Hawaii Garnishee Disclosure is a legal document that is used to disclose information about an employee's wages. It is required by law for employers in Hawaii whenever a garnishment order or similar legal action is taken against an employee's wages. The document discloses the amount of wages the employee earns, the amount of wages being garnished, and the date the garnishment order was issued. The disclosure also includes the amount of any deductions being taken from the employee's wages, such as taxes or child support orders. There are two types of Hawaii Garnishee Disclosure: the Voluntary Disclosure and the Court-Ordered Disclosure. The Voluntary Disclosure is a signed statement from the employee that authorizes the employer to comply with the garnishment order or similar legal action. The Court-Ordered Disclosure is a document that is issued by a judge or court that requires the employer to comply with the garnishment order or similar legal action.

Hawaii Garnishee Disclosure

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Hawaii Garnishee Disclosure?

How much duration and resources do you typically allocate for drafting formal documentation.

There’s a more efficient method to obtain such forms than employing legal professionals or expending hours searching the internet for an appropriate template. US Legal Forms is the premier online repository that offers expertly crafted and validated state-specific legal documents for any reason, including the Hawaii Garnishee Disclosure.

Another benefit of our service is that you can retrieve previously downloaded documents that you securely store in your profile under the My documents tab. Retrieve them at any time and re-complete your paperwork whenever necessary.

Conserve time and effort managing legal documents with US Legal Forms, one of the most reliable online solutions. Register with us today!

- Review the form content to ensure it complies with your state laws. To do this, consult the form description or use the Preview option.

- If your legal template doesn’t fulfill your requirements, find another one using the search bar at the top of the page.

- If you are already a member of our service, Log In and download the Hawaii Garnishee Disclosure. Otherwise, move on to the next steps.

- Click Buy now after you locate the correct blank. Choose the subscription plan that best fits your needs to access our library’s complete services.

- Establish an account and remit payment for your subscription. You can complete the transaction with your credit card or via PayPal - our service is completely secure for that.

- Download your Hawaii Garnishee Disclosure to your device and finish it on a printed copy or electronically.

Form popularity

FAQ

To file a Land Court petition in Hawaii, first, gather the necessary documents outlining your claim. After preparing your petition, submit it to the Land Court along with any required filing fees. Resources such as US Legal Forms can aid you in understanding the detailed process of filings, including those pertinent to Hawaii Garnishee Disclosure.

Court filing fees refer to the costs associated with submitting legal documents to the court. In Hawaii, these fees can vary based on the type of case or document filed. Knowing about these fees can help you prepare for expenses related to your case, including those involving the Hawaii Garnishee Disclosure process.

