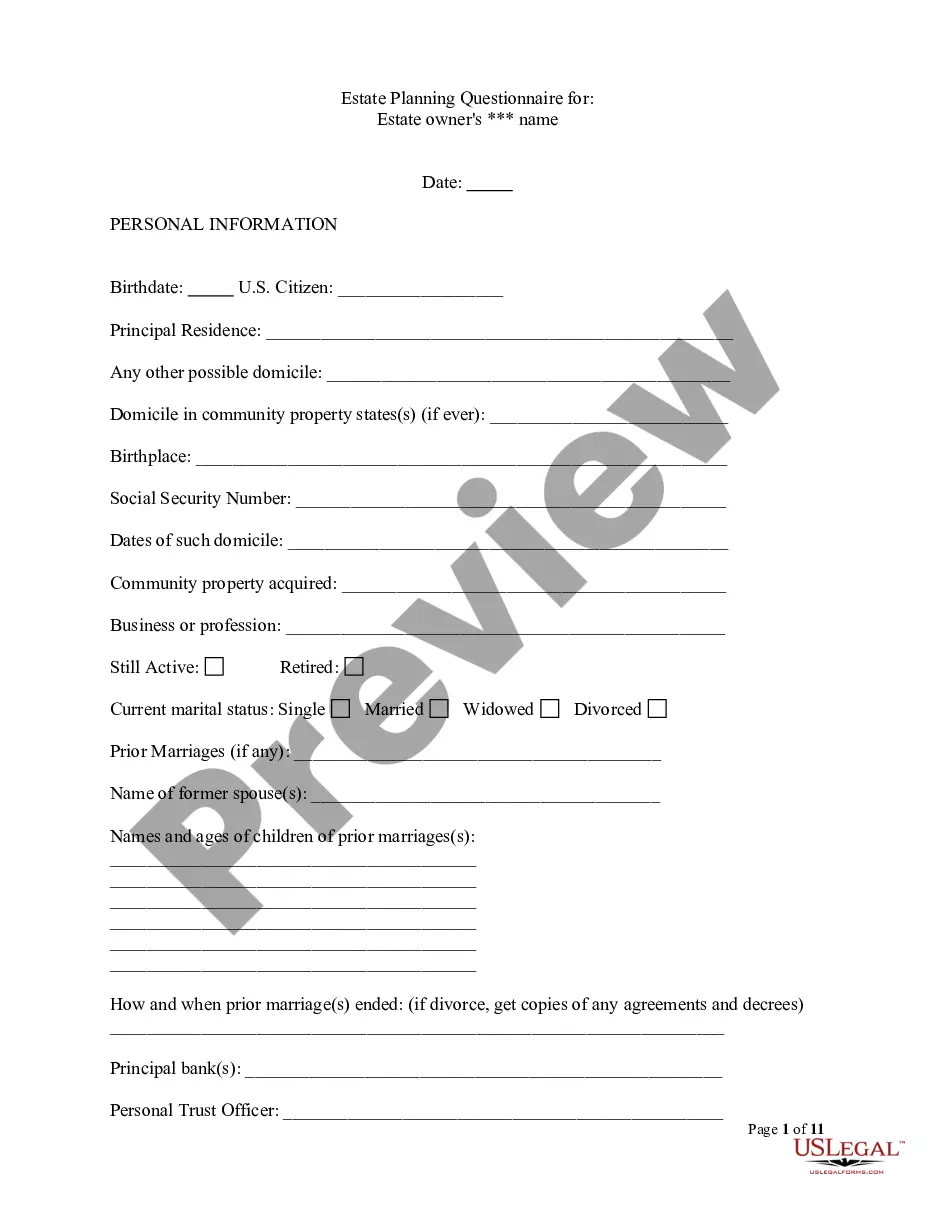

Mississippi Estate Planning Questionnaire

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Mississippi Estate Planning Questionnaire?

Obtain a printable Mississippi Estate Planning Questionnaire with just a few clicks from the largest collection of legal electronic files.

Locate, download, and print professionally prepared and verified templates on the US Legal Forms website. US Legal Forms has been the leading provider of economical legal and tax documents for American citizens and residents online since 1997.

After downloading your Mississippi Estate Planning Questionnaire, you can complete it in any online editor or print it out and fill it in by hand. Utilize US Legal Forms to gain access to 85,000 expertly drafted, state-specific documents.

- Users with a subscription must Log In directly to their US Legal Forms account, retrieve the Mississippi Estate Planning Questionnaire, and access it in the My documents section.

