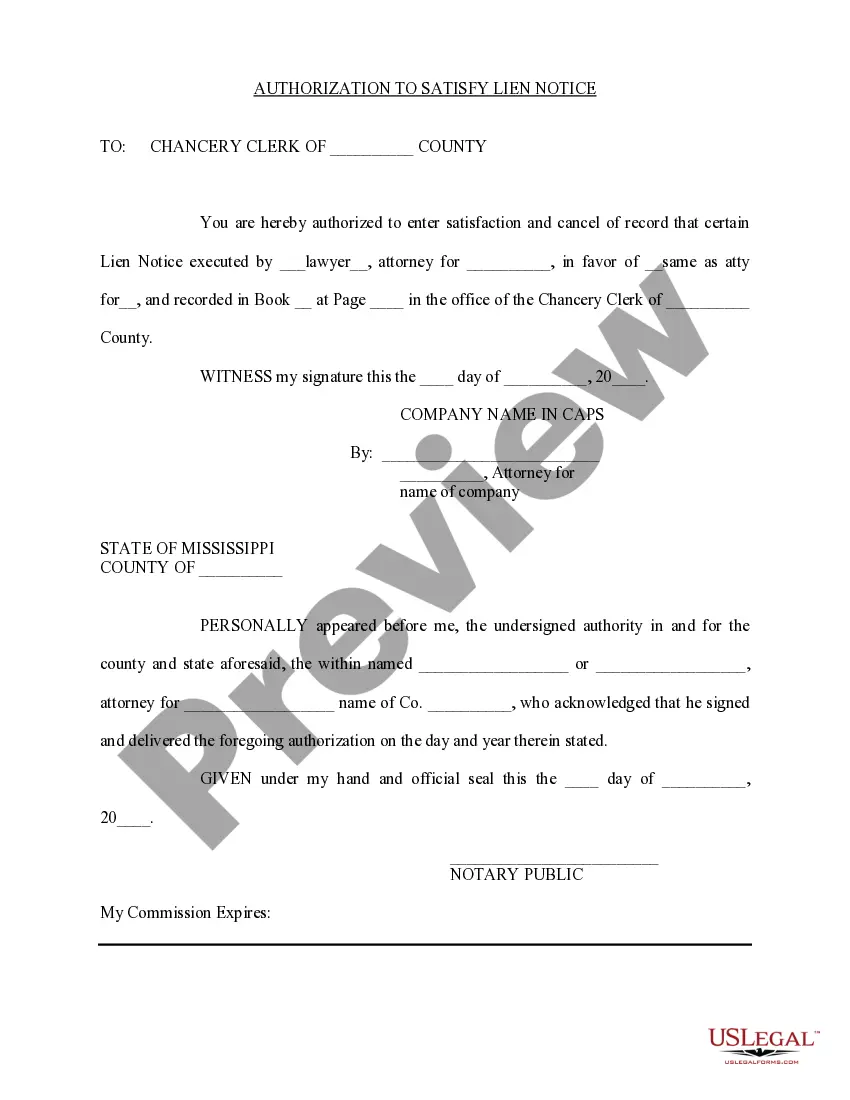

Mississippi Authorization to Satisfy Lien Notice

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

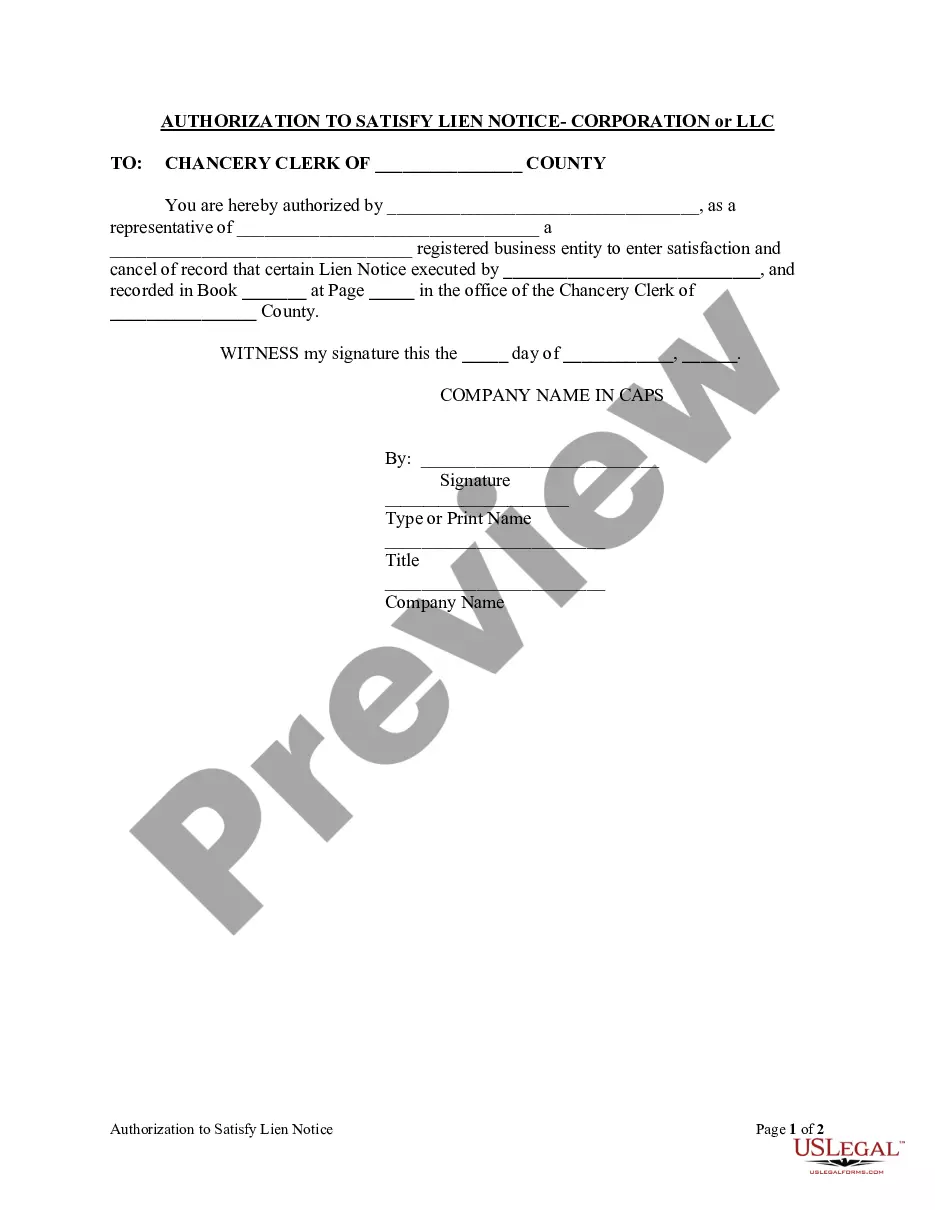

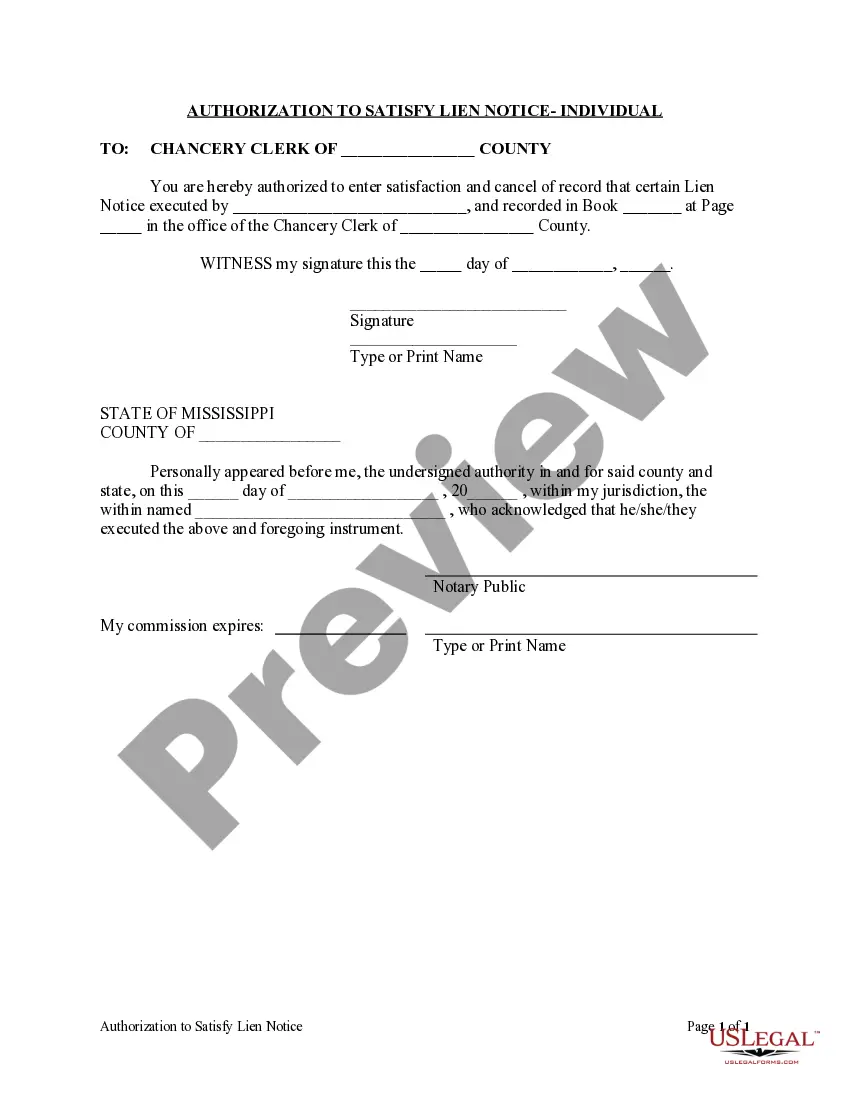

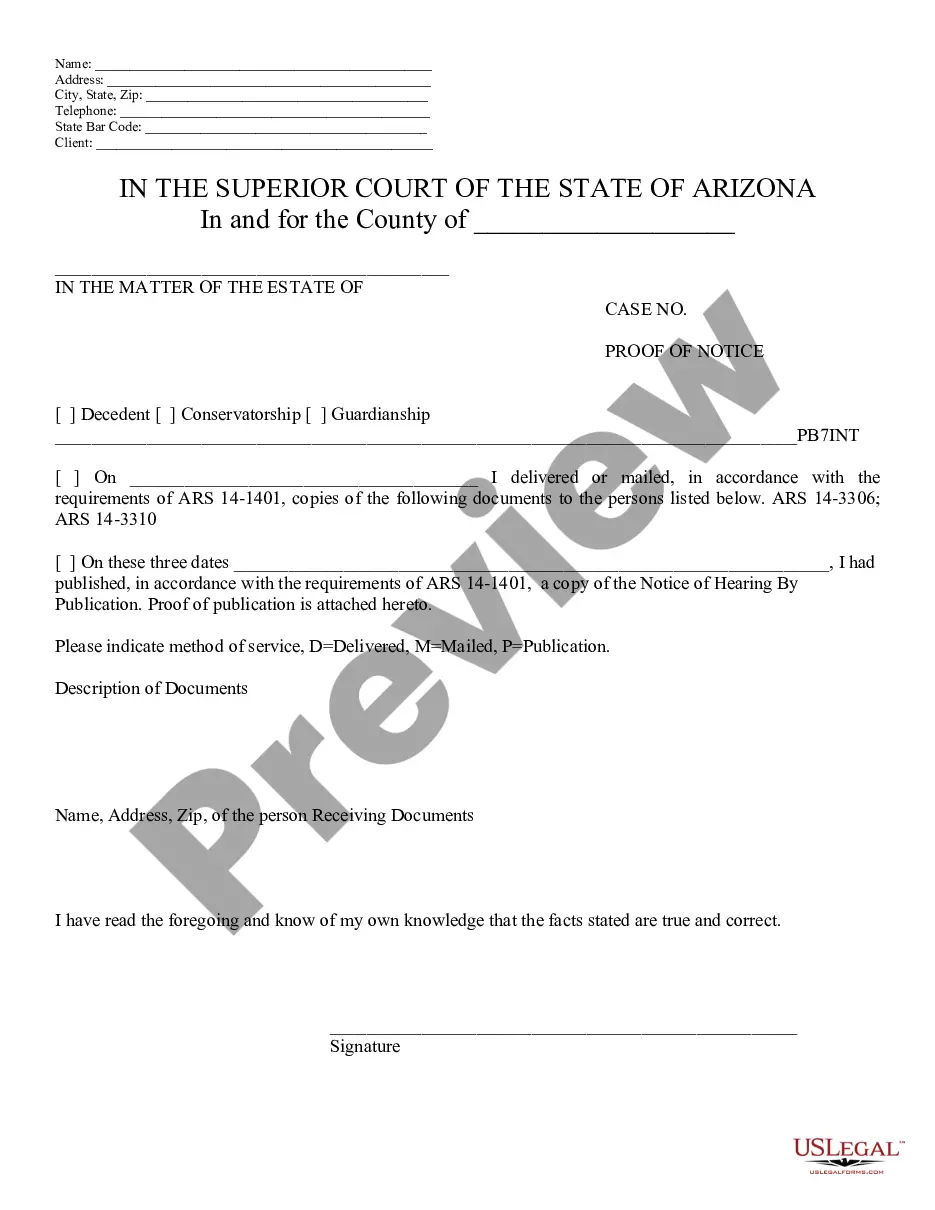

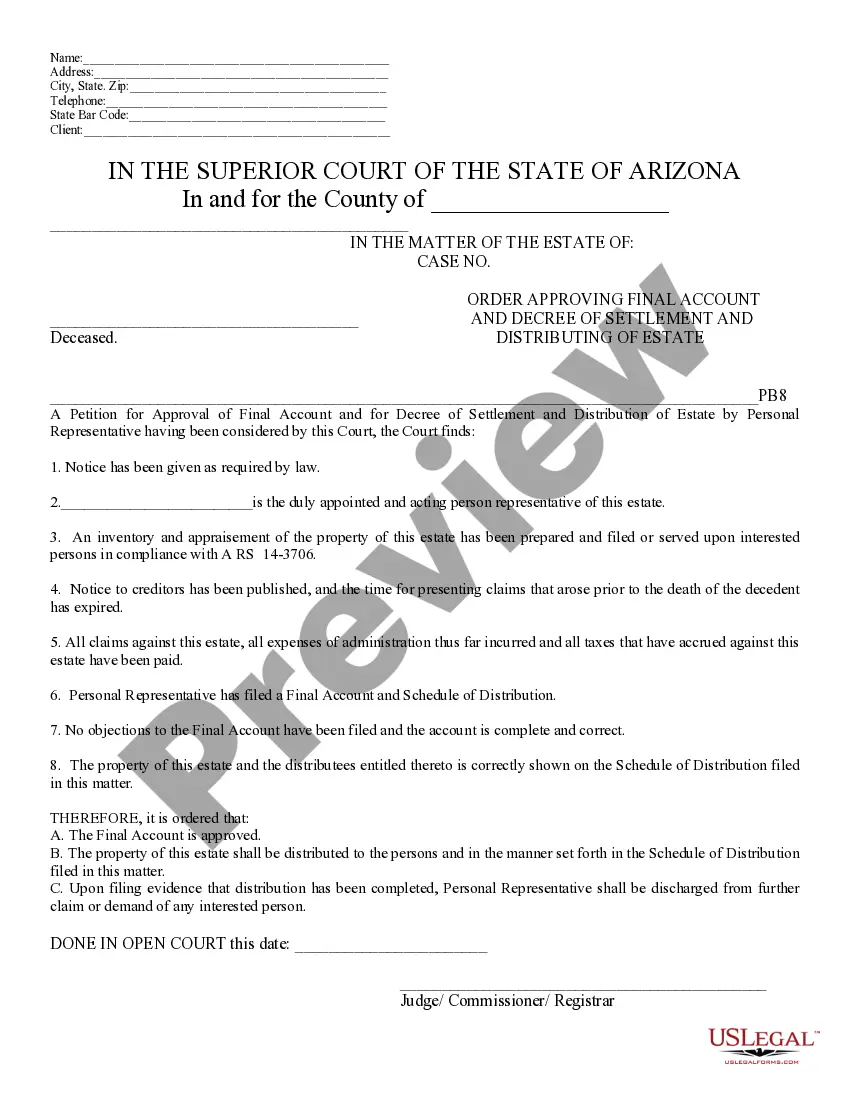

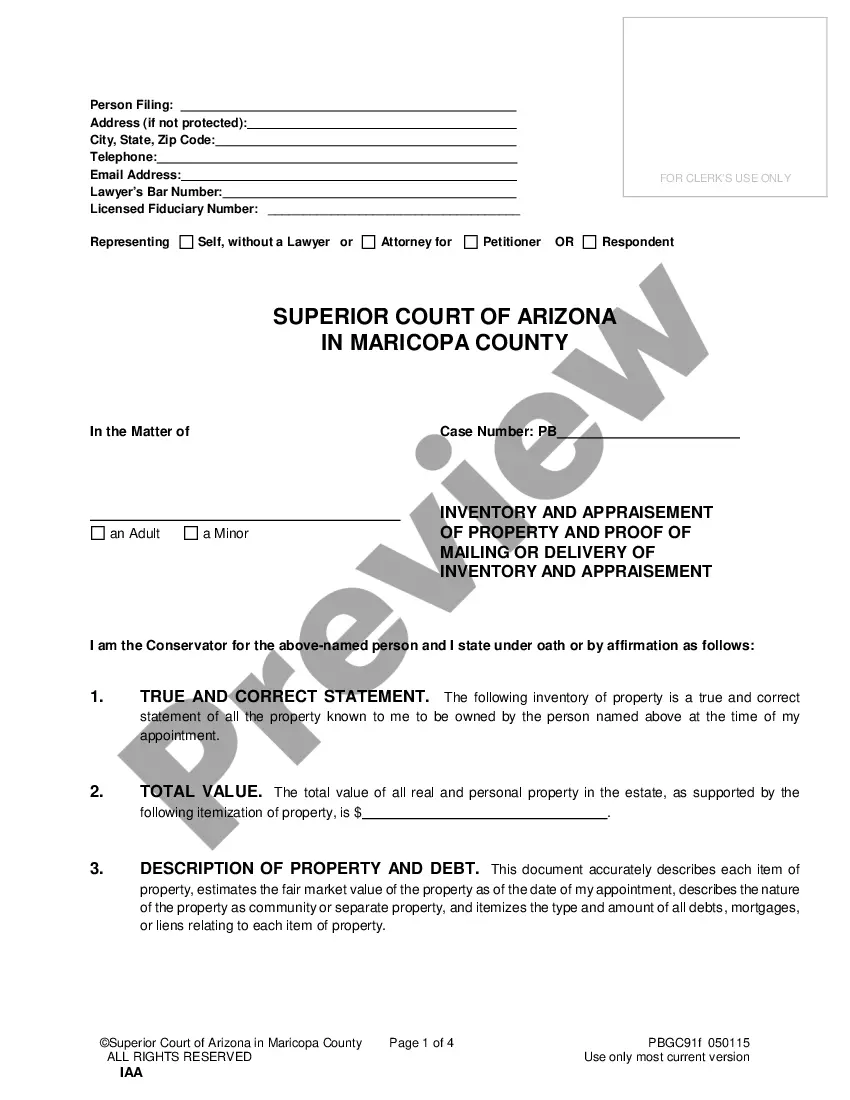

How to fill out Mississippi Authorization To Satisfy Lien Notice?

Acquire a printable Mississippi Authorization to Satisfy Lien Notice in just a few clicks within the most extensive library of legal e-files.

