Hawaii Garnishee Information is data related to the garnishment process in the state of Hawaii. This includes information such as the identity of the debtor and creditor, the amount of the debt to be collected, and the date of service of the garnishment order. It also includes the identity of the garnishee, the amount of the garnishment, and the date of service of the garnishment. There are two major types of Hawaii Garnishee Information: voluntary garnishment and involuntary garnishment. Voluntary garnishment is when a debtor voluntarily agrees to have their wages garnished to pay a debt. Involuntary garnishment is when a creditor obtains a court order to garnish a portion of a debtor's wages to pay off a debt. Hawaii Garnishee Information is used for a variety of purposes, including debt collection, wage garnishment enforcement, and tax levies.

Hawaii Garnishee Information

Description

Get your form ready online

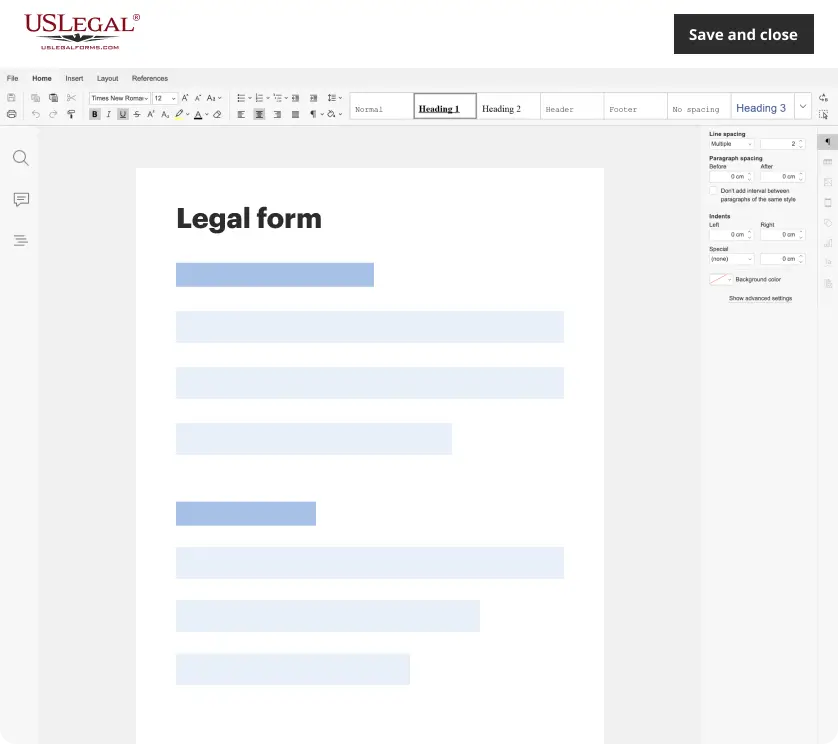

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

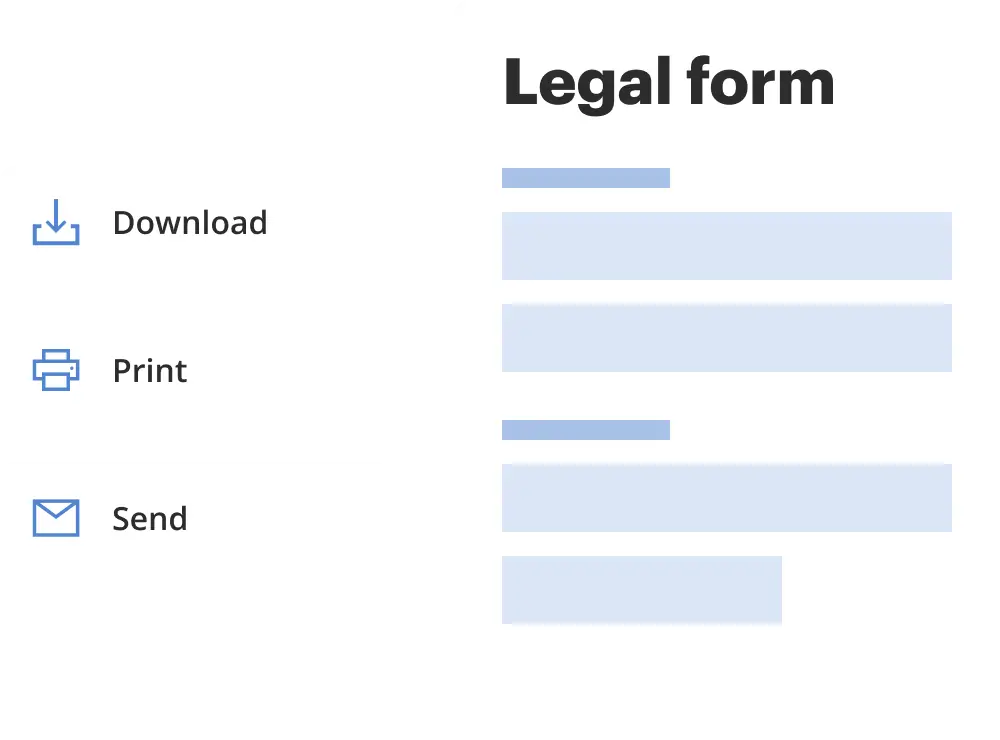

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Hawaii Garnishee Information?

US Legal Forms is the simplest and most economical method to discover suitable official templates.

It’s the most comprehensive online library of corporate and personal legal documents crafted and validated by attorneys.

Here, you can find downloadable and fillable templates that adhere to federal and local laws - just like your Hawaii Garnishee Information.

