North Carolina Self-Employed Steel Services Contract

Description

How to fill out Self-Employed Steel Services Contract?

It is feasible to spend hours online searching for the official document template that fulfills the state and federal requirements you need. US Legal Forms offers a multitude of legal forms that are reviewed by experts.

You can obtain or print the North Carolina Self-Employed Steel Services Contract from our service. If you already have a US Legal Forms account, you can Log In and click on the Download option.

After that, you can complete, modify, print, or sign the North Carolina Self-Employed Steel Services Contract. Each legal document template you purchase is yours indefinitely. To obtain another copy of any purchased form, navigate to the My documents tab and click on the corresponding option.

Complete the transaction. You may use your Visa or Mastercard or PayPal account to purchase the legal form. Choose the format of the document and download it to your system. Make modifications to your document if necessary. You can complete, edit, sign, and print the North Carolina Self-Employed Steel Services Contract. Download and print numerous document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your county/town of choice.

- Read the form description to confirm you have chosen the right form.

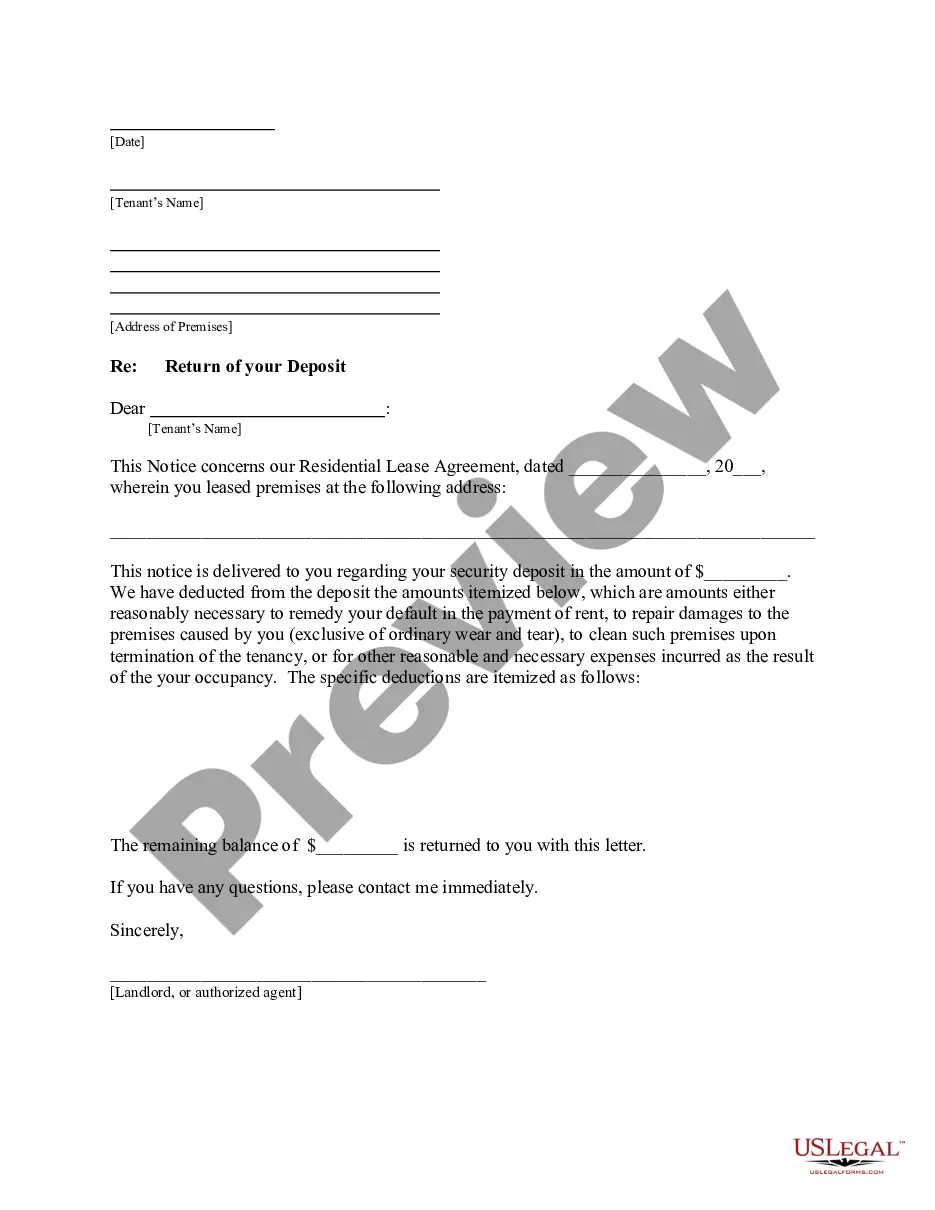

- If available, use the Review option to view the document template as well.

- If you wish to find another version of the form, use the Search field to locate the template that meets your needs and specifications.

- Once you have found the template you want, click on Purchase now to proceed.

- Select the pricing plan you prefer, enter your details, and register for your account on US Legal Forms.

Form popularity

FAQ

To reiterate, a contract is legally binding in North Carolina when it includes mutual consent, clear terms, lawful consideration, and both parties have the capacity to enter into the agreement. This applies to various contracts, including those for self-employed steel services. By ensuring these elements are met in your North Carolina Self-Employed Steel Services Contract, you can create a solid foundation for your business agreement.

Yes, in North Carolina, you can act as your own contractor for your projects, provided you follow the necessary regulations and obtain the appropriate permits. However, it is essential to understand the responsibilities and liabilities involved in this role. If you are entering into a North Carolina Self-Employed Steel Services Contract, ensure you are well-informed about local building codes and compliance requirements.

