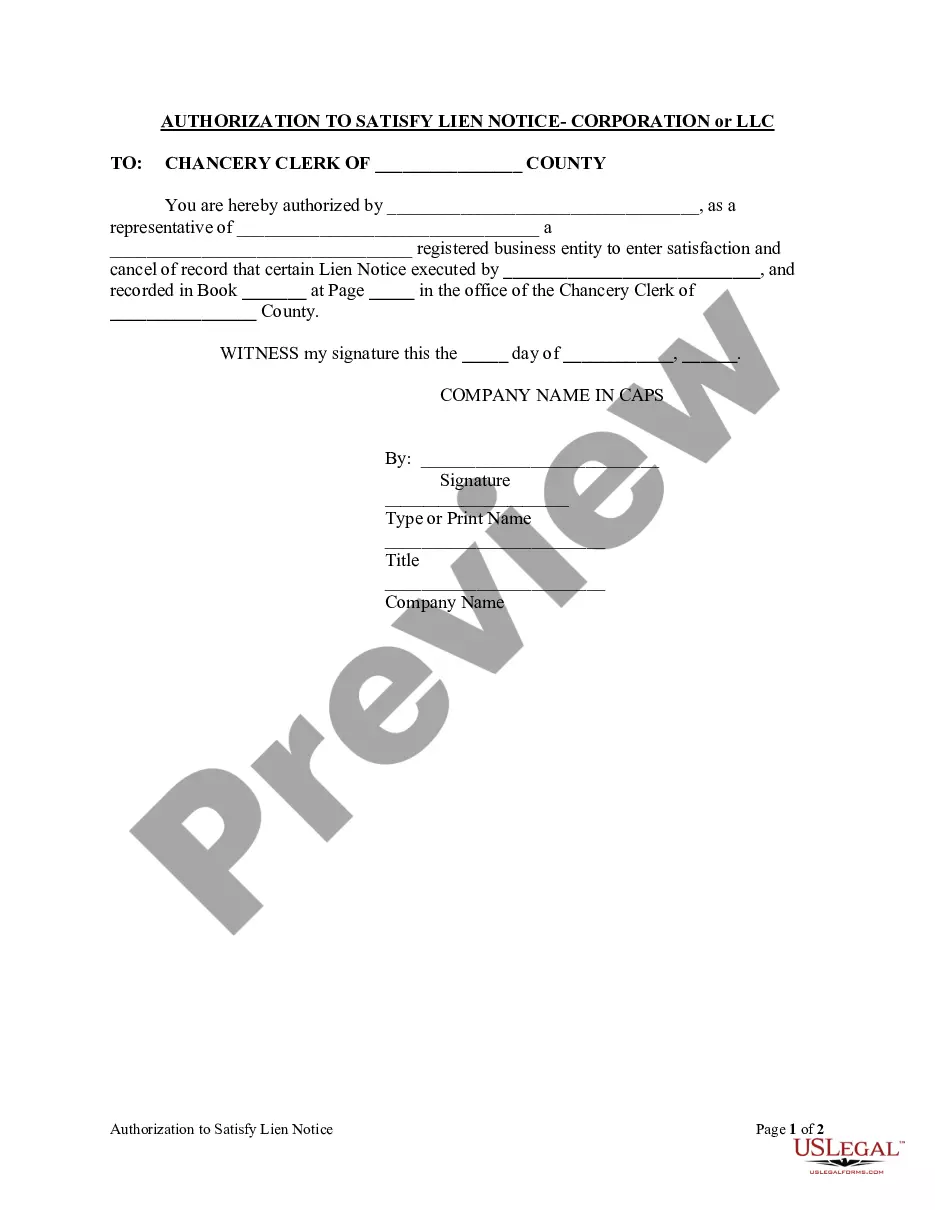

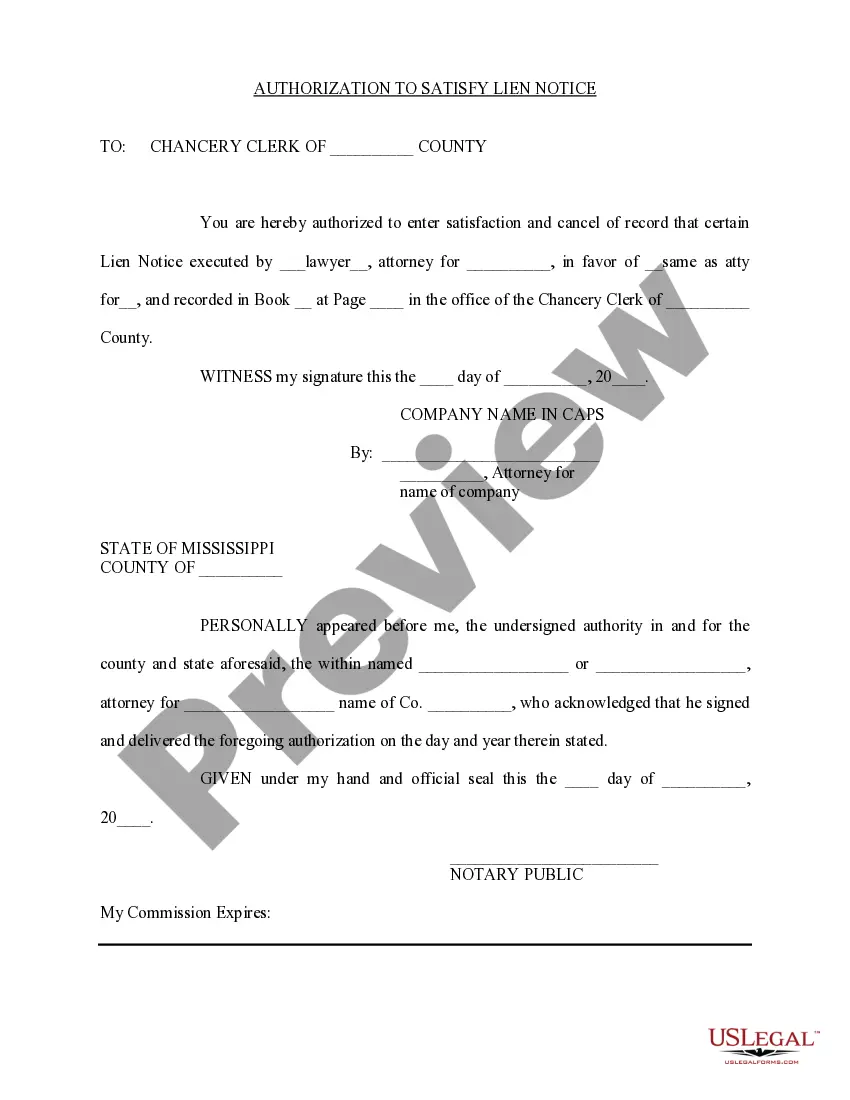

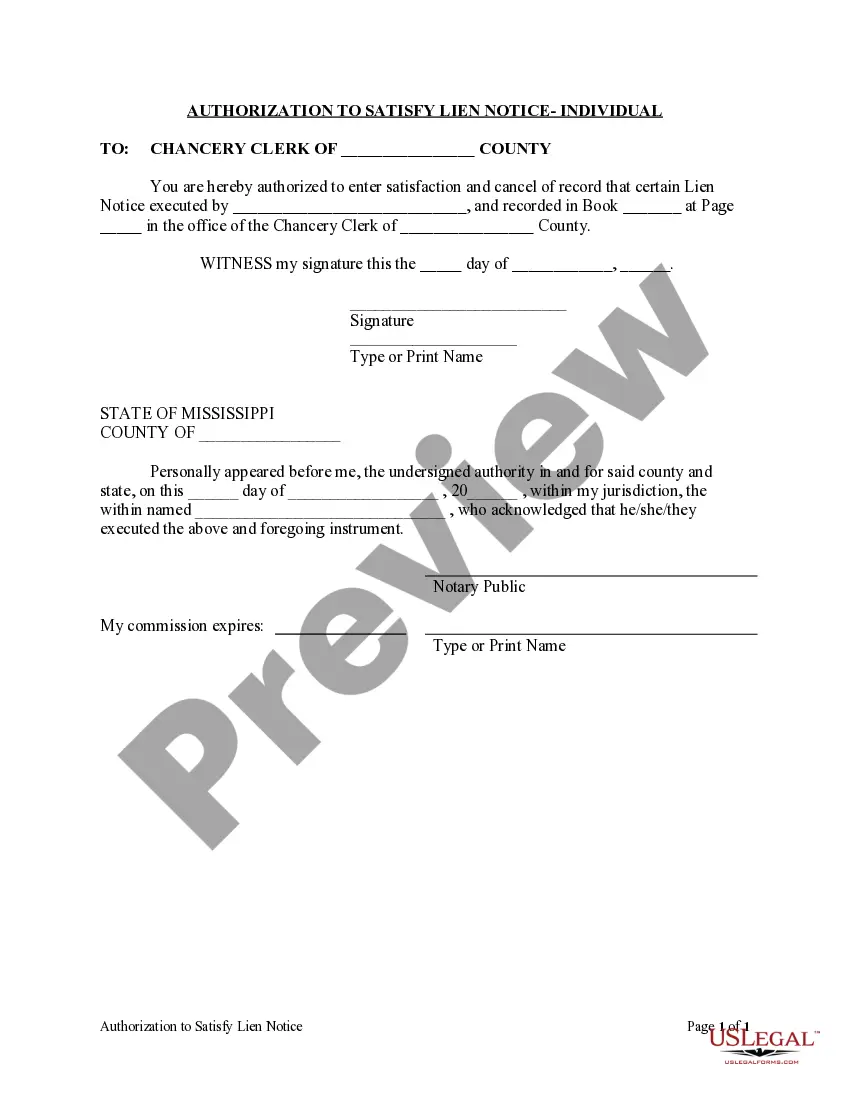

This Authorization to Satisfy Lien Notice form is for use by an individual and is signed by the court clerk's office, which states that the lien has been satisfied. Therefore, due to the satisfaction of the lien, it should be removed from the record books, as being active on a particular parcel of property.

