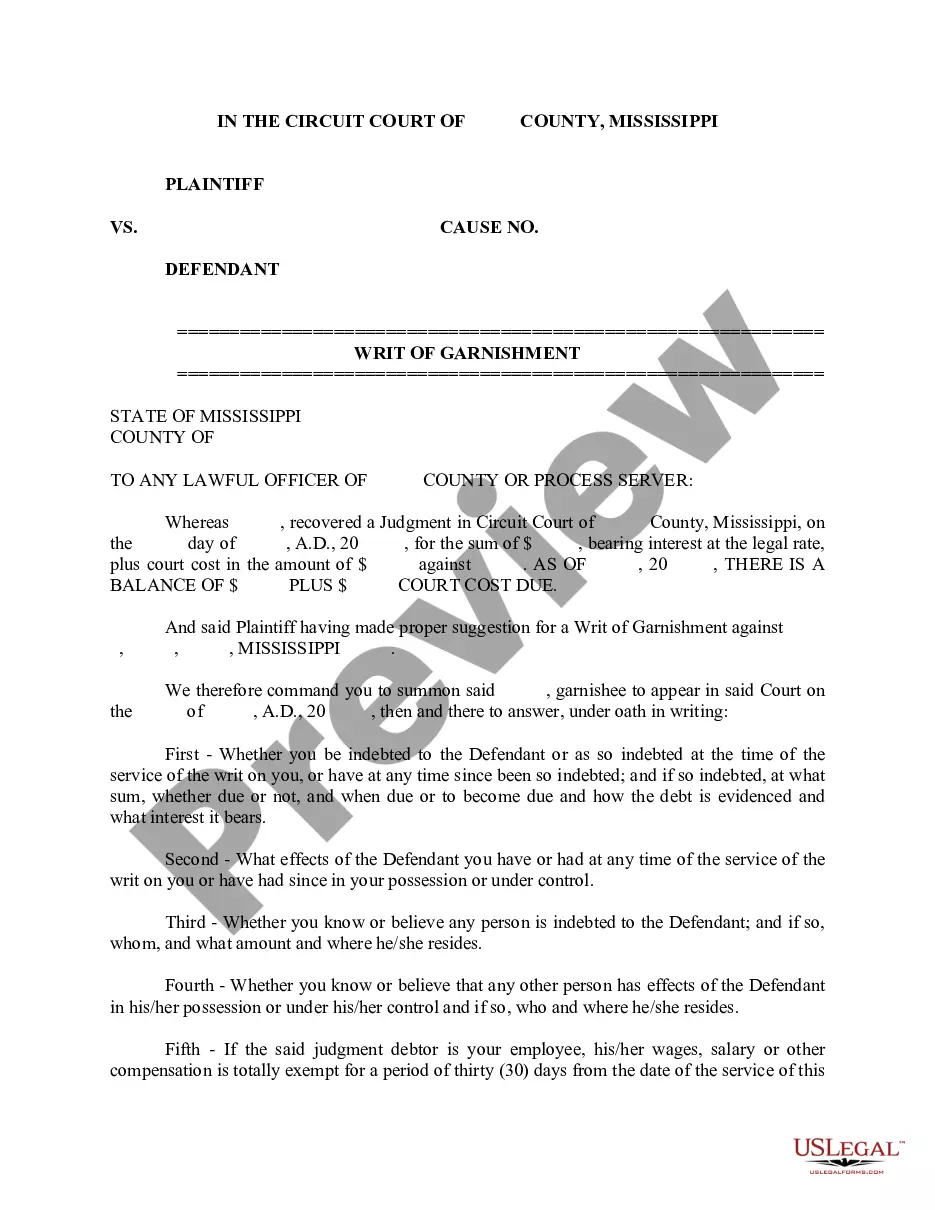

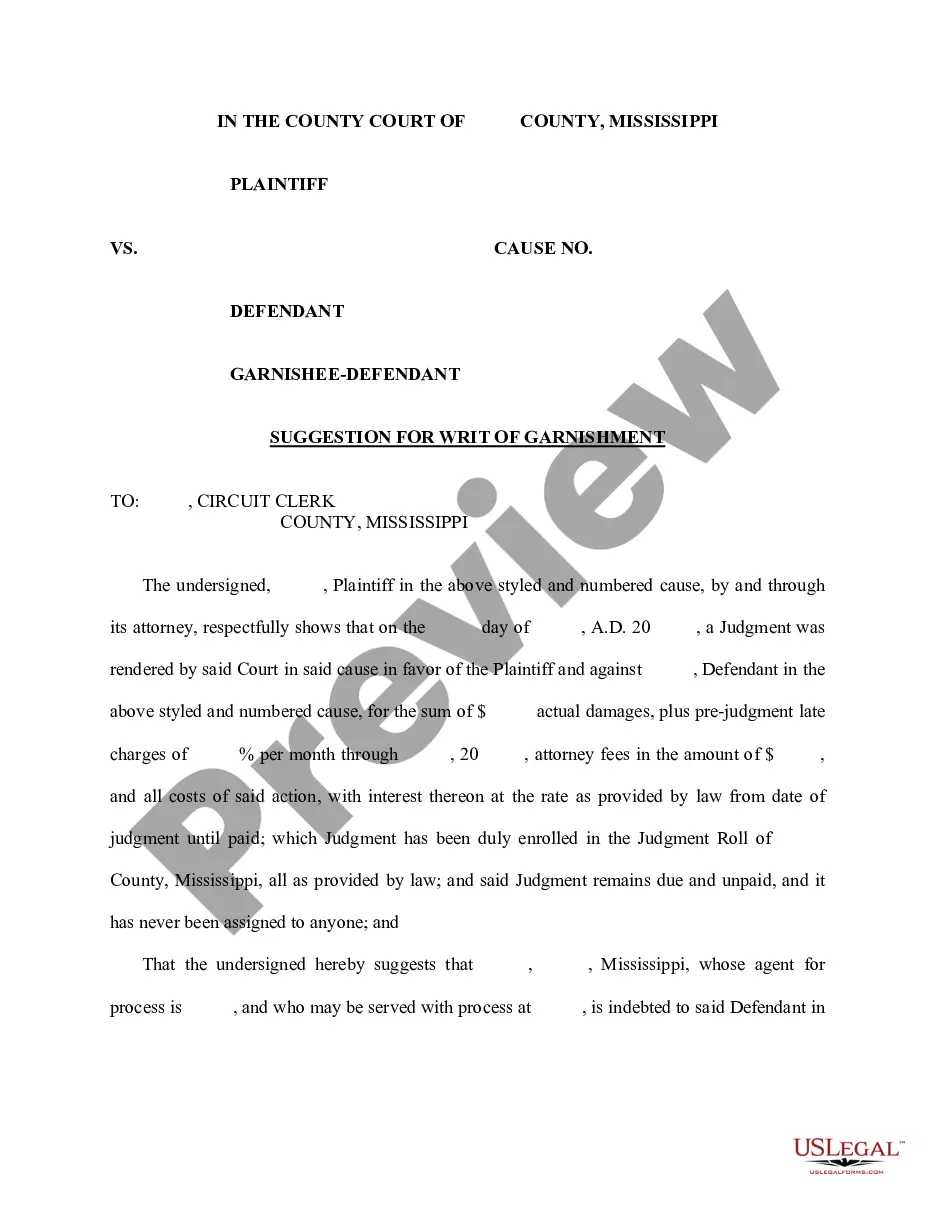

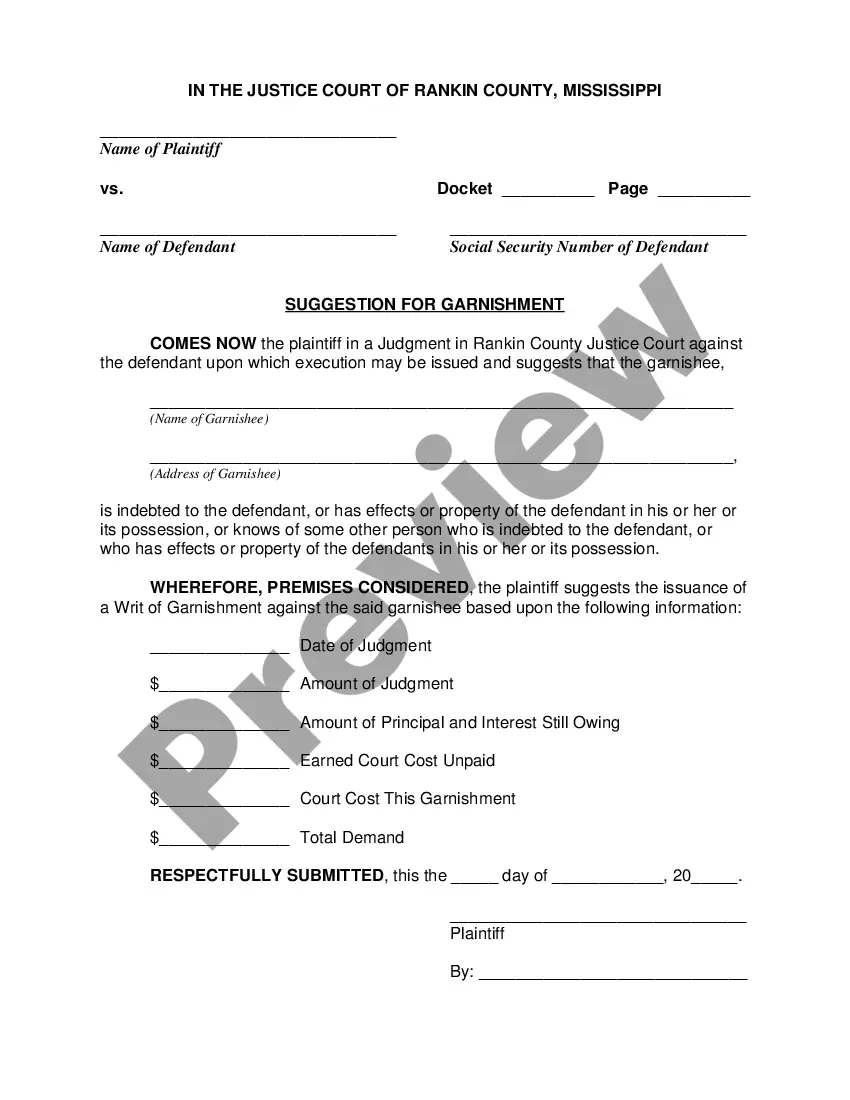

This is an official Rankin County Mississippi Justice Court form that is used one is indebted or has effects or property to the other party.

Mississippi Suggestion for Garnishment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Mississippi Suggestion For Garnishment?

Acquire a printable Mississippi Suggestion for Garnishment in just a few clicks from the most extensive collection of legal e-forms. Locate, download, and print professionally prepared and certified samples on the US Legal Forms website. US Legal Forms has been the leading provider of affordable legal and tax templates for US citizens and residents online since 1997.

Users who already have a subscription need to Log In to their US Legal Forms account, download the Mississippi Suggestion for Garnishment, and find it saved in the My documents section. Customers without a subscription must follow the steps below.