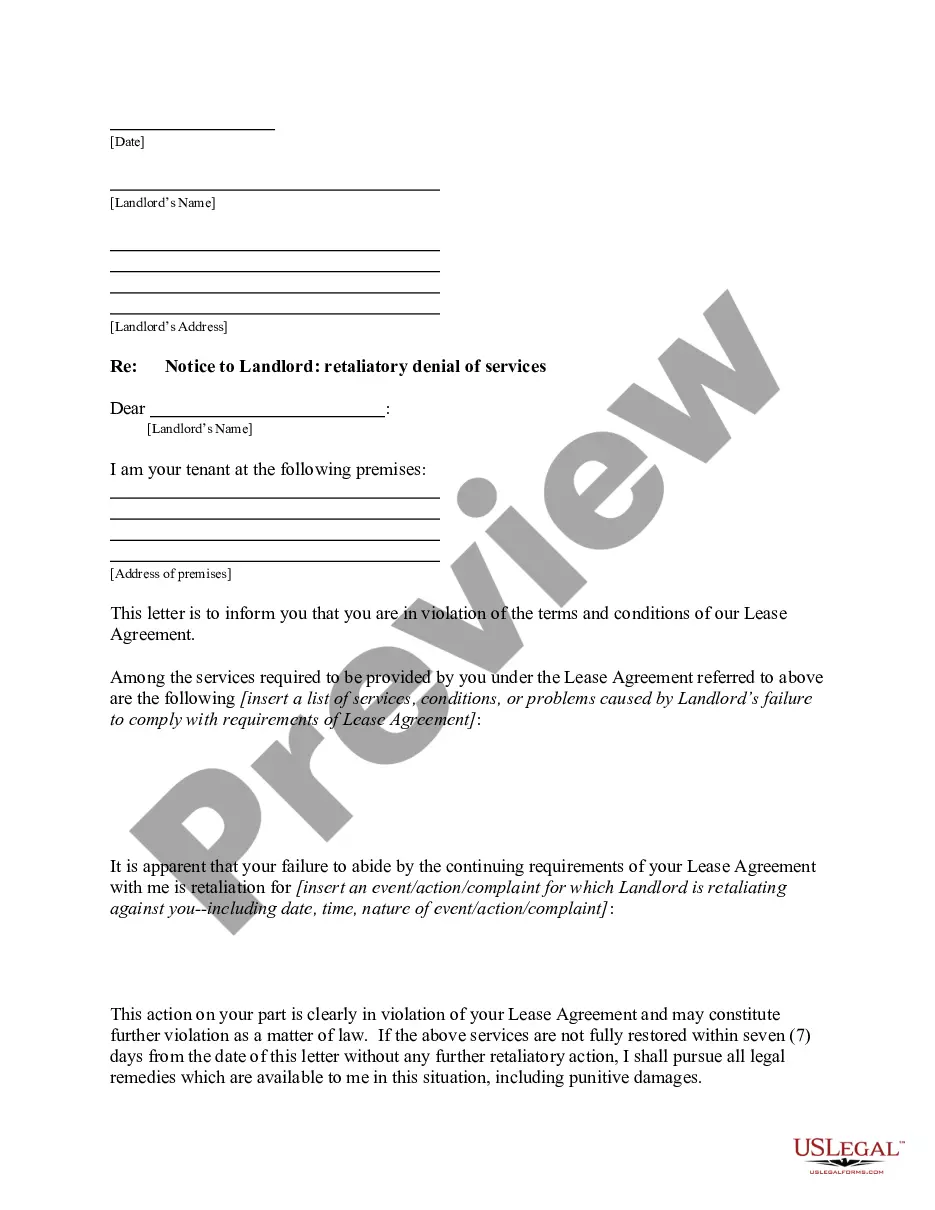

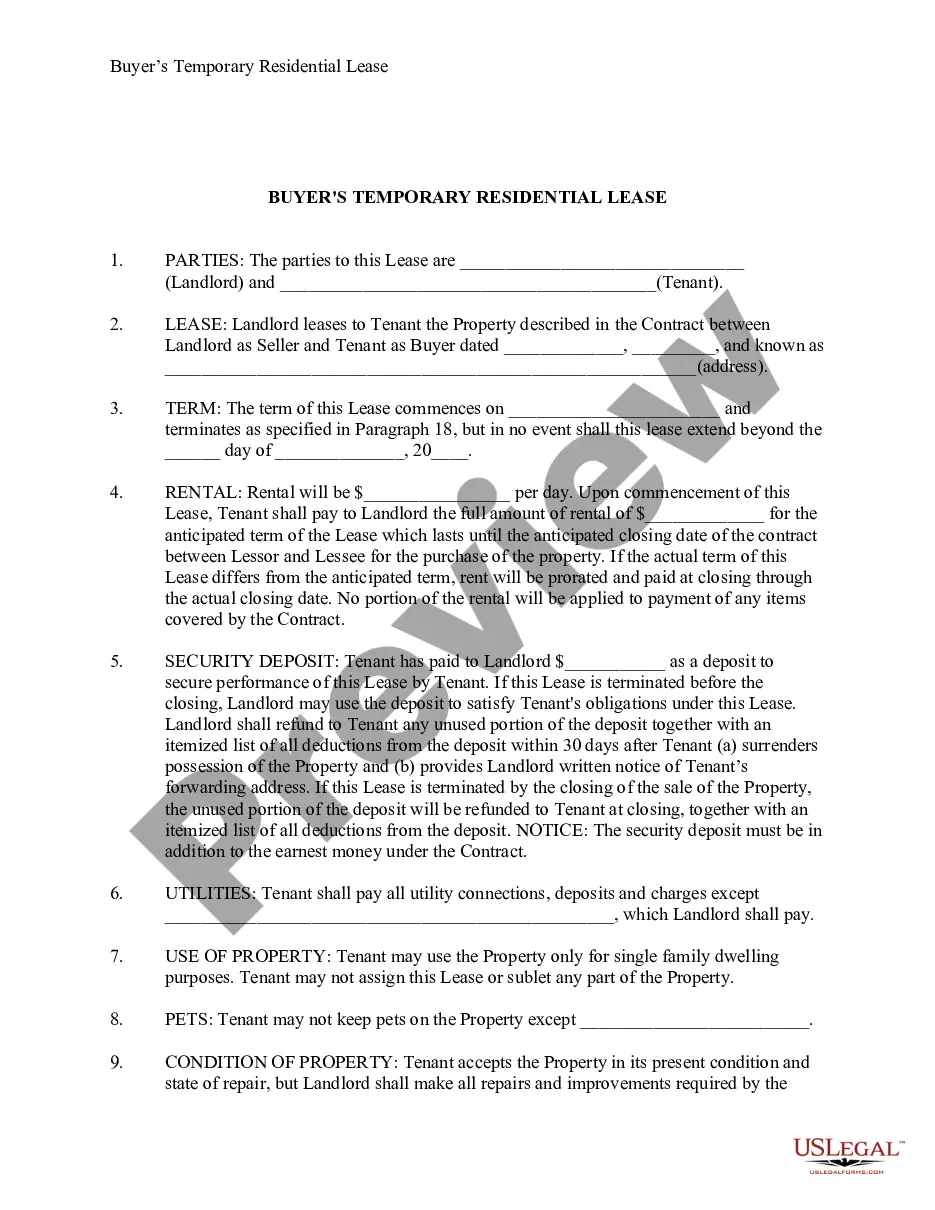

Review the form description or preview the document to ensure you’ve identified the one that fulfills your requirements, or find another one utilizing the search tab above.

Click Buy now when you’re confident about its suitability with all the specifications, and choose your preferred subscription plan.

- Acquiring your template involves only a few straightforward steps.

- Users who already possess an account with an active subscription merely need to Log In to the online service and save the document to their device.

- Subsequently, they can locate it in their profile under the My documents section.

- And here’s the process to obtain a correctly formatted Hawaii Garnishee Information if you’re using US Legal Forms for the first time.

Form popularity

FAQ

Typically, you are not required to appear in court for a garnishment summons unless you intend to contest the order. However, attending the hearing can be beneficial, as it allows you to present your case and negotiate terms. Useful Hawaii garnishee information can help you understand the court procedures and whether your presence is necessary.

You can discover what you are being garnished for by reviewing the garnishment order, which should outline the debt involved. Additionally, contacting your employer or the creditor can provide you with further clarity on the matter. For comprehensive insights, refer to Hawaii garnishee information, which can offer guidance on understanding your garnishment specifics.