Mississippi Authorization to Satisfy Lien Notice - Individual

Description

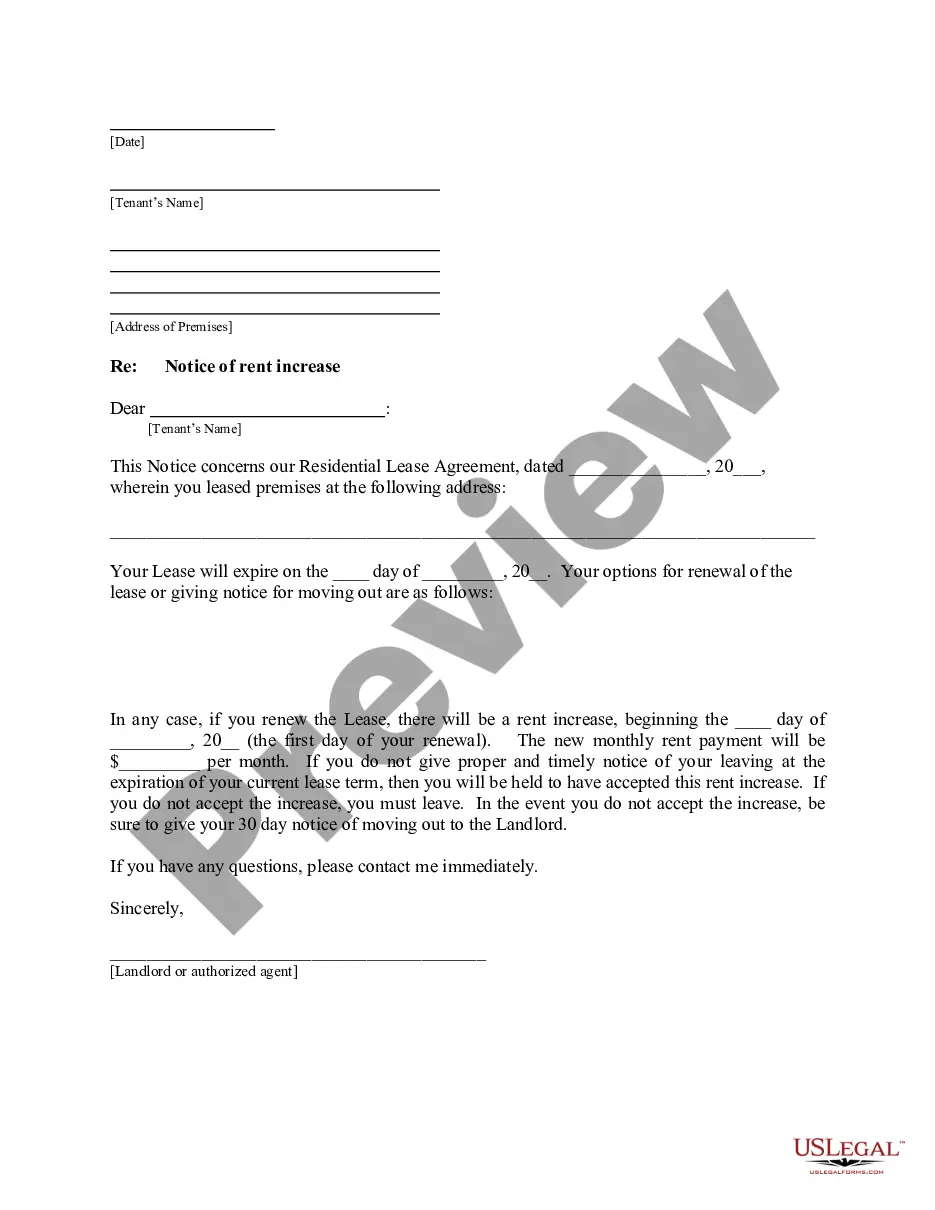

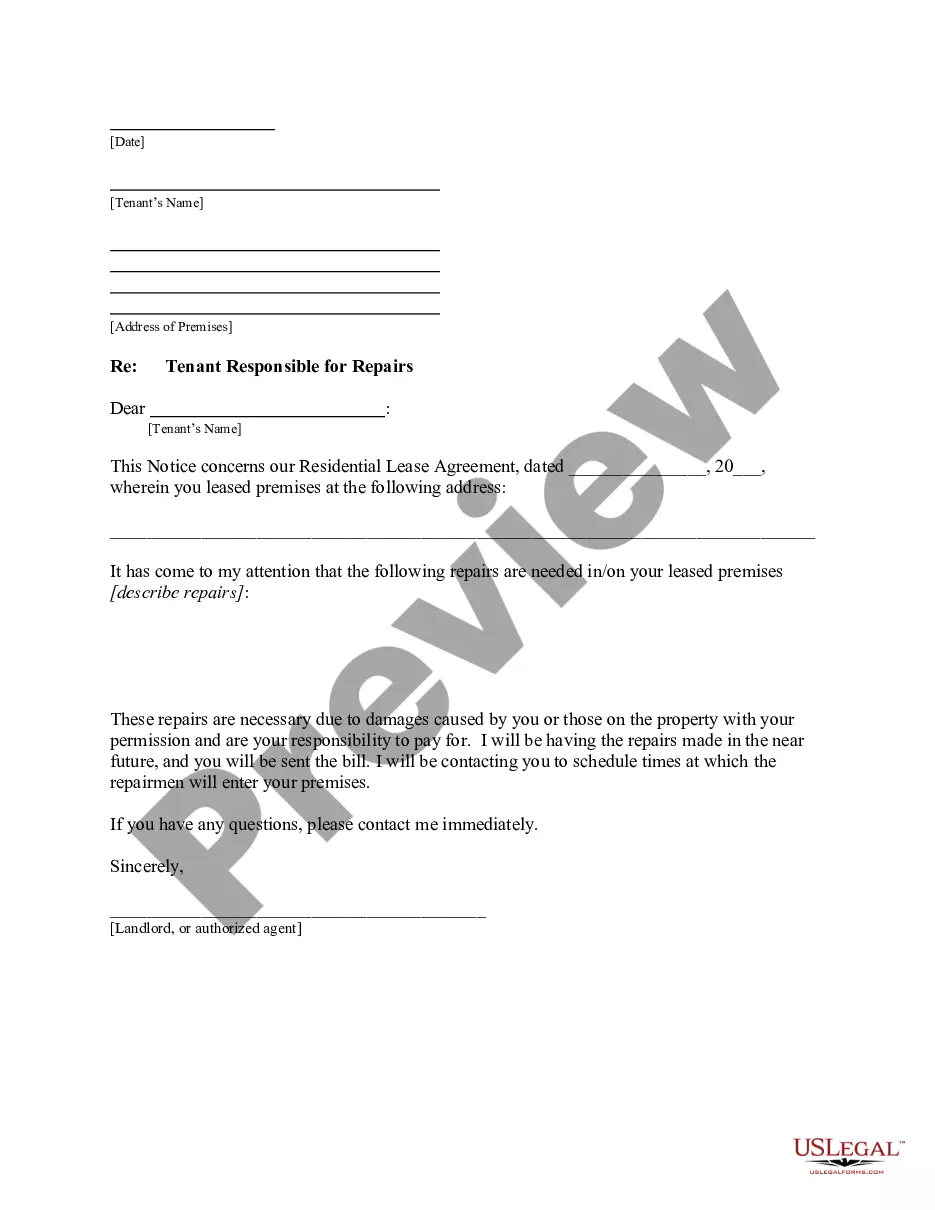

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Mississippi Authorization To Satisfy Lien Notice - Individual?

Acquire a printable Mississippi Authorization to Satisfy Lien Notice - Individual with just a few clicks in the most extensive collection of legal e-forms.

Discover, download and print professionally created and authenticated samples on the US Legal Forms platform. Since 1997, US Legal Forms has been the leading provider of affordable legal and tax documents for US citizens and residents online.

After you have downloaded your Mississippi Authorization to Satisfy Lien Notice - Individual, you can fill it out in any online editor or print it and complete it manually. Utilize US Legal Forms to access 85,000 professionally drafted, state-specific documents.

- Clients who already possess a subscription must sign in to their US Legal Forms account, download the Mississippi Authorization to Satisfy Lien Notice - Individual, and locate it saved in the My documents section.

- Clients who lack a subscription need to complete the following steps.

- Ensure your template complies with your state's regulations.

- If available, review the form’s description for further details.

