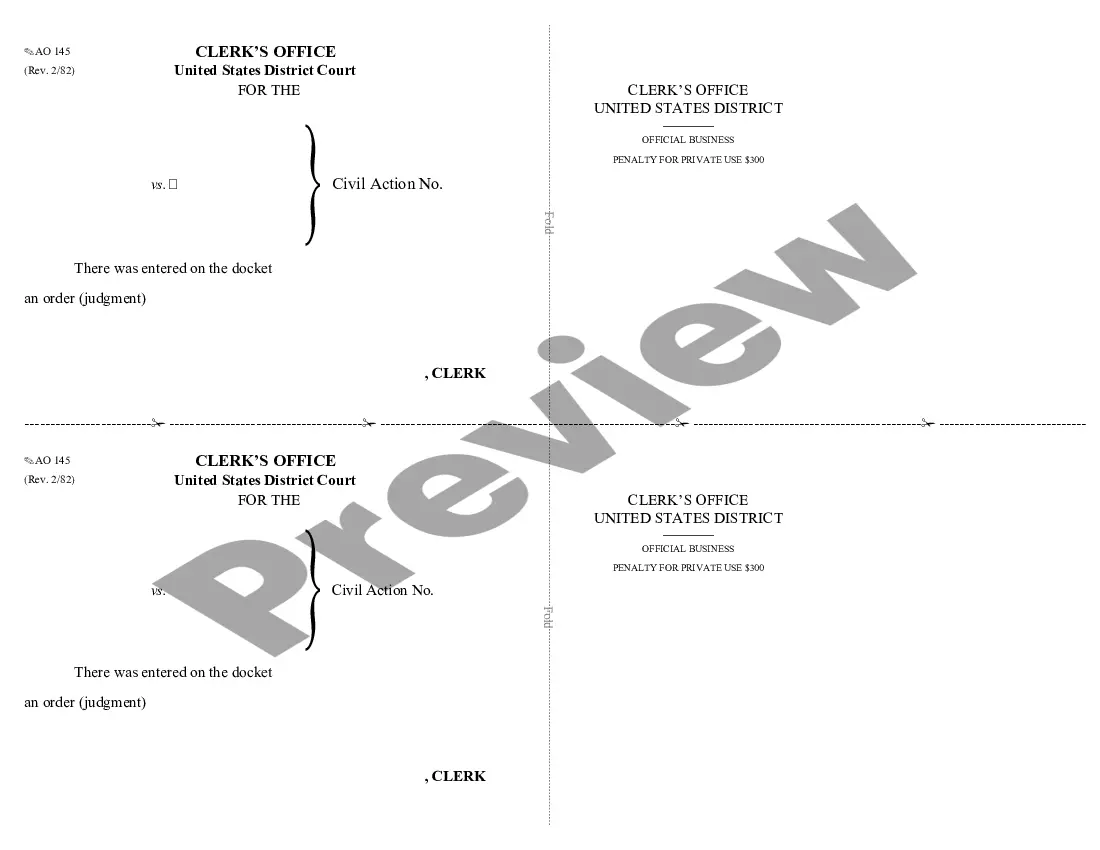

A Hawaii Garnishee Order is an order issued by the court to an employer or other entity that holds funds on behalf of a debtor. It requires the entity to withhold wages, bank deposits, or other assets of the debtor and to turn those funds over to the court. The court then distributes the funds to the creditor in satisfaction of the debt. There are two types of Hawaii Garnishee Orders: Wage Garnishee Orders, which require an employer to withhold wages from an employee's paycheck, and Bank Garnishee Orders, which require a bank to withhold funds from a debtor's account.

