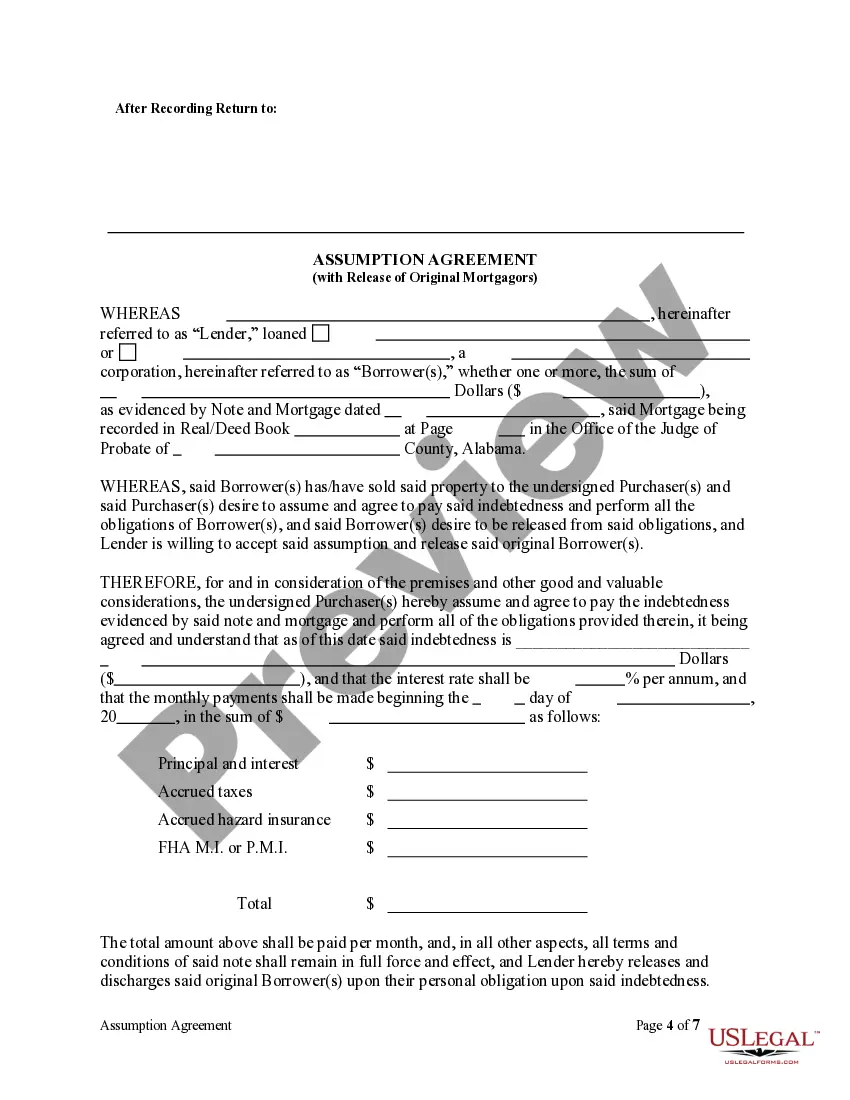

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

Alabama Assumption Agreement of Mortgage and Release of Original Mortgagors

Description

How to fill out Alabama Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

Utilizing Alabama Assumption Agreement of Mortgage and Release of Original Mortgagors templates crafted by professional lawyers enables you to sidestep complications when filling out documents.

Just download the template from our site, complete it, and request an attorney to review it. This approach can significantly save you more time and effort than seeking a legal expert to prepare a document for you.

If you possess a US Legal Forms membership, simply Log In to your profile and return to the sample page. Locate the Download button adjacent to the template you are examining. After downloading a template, all your saved samples will be found in the My documents section.

Once you have completed all the steps mentioned above, you will be able to fill out, print, and sign the Alabama Assumption Agreement of Mortgage and Release of Original Mortgagors template. Remember to double-check all entered information for accuracy before submitting or dispatching it. Minimize the time taken to complete documents with US Legal Forms!

- When you lack a subscription, it's not an issue.

