Conveyance of Deed to Lender in Lieu of Foreclosure

Description

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

Aren't you sick and tired of choosing from countless samples every time you want to create a Conveyance of Deed to Lender in Lieu of Foreclosure? US Legal Forms eliminates the wasted time numerous Americans spend surfing around the internet for appropriate tax and legal forms. Our skilled team of lawyers is constantly upgrading the state-specific Samples collection, so that it always provides the appropriate files for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and then click the Download button. After that, the form are available in the My Forms tab.

Users who don't have a subscription should complete simple steps before being able to get access to their Conveyance of Deed to Lender in Lieu of Foreclosure:

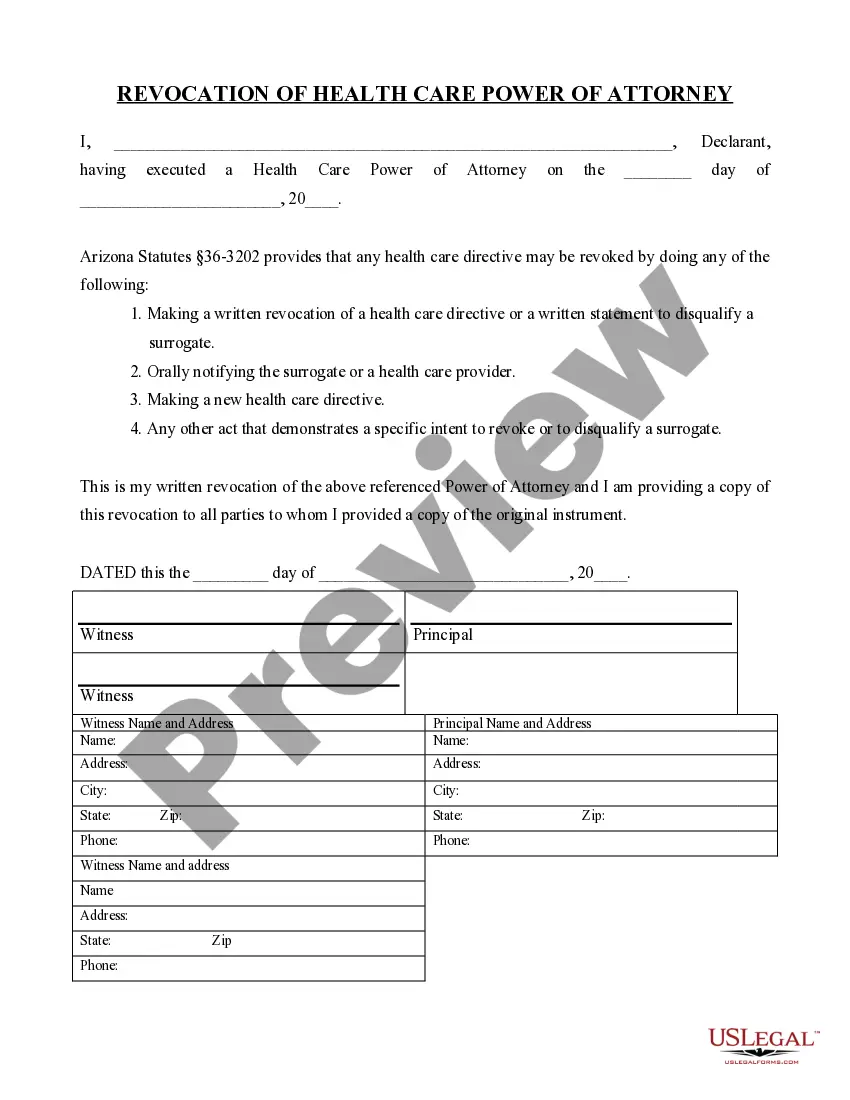

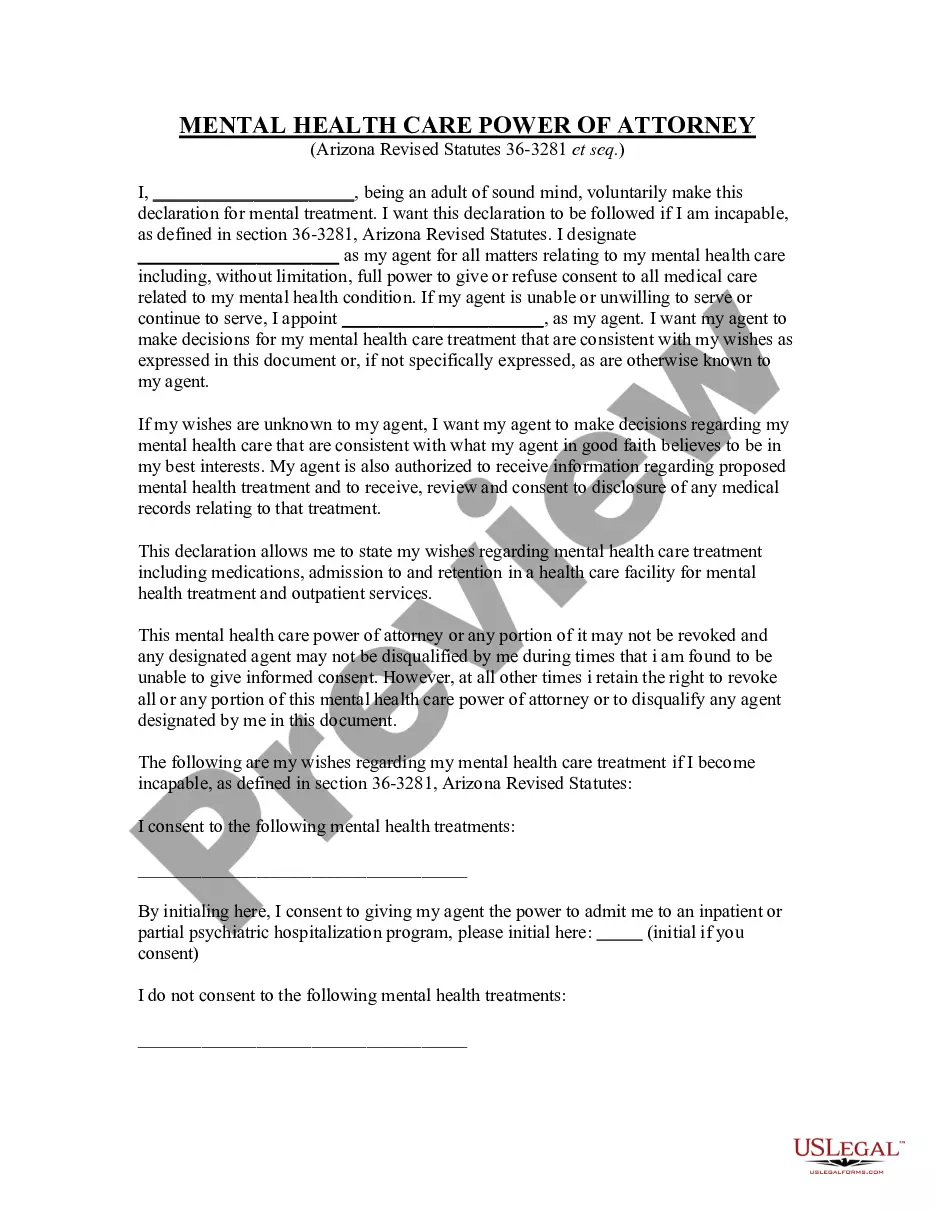

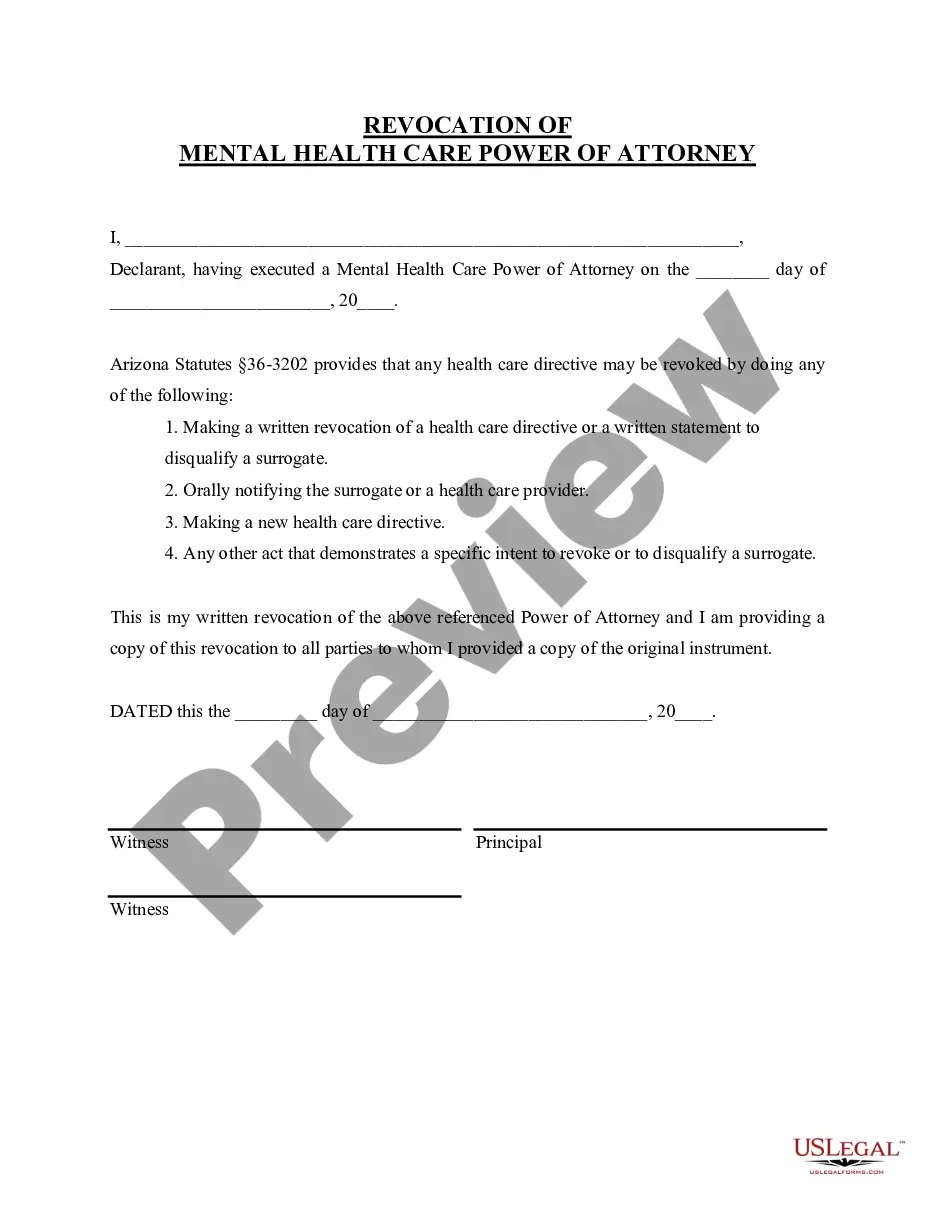

- Utilize the Preview function and read the form description (if available) to make sure that it is the correct document for what you’re looking for.

- Pay attention to the validity of the sample, meaning make sure it's the correct sample to your state and situation.

- Use the Search field at the top of the page if you want to look for another file.

