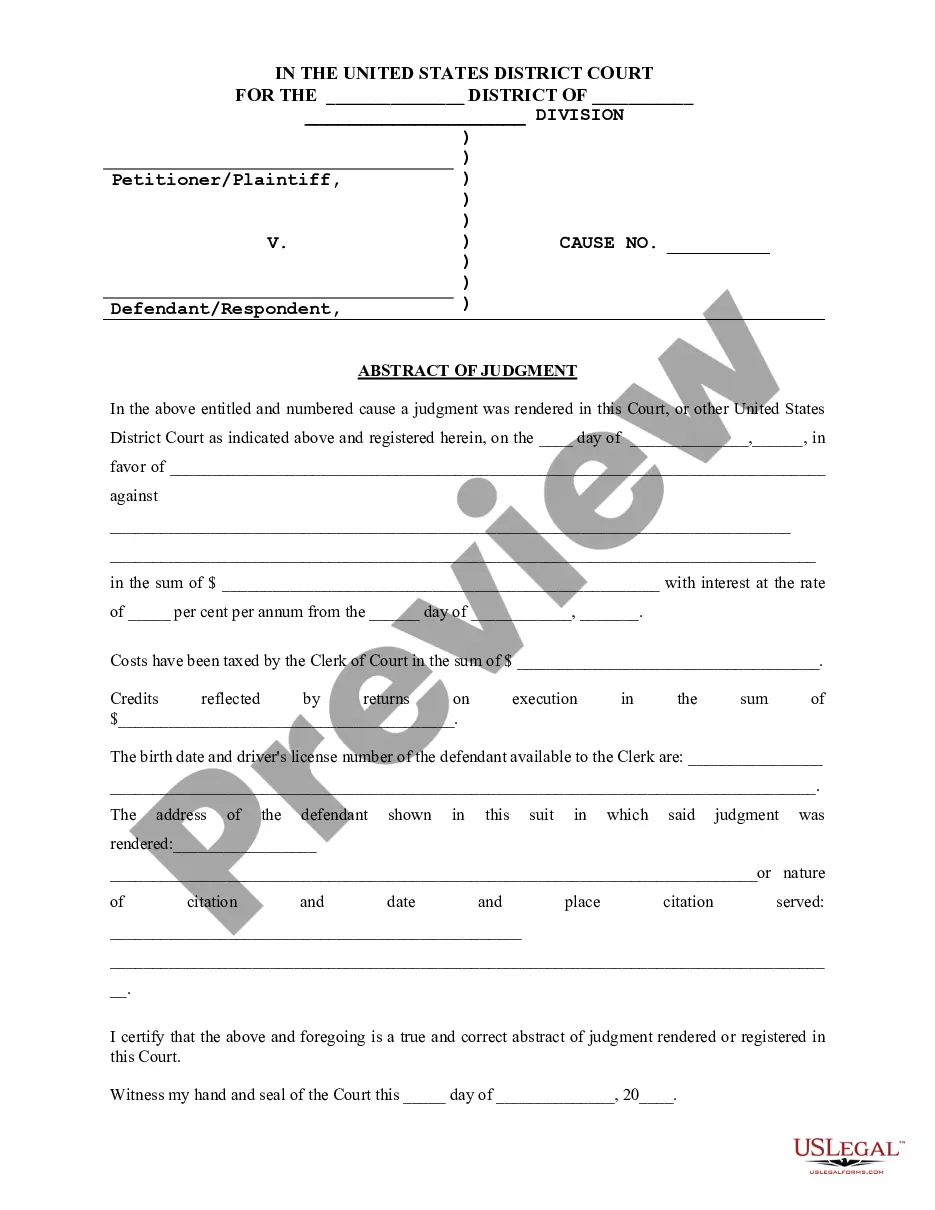

A Hawaii Garnishee Order is a court order issued in Hawaii that requires an employer to withhold a portion of an employee's wages for the payment of a debt. It is similar to a wage garnishment, but is specific to Hawaii. There are two types of Hawaii Garnishee Orders: Prejudgment and Postjudgment. A Prejudgment Order is issued prior to a judgment being entered in court against an employee, and requires the employer to withhold a portion of the employee's wages and turn the money over to the court in order to secure a judgment against the employee. A Postjudgment Order (also called a Writ of Execution) is issued after a judgment has been entered and requires the employer to withhold a portion of the employee's wages and turn the money over to the creditor in order to satisfy the judgment.

Hawaii Garnishee Order

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

Garnishee Order: A legal procedure used to enforce a debt payment by directing a third party who owes money to the debtor to pay that money directly to the creditor. This order is often used for debts like child support, unpaid loans, or other financial obligations in the United States. The third party, often an employer or bank, is known as the 'garnishee.'

Step-by-Step Guide to Handling a Garnishee Order

- Receive Notification: The first step for a garnishee (employer or bank) is to receive a court order that an employee's or debtor's wages need to be garnished.

- Review the Order: Carefully read the garnishee order to understand the amount to be deducted and other relevant details.

- Notify the Employee: The employer must inform the employee about the garnishee order and the amount that will be withheld from their earnings.

- Begin Withholding: Start deducting the specified amount from the employee's wages as directed by the order.

- Remit Payment: Send the withheld amount to the court or creditor as stipulated in the order.

- Maintain Records: Keep detailed records of the amounts withheld and remitted, along with dates and other relevant documentation.

Risk Analysis

Managing a garnishee order has several risks including legal penalties for non-compliance, administrative burden, potential negative impacts on employee relations, and possible errors in withholding amounts. Non-compliance can lead to fines or additional court actions, emphasizing the importance of accurate and timely processing of garnishee orders.

