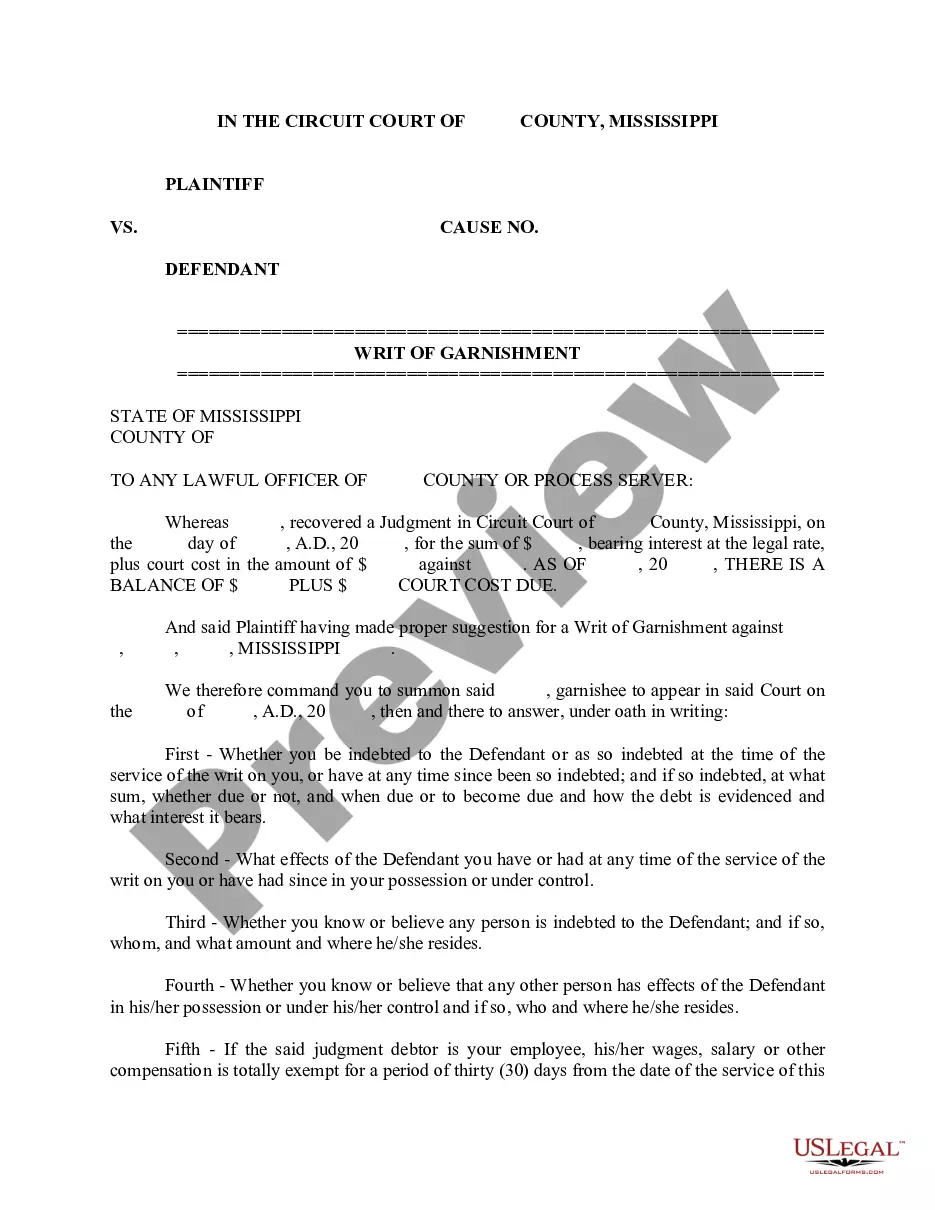

Mississippi Writ of Garnishment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