Hawaii Garnishee Order

Description

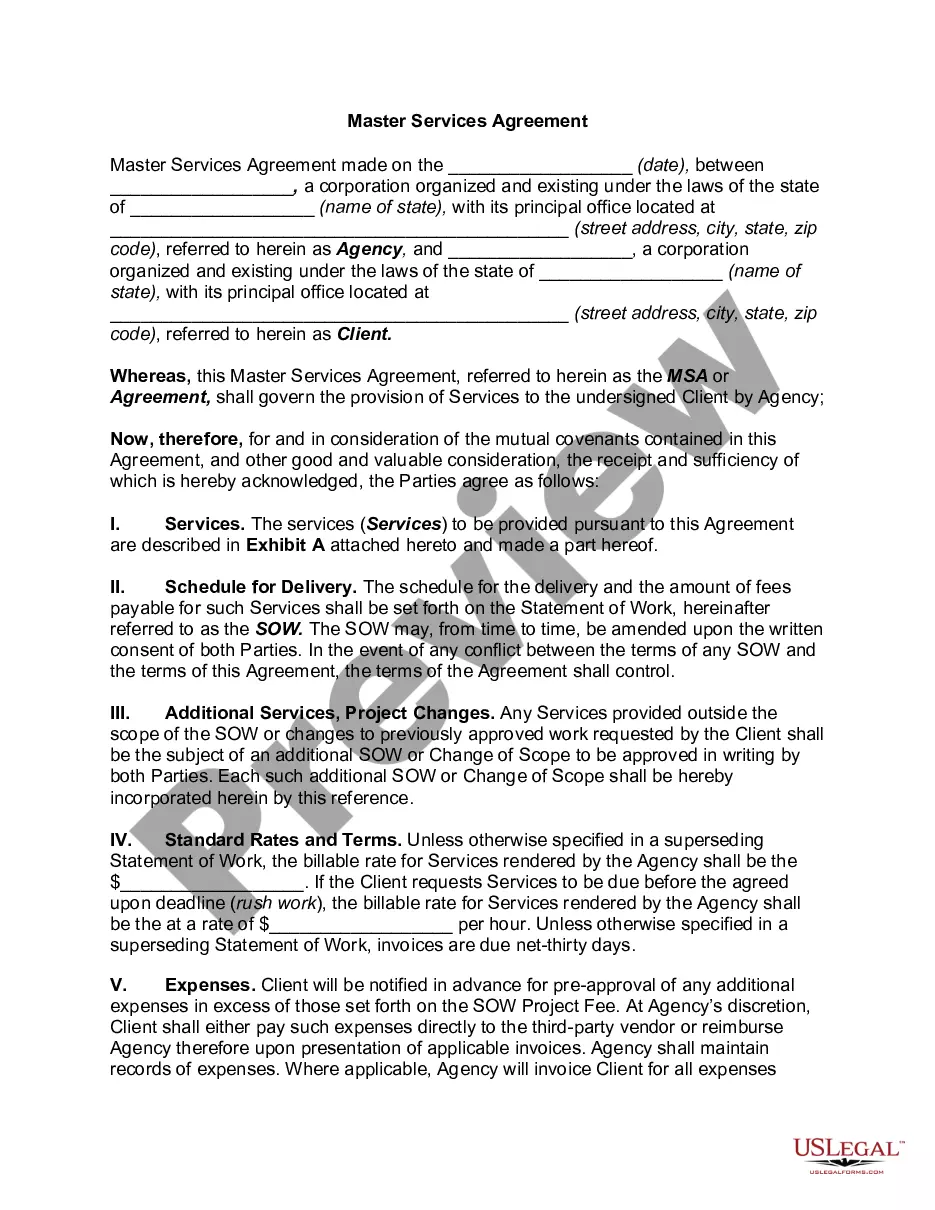

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Hawaii Garnishee Order?