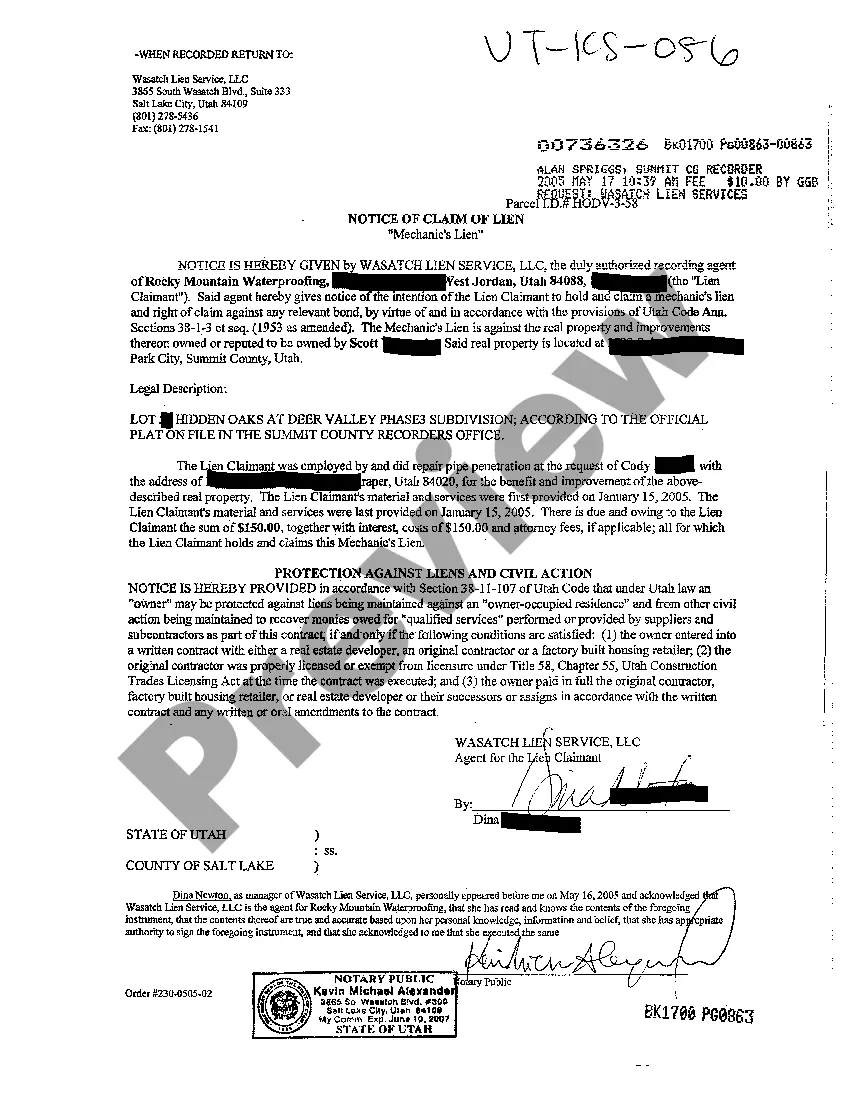

Garnishment laws in Hawaii dictate how creditors can access a debtor's assets to fulfill a court judgment. Under these laws, a court must issue an order before any garnishment can occur, ensuring due process. Familiarizing yourself with Hawaii Garnishee Disclosure will help you navigate these regulations effectively.