- Users without a subscription should adhere to the guidelines listed below.

- Ensure your form complies with your state's regulations.

- If applicable, read the form's description for more information.

- If available, examine the form for additional details.

- Once you confirm the form meets your needs, click Buy Now.

- Create a personal account.

- Select a payment plan.

- Process payment via PayPal or credit card.

- Download the form in Word or PDF format.

Form popularity

FAQ

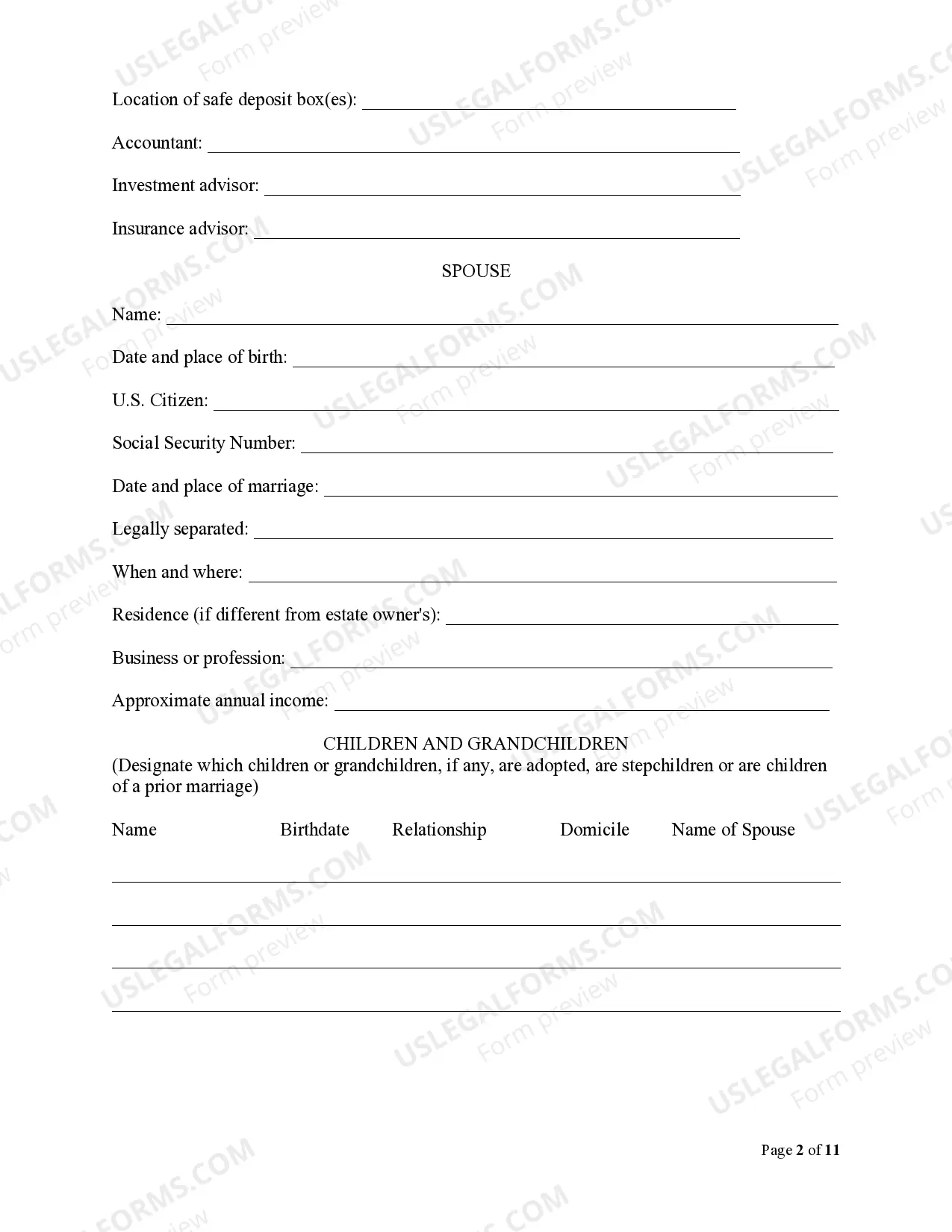

Fill out your attorney's intake questionnaire. Gather your financial documents. Bring copies of your current estate plan documents. Divorce agreements, premarital agreements, and other relevant contracts. Choose your executors and health care agents.

