This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Warranty Deed in Lieu of Foreclosure, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

Florida Warranty Deed in Lieu of Foreclosure

Description

Key Concepts & Definitions

Warranty Deed in Lieu of Foreclosure: A legal document where a borrower conveys all ownership in a property to a lender in exchange for the cancellation of the mortgage debt. This aids in avoiding the foreclosure process. Mortgage Loan: A loan secured by the collateral of specified real estate property that the borrower is obliged to pay back with a predetermined set of payments. Deed in Lieu of Foreclosure: Often shortened to 'deed in lieu,' it involves transferring the title of your property voluntarily to the lender if you are unable to make mortgage payments, to avoid foreclosure.

Step-by-Step Guide to Obtaining a Warranty Deed in Lieu of Foreclosure

- Contact Your Mortgage Lender: Discuss your inability to make mortgage payments and express your interest in a deed in lieu of foreclosure.

- Financial Documentation: Provide your lender with all necessary documents proving your financial status, including debts, assets, and income statements.

- Agreement Negotiation: Review the terms provided by the lender, possibly with legal assistance, to understand the implications of the title transfer.

- Signing the Warranty Deed: After agreeing to the terms, sign the warranty deed that legally transfers the property title to the lender.

- Settlement and Release: Ensure all mortgage debts are settled as specified, and obtain documents releasing you from any further obligations.

Risk Analysis

- Credit Impact: Completing a deed in lieu can negatively impact your credit score, albeit potentially less so than a foreclosure.

- Eligibility Issues: Not all lenders accept a warranty deed in lieu of foreclosure, and it might not be available if there are other liens against the property.

- Future Mortgage Complications: Future lenders may view this as a negative mark on your credit report, affecting your ability to secure new loans.

Key Takeaways

- Consider a warranty deed in lieu of foreclosure as an alternative to avoid stressful foreclosure proceedings.

- It is essential to understand the full legal implications and how it affects your credit before proceeding.

- Always seek professional advice to navigate the process effectively.

Pros & Cons

- Pros: Avoids foreclosure; may reduce the negative impact on credit score; quicker resolution.

- Cons: Still damages credit score; not always guaranteed as a solution; possible tax implications.

Best Practices

Engage with a real estate attorney to provide guidance through the process. Keep open and honest communication with your lender to explore all available options for your situation. Ensure all agreements are documented and official releases are obtained post-transfer.

FAQ

Can a warranty deed in lieu of foreclosure stop a foreclosure once it's started? Yes, if agreed upon by the lender, it can halt the foreclosure process.

Are there any tax implications with a deed in lieu of foreclosure? Yes, forgiven debt may be treated as taxable income, though there are exceptions. Consult a tax professional.

How to fill out Florida Warranty Deed In Lieu Of Foreclosure?

The larger quantity of documents you should prepare - the more anxious you become.

You can find a vast amount of Florida Warranty Deed in Lieu of Foreclosure templates online, however, you are uncertain about which ones to trust.

Remove the difficulty and simplify finding samples using US Legal Forms.

Select Buy Now to initiate the registration process and choose a pricing plan that fits your needs. Enter the required information to create your account and process your payment via PayPal or credit card. Opt for a convenient file format and obtain your copy. Locate each file you receive in the My documents section. Just visit there to complete a new copy of the Florida Warranty Deed in Lieu of Foreclosure. Even with professionally prepared forms, it's still vital to consider consulting a local attorney to verify that your document is correctly completed. Achieve more for less with US Legal Forms!

- Obtain expertly prepared documents that are designed to meet state requirements.

- If you possess a US Legal Forms subscription, Log In to your account, and you will see the Download option on the Florida Warranty Deed in Lieu of Foreclosure page.

- If you are new to our service, complete the registration process with the following steps.

- Ensure the Florida Warranty Deed in Lieu of Foreclosure is applicable in your state.

- Verify your selection by reviewing the description or using the Preview feature if available for the chosen document.

