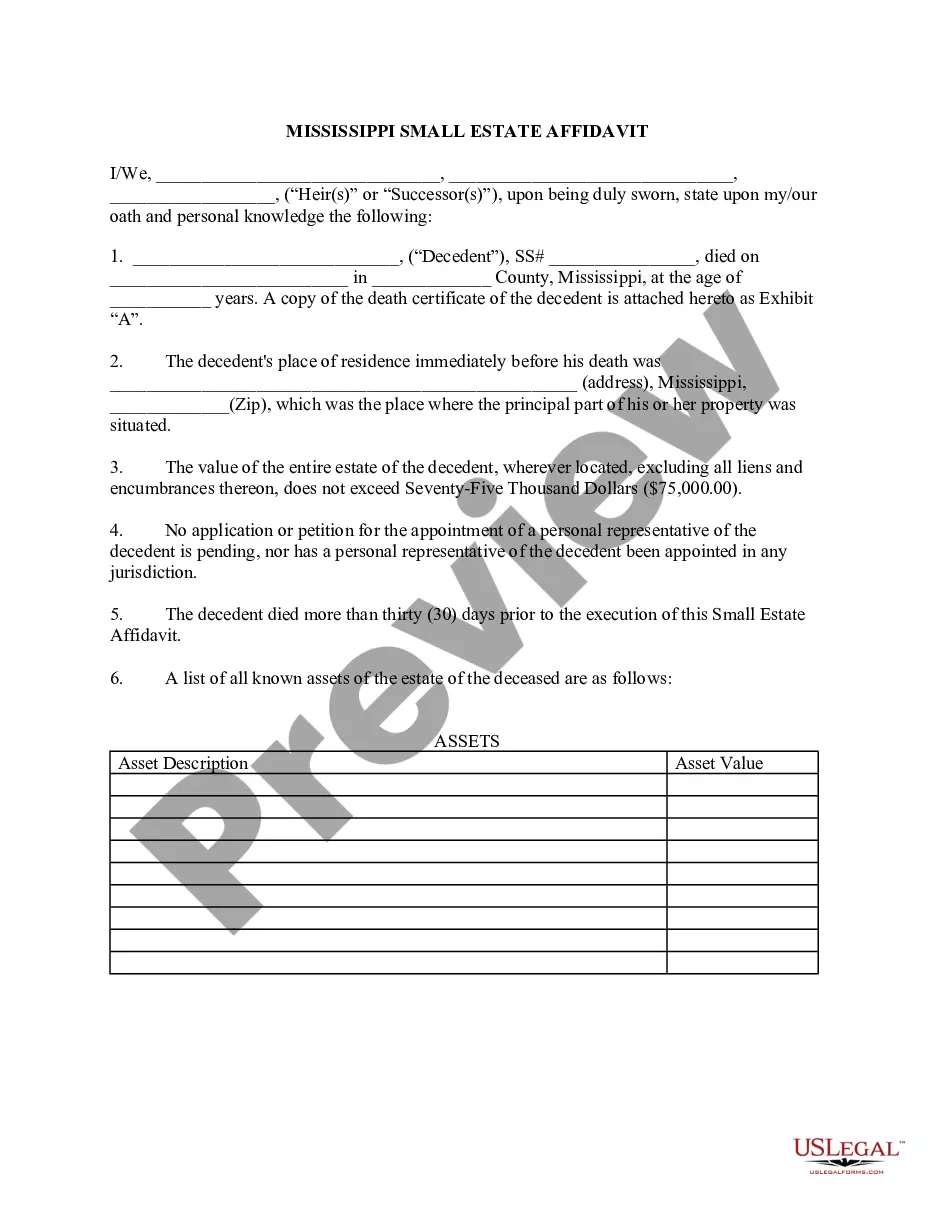

Mississippi Small Estate Affidavit for Estates under $75,000

Description

How to fill out Mississippi Small Estate Affidavit For Estates Under $75,000?

Acquire a printable Mississippi Small Estate Affidavit for Estates under $50,000 in just a few clicks from the largest collection of legal e-forms.

Locate, download, and print expertly prepared and certified templates on the US Legal Forms platform. US Legal Forms has been the leading provider of economical legal and tax documents for US citizens and residents online since 1997.

