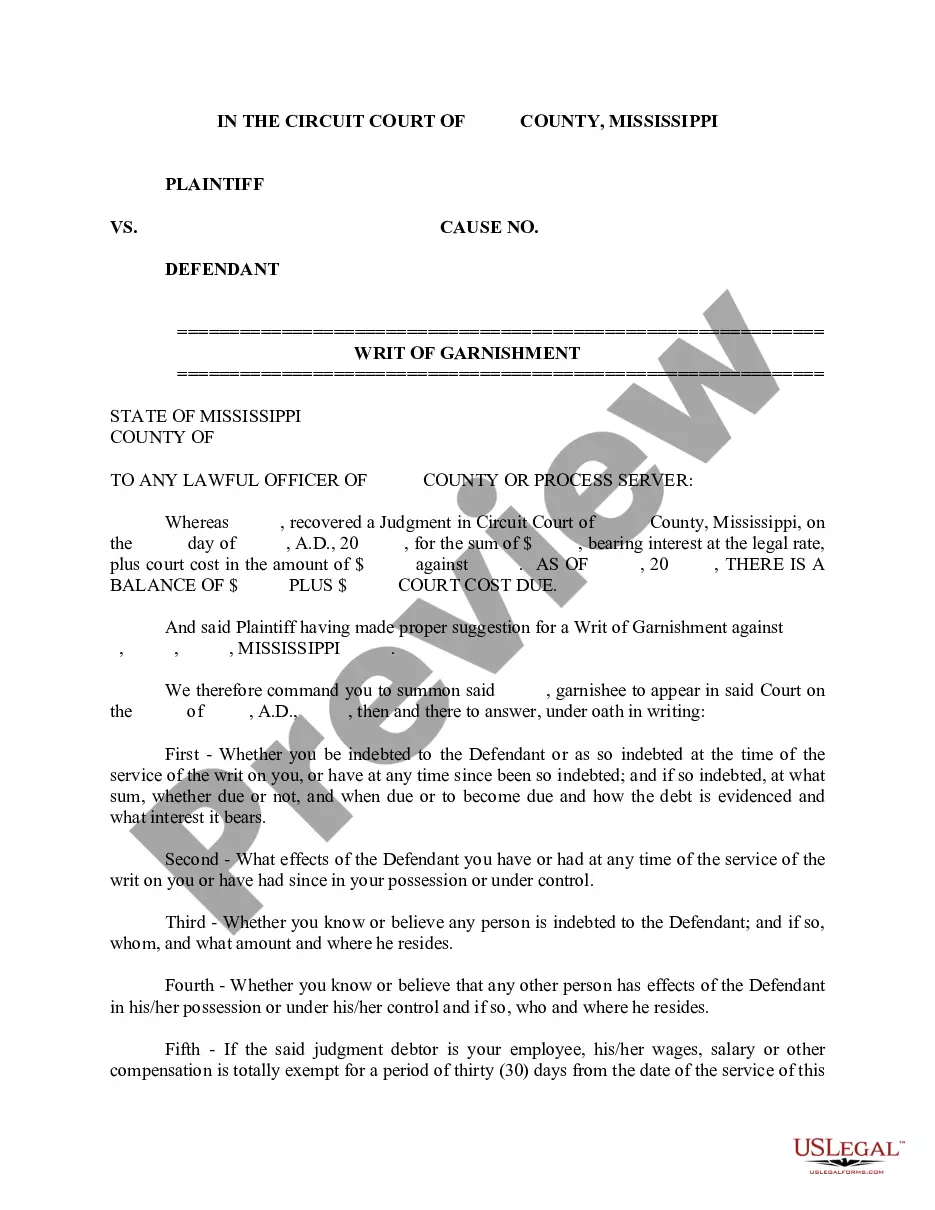

Mississippi Writ of Garnishment

What is this form?

A Writ of Garnishment is a legal order issued by the court that allows a creditor to collect a debt directly from a third party, typically an employer, who owes money to the debtor. This form is used when the plaintiff proves that the defendant has failed to pay a debt or satisfy a judgment. It is distinct from other legal forms, as it specifically targets the wages or assets of the defendant through garnishment proceedings.

Form components explained

- Identification of the debt owed by the defendant.

- Details regarding any assets the defendant may have in possession or control.

- Information on third parties who may owe money or hold assets belonging to the defendant.

- Verification of the nature and amount of any debts related to the defendant.

Situations where this form applies

This form should be used when a creditor has obtained a court judgment against a debtor and needs to enforce that judgment through garnishment. It is applicable in situations where a debtor has not paid their debts, allowing the creditor to collect a portion of the debtor's wages directly from their employer or other sources of income. It may also be relevant if the creditor needs to identify assets that the debtor owns.

Who can use this document

- Creditors who have won a judgment in court against a debtor.

- Employers who have been served with a Writ of Garnishment for one of their employees.

- Individuals seeking to understand their rights and obligations related to garnishment actions.

Steps to complete this form

- Identify all parties involved, including the plaintiff and defendant.

- Detail the amount owed by the debtor and how this amount is evidenced.

- List any assets or possessions you have from the defendant.

- Include information on any third parties who may owe money or have control over the debtor's assets.

- Review the completed form for accuracy and ensure it meets state-specific requirements.

Does this form need to be notarized?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to provide the correct names or addresses of parties involved.

- Not including all necessary details about the outstanding debt.

- Omitting relevant third-party information that could affect the garnishment.

- Submitting the form without verifying compliance with local laws.

Why complete this form online

- Convenience of completing the form from anywhere at any time.

- Editability allows quick revisions and personalization as needed.

- Access to legally vetted templates drafted by licensed attorneys.

What to keep in mind

- A Writ of Garnishment is a court order to collect debts directly from a third party.

- Complete the form accurately to avoid delays in enforcement.

- Understand state-specific rules and guidelines to ensure validity.

Looking for another form?

Form popularity

FAQ

Garnishment is a proceeding by a creditor (a person or entity to whom money is owed) to collect a debt by taking the property or assets of a debtor (a person who owes money). Wage garnishment is a court procedure where a court orders a debtor's employer to hold the debtor's earnings in order to pay a creditor.

It releases your garnishment! When a creditor sues you, they eventually get a judgment in court. With this judgment, they can send a letter to your employer so that they can garnish your wages.A release of garnishment would stop any future garnishments.

In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

The employer is also required to return a statutory response form within 7 days of receiving the writ of garnishment. This form is usually sent to the employer with the garnishment order. With very few exceptions, the employer is required to complete the form indicating that they will pay the garnishment.