Affidavit of Heirship for Mineral Rights

Description

Key Concepts & Definitions

An affidavit of heirship for mineral rights is a legal document used to establish ownership of mineral rights after the death of the original owner. It is a form of heirship affidavit particularly used in the oil, gas, and mineral sectors. This affidavit is commonly utilized when the deceased did not leave a will and the property was not otherwise legally transferred prior to their death.

Step-by-Step Guide

- Gather Necessary Documents: Collect all required documents such as the death certificate of the deceased, proof of identification, and any previous property and mineral rights documents.

- Identify Heirs: Establish and list all potential heirs to the mineral rights. This typically includes immediate family members or relatives defined under state law.

- Consult with an Attorney: Due to the complexities associated with mineral rights, consulting with an attorney specialized in estate or mineral rights law is advisable.

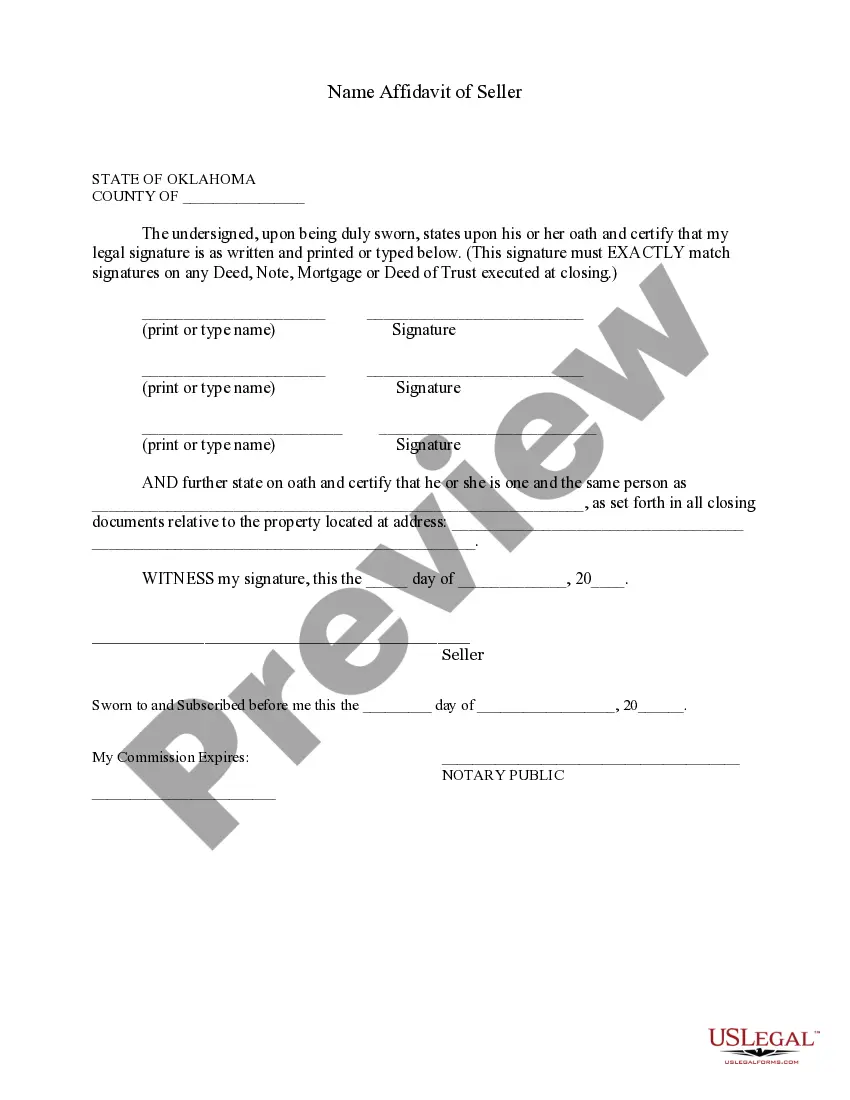

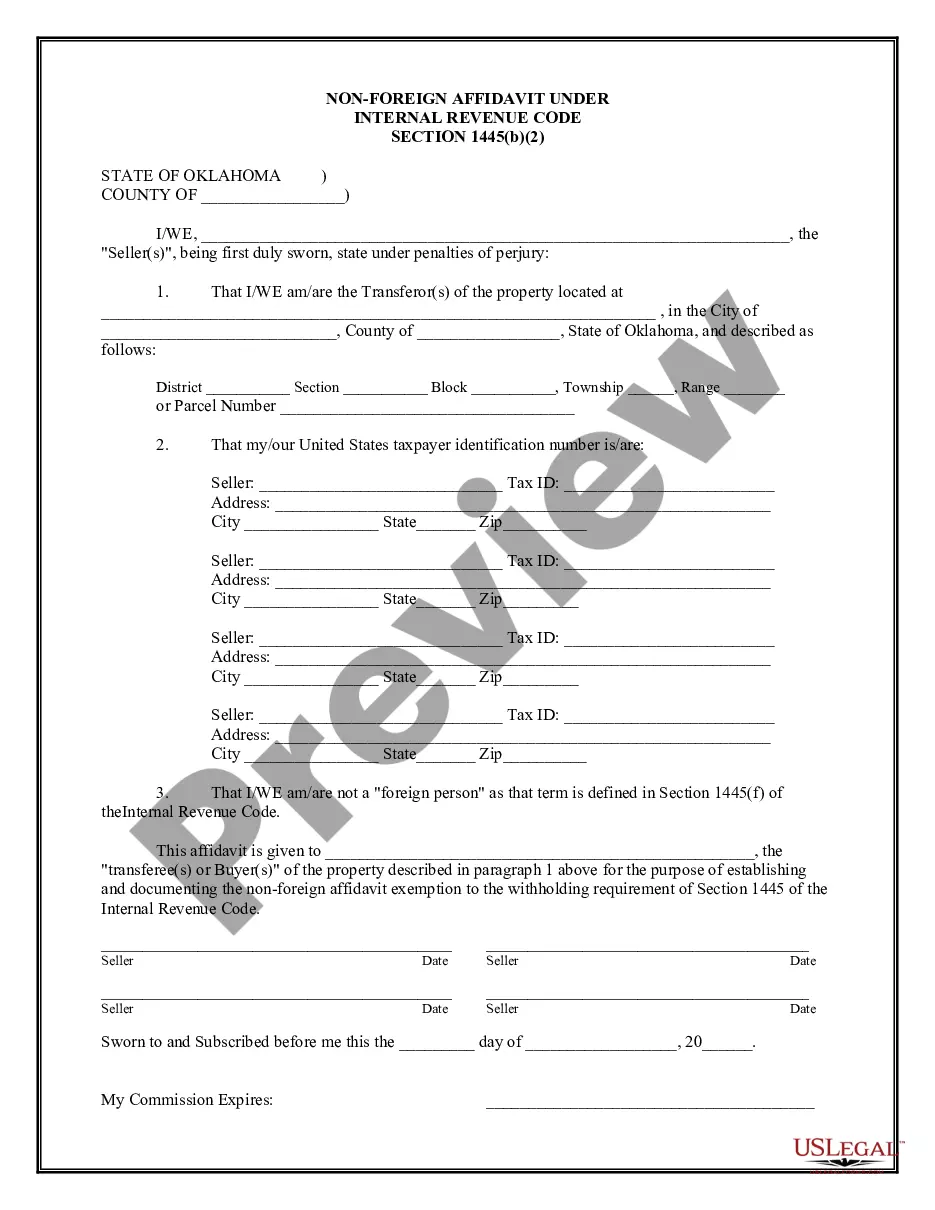

- Complete the Affidavit: Fill out the affidavit of heirship for mineral rights, ensuring all information is accurate and truthful. Include a detailed description of the mineral rights in question.

- Notarization: Have the affidavit notarized to affirm the authenticity of the document and the signees.

- File the Affidavit: File the completed and notarized affidavit with the appropriate county records where the mineral rights are located.