Best Practices

- Understand the Legal Requirements: Ensure compliance by fully understanding federal and state laws regarding garnishment.

- Act Promptly: Process the garnishee order quickly to avoid penalties.

- Accurate Record-Keeping: Maintain clear records of all transactions and communications regarding the garnishment.

- Effective Communication: Communicate transparently with the affected employee to help manage the situation sensitively.

Common Mistakes & How to Avoid Them

- Ignoring Garnishee Orders: Delaying or ignoring garnishee orders can escalate the situation, leading to penalties. Ensuring timely response is crucial.

- Incorrect Calculations: Miscalculating the garnishment amount can lead to under or over-withholding. Double-check calculations and consult legal advice if unsure.

- Poor Communication: Failing to properly notify the employee can lead to disgruntlement and legal issues. Maintain open lines of communication.

FAQ

- Who is a garnishee? - A garnishee is a third-party, such as an employer or bank, holding assets or wages of a debtor, from which debts are paid directly to a creditor.

- What types of debts can be subjected to garnishee orders? - Common debts include child support, tax debts, student loans, and outstanding credit card payments.

- Are there any exemptions to garnishment? - Certain types of income, like Social Security benefits and disability payments, are typically exempt from garnishment.

How to fill out Hawaii Garnishee Order?

Creating legal documents can be quite a hassle if you lack ready-to-use fillable forms. With the US Legal Forms online collection of formal documentation, you can trust the blanks you acquire, as they all comply with federal and state regulations and are validated by our professionals.

Obtaining your Hawaii Garnishee Order from our library is as simple as 1-2-3. Previously registered users with an active subscription just need to sign in and click the Download button after finding the correct template. If necessary, users can also access the same blank from the My documents section of their account.

Haven't you explored US Legal Forms yet? Sign up for our service today to acquire any formal document quickly and effortlessly whenever you need it, and keep your paperwork organized!

- Document conformity verification. You should carefully review the text of the form you desire and ensure that it meets your requirements and complies with your state laws. Reviewing your document and checking its general description will assist you in this process.

- Alternative search (optional). If there are any discrepancies, search the library using the Search tab at the top of the page until you locate a suitable template, and click Buy Now once you find the one you require.

- Account setup and form acquisition. Register for an account with US Legal Forms. After account verification, Log In and choose your desired subscription plan. Make a payment to continue (options include PayPal and credit cards).

- Template download and subsequent use. Choose the file format for your Hawaii Garnishee Order and click Download to save it on your device. Print it to fill out your documents physically, or utilize a multi-featured online editor to create an electronic copy more swiftly and efficiently.

Form popularity

FAQ

Writing an objection letter for wage garnishment involves clearly stating your objection and the reasons behind it. Begin with your personal information and relevant case details, then explain why you believe the garnishment is unjust or incorrect. It's beneficial to reference specific laws or regulations concerning the Hawaii Garnishee Order, and platforms like US Legal Forms can assist you in drafting a formal objection.

To win a garnishment case, gather all evidence that supports your claim. This might include financial records, payment histories, or documents that show the debt is invalid. Additionally, understanding the details of your Hawaii Garnishee Order and exploring your rights can greatly increase your chances of success.

Filling out a challenge to a garnishment form requires accurate information about your case. Start by clearly stating the reasons you believe the garnishment is inappropriate. Include relevant details such as your financial situation or any disputes regarding the underlying debt. Platforms like US Legal Forms can provide you with guidance and templates to streamline this process.

In Hawaii, garnishment laws are structured to protect both creditors and debtors. The law limits the percentage of income that can be garnished to ensure you retain enough funds for living expenses. Familiarizing yourself with these laws can help you navigate a Hawaii Garnishee Order effectively, ensuring your rights are upheld.

The formula for garnishment typically depends on your disposable income. This amount is calculated by taking your total earnings and subtracting mandatory deductions such as taxes and social security. Knowing the formula helps you understand the potential impact of a Hawaii Garnishee Order on your income.

Writing a hardship letter for wage garnishment involves clearly stating your financial difficulties. Begin by explaining your current situation, including your income, expenses, and any unexpected financial burdens. Include specific details about how the Hawaii Garnishee Order affects your ability to meet basic needs, emphasizing your commitment to resolving the debt.

Yes, you can negotiate after a garnishment. It is often possible to work out new payment terms or settle the debt directly with the creditor, even if a Hawaii Garnishee Order is in place. By proactively discussing your situation, you may find options that allow you to manage your finances better. UsLegalForms can assist you in drafting the necessary paperwork to support your negotiations effectively.

You cannot ignore a garnishee order without facing potential legal consequences. Failure to comply may result in additional fines or judgments against you, worsening your financial situation. It’s important to take garnishee orders seriously and to understand your rights. Consulting with uslegalforms can provide vital guidance on addressing a Hawaii Garnishee Order.

Ignoring a garnishment can lead to severe consequences, including additional legal action and further financial repercussions. Creditors may obtain a judgment against you, increasing your debt and potentially leading to more aggressive collection efforts. It is essential to address garnishments swiftly and appropriately. Utilizing resources from uslegalforms can help you manage your response to a Hawaii Garnishee Order effectively.

A garnishee order is a legal document that instructs a third party to withhold funds from a debtor’s wages or bank account to satisfy a debt. This order directs the garnishee, such as an employer or bank, to send a portion of the debtor’s funds to the creditor. Understanding this order is vital for anyone facing debt repayment issues. The Hawaii Garnishee Order specifically outlines how this process works within the state.