A Successor In Interest (SII) Intent Questionnaire is a document that is used to help identify a person or entity that is entitled to take over the rights and responsibilities of another. This document is typically used in real estate transactions when the original owner of a property passes away or is no longer able to manage the property. The questionnaire helps to identify the rightful heir to the property, whether that person is a family member, business partner, or other entity. The questions typically ask for information about the deceased owner, the intended successor, and the relationship between the two. There are several types of SII Intent Questionnaires, including those used for the transfer of property in probate court, those used for the transfer of property in a trust, and those used for the transfer of title in a real estate transaction. Additionally, some states may have their own specific SII Intent Questionnaires.

Successor In Interest Intent Questionnaire

Description

Key Concepts & Definitions

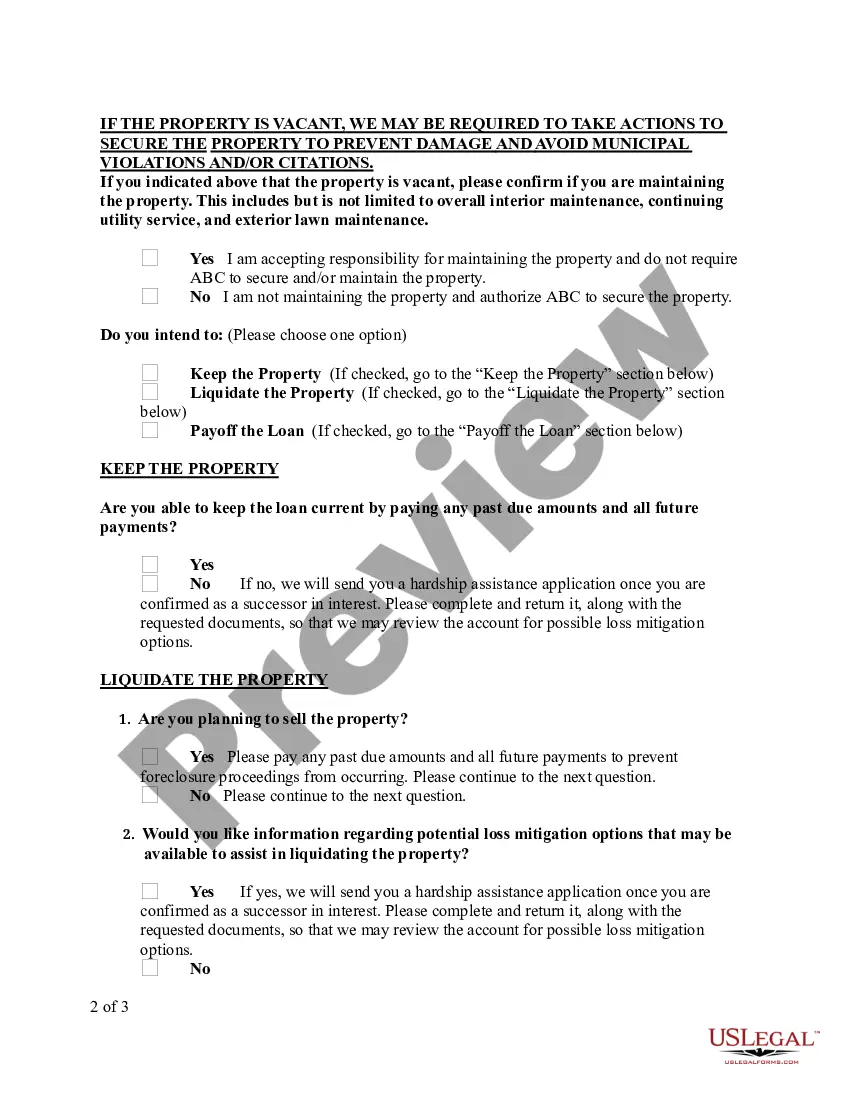

Successor in interest intent questionnaire refers to a formal document used by organizations or entities to assess the intentions of a successor in interest regarding their plans for the acquired interest. This is commonly applied in real estate, finance, and business settings to ensure continuity and clarity in transactions involving inherited or transferred interests.

