Offer by Borrower of Deed in Lieu of Foreclosure

About this form

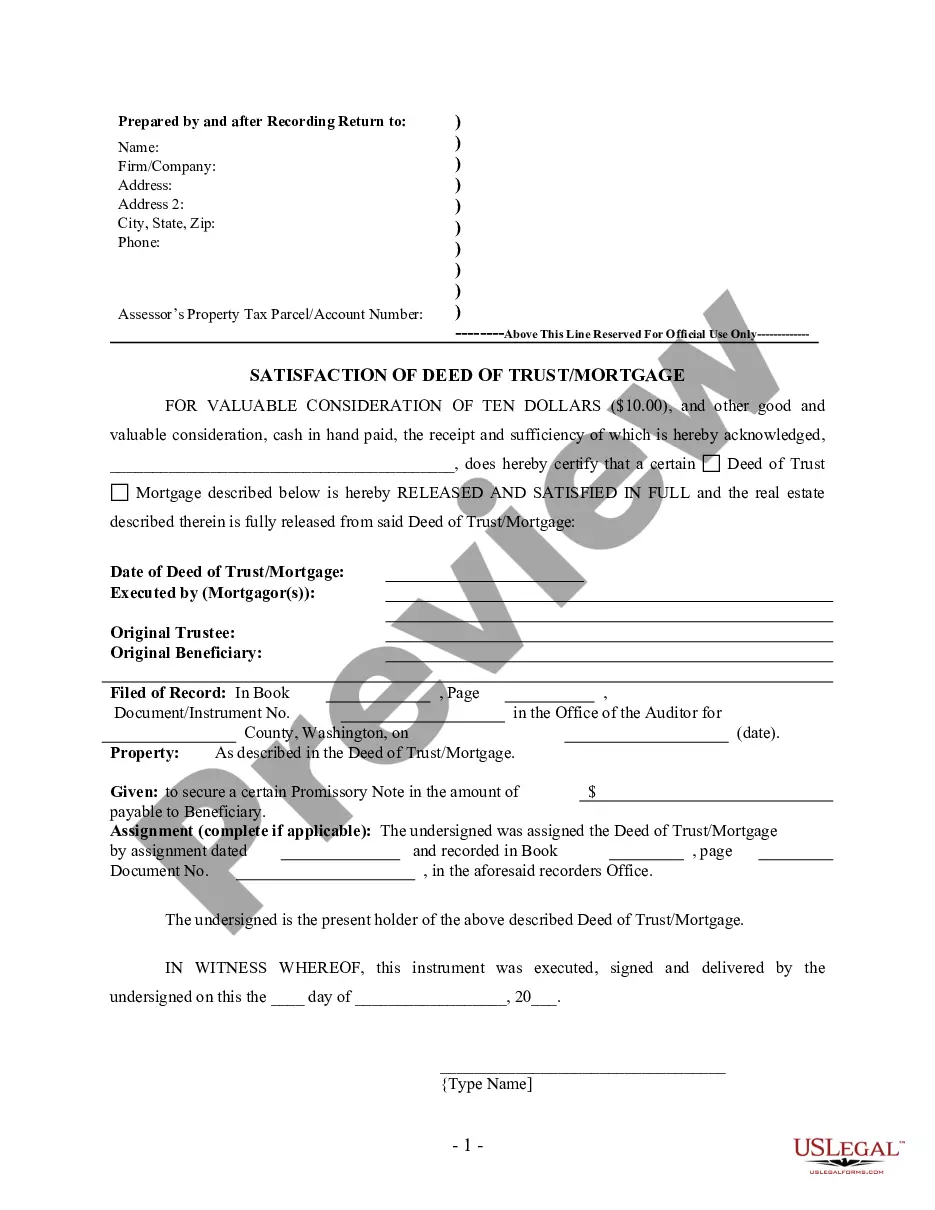

The Offer by Borrower of Deed in Lieu of Foreclosure is a legal document used when a property owner wishes to transfer ownership of their property to the lender instead of proceeding with foreclosure. This form serves as an alternative to a lengthy and costly foreclosure process, allowing the borrower to satisfy their mortgage obligations and avoid a deficiency judgment. Unlike other forms related to property transfer, this document specifically addresses the conditions for a deed in lieu of foreclosure, differentiating it from standard deeds and offers to sell.