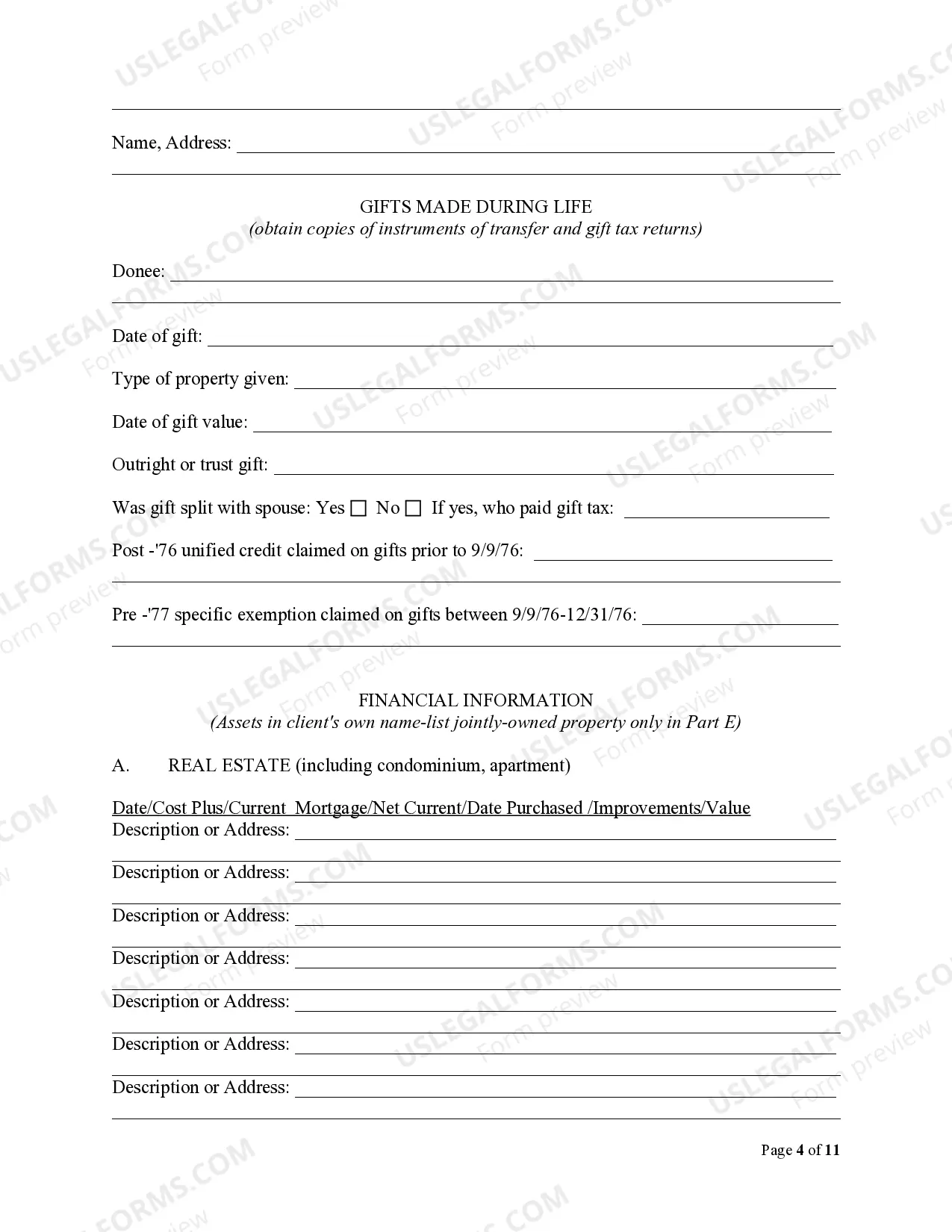

More Than a Last Will. Itemize Your Inventory. Follow with Non-Physical Assets. Assemble a List of Debts. Make a Memberships List. Make Copies of Your Lists. Review Your Retirement Account. Update Your Insurance.

