Connecticut Warranty Deed from Individual to a Trust

Definition and meaning

A Connecticut Warranty Deed from Individual to a Trust is a legal document used to transfer property ownership from an individual, referred to as the Grantor, to a trust, represented by a Trustee. This type of deed guarantees that the Grantor holds clear title to the property and has the right to transfer it. In essence, it is a promise that the property is free from liens and other claims, unless otherwise stated. This deed is often used in estate planning and asset management.

How to complete the form

Completing a Connecticut Warranty Deed requires careful attention to detail. Follow these steps:

- Identify the Grantor and Grantee: Write the full names and addresses of the individual transferring the property and the trustee receiving it.

- Provide legal description: Accurately describe the property being transferred, including address and any relevant boundaries.

- State the consideration: Indicate any payment or value exchanged for the transfer, if applicable.

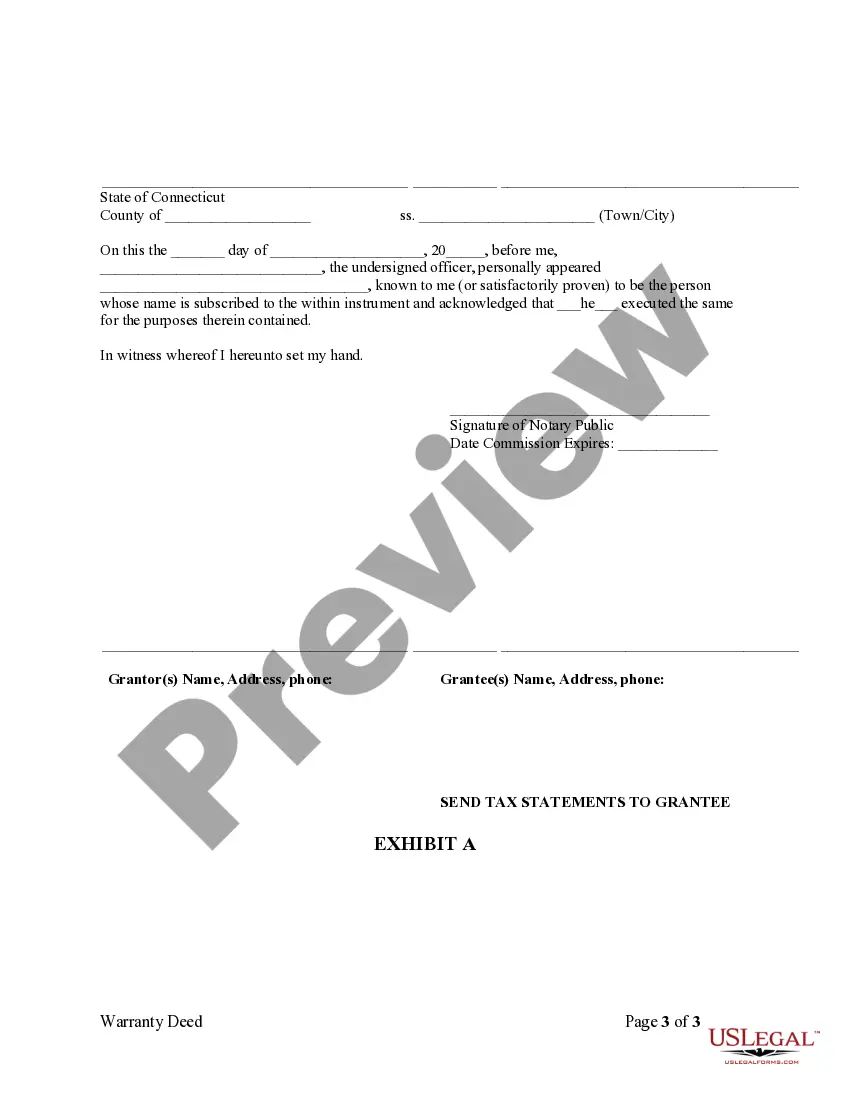

- Sign and notarize: The Grantor must sign the deed in the presence of a notary public.

Ensure to review the document for any missing information before filing.

Who should use this form

This form is ideal for individuals looking to transfer property into a trust for estate planning, asset protection, or tax benefits. It is particularly useful for those who want to efficiently manage property and pass assets to beneficiaries without going through probate. Users typically include homeowners, investors, and estate planners.

