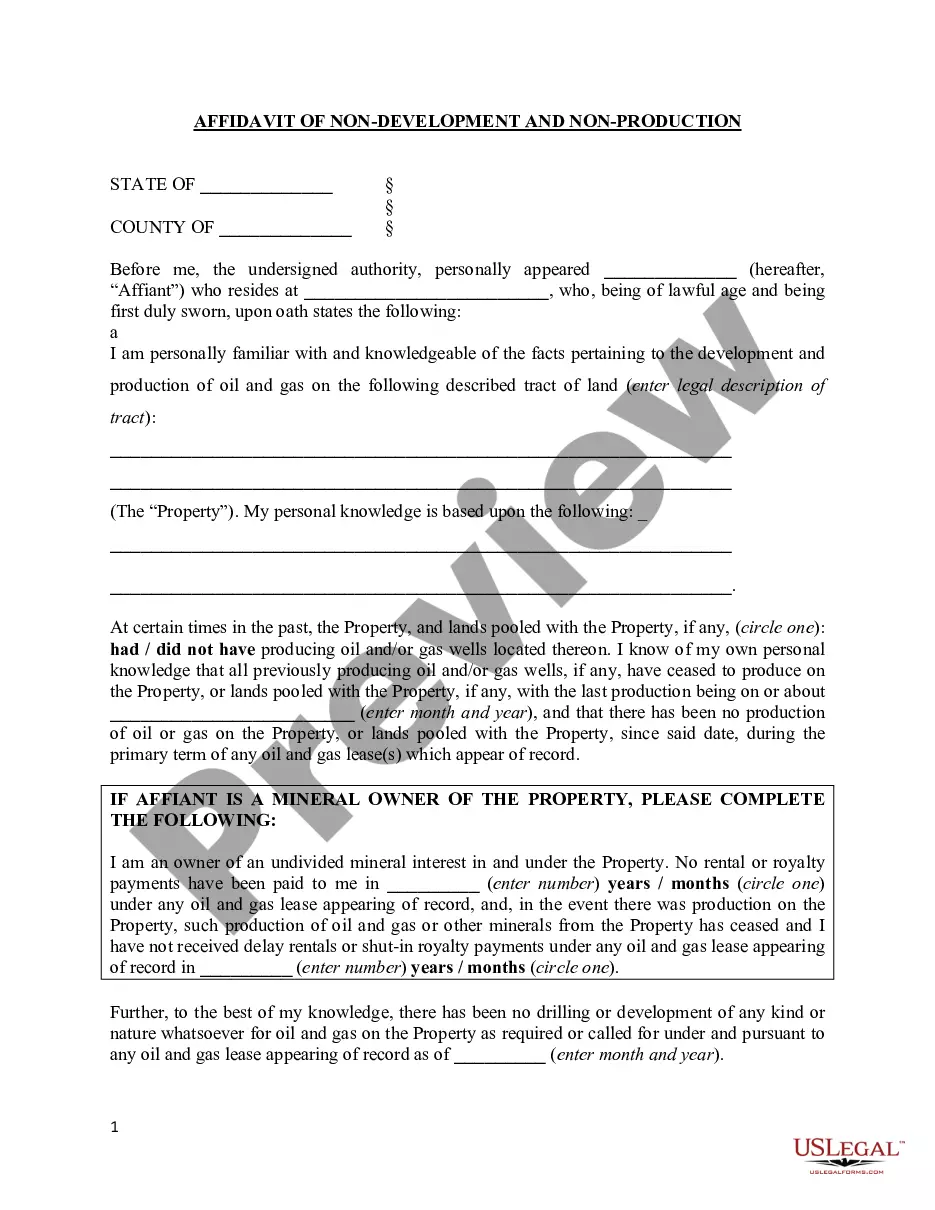

A North Carolina Non-Foreign Affidavit is a legal document used to prove that a business entity is not registered in any foreign country or jurisdiction. This document is required when a company applies for a Certificate of Authority to do business in North Carolina. It is also used for obtaining a Certificate of Good Standing and other certificates from the Secretary of State. There are three types of North Carolina Non-Foreign Affidavits: a Domestic Entity Non-Foreign Affidavit, a Foreign Entity Non-Foreign Affidavit, and a Foreign Limited Liability Company Non-Foreign Affidavit. The Domestic Entity Non-Foreign Affidavit is filed by domestic corporations, limited liability companies, limited partnerships, and limited liability partnerships. The Foreign Entity Non-Foreign Affidavit is filed by foreign corporations, foreign limited liability companies, foreign limited partnerships, and foreign limited liability partnerships. The Foreign Limited Liability Company Non-Foreign Affidavit is filed by foreign limited liability companies.