After downloading your Mississippi Small Estate Affidavit for Estates under $50,000, you can fill it out using any online editor or print it and complete it manually. Utilize US Legal Forms to access 85,000 expertly drafted, state-specific documents.

- Subscribers must sign in to their US Legal Forms account, download the Mississippi Small Estate Affidavit for Estates under $50,000, and find it saved in the My documents section.

- Non-subscribers need to follow the steps outlined below.

- Ensure your form aligns with your state’s regulations.

- If available, read the form’s description for additional information.

- If provided, examine the document for more content.

- Once you are confident the template suits your needs, click Buy Now.

- Create a personal account.

- Select a plan.

- Pay via PayPal or credit card.

- Download the document in Word or PDF format.

Form popularity

FAQ

In California for example, an estate valued at $150,000 or less may not need to go to court. In Nebraska, the threshold is $50,000 or less. Figuring out if your estate qualifies as small only takes a few simple steps.

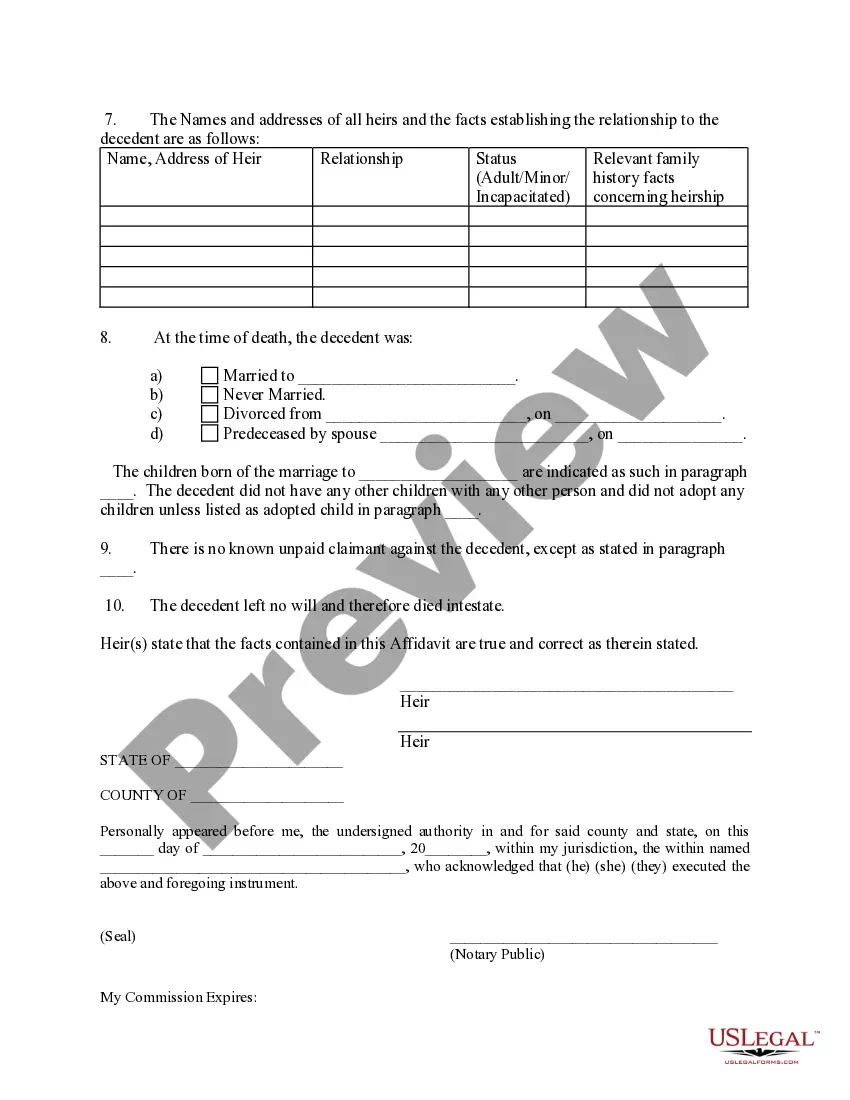

If a person dies without a will, Mississippi's laws of intestacy distribute the person's estate to his or her heirs at law.To establish heirs, the probate attorney files a Petition to Establish Heirs with the chancery court in the county where the decedent died or owned property.

