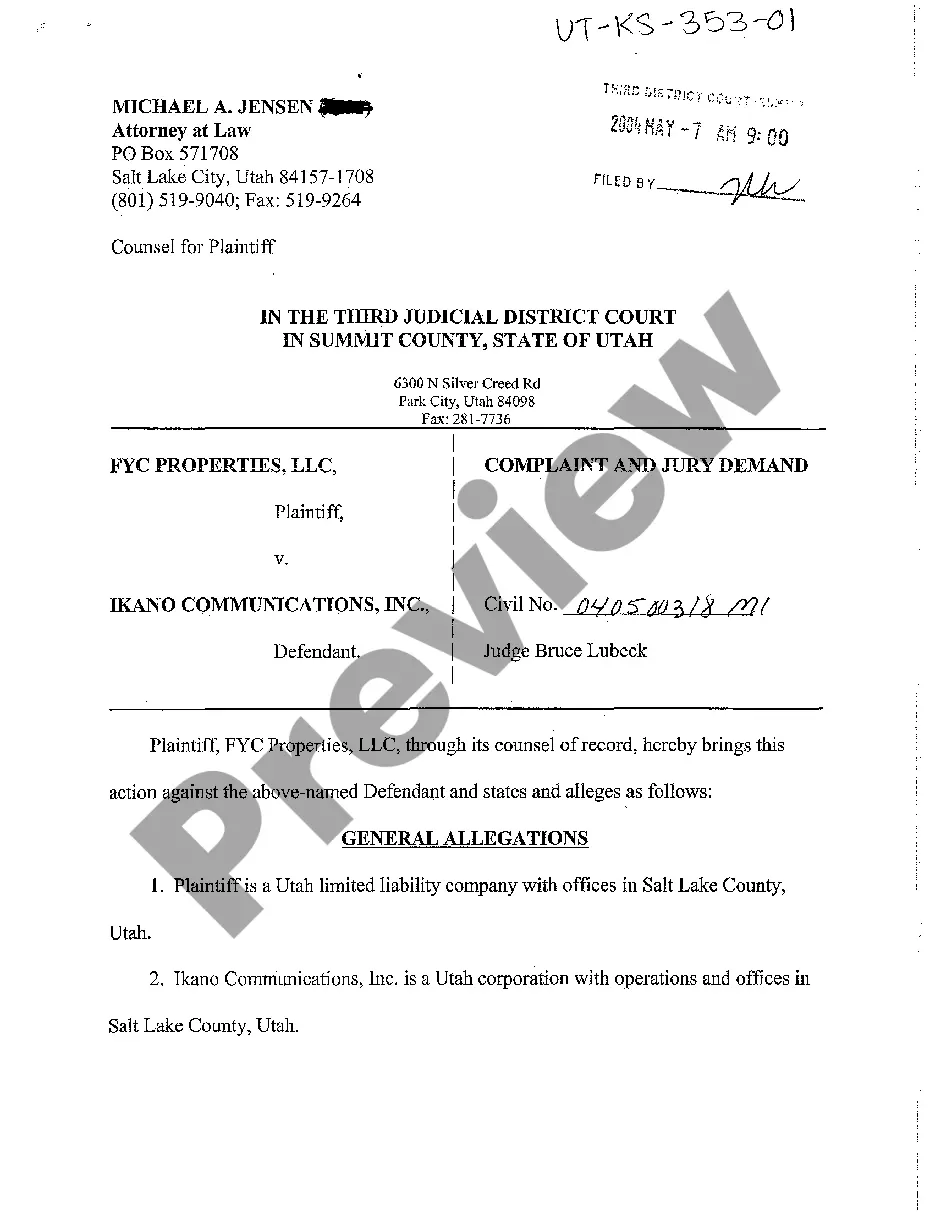

Hawaii Garnishee Disclosure is a document used to establish the amount of wages and other income due to an employee from an employer in the state of Hawaii. It is used in cases where a creditor is attempting to collect a debt from an employee. This document states the amount of wages and other income due to the employee, as well as any amounts that have been withheld from the employee's wages. There are two types of Hawaii Garnishee Disclosure: the Employer's Garnishee Disclosure and the Employee's Garnishee Disclosure. The Employer's Garnishee Disclosure is used by the employer to document the amount of wages and other income due to the employee, as well as any amounts that have been withheld from the employee's wages. The Employee's Garnishee Disclosure is used by the employee to document any amounts withheld from their wages by the creditor. Both forms must be completed and filed with the appropriate court in order for the garnishment to be enforced.