Risk Analysis

- Legal Disputes: Incomplete or inaccurate affidavits can lead to disputes among heirs or challenges from external parties, potentially resulting in costly litigation.

- Regulatory Compliance: Failure to properly document and file an affidavit can result in non-compliance with state laws, affecting the legal standing of the heirs claims to the mineral rights.

- Financial Implications: Incorrect handling of affidavit filing may delay or disrupt revenue streams generated from the mineral rights, impacting financial stability for the heirs.

Common Mistakes & How to Avoid Them

- Inadequate Documentation: Ensure all documents, including the death certificate and property records, are up-to-date and accurate. Missing documents can invalidate the affidavit.

- Failing to Consult Legal Advice: Always seek legal advice when dealing with legal documents like affidavits of heirship for mineral rights to avoid procedural errors.

- Delay in Filing: Timely file the affidavit to avoid complications that arise from claiming the inheritance later than necessary.

FAQ

- What are mineral rights? Mineral rights are the ownership rights to underground resources such as oil, natural gas, metals, and minerals.

- Who can file an affidavit of heirship for mineral rights? Any potential heir or appointed representative can file it, preferably under the guidance of a lawyer specialized in estate or mineral law.

- Is an affidavit of heirship for mineral rights recognized across all states? Yes, however, the specific rules and requirements can vary by state.

How to fill out Affidavit Of Heirship For Mineral Rights?

Use US Legal Forms to obtain a printable Affidavit of Heirship for Mineral Rights. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most comprehensive Forms catalogue online and provides reasonably priced and accurate templates for consumers and lawyers, and SMBs. The templates are grouped into state-based categories and some of them can be previewed before being downloaded.

To download samples, customers need to have a subscription and to log in to their account. Press Download next to any template you need and find it in My Forms.

For individuals who don’t have a subscription, follow the following guidelines to easily find and download Affidavit of Heirship for Mineral Rights:

- Check out to make sure you have the correct template in relation to the state it is needed in.

- Review the document by looking through the description and using the Preview feature.

- Press Buy Now if it’s the template you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it multiple times.

- Make use of the Search engine if you want to find another document template.

US Legal Forms offers thousands of legal and tax samples and packages for business and personal needs, including Affidavit of Heirship for Mineral Rights. Above three million users have already used our platform successfully. Select your subscription plan and get high-quality forms within a few clicks.

Form popularity

FAQ

You have no idea how troublesome it is to probate wills decades after the person died so that the oil company will pay royalties to the heirs. But if you push they will pay per the state statutes. So, if you had no siblings, your state statute probably says that you inherit from your mother.

If you want to sell the mineral rights to another person, you can transfer them by deed. You will need to create a mineral deed and have it recorded. You should check with the county Recorder of Deeds in the county where the land is located and ask if a printed mineral deed form is available to use.

Not owning the mineral rights to a parcel of land doesn't mean your property is worthless. If someone else owns the mineral rights and they sell those rights to an individual or corporation, you can still make a profit as the surface rights owner.

Even if mineral rights have been previously sold on your property, they could be expired. There is no one answer to how long mineral rights may last. Each mineral rights agreement will have different terms.

Oklahoma law allows for certain mineral interests to be transferred by filing an affidavit in the county real estate records.

Mineral rights must be transferred to heirs before any transactions related to them can take place. Unlike a home, which can be sold by an estate, mineral rights must be transferred before any sale. Mineral rights can be transferred to rightful heir(s) or to a trust through a mineral deed.

Mineral rights are automatically included as a part of the land in a property conveyance, unless and until the ownership gets separated at some point by an owner/seller.Conveying (selling or otherwise transferring) the land but retaining the mineral rights.

Call the county where the minerals are located and ask how to transfer mineral ownership after death. They will probably advise you to submit a copy of the death certificate, probate documents (if any), and a copy of the will (or affidavit of heirship if there is no will).

The price of the Affidavit of Heirship is $500. This price includes the attorneys' fees to prepare the Affidavit of Heirship and the cost to record in the real property records. You can save $75 if you record the Affidavit of Heirship yourself.