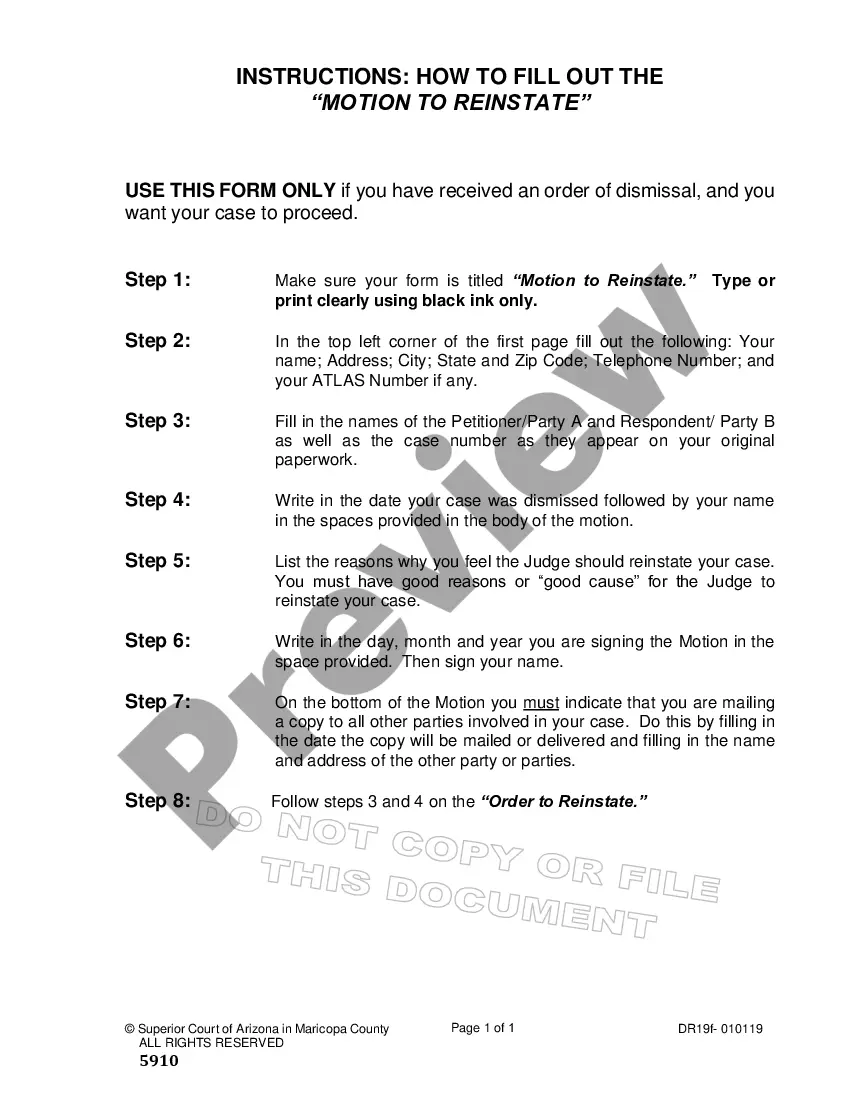

How to fill out Mississippi Writ Of Garnishment?

Acquire a printable Mississippi Writ of Garnishment in just a few clicks from the most extensive collection of legal electronic forms.

Locate, download, and print professionally composed and certified samples on the US Legal Forms website. US Legal Forms has been the leading provider of budget-friendly legal and tax templates for US citizens and residents online since 1997.

After you have downloaded your Mississippi Writ of Garnishment, you can fill it out in any online editor or print it and complete it manually. Utilize US Legal Forms to access 85,000 professionally drafted, state-specific documents.

