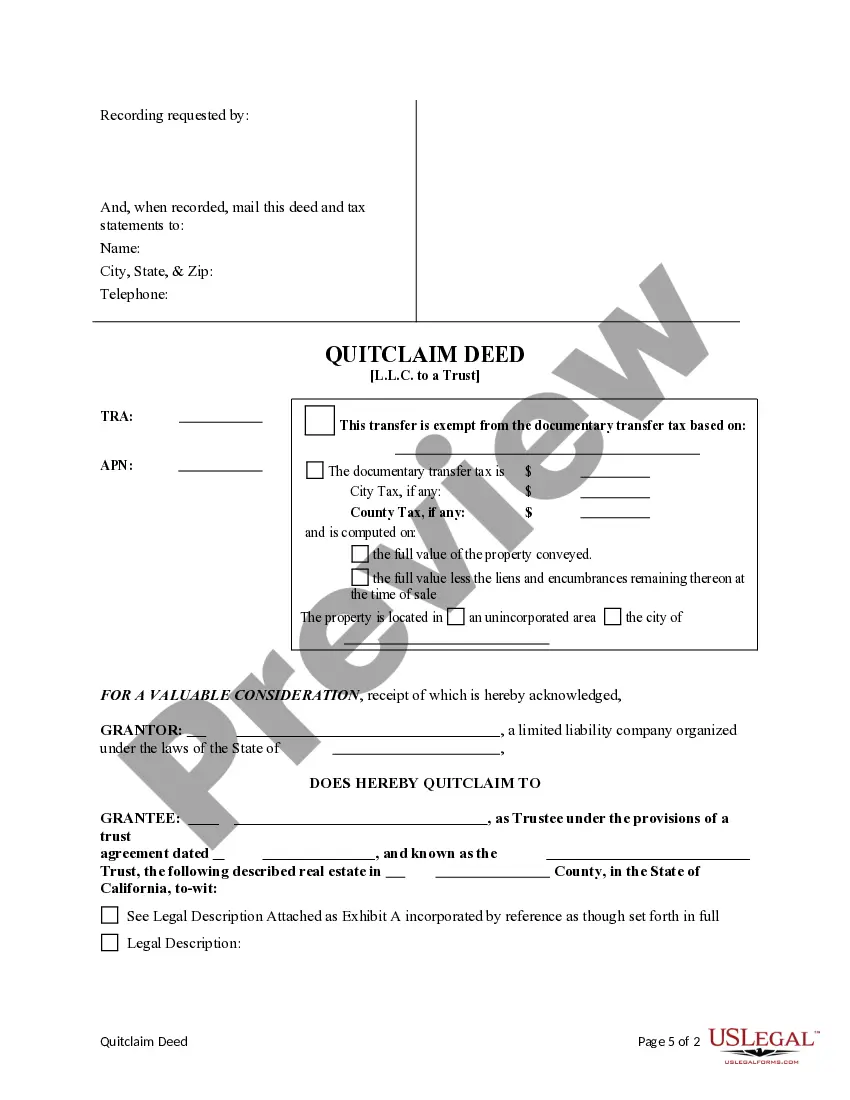

This form is a Quitclaim Deed where the Grantor is an LLC and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

California Quitclaim Deed from a Limited Liability Company to a Trust

Description

How to fill out California Quitclaim Deed From A Limited Liability Company To A Trust?

If you are looking for accurate California Quitclaim Deed templates from a Limited Liability Company to a Trust, US Legal Forms is precisely what you require; access documents that are provided and reviewed by state-certified legal professionals.

Utilizing US Legal Forms not only spares you from the hassle related to legal documents; it also conserves your time, effort, and finances! Downloading, printing, and completing a competent form is far less expensive than hiring an attorney to do it on your behalf.

And that's all. With a few simple steps, you acquire an editable California Quitclaim Deed from a Limited Liability Company to a Trust. After creating an account, all future orders will be processed more efficiently. Once you have a US Legal Forms subscription, just Log In and click the Download button you see on the form's page. Then, when you need to access this form again, you will always find it in the My documents section. Don't waste your time sifting through countless forms on different platforms. Order precise copies from one reliable platform!

- Initiate by completing your registration process by providing your email and creating a secure password.

- Follow the steps outlined below to establish an account and obtain the California Quitclaim Deed from a Limited Liability Company to a Trust template to manage your situation.

- Use the Preview feature or review the document description (if available) to confirm that the sample is the one you need.

- Verify its legitimacy in your residing state.

- Click Buy Now to finalize your purchase.

- Select a suitable payment plan.

- Establish an account and pay using your credit card or PayPal.

- Select a preferred format and download the document.

Form popularity

FAQ

Yes, a trust can serve as a manager of an LLC in California. This setup allows the trust to effectively manage the LLC's operations and assets according to the trust's terms. It is essential to ensure that the LLC's operating agreement accommodates this arrangement to avoid any legal complications.

Transferring an LLC to a trust in California involves executing a California Quitclaim Deed from a Limited Liability Company to a Trust. You need to draft the appropriate deed, have it properly executed, and file it according to state regulations. This ensures that the trust becomes the new owner of the LLC's assets.

To transfer your LLC to a trust in California, you will need to prepare a California Quitclaim Deed from a Limited Liability Company to a Trust. It typically involves drafting the deed, ensuring it is signed, notarized, and then recorded with the county. This process ensures that the LLC's assets are legally moved into the trust.

One common mistake parents make is failing to communicate their intentions clearly to their beneficiaries. It’s essential to outline the purpose of the trust and how assets will be distributed. Moreover, not properly updating the trust to reflect changing family dynamics can lead to confusion. When using a California Quitclaim Deed from a Limited Liability Company to a Trust, keeping these factors in mind can prevent future issues.

Certain assets cannot be placed in a trust, including retirement accounts with specific beneficiary designations and life insurance policies where you are not the policy owner. Additionally, personal assets such as vehicles or items with significant personal value may be best handled outside a trust. If you need guidance on the California Quitclaim Deed from a Limited Liability Company to a Trust, consider consulting with experts.

To transfer a deed to a trust in California, execute a California Quitclaim Deed specifically transferring the property to the trust. First, complete the quitclaim deed with accurate names and property details. Then, have the deed notarized and file it with the appropriate county recorder's office. Utilizing services from US Legal Forms can guide you through this process smoothly.

Filing a deed of trust in California requires preparing and signing the document, which outlines the borrower, lender, and property involved. After signing, you must file the deed with the county recorder’s office where the property is located. Make sure to keep a copy for your records, as well as the original deed. For a comprehensive resource, consider using platforms like US Legal Forms that simplify the filing process.

Yes, a quitclaim deed can effectively transfer property from a trust to another party. This type of deed relinquishes any claim the trust has to the property, ensuring a clear transfer. It's important to execute the deed properly to guarantee its enforceability. For added security, consider consulting a legal professional before proceeding with the transfer.

Transferring an LLC into a trust in California involves creating a California Quitclaim Deed from the LLC to the trust. First, draft the deed and include all essential details, such as the name of the LLC, the trust, and the property information. It is also wise to consult with an attorney to ensure compliance with state laws. Once completed, file the deed with the county recorder.

To transfer property from a Limited Liability Company (LLC) to a person, you typically need to execute a California Quitclaim Deed. This document allows the LLC to convey ownership of the property to the individual. Ensure that you properly fill out the deed, include necessary details, and have it notarized. Finally, file the completed deed with your local county recorder's office.