What’s included in this form

- Your name and contact information.

- The lender's name and contact information.

- Details of the mortgage loan number.

- Offer to convey the property by deed in lieu of foreclosure.

- Representation of financial solvency and title conditions.

- Agreement on the title insurance commitment.

Common use cases

This form should be used when a borrower is facing foreclosure due to non-payment of a mortgage and wishes to avoid the legal complexities of foreclosure. By offering a deed in lieu of foreclosure, the borrower can directly transfer the property back to the lender, thus resolving any outstanding mortgage obligations in a more straightforward manner. This option is particularly beneficial if the property's market value is less than the existing mortgage amount, allowing for a cleaner resolution without the repercussions of foreclosure.

Who can use this document

This form is intended for:

- Homeowners facing potential foreclosure.

- Borrowers who wish to relinquish their property to avoid legal proceedings.

- Individuals who want to negotiate with their lender regarding mortgage obligations.

- Those seeking to protect themselves from the consequences of a deficiency judgment.

Instructions for completing this form

- Identify the parties involved by entering your name and address as the borrower, along with the lender's name and address.

- Include the mortgage loan number for accurate identification of the loan.

- Clearly state your intention to offer the property through the deed in lieu of foreclosure.

- Detail any specific conditions regarding title insurance and encumbrances on the property.

- Sign and date the document to finalize your offer.

Is notarization required?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Common mistakes

- Failing to include accurate contact information for both parties.

- Not stating the correct mortgage loan number.

- Omitting necessary signatures or dates, making the document invalid.

- Not providing clear terms regarding title insurance or encumbrances.

- Neglecting to review state-specific requirements that may affect the offer.

Why use this form online

- Convenience of filling out the form at your own pace from anywhere.

- Editability allows you to customize the content as needed.

- Access to attorney-drafted templates ensures reliability and legal compliance.

- Reduced costs compared to hiring an attorney for drafting from scratch.

State-specific compliance details

This form is suitable for use across multiple states but may need changes to align with your state’s laws. Review and adapt it before final use.

Form popularity

FAQ

The impact that a deed in lieu has on your score depends primarily on your credit history.According to FICO, if you start with a score of around 780, a deed in lieu (without a deficiency balance) shaves 105 to 125 points off your score; but if you start with a score of 680, you'll lose 50 to 70 points.

The deed in lieu of foreclosure offers several advantages to both the borrower and the lender. The principal advantage to the borrower is that it immediately releases him/her from most or all of the personal indebtedness associated with the defaulted loan.

A deed in lieu means you and your lender reach a mutual understanding that you cannot make your loan payments. The lender agrees to avoid putting you into foreclosure when you hand the property over amicably. In exchange, the lender releases you from your obligations under the mortgage.

A deed in lieu can eliminate your deficiency if you owe more on your home than the home is worth. In exchange for giving the lender your deed voluntarily and keeping the home in good condition, your lender may agree to forgive your deficiency or greatly reduce it.

C. The purchaser must pay off both the mortgage and junior lienholders after the sale. What is a major disadvantage to lenders of accepting a deed in lieu of foreclosure?The lender gains rights to private mortgage insurance.

An FHA-approved lender may approve a borrower for a loan three years after a deed-in-lieu.Under extenuating circumstances, FHA may waive the seasoning requirement. Such circumstances include the death or serious illness of a wage earner and a borrower must re-establish good credit to get approved.

Rather than deal with the foreclosure process, I would like to give you the deed to my home, in exchange for forgiveness on the loan. I do not have a second mortgage, and there are no other liens on the property. I have attached all relevant documents for the house and for my current economic situation.

Final Thoughts On Deed In Lieu Of Foreclosure When you take a deed in lieu agreement, you transfer your home's deed to your lender voluntarily. In exchange, the lender agrees to forgive the amount left on your loan. A deed in lieu agreement won't stay on your credit report if a foreclosure will.

First, approach your lender with sufficient proof of inability to repay your mortgage, and then offer a deed in lieu of foreclosure. Second, negotiate the terms of any reports to credit bureaus your lender may make after it accepts your deed in lieu.