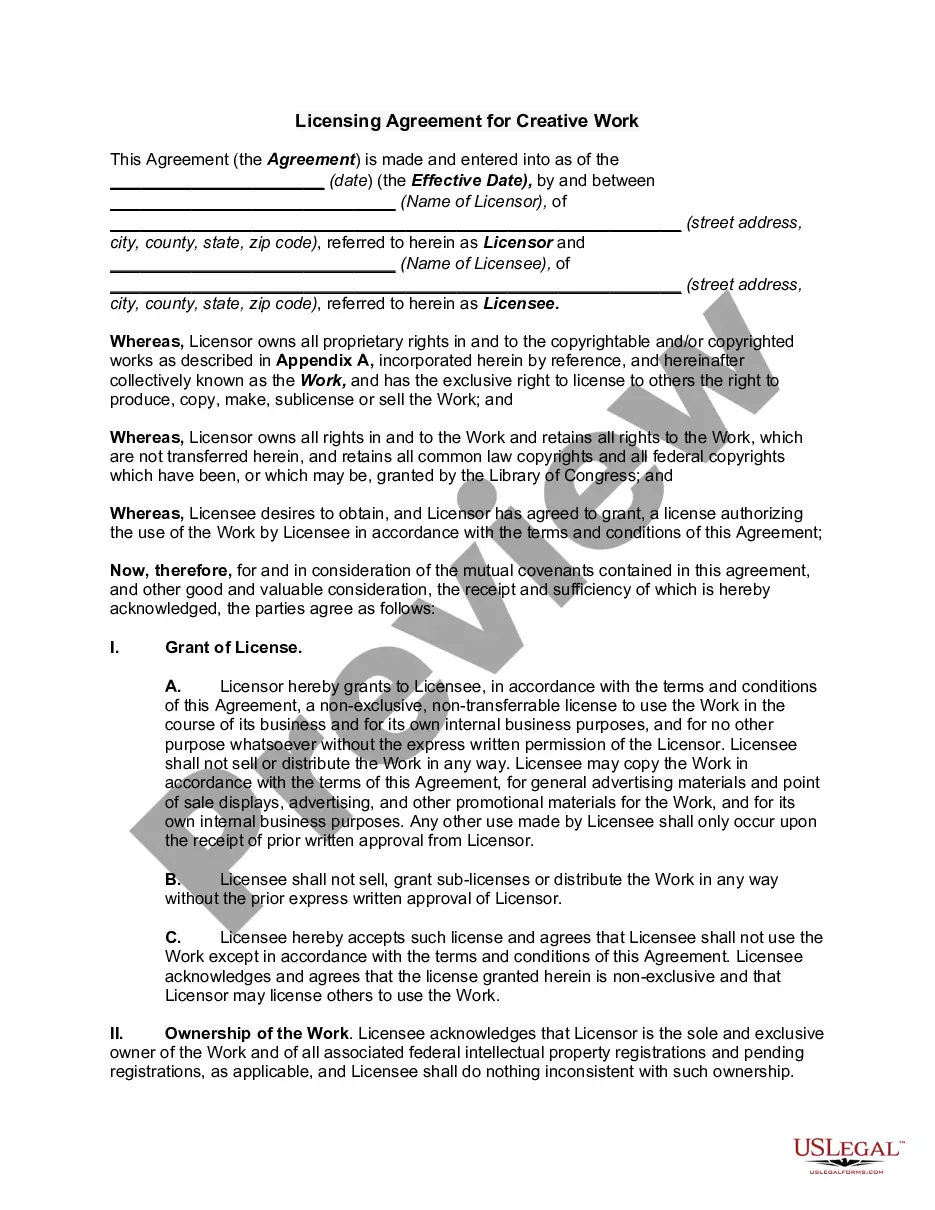

If you’re seeking a method to accurately finalize the Hawaii Garnishee Order without engaging a legal representative, then you’re exactly in the appropriate location.

US Legal Forms has established itself as the most comprehensive and dependable collection of formal templates for every personal and business scenario.

Another significant benefit of US Legal Forms is that you will never misplace the documents you have obtained - you can access any of your downloaded forms in the My documents tab of your profile whenever necessary.

