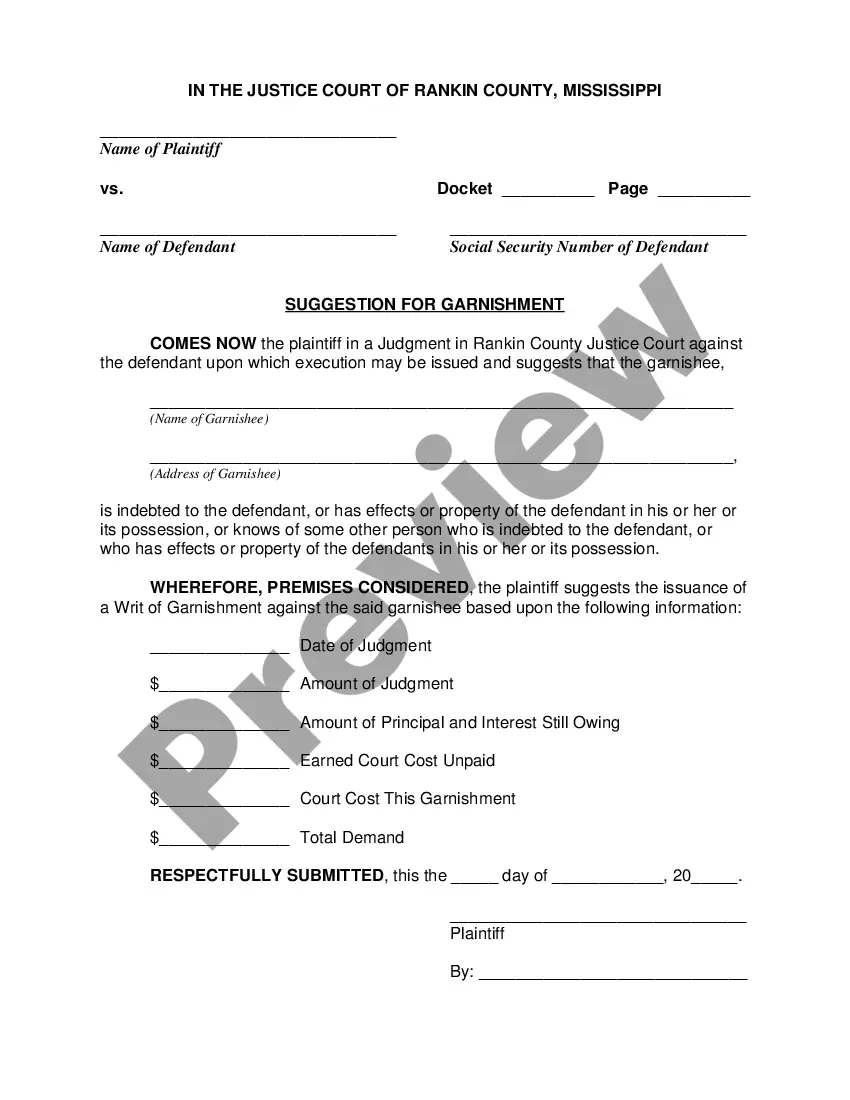

Mississippi Suggestion for Writ of Garnishment

Description

How to fill out Mississippi Suggestion For Writ Of Garnishment?

