The Hawaii Declaration of Judgment Creditor For Garnishment of Wages is a legal document that is used by creditors to collect money owed to them by debtors via wage garnishment. This document must be signed by the creditor and submitted to the court for approval. The document outlines the amount of money owed to the creditor, the debtor's wages, and the court-ordered garnishment of wages. There are two types of Hawaii Declaration of Judgment Creditor For Garnishment of Wages: One-Time Garnishment and Continuous Garnishment. A One-Time Garnishment is used when the creditor is seeking a single payment from the debtor's wages while a Continuous Garnishment allows the creditor to take multiple payments from the debtor's wages until the full amount of the debt has been paid.

Hawaii Declaration of Judgment Creditor For Garnishment of Wages

Description

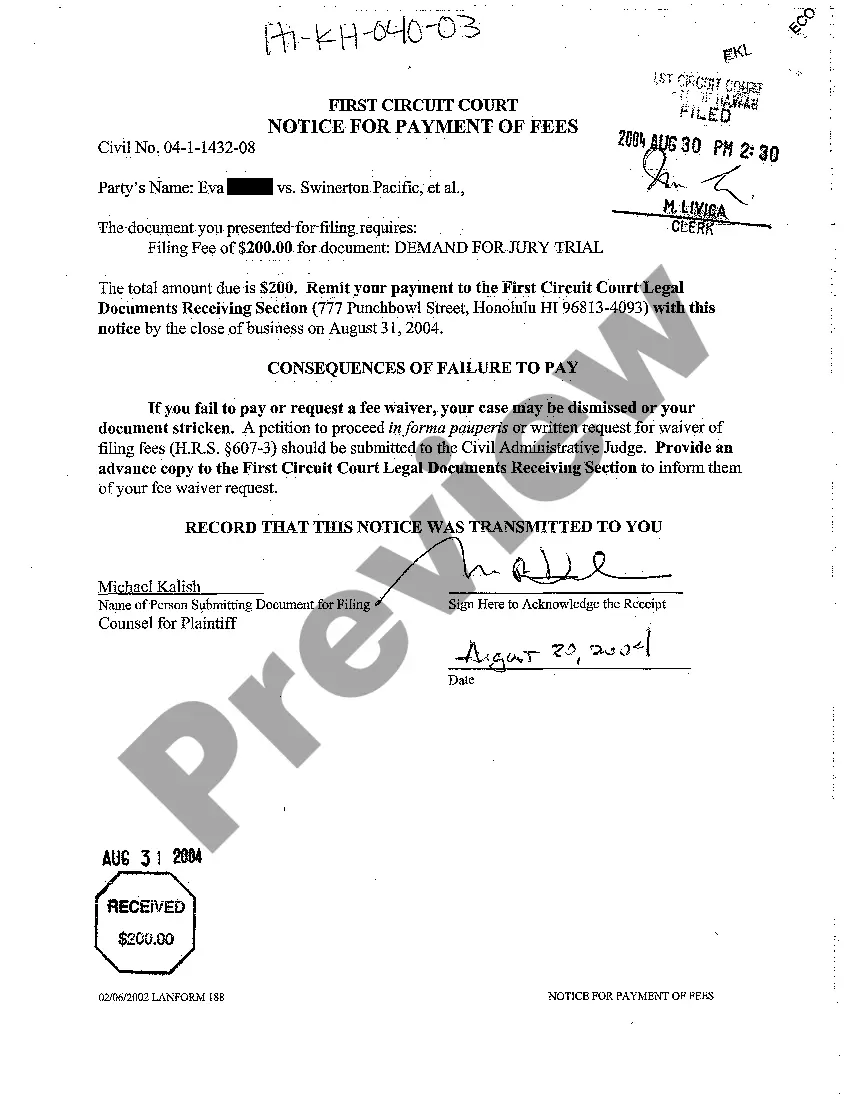

How to fill out Hawaii Declaration Of Judgment Creditor For Garnishment Of Wages?

Completing official documents can be quite challenging if you lack readily available fillable templates. With the US Legal Forms online repository of formal documents, you can trust the forms you receive, as all of them adhere to federal and state guidelines and have been validated by our specialists.