In North Carolina, the sales tax on a service contract generally varies depending on the nature of the services provided. Typically, many services are exempt from sales tax, but certain taxable services may apply. When drafting a North Carolina Self-Employed Steel Services Contract, it is wise to consult with a tax professional to ensure compliance with state tax regulations.

In North Carolina, various factors can void a contract, including fraud, misrepresentation, duress, or if the contract involves illegal activities. Additionally, if one of the parties lacks the capacity to contract, this can render the contract void. When creating a North Carolina Self-Employed Steel Services Contract, be mindful of these factors to protect your agreement's validity.

While an operating agreement is not legally required for LLCs in North Carolina, it is highly recommended. This document outlines the management structure and operational procedures of your LLC. For those in the self-employed steel services sector, having a clear operating agreement can help prevent disputes and ensure smooth operations.

The five essential elements of a legally binding contract in North Carolina include offer, acceptance, consideration, capacity, and legality. Each party must clearly understand the agreement's terms and conditions. When drafting a North Carolina Self-Employed Steel Services Contract, incorporating these elements ensures that your contract is enforceable in court.

In North Carolina, for a contract to be legally binding, it must have mutual consent, clear terms, and lawful consideration. Additionally, the parties involved must have the capacity to contract, meaning they are of legal age and sound mind. When creating a North Carolina Self-Employed Steel Services Contract, ensure all these elements are present to enforce your agreement.

In North Carolina, service contracts may be subject to sales tax depending on the nature of the services provided. Specifically, if your services fall under taxable categories, you need to collect sales tax from your clients. It is advisable to consult with a tax professional to understand how the North Carolina Self-Employed Steel Services Contract impacts your tax obligations and ensure compliance.

To become an independent contractor in NC, begin by identifying your skills and the services you want to provide. Then, register your business, obtain any necessary licenses, and set up your financial systems. A North Carolina Self-Employed Steel Services Contract can be a valuable tool to outline your work agreements and establish professional relationships with clients.

Becoming an independent contractor in North Carolina involves several key steps. First, you need to determine your business structure and register it with the state. Following this, consider drafting a North Carolina Self-Employed Steel Services Contract to use with your clients, as this will help clarify expectations and protect your legal rights.