Hawaii Declaration of Judgment Creditors For Garnishment of Wages

Description

How to fill out Hawaii Declaration Of Judgment Creditors For Garnishment Of Wages?

How much time and resources do you usually allocate for creating formal documents.

There’s a superior method to obtain such forms than employing legal professionals or investing hours browsing the internet for an appropriate template.

Another benefit of our service is that you can obtain previously purchased documents securely saved in your profile in the My documents tab. Access them at any time and re-complete your documents as often as necessary.

Streamline the preparation of official paperwork with US Legal Forms, one of the most reliable online services. Sign up with us today!

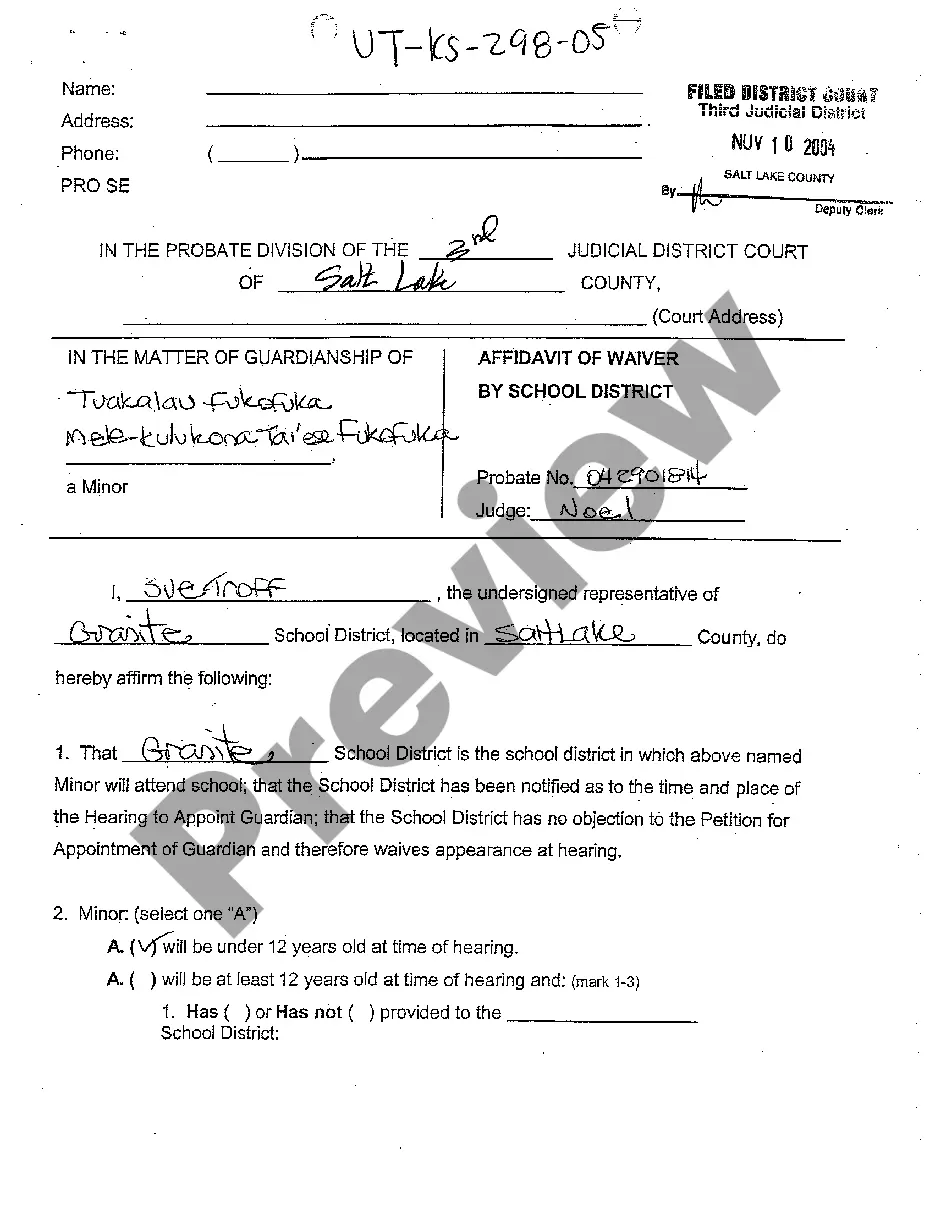

- Examine the document content to ensure it meets your state requirements. You can achieve this by reading the document description or using the Preview option.