Locate, download, and print professionally prepared and certified templates on the US Legal Forms website. US Legal Forms has been the leading provider of affordable legal and tax documents for US citizens and residents online since 1997.

Once you have downloaded your Mississippi Authorization to Satisfy Lien Notice, you can complete it in any online editor or print it out and fill it in manually. Utilize US Legal Forms to access 85,000 professionally drafted, state-specific documents.

- Users who already possess a subscription must sign in directly to their US Legal Forms account, download the Mississippi Authorization to Satisfy Lien Notice, and find it stored in the My documents section.

- Clients without a subscription are required to follow the steps below.

- Ensure your document complies with your state’s regulations.

- If available, review the document’s description to learn more.

- If provided, preview the document to see additional details.

- When you are certain the template is suitable for you, click on Buy Now.

- Create a personal account.

- Select a plan.

- Make a payment via PayPal or credit card.

- Download the document in Word or PDF format.

Form popularity

FAQ

Prepare the lien document, taking care to include all the necessary information set forth above including the required statements. Sign the document. Deliver the lien must the office of the clerk of the chancery court of the county where the property is located.

The answer is simple no. In Mississippi, paying the property taxes on someone else's land does not affect ownership in any manner. You simply cannot obtain title to someone's land by paying their taxes for them.

The Tax-Forfeited Inventory200b link provides access to the properties available for sale or you may contact the Public Lands Division in the Secretary of State's Office at 601-359-5156 or toll free (in-state) at 1-866-TFLANDS(835-2637). Approximately how long does the process take?

