COBRA Notice Timing Delivery Chart

Overview of this form

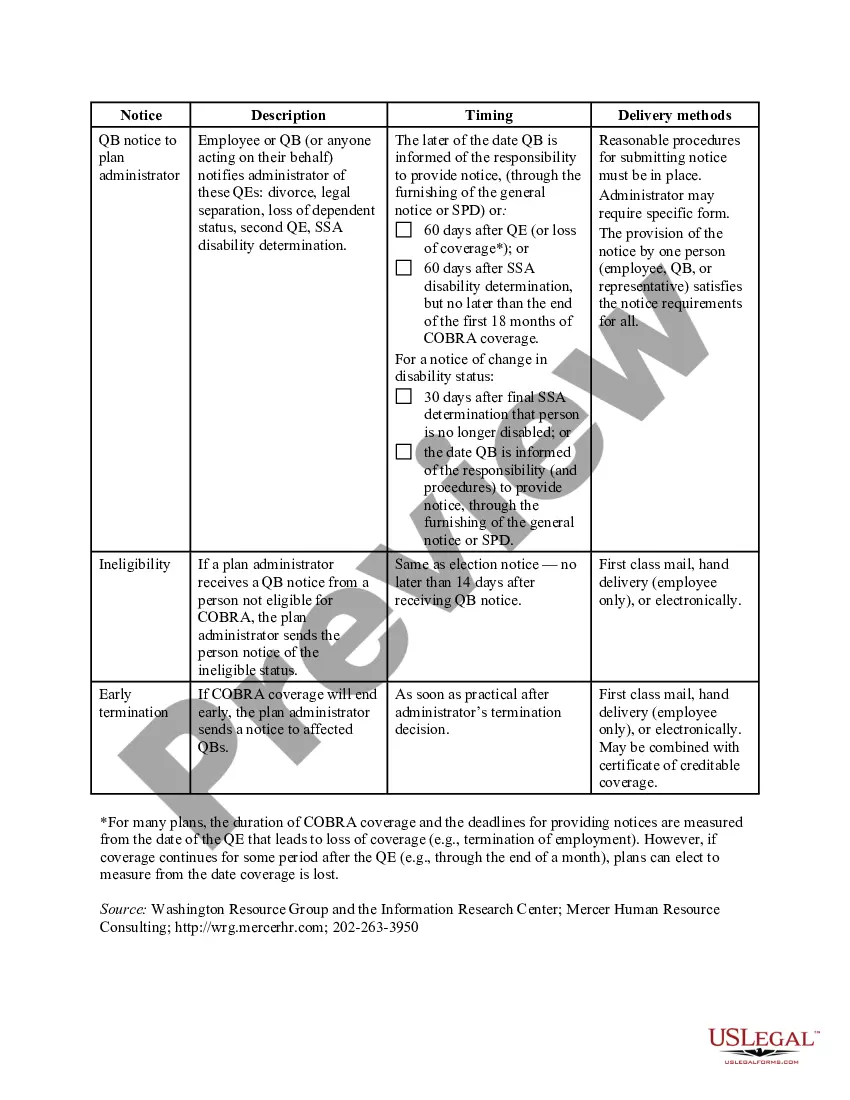

The COBRA Notice Timing Delivery Chart is a vital resource that outlines the timing requirements and delivery methods for providing notices under the Consolidated Omnibus Budget Reconciliation Act (COBRA). This form helps employers and plan administrators ensure compliance with federal regulations in notifying eligible participants about their rights regarding continued healthcare coverage. Unlike general notification forms, this chart specifically focuses on timing and delivery protocols required by law.

Key parts of this document

- Notice Description: Details the type of notice required such as general notices, election notices, and notifications of ineligibility.

- Timing: Specifies the deadlines for delivering notices after qualifying events (QEs).

- Delivery Methods: Outlines acceptable methods for sending notices, including mailing and electronic options.

- Plan Administrator Responsibilities: Clarifies the obligations of the plan administrator regarding notifications.

- Qualified Beneficiaries (QBs): Identifies who the notices should be sent to, ensuring all eligible individuals receive required information.

Common use cases

This form should be used by employers and plan administrators when there are qualifying events such as employee termination, reduction of work hours, or other situations that could lead to loss of health insurance coverage. It serves as a checklist to ensure that notifications are sent promptly and in compliance with legal requirements, helping to uphold the rights of individuals entitled to COBRA coverage.

Who can use this document

- Employers who offer group health plans and are responsible for adhering to COBRA regulations.

- Plan administrators tasked with managing health benefits and notifying employees about their COBRA rights.

- Human resources professionals ensuring compliance with federal regulations regarding health insurance notifications.

Steps to complete this form

- Determine the type of notice required based on the qualifying event.

- Review the timing section to ensure notifications are sent within the specified deadlines.

- Identify the delivery method that best meets the needs of the recipients.

- Document the delivery method and timing for record-keeping and compliance purposes.

- Ensure that all qualified beneficiaries are notified as per their individual circumstances.

Notarization requirements for this form

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to send notices within the specified time frames.

- Sending the same notice to all parties without proper identification of qualified beneficiaries.

- Using incorrect or outdated delivery methods that do not comply with legal requirements.

Benefits of completing this form online

- Convenient access to the form for quick completion and secure storage.

- Editability allows for customization to meet specific needs and ensure accuracy.

- Reliability through guidance provided by legal experts at US Legal Forms.

Legal use & context

- This form is designed to ensure compliance with COBRA regulations, helping employers avoid penalties.

- Proper use of this chart can assist in safeguarding the rights of individuals seeking continued health coverage under COBRA.

- Guidelines established within this form should be adhered to strictly to ensure legal enforceability.

What to keep in mind

- The COBRA Notice Timing Delivery Chart is essential for compliance with federal laws.

- Understanding the key components can help prevent costly mistakes.

- Employers and plan administrators are responsible for timely and accurate notifications to qualified beneficiaries.

Looking for another form?

Form popularity

FAQ

Your employer must mail you the COBRA information and forms within 14 days after receiving notification of the qualifying event. You are responsible for making sure your COBRA coverage goes into and stays in effect - if you do not ask for COBRA coverage before the deadline, you may lose your right to COBRA coverage.

An employer that is subject to COBRA requirements is required to notify its group health plan administrator within 30 days after an employee's employment is terminated, or employment hours are reduced.

Notices properly mailed are generally considered provided on the date sent, regardless of whether they're actually received. 1. COBRA Initial Notice must be provided. Within 30 days after the employee first becomes enrolled in the group health plan.

Employers should send notices by first-class mail, obtain a certificate of mailing from the post office, and keep a log of letters sent. Certified mailing should be avoided, as a returned receipt with no delivery acceptance signature proves the participant did not receive the required notice.

COBRA Coverage Timeline An employee who's eligible for Consolidated Omnibus Budget Reconciliation Act (COBRA) coverage must elect it within 60 days of their insurance termination date, or the date that the employee recieved their COBRA notification, whichever is later.

The insurance company. COBRA Election Notice. After receiving a notice of a qualifying event, the plan must provide the qualified beneficiaries with an election notice within 14 days. The election notice describes their rights to continuation coverage and how to make an election.

The employer must notify the plan within 30 days of the event. You (the covered employee or one of the qualified beneficiaries) must notify the plan if the qualifying event is divorce, legal separation, or a child's loss of dependent status under the plan.