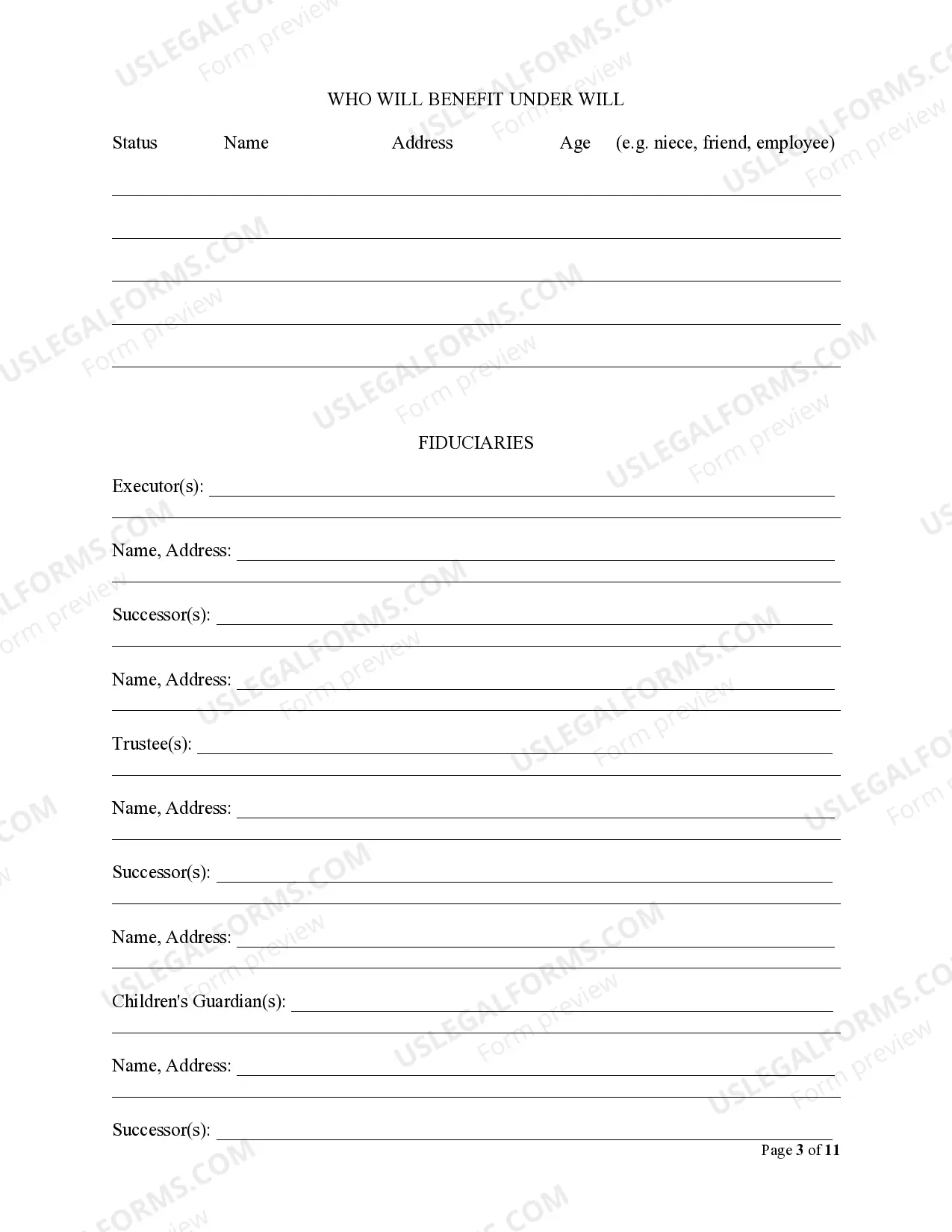

There are four main elements of an estate plan; these include a will, a living will and healthcare power of attorney, a financial power of attorney, and a trust.

What Property Can Go in a Living Trust? Who Should Be My Trustee? Does a Living Trust Avoid Estate and Probate Taxes? What Are the Benefits of a Living Trust? What Are the Drawbacks of a Living Trust? Do I Still Need a Power of Attorney?

What will happen during an initial meeting with your office and how much will it cost? Are all of your fees flat fees? Does my planning fee include a regular review of my legal documents? Do you make sure my assets are titled in the right way and my business stays in compliance?

A highly skilled trust attorney will be able to establish trusts for loved ones, minimize estate taxes, avoid probate, create wills, plan for disability, and much more.Or, if you have extensive real estate holdings, the ideal trust planning attorney will have a wealth of knowledge about real property law.

Creating an estate plan is a lot like getting into better shape. Step 1: Sign a will. Step 2: Name beneficiaries. Step 3: Dodge estate taxes. Step 4: Leave a letter. Step 5: Draw up a durable power of attorney. Step 6: Create an advance health care directive.

Bank accounts. Brokerage or investment accounts. Retirement accounts and pension plans. A life insurance policy.

You can make your own will in Mississippi, using Nolo's do-it-yourself will software or online will programs. However, you may want to consult a lawyer in some situations. For example, if you think that your will might be contested or if you want to disinherit your spouse, you should talk with an attorney.