Form popularity

FAQ

Yes, you can often obtain a copy of your warranty deed online, depending on your county's services. Many county clerks provide online access to public records. If you want an easy and reliable method to find your Florida Warranty Deed in Lieu of Foreclosure, you can utilize USLegalForms, which offers resources to help streamline your search.

Many counties in Florida allow you to access property deeds online through their official websites. Search for the public records section and enter your property's details to find your deed. If you need assistance, consider exploring USLegalForms, where you can find detailed information about securing a copy of your Florida Warranty Deed in Lieu of Foreclosure.

Finding a warranty deed in Florida involves checking with the county clerk’s office where the property is located. Most counties have online databases where you can search public records. You can also utilize platforms like USLegalForms to access the necessary forms and guides related to Florida Warranty Deeds in Lieu of Foreclosure.

The process to obtain a Florida Warranty Deed in Lieu of Foreclosure can take anywhere from a few weeks to several months. It largely depends on the lender's policies and the complexity of your situation. Once you and your lender agree on the terms, the paperwork must be filed with the county clerk. Ensure you have all required documents ready to expedite the process.

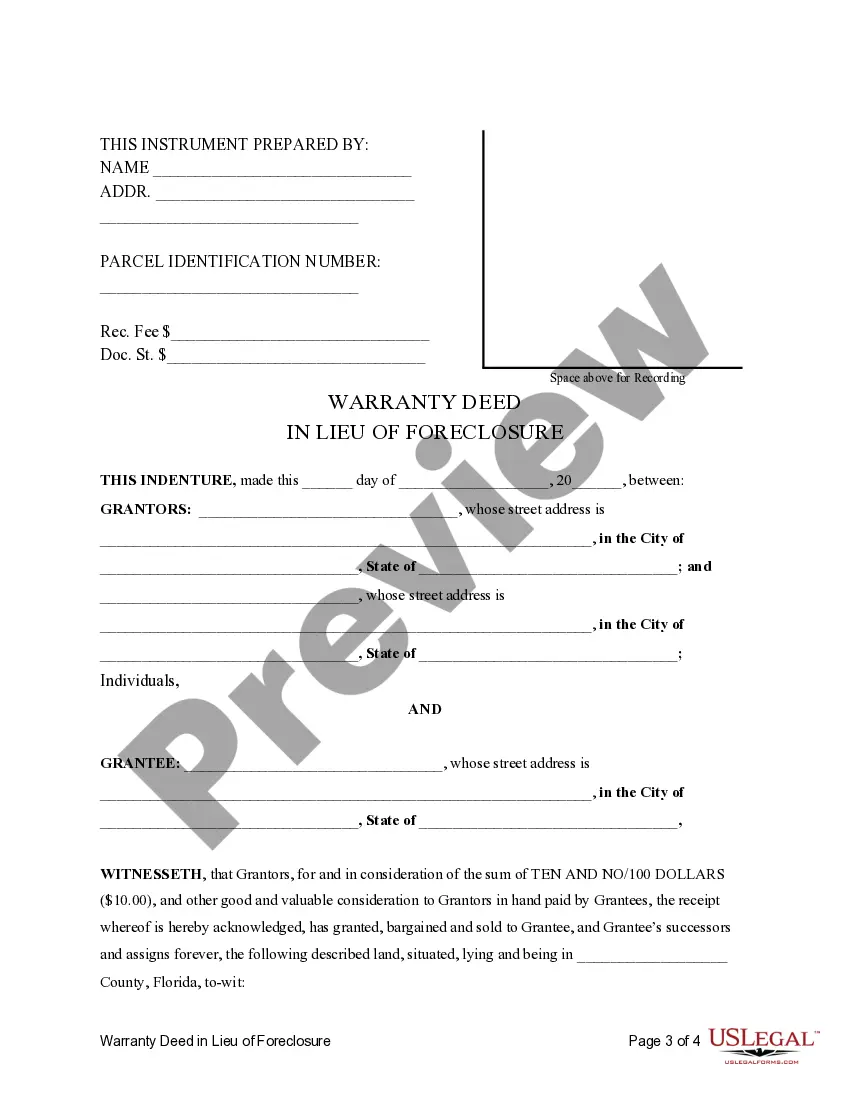

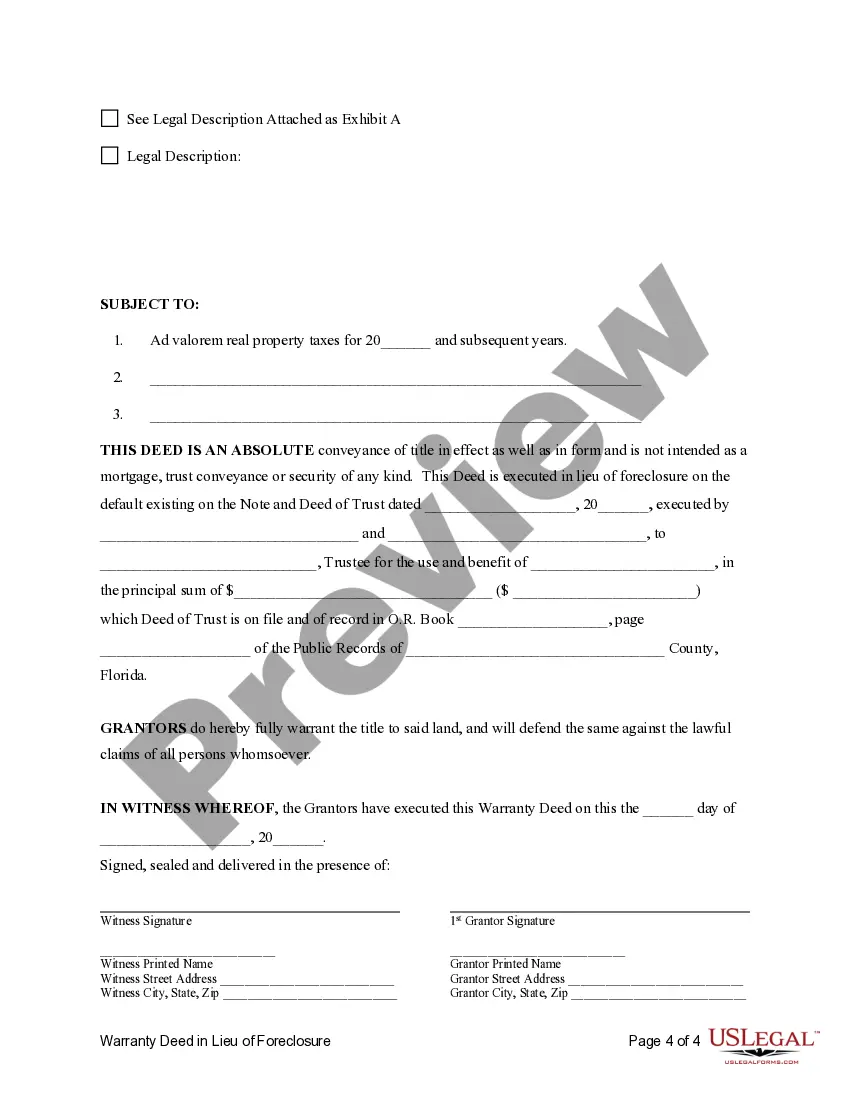

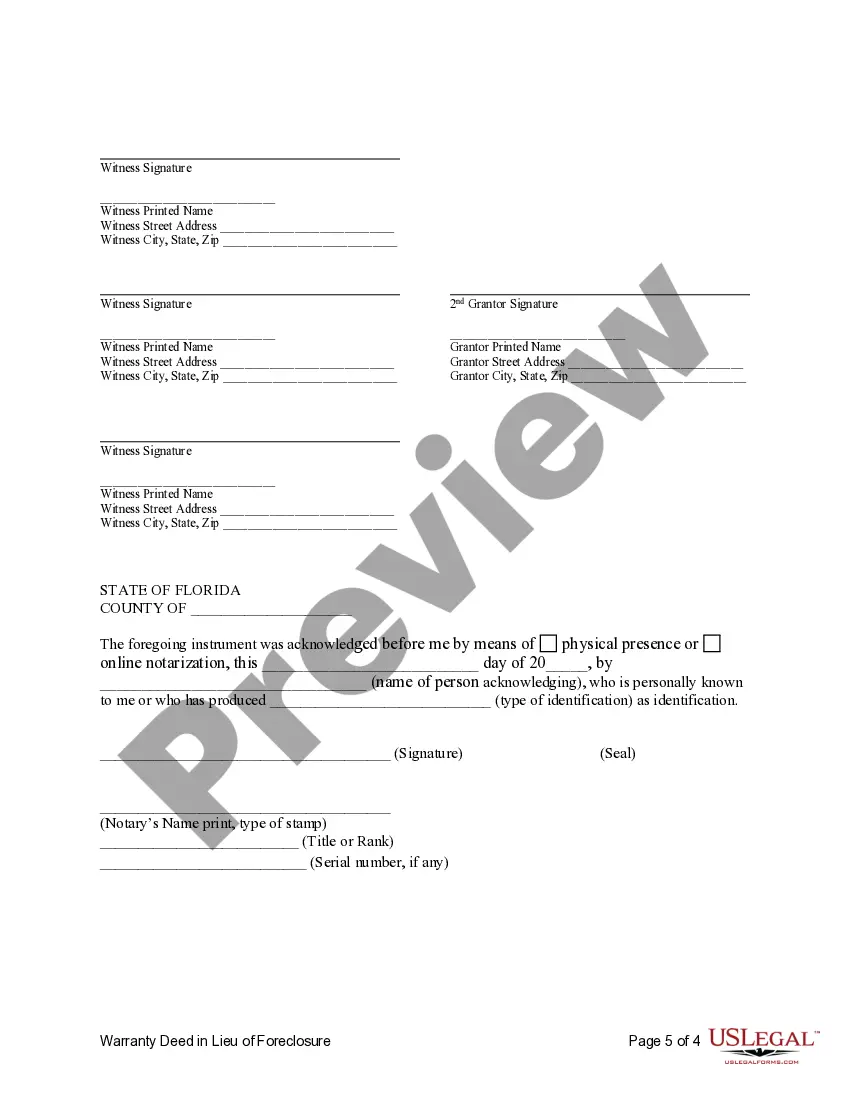

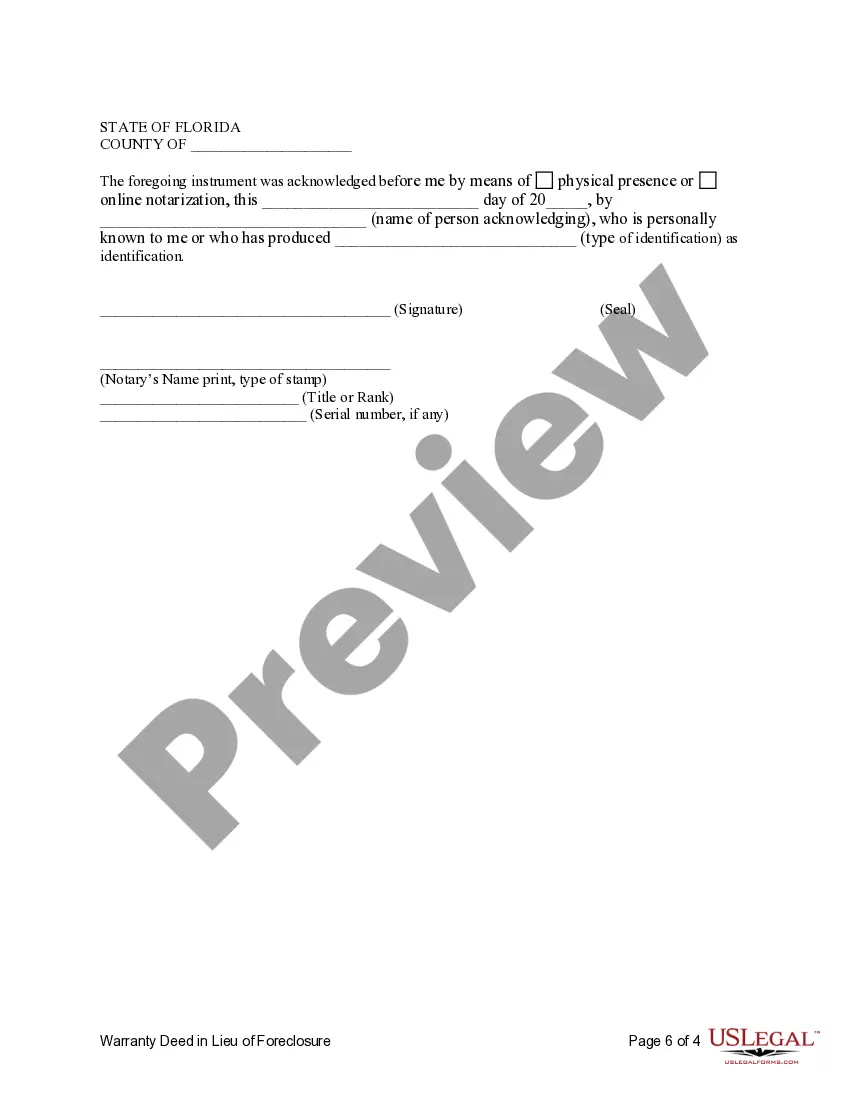

To effectively fill out a warranty deed in Florida, start with the correct form and complete it with accurate information. Input the names of the grantor and grantee, along with the property’s legal description. After providing the necessary details, sign the document before a notary. Utilizing a service like uslegalforms can help ensure you have the right format and language to establish your Florida Warranty Deed in Lieu of Foreclosure properly.

