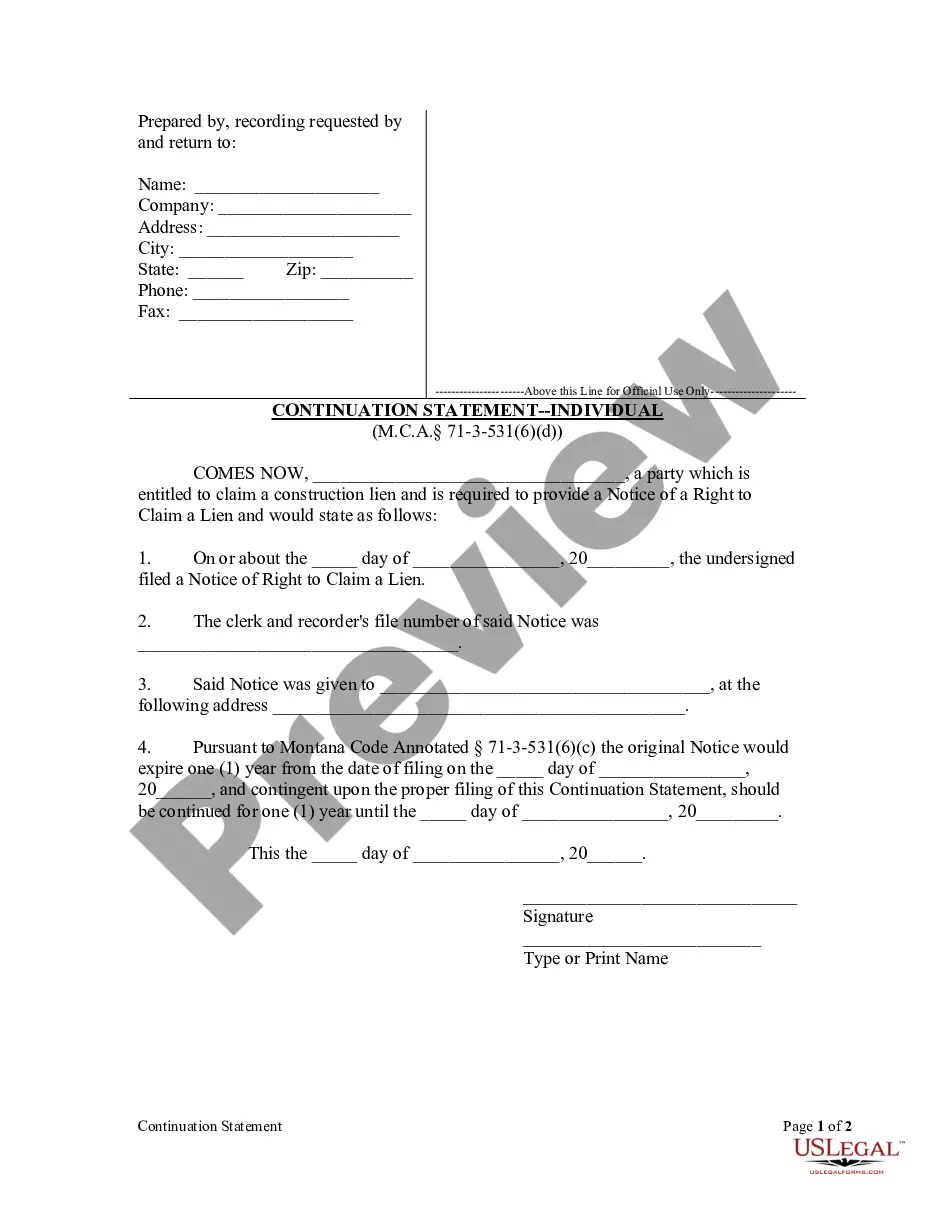

Generally, if required, a Notice of Right to Claim Lien must be filed within

twenty (20) days after the date that materials and services began to be

provided. These Notices are valid for one (1) year after filing,

but may be extended an additional (1) year after the filing of a Continuation

Notice. If a Notice of Right to Claim Lien is required, an unexpired

Notice of Right to Claim Lien or Continuation Notice is necessary before

a lien may be claimed. M.C.A. § 71-3-531

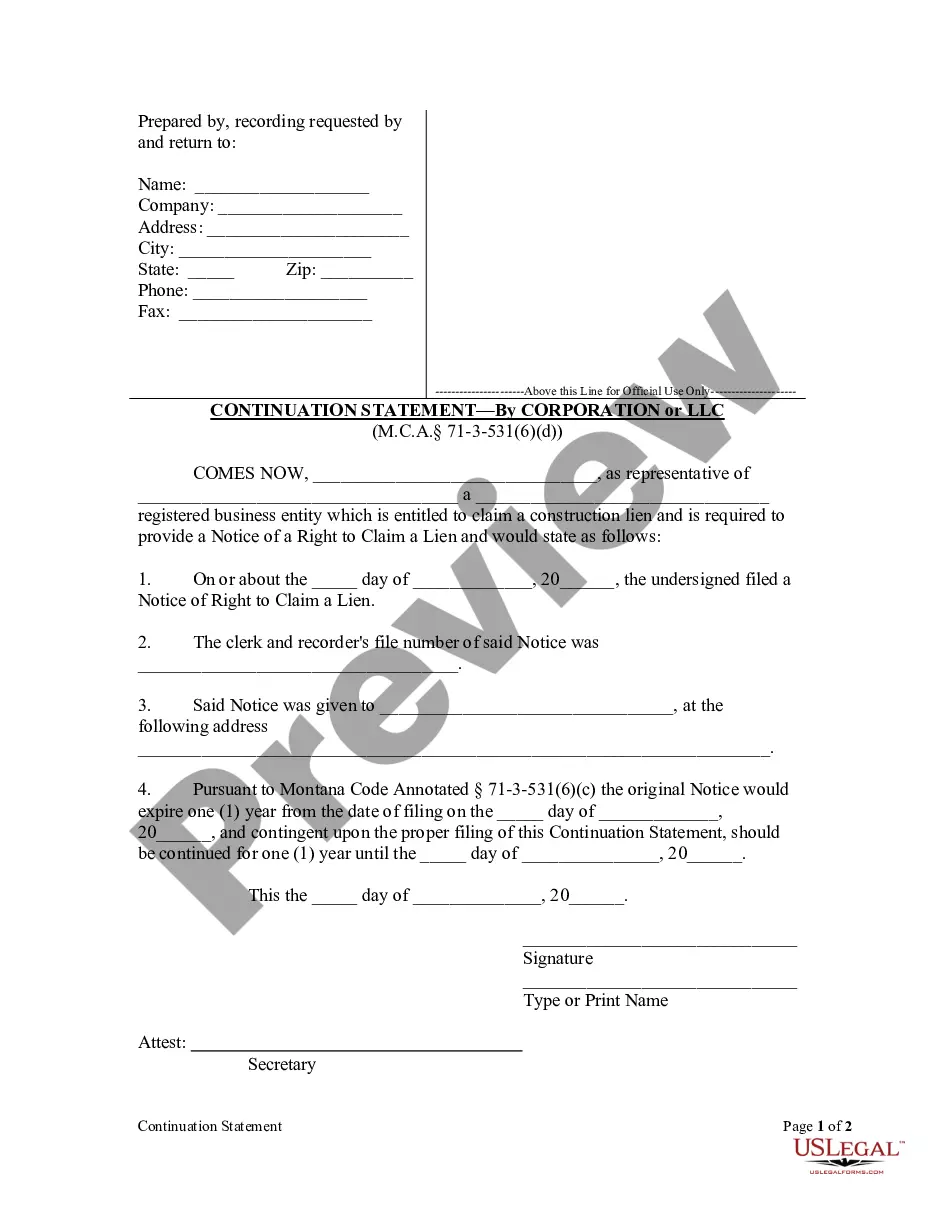

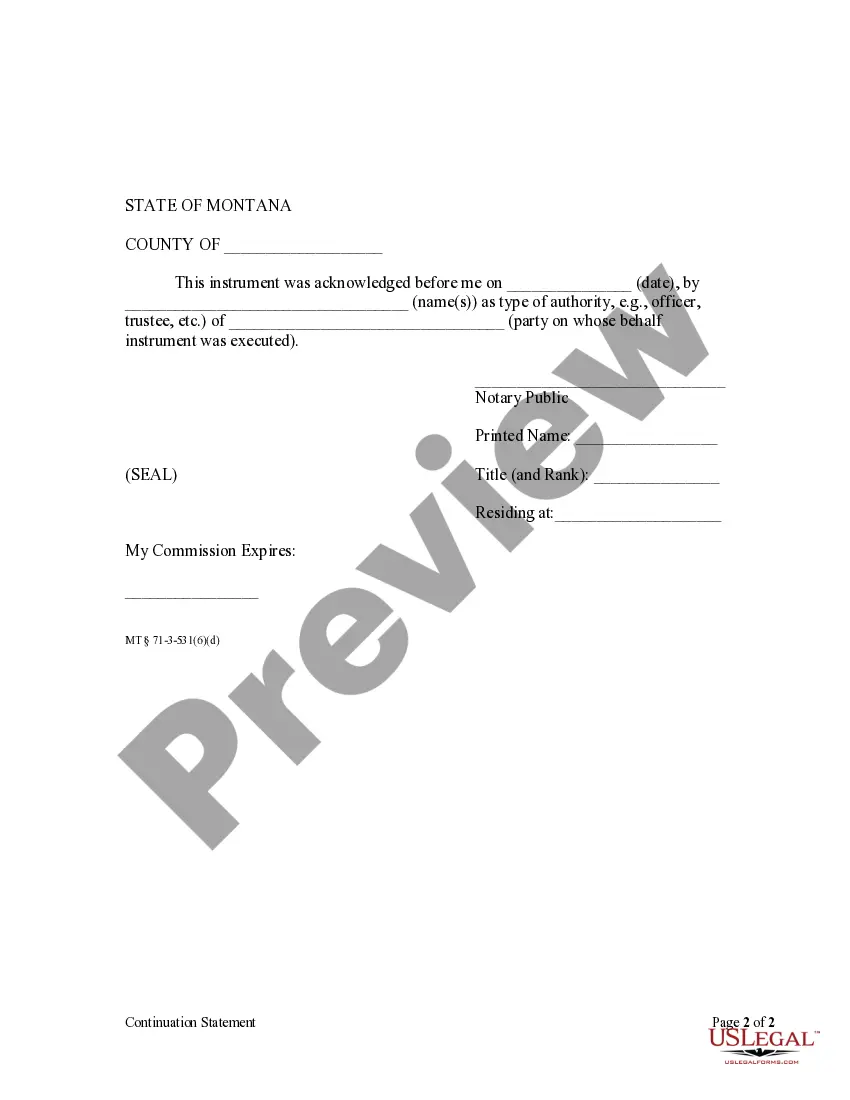

Montana Continuation Statement - Corporation

Description

How to fill out Montana Continuation Statement - Corporation?

Acquire a printable Montana Continuation Statement - Corporation or LLC with just a few clicks in the most comprehensive collection of legal electronic forms.

Locate, download, and print expertly prepared and certified samples on the US Legal Forms platform.

After downloading your Montana Continuation Statement - Corporation or LLC, you can complete it in any online editor or print it out and fill it in by hand. Utilize US Legal Forms to gain access to 85,000 professionally drafted, state-specific documents.

- US Legal Forms has been the leading provider of affordable legal and tax documents for US citizens and residents online since 1997.

- Users who currently hold a subscription must Log In directly into their US Legal Forms account, download the Montana Continuation Statement - Corporation or LLC, and find it saved in the My documents section.