- If provided, examine the form to uncover additional content.

- Once you are sure the template is suitable for you, click on Buy Now.

- Establish a personal account.

- Choose a subscription plan.

- Pay via PayPal or Visa or Mastercard.

Form popularity

FAQ

Formalize a defense for disputing the amount of the lien. Gather supporting documentation for your rebuttal, depending on the type of lien. Contact the agent representing the creditor to dispute the amount of the claim. Negotiate a payment settlement with the creditor if you cannot pay the amount you owe in full.

The simplest way to prevent liens and ensure that subcontractors and suppliers are paid is to pay with joint checks. This is when both parties endorse the check. Compare the contractor's materials or labor bill to the schedule of payments in your contract and the Preliminary Notices.

Be in substantial compliance with the contract or purchase order; File claim of lien within 90 days; Include in the lien a statement of amount due and due date of the claim; Notice the filing of claim of lien within 2 days to contractor and owner;

A lien is a legal claim against your property to secure payment of your tax debt, while a levy actually takes the property to satisfy the tax debt.When filed, the Notice of Federal Tax Lien is a public document that alerts other creditors that the IRS is asserting a secured claim against your assets.

What Is a Fraudulent Lien?the claimant is owed money on another job by the same general contractor or property owner, but didn't file a lien on that project before time expired; or. the claimant wants to file a lien because of personal reasons generally related to the identity of the property owner.

If a creditor puts a lien on your property, you may make an offer to settle the amount for less than you owe. As part of the negotiations, get the creditor to agree to release the lien. If you need help in the negotiations, consider hiring a debt settlement lawyer to help you.

While it's unlikely that just anyone can put a lien on your home or land, it's not unheard of for a court decision or a settlement to result in a lien being placed against a property.

If a creditor gets a judgment against you, it can then place a lien on your property. The lien gives the creditor an interest in your property so that it can get paid for the debt you owe.And in some cases, the lien gives the creditor the right to force a sale of your property in order to get paid.

The Tax-Forfeited Inventory200b link provides access to the properties available for sale or you may contact the Public Lands Division in the Secretary of State's Office at 601-359-5156 or toll free (in-state) at 1-866-TFLANDS(835-2637). Approximately how long does the process take?