To fill out a warranty deed form, download the appropriate template from a reliable resource. Clearly provide all required information, such as names, property details, and any necessary disclosures. Be sure to check for any state-specific requirements for Florida, especially if you are considering a Florida Warranty Deed in Lieu of Foreclosure. Lastly, have the form signed and notarized for legal validity.

Filling out a warranty deed in Florida involves several straightforward steps. Start by entering the grantor's and grantee's full names and addresses. Include a legal description of the property and specify any restrictions or covenants that apply. Make sure to sign the document in the presence of a notary, which solidifies your Florida Warranty Deed in Lieu of Foreclosure.

To execute a Florida Warranty Deed in Lieu of Foreclosure, you should first consult a legal professional. Begin by gathering necessary documents, including the original mortgage and any default notices. Next, both parties should sign the deed before a notary public. Finally, record the deed with your local county clerk to ensure it is legally binding.

In Florida, a deed in lieu of foreclosure is a legal mechanism that allows homeowners to transfer property ownership to their lender, thereby avoiding foreclosure proceedings. This process can streamline resolution and help homeowners avoid the lengthy foreclosure process. However, it is vital for homeowners to consult legal resources, like US Legal Forms, to navigate the necessary documentation and understand their rights and obligations throughout this process.

A general warranty deed in lieu of foreclosure is a legal document wherein the borrower transfers their property to the lender to avoid the foreclosure process. This type of deed guarantees that the lender receives full ownership and clear title of the property. Unlike other deeds, it provides the lender with assurances against future claims to the property. Understanding the implications of this legal instrument can help both parties manage risks associated with the transfer.