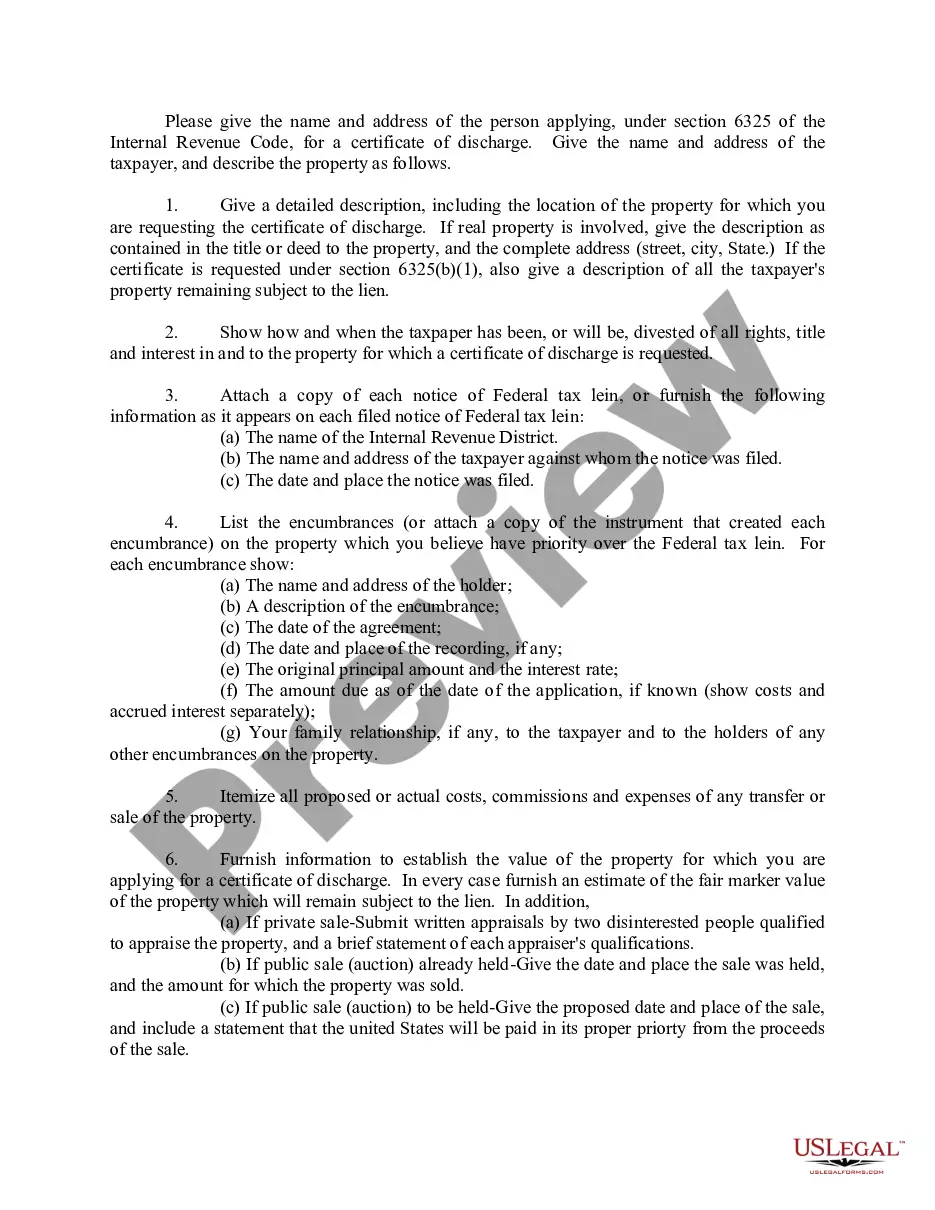

A garnishee disclosure is a legal document that a garnishee must file in court, disclosing any funds or property they hold on behalf of a debtor. This disclosure allows the court to determine the amount that can be garnished from the debtor's assets. Understanding Hawaii Garnishee Disclosure is essential for both creditors and debtors to understand their rights and responsibilities.

In Hawaii, specific exemptions protect certain assets from garnishment. Common exemptions include wages up to a certain amount, social security benefits, and other essential resources. Knowing which assets are exempt can help you maintain financial stability while navigating garnishment proceedings. For comprehensive information on exemptions, refer to Hawaii Garnishee Disclosure guidelines, or consult uslegalforms for tailored assistance.

The entry of default occurs when a party fails to respond to a legal summons within the designated time frame. In the context of garnishment, this can lead to a default judgment against the debtor. It simplifies the process for the creditor, who can then pursue garnishment more efficiently. Understanding how the entry of default works is crucial for anyone dealing with Hawaii Garnishee Disclosure.

Rule 37 in Hawaii pertains to disclosure requirements in garnishment cases. It mandates that garnishees must provide information about the debtor's assets and debts. This ensures transparency and fairness throughout the garnishment process. For detailed guidance on complying with Rule 37, you can explore resources related to Hawaii Garnishee Disclosure.

Rule 48 in Hawaii pertains to the dismissal of cases due to inactivity. If a plaintiff does not take action to move the case forward within one year, the court may dismiss it for lack of prosecution. This rule underscores the importance of staying proactive in your legal matters. If you are navigating legal challenges, including garnishment issues, consider using resources like USLegalForms, which can guide you through the process efficiently.

Hawaii's statute of limitations for civil lawsuits varies based on the type of claim, typically ranging from two to six years. For many tort claims, like personal injury, you have two years from the incident to file. On the other hand, certain contractual disputes may allow up to six years. Knowing these timelines is vital, particularly when dealing with matters like Hawaii garnishee disclosure to ensure proper legal action.

While pursuing a lawsuit for $500 may seem minor, it is essential to weigh the costs versus potential benefits. Small claims court may be a viable option, providing a more accessible and affordable route for such disputes. Additionally, applying for a Hawaii garnishee disclosure can help you recover your funds if the other party does not comply with the judgment. Always consider consulting experts for the best approach.