In California, estates valued over $150,000, and that don't qualify for any exemptions, must go to probate.If a person dies and owns real estate, regardless of value, either in his/her name alone or as a "tenant in common" with another, a probate proceeding is typically required to transfer the property.

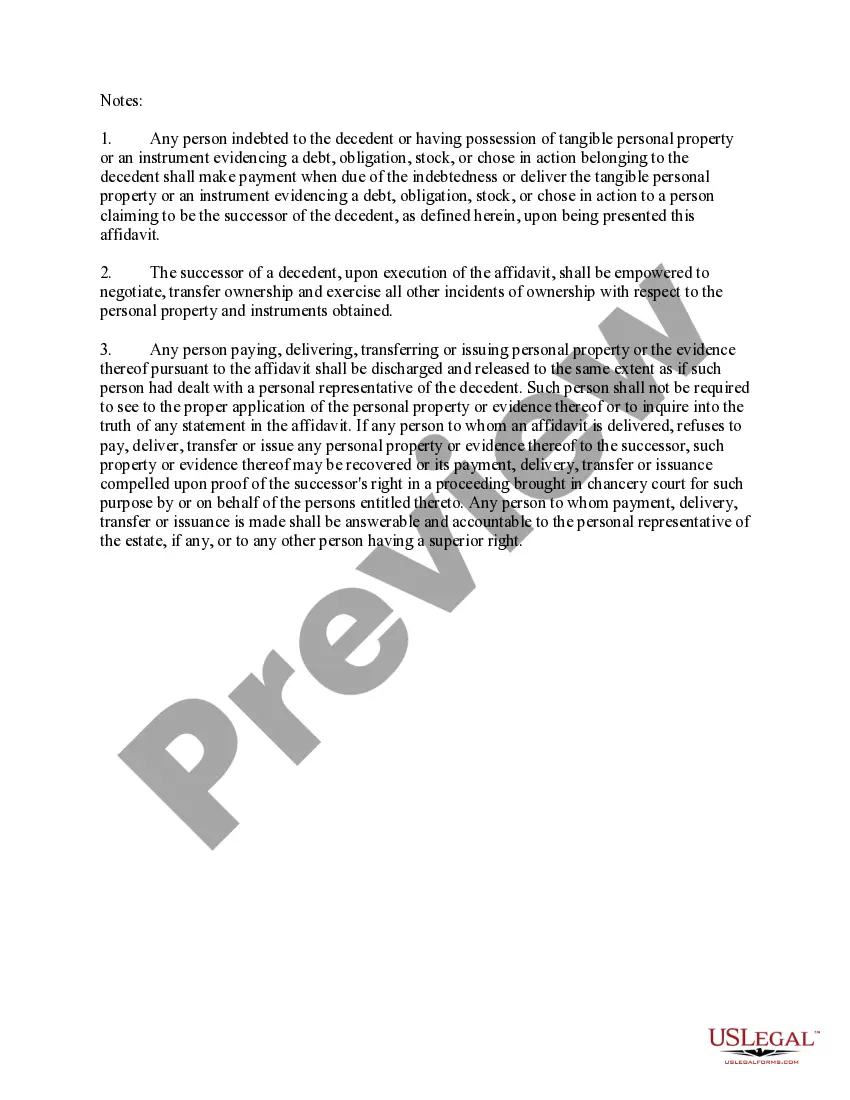

Most of the time, probate is required in Mississippi. Small estates may have a more informal version of probate, and there are other cases where probate isn't necessary. However, for most instances, probate is necessary to distribute the assets of the estate and transfer ownership to the heirs.

Net value of probate estate is $50,000 or less, or. Probate asset is bank account or accounts totaling no more than $12,500, or. Probate estate is $500 or less.

The executor will need to wait until the 2 month time limit is up, before distributing the estate. Six month limit to bring a claim in other cases, it can be sensible for the executors not to pay any beneficiaries until at least 6 months after receiving the grant of probate.

In the best of circumstances, the Mississippi probate process usually takes 4 to 6 months. This would only be possible if the estate was fairly simple, all interested parties are agreeable, and documents are signed and returned to the probate attorney in a timely manner.

To write a will, Mississippi law states you must be at least 18 years old, of sound and disposing mind, must intend the document to be your will and must have the written will validly executed. Upon your death, your will must go through probate, a court proceeding that declares the will valid or invalid.

In Mississippi, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).