Step-by-Step Guide

- Identify Necessary Information: Gather all required personal details, property or business information from the current holder and potential successor.

- Design the Questionnaire: Create questions that effectively capture the successor's intentions, such as plans for the property, financial management, or operational changes.

- Consult Legal Experts: Ensure that the questionnaire adheres to local regulations and real estate laws.

- Execute Distribution: Distribute the questionnaire to the intended successor and ensure it's filled out completely and truthfully.

- Analyze Responses: Assess the completed questionnaire to determine if the responses align with legal and organizational requirements.

Risk Analysis

- Legal Risks: Incorrect or incomplete questions might lead to legal challenges or conflicts between interested parties.

- Financial Risks: Misinterpretation of a successors financial intentions might lead to misguided business decisions or financial loss.

- Data Privacy: Handling personal information requires adherence to privacy laws, and any breach could result in penalties.

Key Takeaways

- Using a successor in interest intent questionnaire helps in aligning the strategic goals between the existing and incoming parties.

- Its crucial to consult legal advice to create a comprehensive and compliant questionnaire.

- Risks associated with this questionnaire involve legal, financial, and data-related considerations that need to be managed effectively.

Common Mistakes & How to Avoid Them

- Vague Questions: Avoid ambiguity by formulating clear and specific questions.

- Lack of Legal Oversight: Always have legal experts review the questionnaire to avoid future legal complications.

- Poor Follow-Up: Ensure thorough follow-up on the responses for detailed understanding and action.

How to fill out Successor In Interest Intent Questionnaire?

Preparing legal paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you find, as all of them correspond with federal and state laws and are examined by our experts. So if you need to complete Successor In Interest Intent Questionnaire, our service is the best place to download it.

Getting your Successor In Interest Intent Questionnaire from our library is as simple as ABC. Previously authorized users with a valid subscription need only log in and click the Download button after they locate the proper template. Afterwards, if they need to, users can get the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, registering with a valid subscription will take only a few moments. Here’s a quick instruction for you:

- Document compliance check. You should attentively examine the content of the form you want and check whether it satisfies your needs and meets your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library through the Search tab above until you find a suitable blank, and click Buy Now once you see the one you need.

- Account creation and form purchase. Create an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Successor In Interest Intent Questionnaire and click Download to save it on your device. Print it to complete your paperwork manually, or use a multi-featured online editor to prepare an electronic copy faster and more effectively.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to obtain any formal document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

Let's do it! Successor in Interest means the estate or beneficiary to whom the right to payment under the Plan shall have passed by will or the laws of descent and distribution.

A successor in interest is someone with an ownership interest in the property, even though they aren't obliged to repay the loan. If we confirm you as a successor in interest to a property, we will send you communications and information about the mortgage loan secured by the property.

Successor in interest is defined as coextensive with transfers listed in the Garn-St. Germain Act after which a due-on-sale clause may not be exercised.

If I inherited a property, am I required to assume the loan? No, as a confirmed successor in interest you may apply for any available loss mitigation option without first assuming the loan, though acceptance of an option may be contingent on the assumption of the loan.

A successor in interest is someone with an ownership interest in the property, even though they aren't obliged to repay the loan. You may qualify as a successor in interest to a property if an ownership interest in the.

A ?Confirmed Successor in Interest? is a successor in interest whose identity and ownership interest in the property securing the mortgage loan has been confirmed by Community Loan Servicing through review and approval of submitted documentation.

A Successor in Interest is a party, other than the original mortgage borrower, who has an ownership interest in the property that serves as collateral for a mortgage obligation. A Successor in Interest usually occurs when an heir is bequeathed property that is subject to a mortgage.