- Verify the document you observe on the page aligns with your legal circumstances and state regulations by reviewing its textual description or browsing through the Preview mode.

- Input the document title in the Search tab located at the top of the page and designate your state from the dropdown menu to discover an alternative template if there are any discrepancies.

- Repeat the content verification process and press Buy now once you are assured of the paperwork's compliance with all stipulations.

- Log in to your account and click Download. If you don’t have an account yet, create one with the service and select the subscription plan.

- Utilize your credit card or the PayPal option to settle the payment for your US Legal Forms subscription. The blank will be available for downloading immediately afterward.

- Select the format in which you wish to receive your Hawaii Garnishee Order and download it by clicking the relevant button.

- Upload your template to an online editor to complete and sign it swiftly, or print it out to prepare your physical copy manually.

Form popularity

FAQ

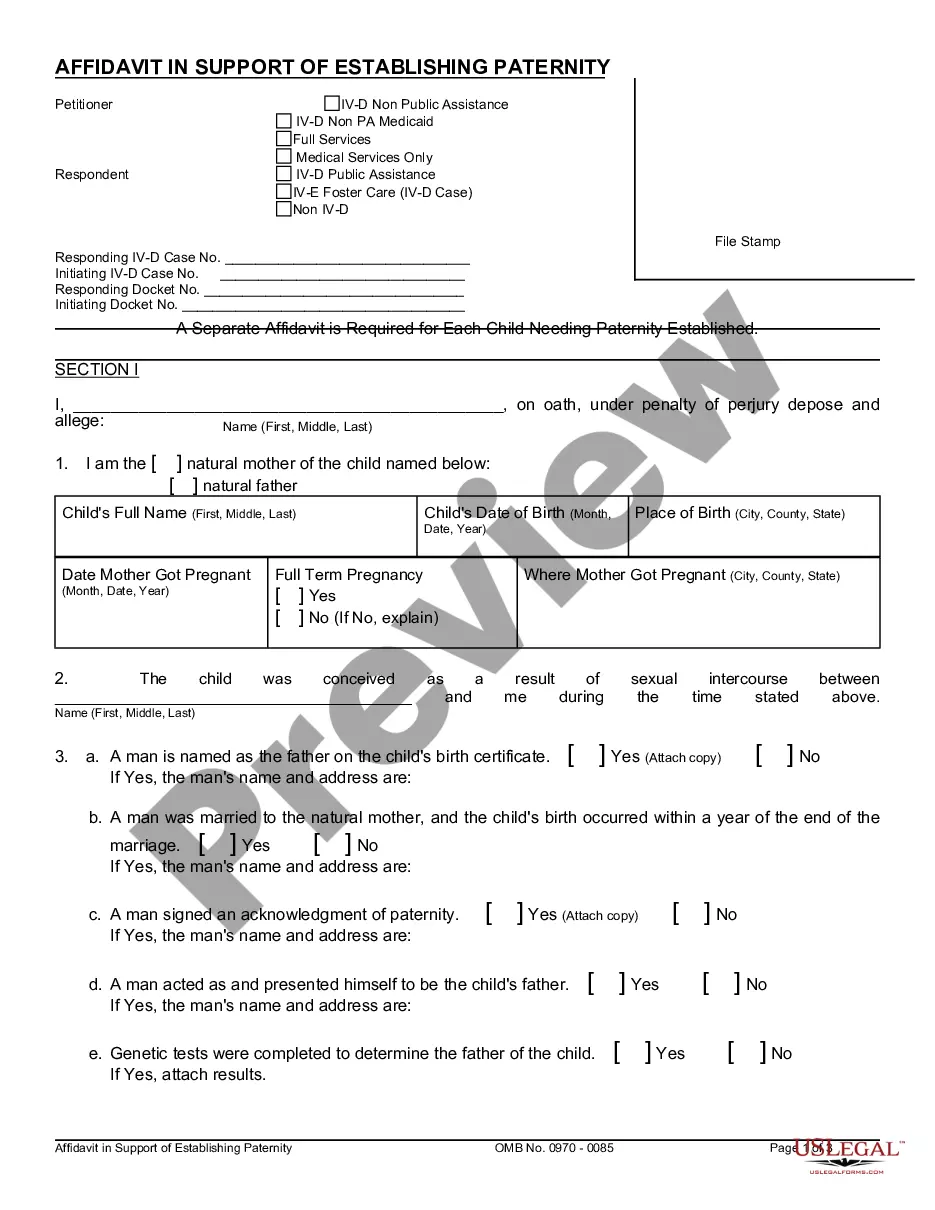

When a garnishment is served, it means the court has officially notified the involved parties about the directive to withhold funds. In the case of a Hawaii Garnishee Order, this notification typically goes to the debtor's employer or bank. Once served, these entities are legally obligated to comply with the order. Being aware of what this process entails can help you react appropriately and seek solutions, like those offered through US Legal Forms, to address the situation.

The term garnishee order refers to a court directive that instructs a third party to withhold paying a debtor and instead transfer those funds to a creditor. In the context of a Hawaii Garnishee Order, the court provides the necessary approval to freeze assets or wages. This order is crucial in debt recovery and protects creditors' rights. Knowing how garnishee orders work can empower you in financial negotiations.

A garnishee order is a legal document that allows a creditor to collect debts directly from a debtor's wages or bank accounts. When a Hawaii Garnishee Order is issued, it provides the creditor the authority to seize funds from the debtor's financial institution. This process helps creditors ensure they get repaid while following legal protocols. Familiarizing yourself with garnishee orders can better prepare you for potential debt-related situations.