- Users without a subscription should follow the instructions outlined below.

- Ensure your form complies with your state's regulations.

- If available, review the form's description for additional details.

- If possible, preview the document to understand its content better.

- Once you are certain the template suits your requirements, click Buy Now.

- Create a personal account.

- Select a subscription plan.

- Pay via PayPal or credit card.

- Download the document in Word or PDF format.

Form popularity

FAQ

Forming an LLC or a corporation will allow you to take advantage of limited personal liability for business obligations. LLCs are favored by small, owner-managed businesses that want flexibility without a lot of corporate formality. Corporations are a good choice for a business that plans to seek outside investment.

In an LLC, individuals with an ownership share are called members. In a corporation, they are called shareholders. One of the advantages an LLC has over a corporation is that in many states, a creditor cannot collect a member's dividends, whereas in a corporation dividends can be collected from shareholders.

A Limited Liability Company (LLC) is an entity created by state statute. Depending on elections made by the LLC and the number of members, the IRS will treat an LLC either as a corporation, partnership, or as part of the owner's tax return (a disregarded entity).

Both types of entities have the significant legal advantage of helping to protect assets from creditors and providing an extra layer of protection against legal liability. In general, the creation and management of an LLC are much easier and more flexible than that of a corporation.

There's no such thing as a "limited liability corporation." An LLC is a limited liability company. It's not a corporation, and you don't incorporate a business as an LLC. Both register with a state, but an LLC doesn't "incorporate."

To form a Montana corporation, you must file articles of incorporation with the Secretary of State and pay a filing fee, at which point a corporation's existence officially begins. At a minimum, the articles must include the following information: Name of the corporation. Names and addresses of incorporators.

Generally, most entrepreneurs choose to form a Corporation or a Limited Liability Company (LLC). The main difference between an LLC and a corporation is that an llc is owned by one or more individuals, and a corporation is owned by its shareholders.It also provides limited liability protection.

A Limited Liability Company (LLC) is an entity created by state statute. Depending on elections made by the LLC and the number of members, the IRS will treat an LLC either as a corporation, partnership, or as part of the owner's tax return (a disregarded entity).

The main advantage of having an LLC taxed as a corporation is the benefit to the owner of not having to take all of the business income on your personal tax return. You also don't have to pay self-employment tax on your income as an owner from the corporation. The main disadvantage is double taxation.