After downloading your Mississippi Suggestion for Garnishment, you can fill it out in any online editor or print it out and complete it by hand. Utilize US Legal Forms to access 85,000 professionally drafted, state-specific forms.

- Ensure your form complies with your state’s requirements.

- If provided, review the form’s description to learn more.

- If available, preview the form to see additional content.

- Once you’re certain the form meets your needs, click Buy Now.

- Create a personal account.

- Select a plan.

- Pay via PayPal or credit card.

- Download the template in Word or PDF format.

Form popularity

FAQ

In Mississippi, your wages cannot be garnished without your knowledge in most cases. In the majority of instances, your creditor must first file and win a lawsuit against you before garnishment is even a question. If the court rules in the creditor's favor, it can then award a judgment against you.

This current liability account reports the amount a company must remit to a court or other agencies for amounts withheld from its employees' salaries and wages.

There is no wage garnishment tax deduction that can automatically reduce your income tax if you have wages garnished. However, if your wages are being garnished to pay a tax-deductible expense, like medical debt, you may be able to deduct those payments.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

Go to Employees, then choose the Employee's name. In the Deductions and Contributions section, select Edit. Select Add a Garnishment. Select a garnishment type, then enter the required information. Field. Select Save, then OK.

The journal entry will be Debit Gross Wages, and Credit "Child Support Liability account." When you write the check to pay the garnishment, on the Expenses tab, you list the Child Support Liability account.