The Hawaii Declaration of Judgment Creditors For Garnishment of Wages is a legal document used by a judgment creditor, or creditor, to collect on a judgment of debt owed by a debtor. The document is used to initiate a wage garnishment, which is an order from a court requiring an employer to withhold a portion of an employee’s wages and pay it directly to the creditor. The garnishment will remain in effect until the full amount of the judgment is paid. The Hawaii Declaration of Judgment Creditors For Garnishment of Wages includes information about the creditor, the debtor, the court order for the wage garnishment, and the employer’s responsibilities in remitting the garnished wages. The document must be signed and notarized in order to be valid. There are two types of Hawaii Declaration of Judgment Creditors For Garnishment of Wages: a Continuing Garnishment and a Non-Continuing Garnishment. A Continuing Garnishment remains in effect until the entire amount of the judgment is paid, while a Non-Continuing Garnishment is only valid for one pay period and must be renewed after the pay period ends.

Hawaii Declaration of Judgment Creditors For Garnishment of Wages

Description

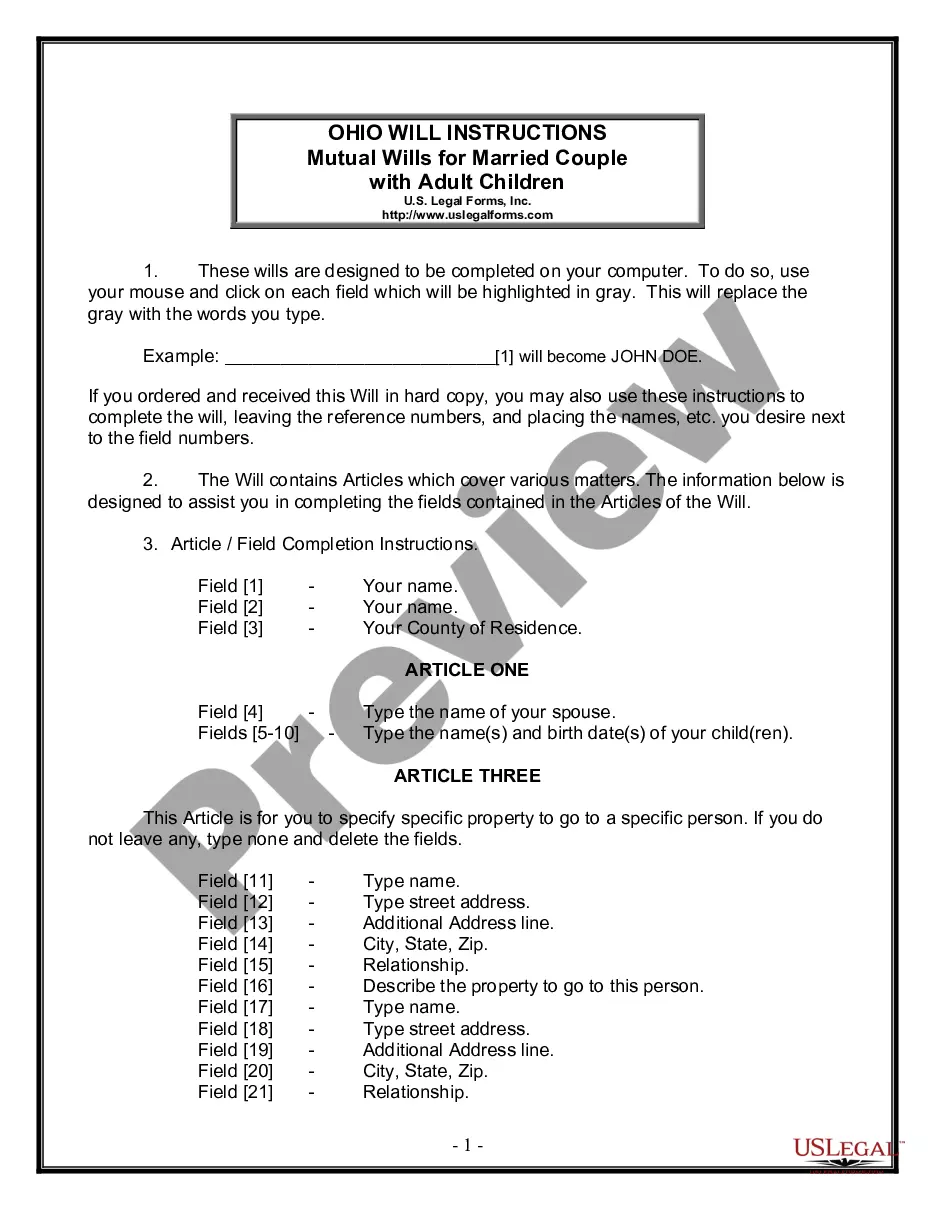

How to fill out Hawaii Declaration Of Judgment Creditors For Garnishment Of Wages?