Winning a garnishment case often involves demonstrating that the garnishment is unwarranted, invalid, or exceeds legal limits. Gathering evidence and understanding the legal process are essential to your success. Consider using the US Legal Forms platform, which provides the necessary forms and instructions to help you prepare for your case confidently. A proactive approach can significantly influence the outcome of your garnishment challenge.

Hawaii's garnishment laws allow creditors to collect debts through a court-issued garnishee order. These laws specify the limits of wage garnishment and the procedure creditors must follow. It's crucial to understand these laws to protect your rights and finances. For more detailed information and guidance, the US Legal Forms platform offers valuable resources tailored to Hawaii garnishment laws.

Several factors can render a garnishment invalid, such as incorrect court procedures or not following specific state laws. For example, if the creditor fails to notify you about the action, this may affect the validity of the garnishment. You may contest the garnishment by filing a challenge; using the resources on the US Legal Forms platform can help you navigate this complex process effectively.

Yes, a creditor can obtain a garnishee order without your prior knowledge, often through a court process. However, you will be notified once the garnishment is initiated, giving you a chance to respond. It's essential to stay informed about your financial obligations to avoid sudden surprises. If you suspect a garnishment may be happening, consult the US Legal Forms platform to better understand your rights.

To challenge a garnishment, you must complete a specific form detailing your objections. You can find the necessary forms through the US Legal Forms platform, which guides you step-by-step. Be sure to include all relevant details, such as your personal information and the basis for your challenge. Submitting this form correctly is critical to ensure that your rights are protected.

In Hawaii, a garnishee order can take a portion of your disposable earnings. Generally, creditors can garnish up to 25% of your earnings or the amount that exceeds 30 times the federal minimum wage, whichever is lower. Understanding these limits helps protect your income while addressing your debts. For further clarity, consider using the US Legal Forms platform, which provides resources to navigate garnishment-related issues.

In Hawaii, the amount that can be garnished from your paycheck typically depends on your disposable income and the type of debt. The law generally permits creditors to take up to 25% of your disposable earnings or the amount by which your weekly wages exceed 30 times the federal minimum wage, whichever is less. Understanding your rights under the Hawaii Garnishee Order is critical, and US Legal Forms can provide tailored resources for your situation.