- Click Buy Now and select a preferred pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Download your file in a needed format to complete, create a hard copy, and sign the document.

Once you’ve followed the step-by-step instructions above, you'll always have the ability to log in and download whatever document you require for whatever state you require it in. With US Legal Forms, completing Conveyance of Deed to Lender in Lieu of Foreclosure samples or any other legal documents is not hard. Begin now, and don't forget to recheck your examples with accredited lawyers!

Form popularity

FAQ

C. The purchaser must pay off both the mortgage and junior lienholders after the sale. What is a major disadvantage to lenders of accepting a deed in lieu of foreclosure?The lender gains rights to private mortgage insurance.

If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven deficiency. The IRS learns of the deficiency when the lender sends it a Form 1099-C, which reports the forgiven debt as income to you.

A deed in lieu arrangement offers several advantages to the homeowner: It allows you to avoid or minimize any deficiency on your mortgage. That's the loss the lender takes on the difference between the current, fair market value for your home and the balance of your home loan.

The waiting period on a conventional loan after a deed in lieu is 4 years, compared to 7 years on a conventional loan.

The deed in lieu of foreclosure offers several advantages to both the borrower and the lender. The principal advantage to the borrower is that it immediately releases him/her from most or all of the personal indebtedness associated with the defaulted loan.

Both short sales and deeds in lieu can help homeowners avoid foreclosure.One benefit to these options is that that you won't have a foreclosure on your credit history. But your credit score will still take a major hit. A short sale or deed in lieu is almost as bad as a foreclosure when it comes to credit scores.

A deed in lieu means you and your lender reach a mutual understanding that you cannot make your loan payments. The lender agrees to avoid putting you into foreclosure when you hand the property over amicably. In exchange, the lender releases you from your obligations under the mortgage.

A deed in lieu of foreclosure is different from a short sale because it transfers the property to the lender instead of selling it to a new buyer.Similar to a short sale, a deed in lieu of foreclosure likely will not damage your credit as severely as a foreclosure or a bankruptcy.