Yes, garnishment orders can expire after a certain period, typically specified by state law. This timeframe may vary in Hawaii, so it’s essential to check the specifics associated with your garnishment. You can find relevant Hawaii garnishee information to stay informed about the duration and implications of any garnishment order.

You may be able to negotiate a payment plan with the creditor, or contest the garnishment in court if you believe it is unjust. Exploring options like filing for bankruptcy may also provide relief from garnishments, depending on your situation. Utilizing resources such as Hawaii garnishee information can guide you through the process of addressing wage garnishments effectively.

If you don't respond to a wage garnishment notice, the court may automatically approve the garnishment, allowing your wages to be deducted. This can significantly impact your financial situation without giving you a chance to contest the matter. It's crucial to familiarize yourself with Hawaii garnishee information to know how to respond effectively and protect your interests.

In general, failing to comply with a garnishment does not lead to jail time, as it is not considered a criminal offense. However, consistent non-compliance can result in further legal actions, which may include contempt of court charges. To navigate this situation effectively, you can seek Hawaii garnishee information to help you understand your rights and responsibilities.

Ignoring a garnishment order can lead to serious consequences, including additional legal actions against you. The creditor may seek further court orders to collect the owed amount. It's essential to understand that Hawaii garnishee information outlines your rights and obligations regarding such orders, so it is advisable to address them promptly.

The formula for garnishment typically involves taking your disposable earnings and calculating the maximum percentage that can be withheld. In most cases, this does not exceed 25% of your disposable income. Keep in mind that certain exemptions may apply based on your financial situation. For clarity on these rules, Hawaii Garnishee Information outlines the necessary guidelines to help you understand garnishment calculations.

To figure out what you are being garnished for, review the court documents associated with the garnishment order. These documents should outline the debts you owe and the reasons for garnishment. Additionally, you can seek information from your employer or the creditor involved. Accurate understanding of this situation is vital, and referring to Hawaii Garnishee Information can provide essential guidance.

Garnishment is determined based on court orders and the laws governing debt collection. The creditor usually files for garnishment after you've defaulted on payment obligations. The court verifies the legitimacy of the claim before approving garnishment. Knowing these details can empower you, so explore Hawaii Garnishee Information for further insights.