North Carolina Self-Employed Independent Contractor Construction Worker Contract

Description

How to fill out Self-Employed Independent Contractor Construction Worker Contract?

Are you currently in a position where you require documents for both organizational or particular purposes nearly every day.

There are numerous legal document templates accessible online, but finding versions you can trust is not easy.

US Legal Forms provides thousands of form templates, including the North Carolina Self-Employed Independent Contractor Construction Worker Agreement, which can be tailored to meet federal and state regulations.

Access all of the document templates you have purchased in the My documents section.

You can download another copy of the North Carolina Self-Employed Independent Contractor Construction Worker Agreement anytime, if necessary. Just select the required form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the North Carolina Self-Employed Independent Contractor Construction Worker Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

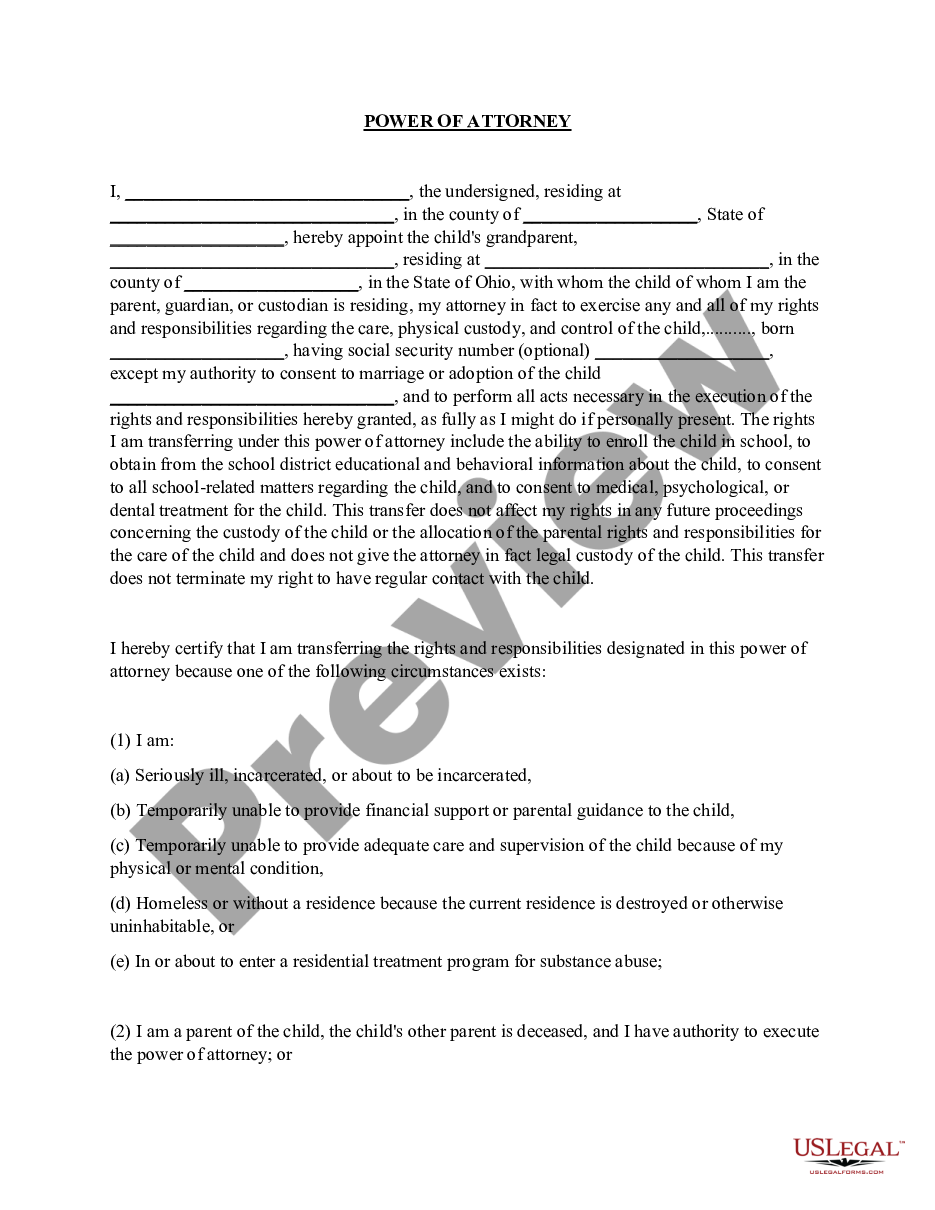

- Utilize the Review button to examine the form.