Acquiring your Hawaii Declaration of Judgment Creditor For Garnishment of Wages from our platform is as easy as 1-2-3. Previously authorized users with a current subscription simply need to Log In and click the Download button after they find the correct template. Later, if necessary, users can retrieve the same document from the My documents section of their account. However, even if you are not familiar with our platform, signing up with a valid subscription will take just a few moments. Here’s a quick guide for you.

Haven’t you experienced US Legal Forms yet? Subscribe to our service today to acquire any official document swiftly and easily whenever needed, and keep your paperwork organized!

- Document compliance verification. You should carefully review the content of the form you are interested in and ensure it meets your requirements and adheres to your state regulations. Reviewing your document and checking its overall description will assist you in that.

- Alternative search (optional). If there are any discrepancies, search the library using the Search tab at the top of the page until you locate a suitable template, and click Buy Now once you find what you need.

- Account creation and form purchase. Sign up for an account with US Legal Forms. After account verification, Log In and choose your preferred subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Hawaii Declaration of Judgment Creditor For Garnishment of Wages and click Download to save it onto your device. Print it to complete your documents manually, or utilize a multi-featured online editor to prepare an electronic version more quickly and effectively.

Form popularity

FAQ

Yes, you can appeal a garnishee order if you believe it was issued in error or if there are valid defenses regarding the garnishment. To do so, you typically need to file a notice of appeal with the court and provide the necessary documentation supporting your case. Understanding the intricacies of the Hawaii Declaration of Judgment Creditor For Garnishment of Wages can help clarify your rights. Consulting with an experienced legal professional can also provide guidance throughout the appeal process.

Writing a hardship letter to stop a garnishment requires you to explain your financial situation clearly. Begin with an introduction stating your name, account number, and the purpose of your letter. Detail your current hardships, showing how the garnishment affects your ability to meet basic living expenses. Invoke the Hawaii Declaration of Judgment Creditor For Garnishment of Wages to underline your circumstances and request a reconsideration of your garnishment.

To fill out a challenge to garnishment form effectively, start by clearly stating your personal details and the case number associated with the garnishment. Include your arguments against the garnishment, such as financial hardship or incorrect creditor claims. Once completed, ensure you submit the form to the appropriate court along with any required supporting documents. Using the Hawaii Declaration of Judgment Creditor For Garnishment of Wages can aid in structuring your challenge.

Yes, wages can still be garnished after 10 years if the judgment is still active. In Hawaii, the judgment can last for up to 20 years, allowing creditors to pursue garnishment throughout that timeframe. Staying informed through resources like the Hawaii Declaration of Judgment Creditor For Garnishment of Wages can help you understand your rights and responsibilities in this matter.

In Hawaii, a judgment typically does not fall off automatically after 7 years. Instead, it remains valid for 20 years unless it is satisfied or overturned. To manage this, refer to the Hawaii Declaration of Judgment Creditor For Garnishment of Wages for insights on how judgments can affect your financial situation over time.

To verify a garnishment, you should contact the court that issued the judgment or check with your employer's payroll department. They can provide you with relevant documentation regarding the garnishment. For added assistance, the Hawaii Declaration of Judgment Creditor For Garnishment of Wages may serve as a helpful tool in understanding your rights and obligations.

In Hawaii, a creditor has up to 20 years to collect a debt after obtaining a judgment. This period allows creditors the necessary time to recover the owed amount through methods such as garnishment. If you have questions about this process, consider utilizing resources like the Hawaii Declaration of Judgment Creditor For Garnishment of Wages for more detailed information.

Yes, there is a time limit for garnishments in Hawaii. Generally, the garnishment remains active for a period defined by state law, which often aligns with the duration of the judgment. If you are navigating this process, tools like the Hawaii Declaration of Judgment Creditor For Garnishment of Wages can provide clarity on the legal timeframe involved.

Wages can typically be garnished for up to 20 years after a judgment is issued in Hawaii. This duration allows creditors ample time to collect what they are owed. It's important to remember that the clock starts ticking from the date of the judgment. Always consult the Hawaii Declaration of Judgment Creditor For Garnishment of Wages for specific legal guidelines.

Yes, creditors can garnish your wages without notifying you if they have already secured a default judgment in court. This often catches individuals off guard, emphasizing the importance of maintaining awareness of any legal actions against you. Learning about the Hawaii Declaration of Judgment Creditor For Garnishment of Wages can help you navigate such scenarios effectively.