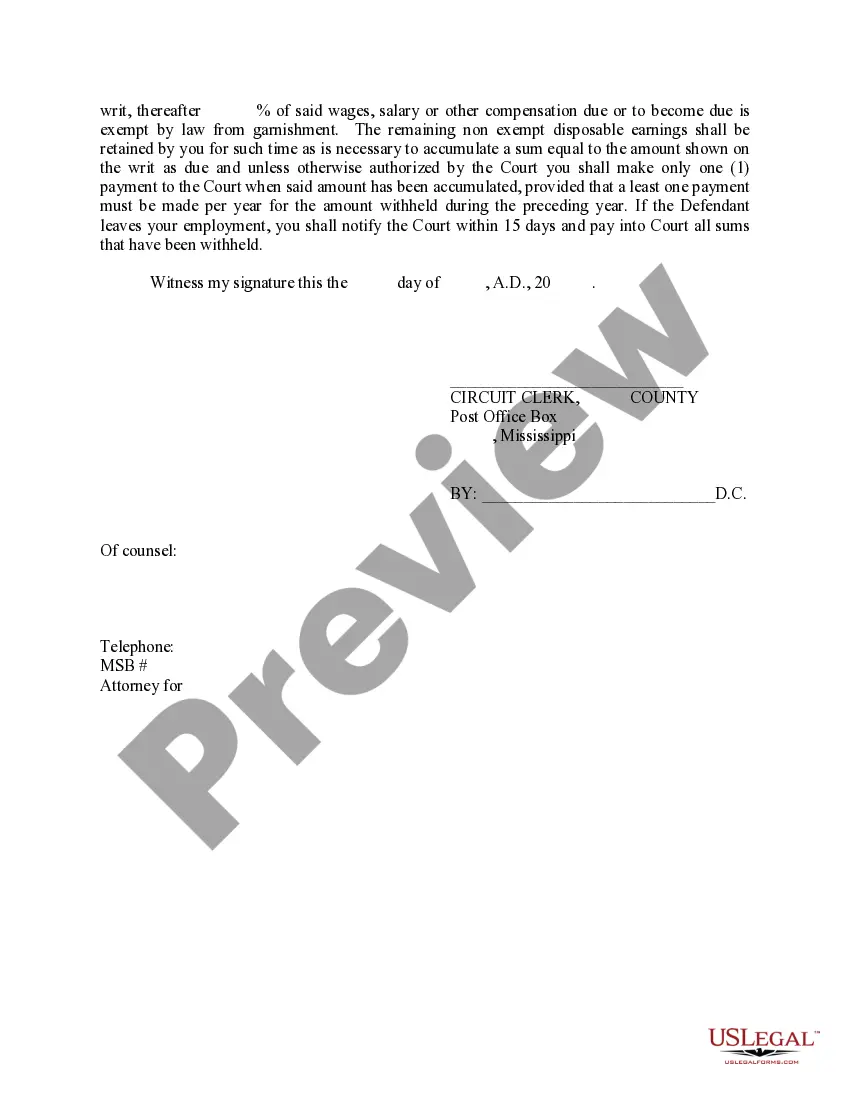

- Users with a subscription must Log In directly to their US Legal Forms account, download the Mississippi Writ of Garnishment, and find it saved in the My documents section.

- Customers without a subscription must adhere to the following steps.

- Ensure your template complies with your state's regulations.

- If accessible, review the form's description for additional information.

- If accessible, preview the form to discover more content.

- Once you are confident that the form meets your needs, simply click Buy Now.

- Create a personal account.

- Select a plan.

- Pay through PayPal or Visa or Mastercard.

Form popularity

FAQ

In order to ensure that you have sufficient wages for living expenses and necessities, Mississippi law limits the amount that may be garnished to the lesser of: 25 percent of your disposable earnings or 30 times the federal minimum wage.

The creditor must serve the Writ of Garnishment on the garnishee via certified mail, restricted delivery, private process, or sheriff/constable. For more information on service of process see Frequently Asked Questions about Service.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

What you can do about wage garnishment.You have to be legally notified of the garnishment. You can file a dispute if the notice has inaccurate information or you believe you don't owe the debt. Some forms of income, such as Social Security and veterans benefits, are exempt from garnishment as income.

It means that the court order to your employer to garnish your wages is dismissed. However, if you still owe money to the creditor, the creditor still can pursue you through other channels including if you start a new job elsewhere.

It releases your garnishment! When a creditor sues you, they eventually get a judgment in court. With this judgment, they can send a letter to your employer so that they can garnish your wages.A release of garnishment would stop any future garnishments.

In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

The Order dissolves the existing writ of garnishment. It means that whatever was being garnished, wages or bank accounts, are no longer subject to the writ of garnishment.