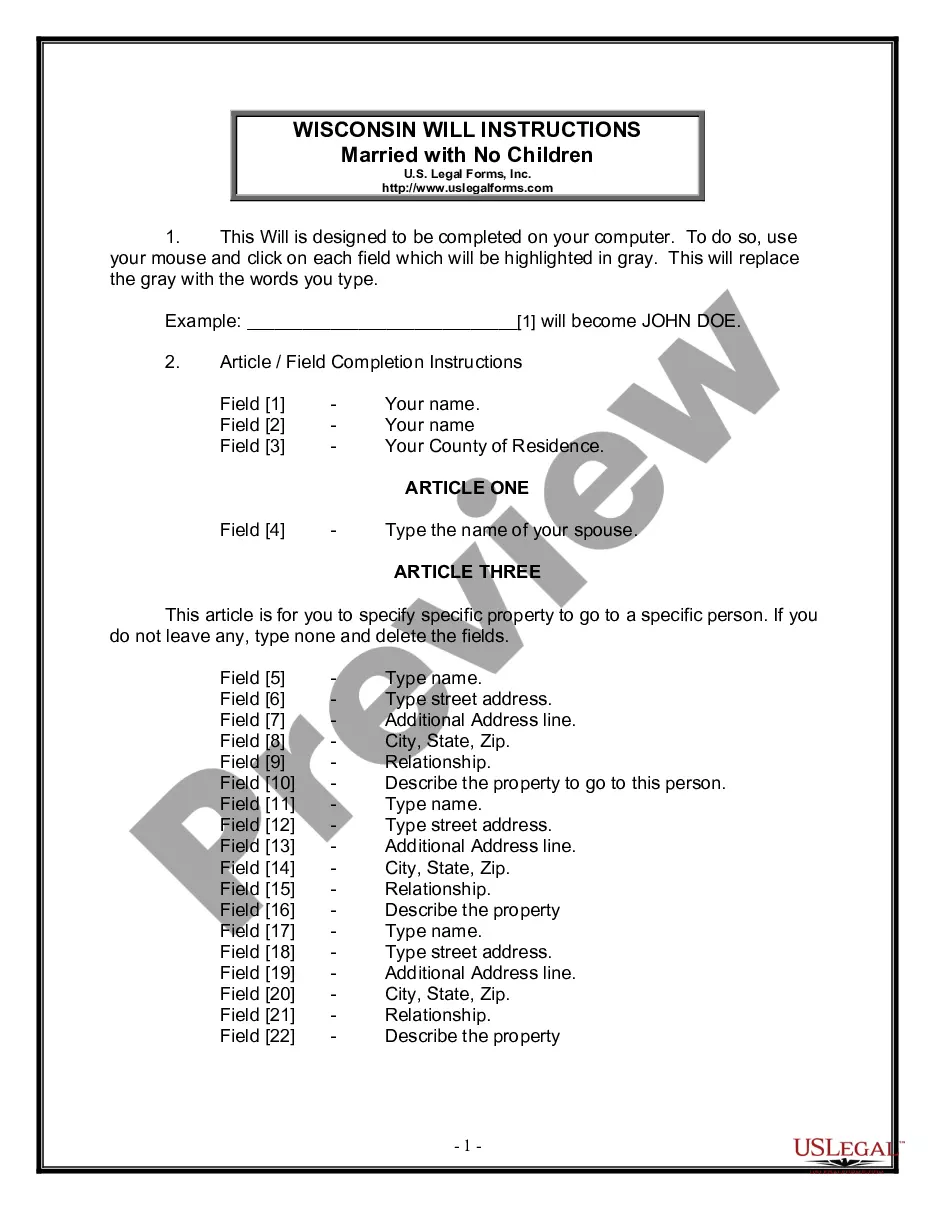

Obtain a printable Mississippi Suggestion for Writ of Garnishment in just several clicks in the most extensive catalogue of legal e-files. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms is the #1 supplier of affordable legal and tax forms for US citizens and residents on-line since 1997.

Customers who have a subscription, need to log in in to their US Legal Forms account, get the Mississippi Suggestion for Writ of Garnishment and find it stored in the My Forms tab. Customers who do not have a subscription are required to follow the tips listed below:

- Make certain your form meets your state’s requirements.

- If provided, read the form’s description to find out more.

- If accessible, preview the form to find out more content.

- Once you are confident the template fits your needs, simply click Buy Now.

- Create a personal account.

- Choose a plan.

- through PayPal or credit card.

- Download the template in Word or PDF format.

When you’ve downloaded your Mississippi Suggestion for Writ of Garnishment, it is possible to fill it out in any online editor or print it out and complete it by hand. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific files.

Form popularity

FAQ

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

If it's already started, you can try to challenge the judgment or negotiate with the creditor. But, they're in the driver's seat, and if they don't allow you to stop a garnishment by agreeing to make voluntary payments, you can't really force them to. You can, however, stop the garnishment by filing a bankruptcy case.

The creditor must serve the Writ of Garnishment on the garnishee via certified mail, restricted delivery, private process, or sheriff/constable. For more information on service of process see Frequently Asked Questions about Service.

Wage garnishment can follow a debtor from job to job, but it requires separate court orders. This means a creditor will need to request the wage garnishment every time a person changes jobs.

Identify The Funds Or Asset You Want To Collect. Prepare The Writ Of Execution. Prepare The Notice of Execution. Prepare The Writ Of Garnishment. Prepare Instructions To The Sheriff Or Constable. Have Your Papers Served And Watch For A Claim Of Exemption. Track Your Collection And Judgment.

The Order dissolves the existing writ of garnishment. It means that whatever was being garnished, wages or bank accounts, are no longer subject to the writ of garnishment.

Your bank isn't required to notify you of an account garnishment unless the withdrawal overdraws your balance. Depending on where you live, you may have certain rights and protections against having your bank account garnished.

What you can do about wage garnishment.You have to be legally notified of the garnishment. You can file a dispute if the notice has inaccurate information or you believe you don't owe the debt. Some forms of income, such as Social Security and veterans benefits, are exempt from garnishment as income.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.