- Just adhere to the comprehensive instructions below to register for an account online, acquire, and fill out your Alabama Assumption Agreement of Mortgage and Release of Original Mortgagors template.

- Verify and ensure that you are obtaining the correct state-specific template.

- Utilize the Preview functionality and review the description (if accessible) to determine if you require this particular template and if so, simply click Buy Now.

- Search for another template using the Search field if necessary.

- Select a subscription that suits your preferences.

- Commence using your credit card or PayPal.

- Choose a file format and download your document.

Form popularity

FAQ

The process of mortgage assumption involves several key steps to ensure compliance with the Alabama Assumption Agreement of Mortgage and Release of Original Mortgagors. First, assess your mortgage terms for any assumption clauses. Following this, submit a formal request to your lender along with the new borrower's financial documentation. Once the lender approves, you will execute the required documents to complete the assumption, facilitating the transfer of obligations.

The process for mortgage assumption begins with reviewing the original mortgage documents and verifying if the Alabama Assumption Agreement of Mortgage and Release of Original Mortgagors allows it. After that, you’ll need to provide your lender with relevant information about the new borrower, such as their creditworthiness. Once approved, the lender will guide you through the necessary paperwork to finalize the assumption. This structured process helps ensure a seamless transition.

When considering the Alabama Assumption Agreement of Mortgage and Release of Original Mortgagors, it’s essential to understand potential downsides. One significant concern is the possibility of assuming a higher interest rate, which can affect your monthly payments. Additionally, the original borrower may still be liable for the mortgage, leading to complications if issues arise. Lastly, the lender may impose restrictions or fees, making the process more complicated than anticipated.

The assumption agreement primarily serves to allow a new borrower to take over a mortgage previously held by another. In the case of the Alabama Assumption Agreement of Mortgage and Release of Original Mortgagors, it facilitates the smooth transfer of responsibility, ensuring that the lender receives payments without disruption. Additionally, this agreement helps the original mortgagor breathe easy, knowing they are no longer liable for the mortgage. Clear terms in this agreement prevent misunderstanding and protect everyone's interests.

An assumption and release agreement is a formal contract that outlines the transition of mortgage obligations from one party to another. Within the framework of the Alabama Assumption Agreement of Mortgage and Release of Original Mortgagors, it includes specific terms that detail how the new borrower will take over payments and liabilities. This document protects all parties by making sure everyone agrees on the terms of the mortgage. Such clarity minimizes future disputes.

An assumption and release refers to a legal process where one party takes over the obligations of another under a mortgage. In an Alabama Assumption Agreement of Mortgage and Release of Original Mortgagors, the new borrower assumes the remaining mortgage payments. At the same time, the original borrower is released from any future liabilities associated with the mortgage. This process benefits both the lender and the parties involved in ensuring clarity in responsibilities.

A release agreement serves the key purpose of formally freeing an individual or entity from liability under a contract. In the context of the Alabama Assumption Agreement of Mortgage and Release of Original Mortgagors, it releases the original mortgagor from their responsibilities once the mortgage has been assumed by another party. This is essential for both the new borrower and the lender. With a clear release, everyone understands their obligations.

To assume a mortgage, you typically need to provide various documents such as proof of income, credit history, and a completed assumption application. Lenders may also require a review of the original mortgage agreement and any other disclosures. The Alabama Assumption Agreement of Mortgage and Release of Original Mortgagors outlines the specific paperwork required, making the process easier for you.

One potential downside of an assumable mortgage is that it might come with specific terms and obligations that are less favorable than new loans. Additionally, not all mortgages are assumable, so you may face limitations depending on the type of mortgage involved. Understanding the Alabama Assumption Agreement of Mortgage and Release of Original Mortgagors helps you identify these disadvantages effectively.

Assuming a mortgage can be a smart financial move, especially if the current mortgage has a lower interest rate than the market average. However, buyers should weigh the overall costs and benefits, considering their financial situation. The Alabama Assumption Agreement of Mortgage and Release of Original Mortgagors provides clear guidance and support in making this important decision.