- Check the description to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search area to locate the form that meets your needs and criteria.

- Once you find the correct form, click Acquire now.

- Choose the pricing plan you prefer, fill in the required information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- Select a convenient file format and download your copy.

Form popularity

FAQ

In North Carolina, businesses must obtain workers' compensation insurance if they have three or more employees. This threshold includes full-time, part-time, and temporary workers. Therefore, if you hire subcontractors, it’s prudent to review your North Carolina Self-Employed Independent Contractor Construction Worker Contract to avoid any compliance issues. Consulting with a legal expert can provide you with guidance that is specific to your situation.

Not all construction workers are self-employed, but many can work as independent contractors. A North Carolina Self-Employed Independent Contractor Construction Worker Contract allows these individuals to operate their businesses while providing services to clients. This type of arrangement offers flexibility and independence, but it also comes with unique responsibilities. Be clear about your role, rights, and obligations to ensure a successful working relationship.

Several groups are exempt from workers' compensation requirements in North Carolina, including some independent contractors and business owners. Specifically, if you operate in certain industries or have a very limited number of workers, you may not be required to carry insurance. Understanding the nuances of a North Carolina Self-Employed Independent Contractor Construction Worker Contract can help clarify your responsibilities. Always check with a legal professional to get tailored advice.

In North Carolina, independent contractors typically do not qualify for workers' compensation benefits, as they are not considered employees. A North Carolina Self-Employed Independent Contractor Construction Worker Contract may outline specific terms regarding injuries and liability. Therefore, it’s essential to understand your status and the protections offered under such a contract. Consider consulting with a legal expert to ensure that you have appropriate coverage.

An independent contractor should fill out forms that include the W-9 for tax purposes and possibly a service agreement or an independent contractor agreement. It's also advisable to maintain records of any correspondence and project details. By utilizing the resources provided by uslegalforms, you can easily access the necessary templates for a North Carolina Self-Employed Independent Contractor Construction Worker Contract.

Filling out an independent contractor agreement requires attention to detail. Start with the date and names of both parties, followed by a clear description of the services to be rendered. Don’t forget to specify the payment terms and any milestones, ensuring that your language reflects the specifics of a North Carolina Self-Employed Independent Contractor Construction Worker Contract for legal effectiveness.

Writing an independent contractor agreement involves clearly defining the work to be performed and the payment structure. Begin with an introduction that identifies the parties and the nature of the contract. Include key sections such as scope of work, deadlines, and confidentiality, all tailored to the context of a North Carolina Self-Employed Independent Contractor Construction Worker Contract, ensuring legal clarity.

To fill out an independent contractor form, start by gathering your personal information such as your name, address, and contact details. Next, provide details about the project, including the scope of work and payment terms. Make sure to indicate that this is a North Carolina Self-Employed Independent Contractor Construction Worker Contract by including specific clauses relevant to your work in North Carolina.

To become an independent contractor in North Carolina, start by determining your business structure and registering your business name. Next, create a North Carolina Self-Employed Independent Contractor Construction Worker Contract to formalize your agreements with clients. It is also important to understand any licensing or permit requirements specific to your trade. Lastly, leveraging resources like uslegalforms can guide you through the documentation and legal aspects of starting your independent business successfully.

Yes, having a contract is crucial as an independent contractor. A North Carolina Self-Employed Independent Contractor Construction Worker Contract provides clarity on roles, responsibilities, and payment structures. It helps to prevent misunderstandings between you and your clients, ensuring a smoother work relationship. Additionally, a written contract can be invaluable in case any disagreements arise down the line.