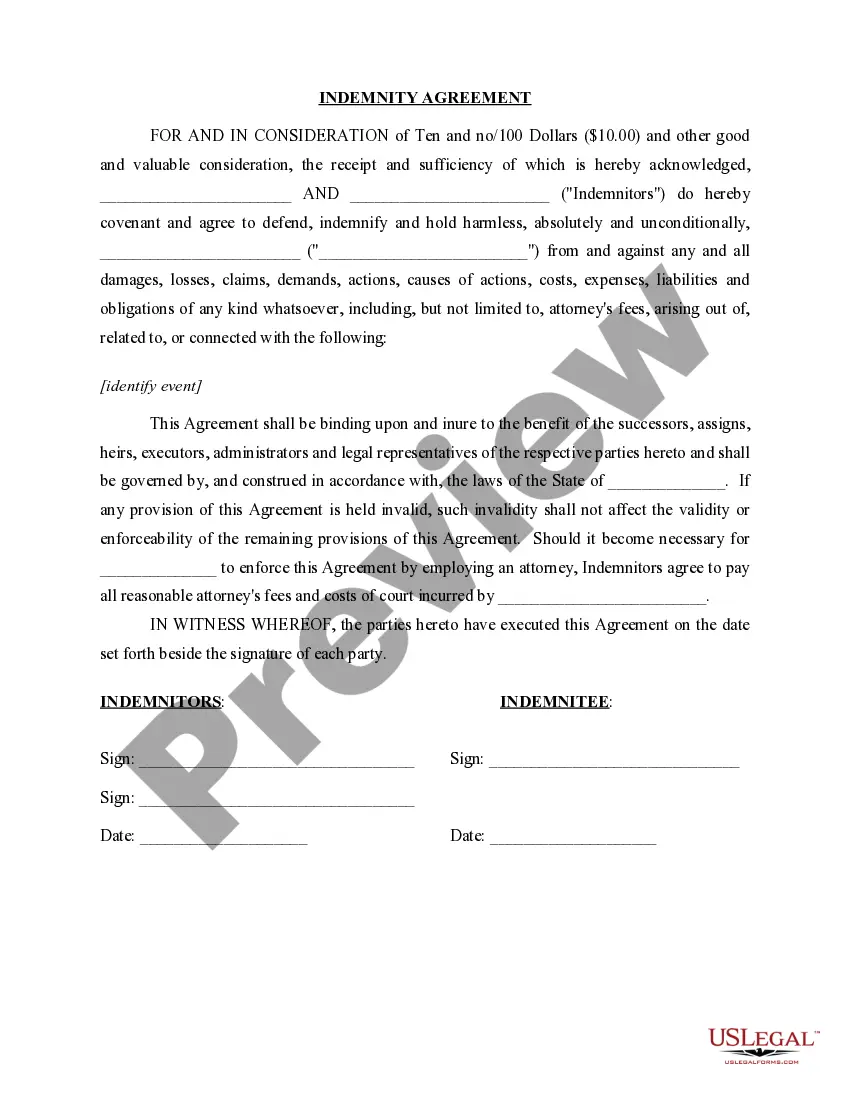

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Before you hire an independent contractor, you need to have three important documents: A W-9 form with the person's contact information and taxpayer ID number, A resume to verify the person's qualifications, and. A written contract showing the details of the agreement between you and the independent contractor.

Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if net earnings from self-employment are $400 or more.