- If your legal template does not fulfill your requirements, search for another one using the search tab at the top of the page.

- If you already possess an account with us, Log In and download the Hawaii Declaration of Judgment Creditors For Garnishment of Wages. Otherwise, proceed to the following steps.

- Click Buy now once you identify the correct document. Choose the subscription plan that best suits your needs to access the complete range of our library’s services.

- Create an account and make payment for your subscription. You can process your transaction using your credit card or via PayPal - our service is completely secure for that.

- Download your Hawaii Declaration of Judgment Creditors For Garnishment of Wages to your device and complete it on a printed hard copy or digitally.

Form popularity

FAQ

Yes, a garnishment can be reversed under certain conditions. Individuals may seek to challenge a Hawaii Declaration of Judgment Creditors For Garnishment of Wages by submitting a motion to the court, particularly if they believe the garnishment is unjust. Seeking legal advice can help in preparing an effective case to potentially reverse the garnishment and reclaim those withheld wages.

Garnishments do not stop automatically when a debtor believes they have fulfilled their obligations. The Hawaii Declaration of Judgment Creditors For Garnishment of Wages remains in effect until the creditor receives proper notification to discontinue the process. It's essential to communicate directly with the court and the creditor to ensure that all requirements are met before assuming that a garnishment has ended.

While it is possible for a garnishment to occur without your awareness, this usually involves specific legal steps. The Hawaii Declaration of Judgment Creditors For Garnishment of Wages aims to ensure that you are informed about any actions taken against your earnings. Staying updated on your financial obligations is vital to prevent unexpected situations. Consulting with an attorney can provide further clarity.

Typically, creditors can garnish a portion of your disposable earnings up to 25%, depending on state laws. In Hawaii, the rules under the Hawaii Declaration of Judgment Creditors For Garnishment of Wages dictate these limits. Understanding these regulations can help you plan your finances accordingly. If you face garnishment, consider reaching out to legal services for guidance.

Yes, in specific cases, garnishment can occur without prior notice, especially if the creditor requests it and the court allows it. However, this is not the norm. The Hawaii Declaration of Judgment Creditors For Garnishment of Wages emphasizes the need for transparency in the process. Familiarizing yourself with these rules can help ensure your rights are protected.

Generally, creditors must notify debtors before garnishing wages. The Hawaii Declaration of Judgment Creditors For Garnishment of Wages requires that individuals receive due notice. In some situations, immediate actions may occur without prior notice, but these cases are rare. Always be aware of your rights regarding garnishment notifications.

A garnishment can be deemed invalid due to improper documentation or lack of a judge's approval. Commonly, errors in the Hawaii Declaration of Judgment Creditors For Garnishment of Wages can lead to complications. Additionally, if the debtor has not been properly notified, the garnishment may not hold up in court. Reviewing your case details with a professional can help clarify any concerns.

Wages can typically be garnished immediately after a default judgment is made. However, it's essential to follow specific procedures outlined in the Hawaii Declaration of Judgment Creditors For Garnishment of Wages. Understanding these timelines can help ensure that you comply with legal expectations. Consult with a legal expert to navigate this process efficiently.

Yes, a writ of garnishment must be signed by a judge to be valid. This ensures the legal process is followed correctly. The Hawaii Declaration of Judgment Creditors For Garnishment of Wages outlines the necessary steps to obtain this writ. Always seek legal assistance to understand the requirements fully.

To file an appeal for a garnishment, prepare a notice of appeal that states your intention to contest the garnishment. Include necessary information such as case numbers and reasons for the appeal. Submitting your appeal on time is crucial, so check deadlines carefully. Utilizing the guidelines from the Hawaii Declaration of Judgment Creditors For Garnishment of Wages will strengthen your case, and visiting uslegalforms can provide you with the necessary forms and instructions.