US Legal Forms is the simplest and most lucrative method to find suitable formal templates.

It boasts the largest online collection of business and personal legal documents created and validated by legal experts.

Here, you can discover printable and fillable templates that adhere to federal and local laws - just like your Hawaii Declaration of Judgment Creditors For Garnishment of Wages.

Once you save a template, you can access it again anytime - just locate it in your profile, re-download it for printing and manual completion, or upload it to an online editor to fill it out and sign more efficiently.

Take advantage of US Legal Forms, your reliable aide in securing the necessary official documentation. Give it a shot!

- Exhibiting the form description or previewing the document ensures you locate the one that meets your needs, or find another using the search tab above.

- Press Buy now when you are confident about its suitability with all the criteria, and evaluate the subscription plan that appeals to you the most.

- Create an account with our service, Log In, and acquire your subscription through PayPal or your credit card.

- Choose your desired file format for the Hawaii Declaration of Judgment Creditors For Garnishment of Wages and store it on your device using the appropriate button.

Form popularity

FAQ

A garnishment affidavit is a legal document filed by a creditor to initiate the garnishment process. It provides evidence of the debt and supports the Hawaii Declaration of Judgment Creditors For Garnishment of Wages. This affidavit outlines the amount owed and the necessary details about the debtor. If you're unsure about creating or submitting a garnishment affidavit, USLegalForms offers templates and tools to assist you every step of the way.

To verify a garnishment, you should start by checking the court documents you received. These documents usually contain information about the Hawaii Declaration of Judgment Creditors For Garnishment of Wages. You can also contact your employer's payroll department to confirm any deductions from your wages. Additionally, it's wise to consult legal resources or use platforms like USLegalForms for guidance on verifying garnishment procedures in Hawaii.

In Hawaii, the law sets the maximum amount that creditors can garnish from your wages. Generally, they can take up to 25% of your disposable income, but this limit can differ based on various factors, including the type of debt. By understanding the Hawaii Declaration of Judgment Creditors For Garnishment of Wages, you can better protect your earnings. For those uncertain about how these laws apply to their situation, UsLegalForms provides comprehensive support and resources to navigate these complexities.

Filling out a challenge to a garnishment form requires careful attention to detail. You'll need to provide specific information regarding the notice you received, including the creditor's details and the amount being garnished. The Hawaii Declaration of Judgment Creditors For Garnishment of Wages offers guidelines for completing this form accurately. To assist you in this essential process, consider utilizing resources available on UsLegalForms, where you can find helpful templates and instructions.

In Hawaii, the amount that can be garnished from your paycheck is limited by law. Typically, a creditor can garnish up to 25% of your disposable earnings per week, but this may vary based on specific circumstances. It's essential to refer to the Hawaii Declaration of Judgment Creditors For Garnishment of Wages to understand your rights better. For those who want to ensure compliance with these regulations, using the UsLegalForms platform can simplify the process.

The process of obtaining a writ of garnishment generally starts with a creditor filing a motion in court. Following the court's approval, a writ is issued to your employer, instructing them to withhold a portion of your wages. It’s crucial to understand your rights under the Hawaii Declaration of Judgment Creditors For Garnishment of Wages during this process to ensure proper handling of your case.

Yes, it is possible for a creditor to initiate wage garnishment without your prior knowledge. Typically, the garnishment process begins after a court judgment has been made, which may occur without your presence at the hearing. To protect yourself, it is essential to stay informed about debts and possible legal actions that could result in garnishment, as outlined in the Hawaii Declaration of Judgment Creditors For Garnishment of Wages.

To file an appeal for a garnishment, you'll need to submit a formal notice of appeal to the court that issued the garnishment order. Make sure to include your reasons for the appeal, such as misapplication of the Hawaii Declaration of Judgment Creditors For Garnishment of Wages. It’s advisable to consult legal resources or professionals to navigate this process effectively.

While this FAQ focuses on Hawaii, it's important to note that garnishment rules vary by state. In Minnesota, for instance, garnishment is subject to different limits and exemptions than those outlined in the Hawaii Declaration of Judgment Creditors For Garnishment of Wages. Always check the specific laws applicable in your state for accurate guidance.

Yes, a writ of garnishment must be signed by a judge to be valid. This judicial approval ensures that the garnishment complies with legal standards set forth in the Hawaii Declaration of Judgment Creditors For Garnishment of Wages. Without the judge's signature, creditors cannot legally garnish your wages, providing you a level of protection against unlawful garnishment.