North Carolina Non- Foreign Affidavit

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

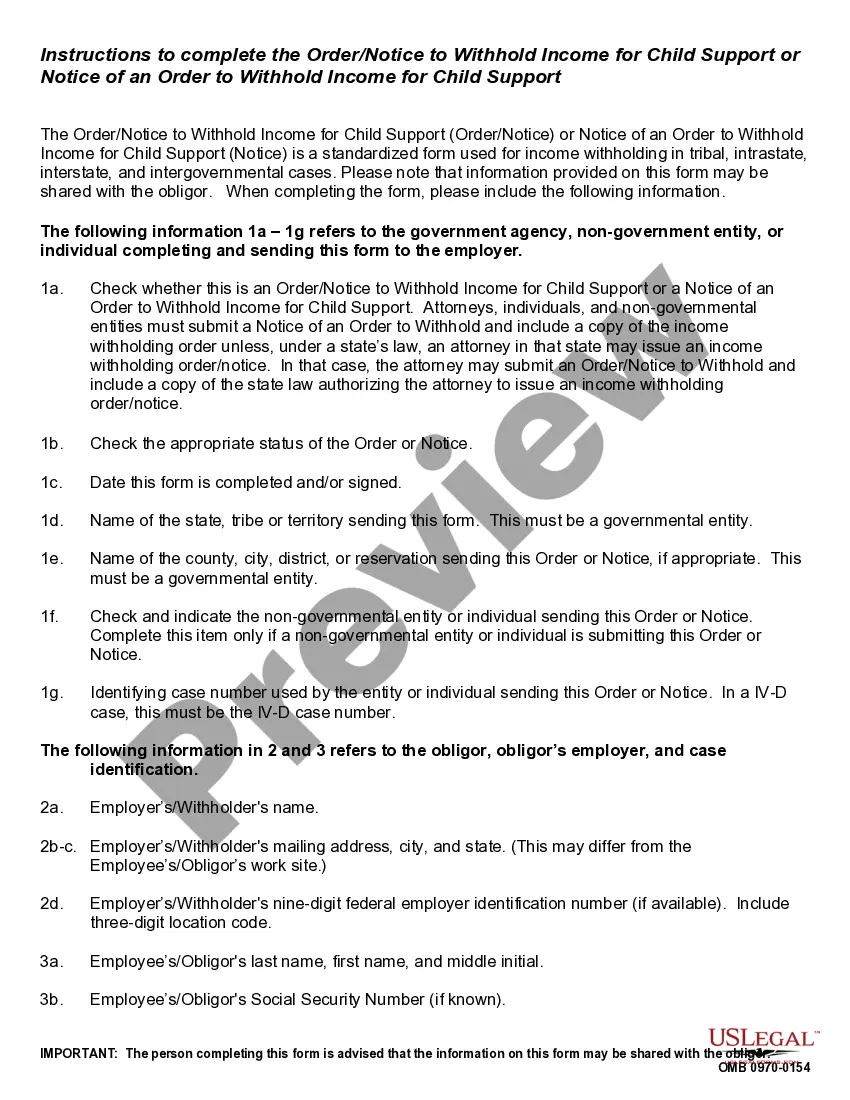

How to fill out North Carolina Non- Foreign Affidavit?

US Legal Forms is the easiest and most affordable way to find suitable formal templates.

It’s the largest online collection of business and personal legal documents crafted and validated by lawyers.

Here, you can discover printable and fillable templates that adhere to federal and local regulations - just like your North Carolina Non-Foreign Affidavit.

Examine the form description or preview the document to ensure you’ve identified the one that meets your needs, or find another one using the search tab above.

Click Buy now when you’re confident about its suitability with all the specifications, and choose the subscription plan you prefer.

- Acquiring your template necessitates just a few uncomplicated steps.

- Users who already possess an account with an active subscription only need to Log In to the online service and download the document onto their device.

- Afterwards, they can locate it in their profile under the My documents section.

- And here’s how you can secure a professionally prepared North Carolina Non-Foreign Affidavit if you are utilizing US Legal Forms for the first time.

Form popularity

FAQ

Yes, in North Carolina, most affidavits, including the North Carolina Non-Foreign Affidavit, must be notarized to be legally binding. Notarization helps verify the identity of the signer and adds an extra layer of authenticity to the document. It is advisable to ensure that your affidavit is properly executed to avoid any potential legal issues. If you need assistance with forms or notarization, USLegalForms offers resources and solutions to help you navigate this requirement.

In North Carolina, the withholding rate for nonresident partners varies based on the type of income. Generally, a flat withholding rate of 5.25% applies to partnerships distributing income to nonresident partners. This requirement ensures compliance with state tax laws, and you might need to complete a North Carolina Non-Foreign Affidavit to report this correctly. For further guidance, consider using USLegalForms to simplify the process.

If you are not a foreign person, you do not need a FIRPTA affidavit to sell your house. This means you will not be subject to withholding tax related to the sale. However, you may still need to provide a non-foreign affidavit, which confirms your status to the buyer. Understanding these requirements can help you navigate the selling process smoothly.

Yes, in North Carolina, an affidavit must be notarized to ensure its legal validity. Notarization provides an official verification of the identities of the signers, which is crucial in real estate transactions. This step adds a layer of protection for both buyers and sellers. To facilitate this process, you can rely on services like USLegalForms to guide you through the notarization requirements.

A FIRPTA affidavit is required if the seller is a foreign person selling U.S. real estate. This document ensures that the buyer understands their withholding obligations under the law. If the seller is a non-foreign person, a FIRPTA affidavit is not necessary. Knowing whether you need this affidavit can prevent complications during the closing process.

foreign person affidavit is a declaration confirming that the seller is not a foreign person and does not fall under FIRPTA guidelines. This affidavit assures the buyer that no withholding tax will be necessary at closing. It is an essential part of real estate transactions in North Carolina, providing clarity and confidence to both parties involved. When using USLegalForms, you can easily prepare a nonforeign person affidavit to streamline the process.

The E500 form in North Carolina is used to report the sale of property by a non-foreign person. This form is typically accompanied by a non-foreign affidavit to confirm the seller's status. Completing the E500 ensures compliance with state regulations, facilitating a smooth transaction. Using platforms like USLegalForms can help you accurately fill out the E500 and related documents.

foreign affidavit is a legal document used in real estate transactions to confirm that the seller is not a foreign person. This affidavit is essential for tax purposes, particularly under the Foreign Investment in Real Property Tax Act (FIRPTA). By providing this affidavit, the seller assures the buyer that withholding tax will not apply, simplifying the closing process. In North Carolina, a nonforeign affidavit is a standard requirement for such transactions.