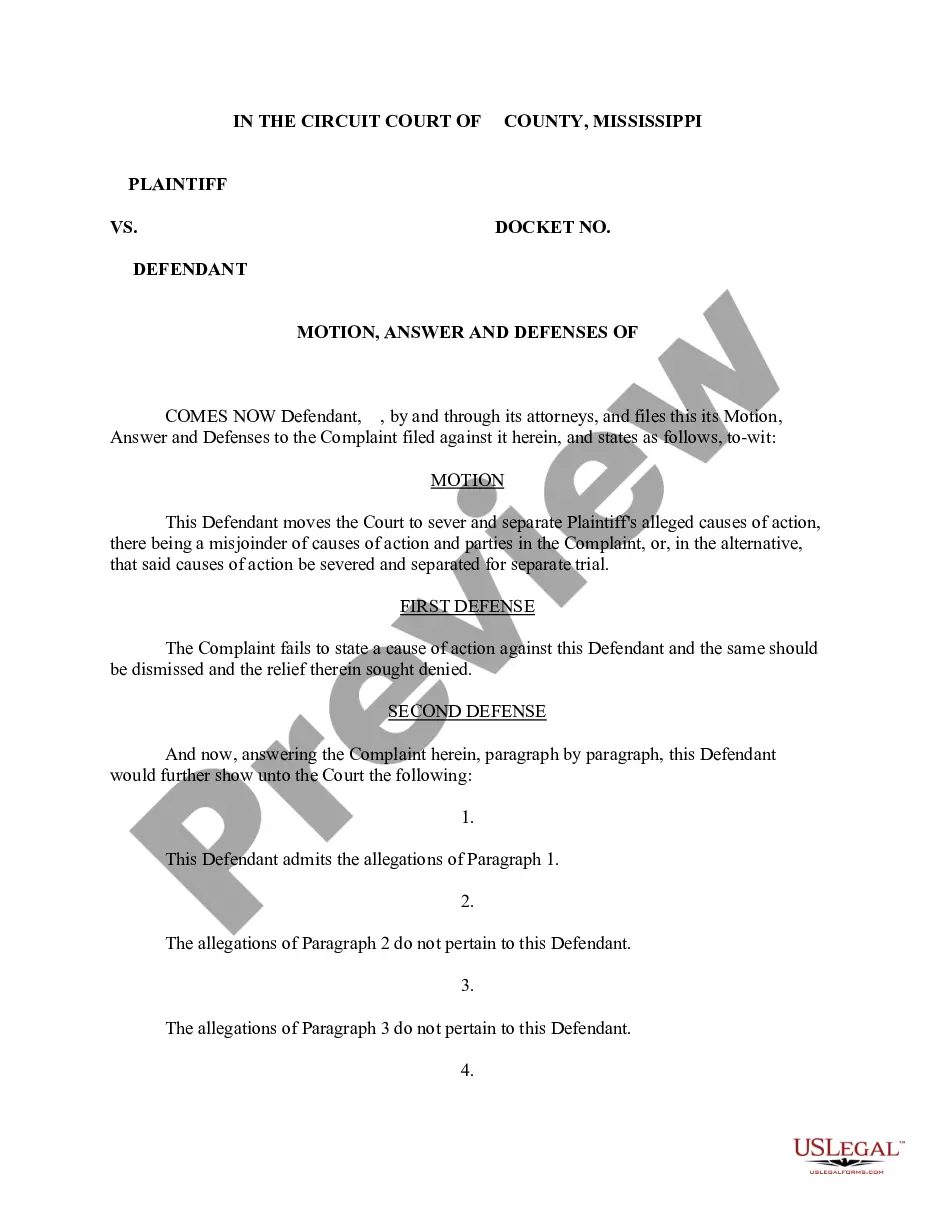

To place a lien, you must first demonstrate that you have a valid debt that has not been paid by the property holder for example if you performed construction work as a contractor or subcontractor at company headquarters and the business did not pay your bill.

A tax lien recorded on the State Tax Lien Registry covers all property in Mississippi. To avoid having a tax lien filed against your property, send the Department of Revenue full payment before the due date as set forth in your Assessment Notice.

A tax lien recorded on the State Tax Lien Registry covers all property in Mississippi. To avoid having a tax lien filed against your property, send the Department of Revenue full payment before the due date as set forth in your Assessment Notice.

What Is a Fraudulent Lien?the claimant is owed money on another job by the same general contractor or property owner, but didn't file a lien on that project before time expired; or. the claimant wants to file a lien because of personal reasons generally related to the identity of the property owner.

Investors can purchase property tax liens the same way actual properties can be bought and sold at auctions. The auctions are held in a physical setting or online, and investors can either bid down on the interest rate on the lien or bid up a premium they will pay for it.

Someone who is owed money is generally not able to just put a lien on property without first securing a judgment. Securing a judgment requires the creditor to sue the debtor. This may be through circuit court in many jurisdictions. If under a certain dollar amount, this suit may be through the small claims court.