Hawaii Garnishee Disclosure

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Hawaii Garnishee Disclosure?

Handling formal documentation necessitates focus, accuracy, and utilizing well-prepared templates.

US Legal Forms has been assisting individuals nationwide with this for 25 years, so when you select your Hawaii Garnishee Disclosure template from our platform, you can be assured it aligns with federal and state regulations.

All documents are designed for multiple uses, like the Hawaii Garnishee Disclosure you see on this site. If you require them in the future, you can complete them without additional payment - simply access the My documents section in your profile and fill out your document whenever you need it. Try US Legal Forms and achieve your business and personal documentation swiftly and with complete legal adherence!

- Ensure to meticulously review the form content and its alignment with general and legal standards by previewing it or reviewing its description.

- Look for an alternative official template if the one you initially opened does not suit your situation or state laws (the option for that is located in the upper page corner).

- Log into your account and download the Hawaii Garnishee Disclosure in your desired format. If it’s your inaugural experience with our site, click Buy now to proceed.

- Create an account, select your subscription option, and pay using your credit card or PayPal account.

- Choose the format in which you want to receive your form and click Download. Print the document or upload it to a professional PDF editor to prepare it without paper.

Form popularity

FAQ

In Hawaii, the statute of limitations for most civil lawsuits is six years. This means that you must file your lawsuit within six years of the date the cause of action arose. Understanding this limitation is crucial for maintaining your legal rights. Keeping track of timelines related to your claims can help you utilize the Hawaii Garnishee Disclosure effectively.

A garnishee disclosure is a document that a third party, such as a bank or employer, is required to file in response to a garnishment order. This disclosure details the debtor's assets held by the garnishee and informs the court about the funds available for garnishment. Knowing about the garnishee disclosure process is vital for both creditors and debtors to ensure fair proceedings. Utilizing the Hawaii Garnishee Disclosure can greatly aid in understanding your financial obligations.

Rule 48 in Hawaii relates to the procedures for filing a garnishment action. It outlines the requirements that a creditor must meet to properly start a garnishment case, including necessary documentation. Understanding Rule 48 is crucial for anyone navigating the garnishment process in Hawaii. This knowledge can ensure compliance and streamline your experience with the Hawaii Garnishee Disclosure.

Hawaii garnishment laws allow creditors to collect debts by taking funds directly from a debtor's wages or bank accounts. Under these laws, they must file a legal action and obtain a court order before initiating garnishment. Individuals should understand their rights under the Hawaii Garnishee Disclosure process to protect themselves. Familiarizing yourself with these laws can help prevent unexpected financial surprises.

In Hawaii, the garnishment amount is typically limited to 25% of your disposable earnings or the amount by which your weekly earnings exceed a certain threshold, whichever is lower. This ensures that you retain a portion of your income for essential living expenses. Familiarizing yourself with the rules of Hawaii Garnishee Disclosure can provide clarity on these limits and help you protect your finances.

Yes, it is possible for someone to garnish your wages without your immediate knowledge if they have obtained a court order. Typically, you will be notified once the garnishment has been initiated. Understanding the Hawaii Garnishee Disclosure system allows you to anticipate any potential garnishments and respond accordingly.

Yes, an employer can refuse to garnish your wages if they do not receive a proper legal order. However, if a valid garnishee order is in place, your employer is legally obligated to comply with it. It's essential to ensure that all legal procedures are followed to avoid complications. Resources like Hawaii Garnishee Disclosure clarify your rights and obligations in this matter.

In Hawaii, a judgment remains valid for ten years from the date of the final judgment. However, this judgment can be renewed for an additional ten years, provided that you follow the proper legal procedures. Regularly checking the status of your judgment can help you manage your rights effectively. Utilizing the tools within Hawaii Garnishee Disclosure can assist in keeping track of these important details.

In Hawaii, the statute of limitations varies depending on the type of lawsuit. Generally, personal injury claims must be filed within two years, while written contracts have a six-year timeframe. It's crucial to file your lawsuit before the deadlines to protect your rights. For guidance on these timelines, refer to the detailed resources available through Hawaii Garnishee Disclosure.

To garnish your wages in Hawaii, you need to obtain a court judgment against the debtor. After securing the judgment, you must file a request for a garnishee order with the court. This order directs the employer to withhold a portion of the debtor's wages, ensuring that you receive the amount owed. Understanding the Hawaii Garnishee Disclosure process can greatly help you navigate these legal requirements.