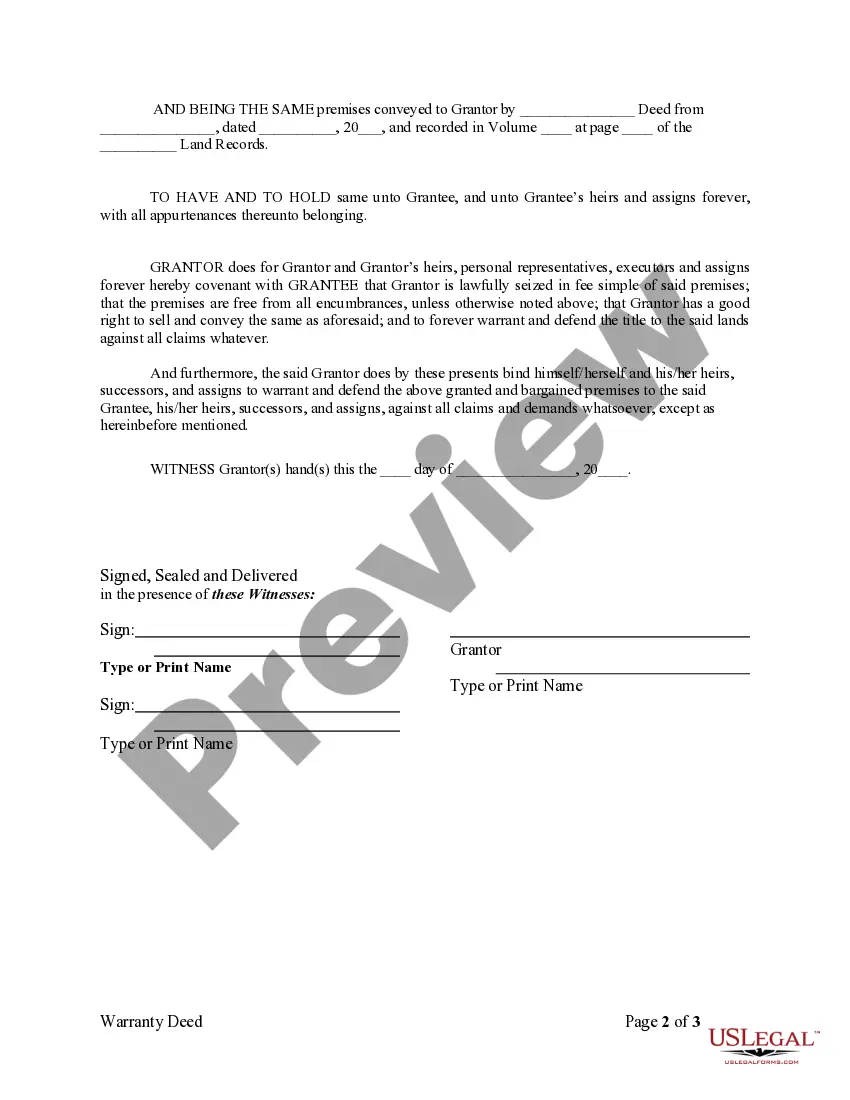

Key components of the form

The Connecticut Warranty Deed includes several essential components:

- Grantor Information: Name and address of the individual transferring the property.

- Grantee Information: Name and address of the trustee receiving the property.

- Property Description: A detailed legal description of the property.

- Consideration Statement: Information on any payment made for the property.

- Notary Section: Area for the notary public to witness the signing.

Each section must be filled out accurately to ensure the document's validity.

Common mistakes to avoid when using this form

Be cautious to avoid these common errors:

- Incomplete legal description of the property.

- Missing signatures or notarization.

- Failure to specify exceptions, such as mineral rights or easements.

- Not reviewing state-specific requirements, which can vary.

Double-checking all entries and seeking legal advice can help mitigate these errors.

Form popularity

FAQ

A trust often provides more robust protection than a simple gift. By using a Connecticut Warranty Deed from Individual to a Trust, you can maintain control over the property while assigning its benefits to your chosen beneficiaries. This arrangement helps avoid potential gift tax implications and provides clarity on management and distribution, which gifts may not offer. Trusts can also protect your property from creditors and ensure that your intentions are honored over time.

Deciding whether to gift a house or to place it in a trust involves various considerations. A Connecticut Warranty Deed from Individual to a Trust can help manage the property's future, providing clear guidelines for its use and control. While gifting may seem straightforward, putting the property in a trust allows for greater protection from creditors and simplifies the transfer of assets upon your passing. It's advisable to consult with a legal expert to weigh these options based on your circumstances.

Putting a house in trust in Connecticut begins with creating a trust document that outlines the terms and conditions of the trust. After the trust is established, you will need to execute a Connecticut Warranty Deed from Individual to a Trust to transfer the property legally. Engaging with uslegalforms can provide you with the necessary forms and guidance to complete this process efficiently and ensure compliance with state regulations.

To place your house in a trust in Connecticut, you need to establish a trust document and detail the property you wish to include. Next, execute a Connecticut Warranty Deed from Individual to a Trust to formally transfer ownership of the property into the trust. It is advisable to work with a legal professional to ensure all local laws are adhered to, and to navigate the specifics of the transfer process.

To transfer a warranty deed, you must complete the deed form and sign it in the presence of a notary. The next step is to file the form with your local land records office to make the transfer official. If you are moving property to a trust using a Connecticut Warranty Deed from Individual to a Trust, ensure you follow your state’s specific requirements for this type of deed. Consulting a legal professional can help ensure a smooth process.

While placing your home in a trust can offer benefits like avoiding probate, there are some disadvantages. You might face upfront costs for setting up the trust, as well as ongoing administrative fees. Additionally, transferring your property with a Connecticut Warranty Deed from Individual to a Trust could limit your access to certain tax benefits or create tax implications. It's essential to assess these factors before making a decision.

To place a house in a trust in Connecticut, you must first create a trust document that outlines the terms and beneficiaries of the trust. Then, you will execute a Connecticut Warranty Deed from Individual to a Trust, transferring the property title into the trust's name. This process may seem complex, but platforms like US Legal Forms provide resources and templates to help simplify the required steps and ensure legal compliance.

A trust deed allows a property owner to place their assets in a trust, ensuring they are managed and protected according to specific wishes. This arrangement can facilitate smoother property transfers and provide benefits like avoiding probate. Utilizing a Connecticut Warranty Deed from Individual to a Trust in this process can help streamline the transition and safeguard your assets effectively.

While a warranty deed provides strong protection for the buyer, it may also present disadvantages for the seller. If a title issue arises after the transfer, the seller is legally responsible for resolving it, which can lead to unexpected costs. Moreover, using a Connecticut Warranty Deed from Individual to a Trust without thorough legal guidance may not address specific needs or concerns, potentially resulting in complications down the road.

Yes, you can transfer a property with an existing mortgage into a trust. However, it is crucial to review the mortgage terms and conditions beforehand, as some lenders have specific requirements. Properly executing a Connecticut Warranty Deed from Individual to a Trust while considering the mortgage can help maintain goodwill with the lender and secure the property effectively within the trust.